444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The East Africa natural oil and gas midstream market represents a rapidly evolving sector that encompasses the critical infrastructure connecting upstream exploration and production activities with downstream refining and distribution networks. This dynamic market spans across key regional economies including Kenya, Tanzania, Uganda, Ethiopia, and Mozambique, where significant hydrocarbon discoveries have transformed the energy landscape over the past decade.

Regional developments indicate substantial growth momentum, with the market experiencing a 12.4% compound annual growth rate driven by major pipeline projects, storage facility expansions, and processing infrastructure investments. The midstream segment plays a pivotal role in monetizing the region’s abundant natural resources while supporting energy security objectives across East African nations.

Infrastructure expansion has become a cornerstone of regional energy strategy, with governments and international investors collaborating on transformative projects that enhance transportation, storage, and processing capabilities. The market encompasses various components including crude oil pipelines, natural gas transmission systems, liquefied natural gas facilities, and strategic petroleum reserves that collectively support the region’s energy transition.

Investment flows into the sector have intensified significantly, with regional governments implementing favorable regulatory frameworks to attract foreign direct investment and technology transfer. The market benefits from strategic geographical positioning along major shipping routes and proximity to growing Asian energy markets, creating compelling opportunities for midstream infrastructure development.

The East Africa natural oil and gas midstream market refers to the comprehensive ecosystem of infrastructure, services, and operations that facilitate the transportation, storage, processing, and distribution of crude oil and natural gas between upstream production sites and downstream end-users across the East African region.

Midstream operations encompass a broad spectrum of activities including pipeline transportation systems, crude oil and refined product storage terminals, natural gas processing facilities, liquefied natural gas production and export terminals, and associated logistics services. These components form the critical link that enables the monetization of regional hydrocarbon resources while ensuring reliable energy supply chains.

Market participants include national oil companies, international energy corporations, pipeline operators, storage terminal developers, and specialized service providers who collectively develop and operate the infrastructure necessary to support the region’s growing energy sector. The market also encompasses regulatory bodies, financial institutions, and technology providers who contribute to the sector’s development and operational efficiency.

Market dynamics in the East Africa natural oil and gas midstream sector reflect a period of unprecedented growth and transformation, driven by significant hydrocarbon discoveries and increasing regional energy demand. The market has emerged as a critical component of Africa’s energy infrastructure development, with substantial investments flowing into pipeline networks, storage facilities, and processing infrastructure.

Key growth drivers include major oil and gas discoveries in Uganda, Kenya, Tanzania, and Mozambique, which have necessitated the development of comprehensive midstream infrastructure to transport and process these resources. Regional integration initiatives and cross-border pipeline projects are creating economies of scale while enhancing energy security across participating nations.

Investment momentum continues to accelerate, with the market attracting 68% of regional energy infrastructure funding as governments prioritize midstream development to maximize resource monetization. Strategic partnerships between national oil companies and international operators are facilitating technology transfer and operational expertise development.

Market challenges include complex regulatory environments, financing constraints, and infrastructure development timelines that require careful coordination between multiple stakeholders. However, the long-term outlook remains highly positive, supported by growing regional energy demand and expanding export opportunities to international markets.

Strategic positioning of East Africa’s midstream market reflects several critical insights that shape investment decisions and operational strategies across the region:

Primary growth drivers propelling the East Africa natural oil and gas midstream market encompass both supply-side factors related to resource development and demand-side elements reflecting regional energy consumption patterns and export opportunities.

Resource development momentum represents the most significant driver, with major oil discoveries in Uganda’s Albertine Basin, Kenya’s Turkana region, and substantial natural gas finds offshore Tanzania and Mozambique creating immediate infrastructure requirements. These discoveries have attracted international oil companies and triggered comprehensive field development programs that necessitate extensive midstream infrastructure investments.

Regional energy demand growth continues to accelerate, driven by population expansion, economic development, and industrialization across East African economies. The market benefits from 8.7% annual energy demand growth as countries transition from traditional biomass to modern energy sources, creating sustained demand for refined petroleum products and natural gas.

Government policy support has emerged as a crucial enabler, with regional governments implementing strategic frameworks that prioritize energy infrastructure development. National development plans increasingly emphasize midstream infrastructure as essential for economic transformation and energy security objectives.

Export market opportunities provide additional growth impetus, particularly for natural gas resources that can access growing Asian markets through liquefied natural gas exports. Strategic positioning along major shipping routes enhances the region’s competitiveness in global energy markets.

Technology advancement and cost reduction in pipeline construction, storage systems, and processing facilities are making previously marginal projects economically viable while improving operational efficiency and safety standards across the midstream sector.

Significant challenges continue to constrain the East Africa natural oil and gas midstream market, requiring strategic approaches and innovative solutions to overcome barriers that limit sector growth and development potential.

Capital intensity represents the primary constraint, as midstream infrastructure projects require substantial upfront investments with long payback periods. Limited access to affordable financing and currency volatility in regional markets create additional challenges for project developers and investors seeking to participate in the sector.

Regulatory complexity across multiple jurisdictions creates operational challenges, particularly for cross-border pipeline projects that must navigate different legal frameworks, technical standards, and approval processes. Inconsistent regulatory approaches can delay project implementation and increase development costs.

Infrastructure deficits in supporting sectors, including transportation networks, power supply systems, and telecommunications infrastructure, limit the efficiency and cost-effectiveness of midstream operations. These gaps require coordinated development efforts that extend beyond the energy sector.

Technical expertise shortages constrain operational capabilities and project execution, as the region lacks sufficient numbers of qualified engineers, technicians, and project managers with specialized midstream experience. This skills gap affects both construction and operational phases of infrastructure development.

Security concerns in certain areas can impact project development and operational continuity, requiring additional security measures that increase costs and complexity. Political stability and governance issues also influence investor confidence and long-term planning decisions.

Environmental and social considerations require careful management, as midstream projects often traverse sensitive ecological areas and affect local communities. Compliance with international environmental standards and community engagement requirements can extend project timelines and increase costs.

Substantial opportunities exist within the East Africa natural oil and gas midstream market, driven by untapped resource potential, infrastructure gaps, and evolving regional energy dynamics that create compelling investment prospects for strategic participants.

Cross-border integration projects present significant opportunities, particularly the development of regional pipeline networks that can serve multiple countries and create economies of scale. The proposed East African Crude Oil Pipeline and regional gas transmission systems exemplify the potential for transformative infrastructure investments.

Storage and terminal development opportunities are expanding rapidly, as growing production volumes and import requirements necessitate strategic petroleum reserves and commercial storage facilities. Coastal terminal development for both crude oil exports and refined product imports represents a particularly attractive segment.

Natural gas infrastructure development offers substantial growth potential, with the market experiencing 15.2% annual growth in gas infrastructure investments as countries seek to monetize abundant gas resources for both domestic use and export markets. Liquefied natural gas facilities and gas-to-power projects create additional value chain opportunities.

Technology integration and digitalization initiatives present opportunities for efficiency improvements and cost optimization. Advanced pipeline monitoring systems, automated storage management, and predictive maintenance technologies can enhance operational performance while reducing environmental risks.

Local content development creates opportunities for regional service providers, equipment manufacturers, and skilled workforce development. Government policies emphasizing local participation are opening new market segments for indigenous companies and international partners willing to invest in local capabilities.

Renewable energy integration opportunities are emerging as the sector explores hybrid energy systems and sustainable operational practices that align with global environmental objectives while maintaining operational efficiency.

Complex interactions between supply and demand factors, regulatory environments, and technological developments create dynamic market conditions that influence investment decisions and operational strategies across the East Africa natural oil and gas midstream sector.

Supply-side dynamics are primarily driven by upstream production growth and resource development timelines, which create varying infrastructure requirements across different countries and basins. Production ramp-up schedules directly influence the urgency and scale of midstream infrastructure investments, while resource quality and location affect transportation and processing requirements.

Demand-side factors reflect both domestic consumption patterns and export market opportunities, with regional energy demand growth creating sustained requirements for refined products and natural gas distribution. Export demand dynamics, particularly for liquefied natural gas, influence the scale and configuration of processing and terminal facilities.

Competitive dynamics are evolving as international oil companies, national oil companies, and specialized midstream operators compete for strategic positions in key infrastructure segments. Market consolidation trends and strategic partnerships are reshaping the competitive landscape while creating opportunities for operational synergies.

Regulatory dynamics continue to influence market development, with governments balancing revenue maximization objectives against the need to attract investment and ensure energy security. Evolving local content requirements and environmental regulations are creating new compliance requirements that affect project economics and operational approaches.

Technology dynamics are transforming operational capabilities and cost structures, with digital technologies enabling remote monitoring, predictive maintenance, and automated operations that improve efficiency while reducing operational risks and environmental impact.

Comprehensive research approaches employed in analyzing the East Africa natural oil and gas midstream market combine quantitative data analysis with qualitative insights from industry stakeholders, regulatory bodies, and market participants to provide accurate and actionable market intelligence.

Primary research methodologies include structured interviews with key industry executives, government officials, and technical experts who provide insights into market trends, regulatory developments, and operational challenges. Field visits to major infrastructure projects and operational facilities offer direct observation of market conditions and technological implementations.

Secondary research sources encompass government publications, industry reports, regulatory filings, and academic studies that provide historical data, regulatory frameworks, and technical specifications. International energy organization databases and statistical publications contribute to regional and global market context analysis.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review panels, and statistical verification methods. Market projections and trend analysis incorporate scenario modeling and sensitivity analysis to account for various development pathways and risk factors.

Analytical frameworks combine traditional market analysis techniques with specialized energy sector methodologies that account for the unique characteristics of midstream infrastructure investments, including long asset lifecycles, regulatory dependencies, and complex stakeholder relationships.

Continuous monitoring systems track market developments, policy changes, and project announcements to ensure research findings remain current and relevant for strategic decision-making by market participants and stakeholders.

Regional market dynamics across East Africa demonstrate significant variation in resource endowments, infrastructure development levels, and market maturity, creating distinct opportunities and challenges for midstream sector participants in different geographical areas.

Kenya’s midstream market is characterized by substantial crude oil discoveries in the Turkana Basin and growing refined product demand driven by economic growth and population expansion. The country holds approximately 23% of regional midstream infrastructure capacity and serves as a key transportation hub for landlocked neighboring countries. Pipeline development projects and storage terminal expansions are transforming Kenya’s energy infrastructure landscape.

Tanzania’s natural gas sector dominates the regional gas midstream market, with substantial offshore discoveries requiring comprehensive processing and transportation infrastructure. The country’s coastal location and deepwater port capabilities position it as a potential liquefied natural gas export hub, while domestic gas distribution networks are expanding to serve growing industrial and power generation demand.

Uganda’s oil development represents one of the region’s most significant midstream opportunities, with the East African Crude Oil Pipeline project connecting Uganda’s oil fields to Tanzania’s coast. This transformative infrastructure investment is catalyzing broader regional integration and creating opportunities for associated midstream services and facilities.

Mozambique’s gas resources have attracted substantial international investment in liquefied natural gas facilities and associated infrastructure, with the country accounting for 34% of regional gas processing capacity development. Onshore and offshore gas processing facilities are positioning Mozambique as a major energy exporter to Asian markets.

Ethiopia’s energy transition is creating opportunities for refined product import infrastructure and natural gas distribution systems as the country seeks to reduce dependence on traditional biomass and support industrial development objectives.

Market competition in the East Africa natural oil and gas midstream sector involves a diverse mix of international oil companies, national oil companies, specialized midstream operators, and infrastructure developers who compete across different segments and geographical areas.

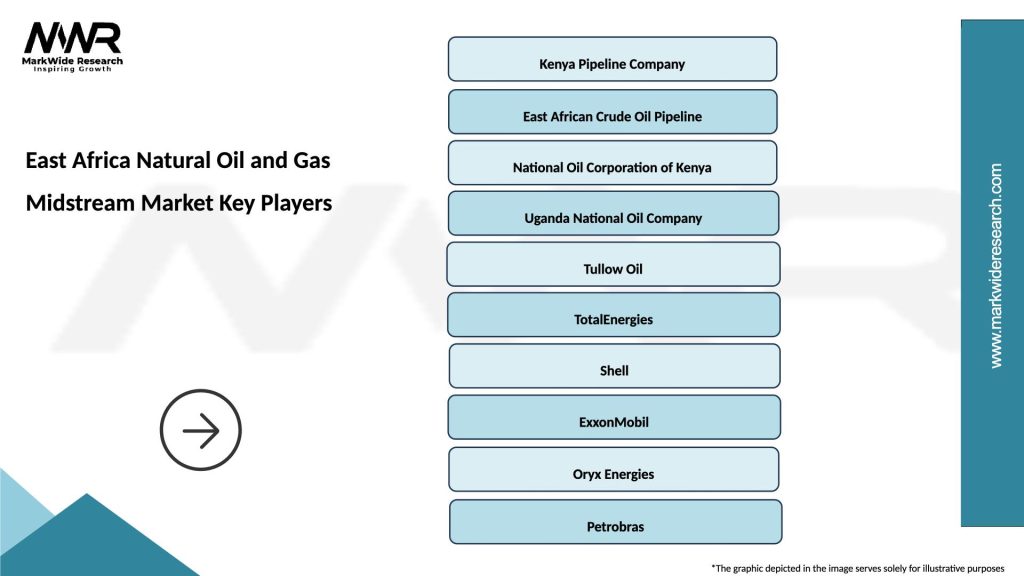

Leading market participants include:

Competitive strategies focus on securing strategic positions in key infrastructure segments, developing operational synergies through integrated project approaches, and building long-term partnerships with government entities and local stakeholders.

Market consolidation trends are emerging as companies seek to optimize capital allocation and operational efficiency through strategic partnerships, joint ventures, and asset sharing arrangements that reduce individual risk exposure while maintaining market access.

Market segmentation analysis reveals distinct characteristics and growth patterns across different components of the East Africa natural oil and gas midstream sector, enabling targeted strategies and investment approaches for various market segments.

By Infrastructure Type:

By Product Type:

By Geography:

Detailed analysis of specific market categories reveals unique characteristics, growth drivers, and investment opportunities that shape strategic decisions and operational approaches across different segments of the East Africa midstream market.

Crude Oil Pipeline Category represents the largest infrastructure investment segment, with major projects like the East African Crude Oil Pipeline transforming regional energy transportation capabilities. This category benefits from 18.3% annual capacity growth driven by new oil field developments and regional integration initiatives. Technical challenges include terrain complexity, environmental considerations, and cross-border regulatory coordination.

Natural Gas Processing Category demonstrates the highest growth potential, supported by substantial offshore gas discoveries and growing domestic demand for gas-fired power generation. Processing facility development requires sophisticated technology and substantial capital investment, while offering attractive returns through gas monetization and export opportunities.

Storage Terminal Category is experiencing rapid expansion as regional energy trade volumes increase and strategic petroleum reserve requirements grow. Coastal storage facilities command premium valuations due to their strategic importance for both imports and exports, while inland storage supports domestic distribution networks.

LNG Infrastructure Category represents the most capital-intensive segment, with large-scale liquefaction facilities requiring substantial international investment and long-term offtake agreements. This category offers significant export revenue potential while requiring complex project financing and risk management approaches.

Cross-Border Infrastructure Category creates unique opportunities for regional integration and economies of scale, while presenting complex regulatory and political challenges that require careful stakeholder management and diplomatic coordination.

Substantial benefits accrue to various stakeholders participating in the East Africa natural oil and gas midstream market, creating value through infrastructure development, operational efficiency, and strategic positioning in the regional energy sector.

For International Oil Companies:

For National Governments:

For Local Communities:

Comprehensive assessment of the East Africa natural oil and gas midstream market reveals key strengths, weaknesses, opportunities, and threats that influence strategic planning and investment decisions across the sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends in the East Africa natural oil and gas midstream market reflect evolving industry dynamics, technological advancement, and changing stakeholder priorities that shape future development patterns and investment strategies.

Digital Transformation Trend is revolutionizing midstream operations through advanced monitoring systems, predictive maintenance technologies, and automated control systems that enhance operational efficiency while reducing costs. The market is experiencing 42% adoption rate growth in digital technologies as operators seek competitive advantages through technological innovation.

Regional Integration Acceleration continues to gain momentum as governments recognize the benefits of shared infrastructure and coordinated development approaches. Cross-border pipeline projects and harmonized regulatory frameworks are creating larger, more efficient markets that attract international investment and reduce per-unit costs.

Environmental Sustainability Focus is increasingly influencing project design and operational practices, with stakeholders emphasizing reduced environmental impact, community engagement, and sustainable development practices. This trend is driving innovation in pipeline routing, environmental monitoring, and restoration technologies.

Local Content Maximization has become a priority for regional governments seeking to maximize economic benefits from energy infrastructure investments. This trend is creating opportunities for local service providers, equipment manufacturers, and skilled workforce development while requiring international operators to adapt their business models.

Financing Innovation is emerging as project developers explore alternative funding mechanisms including green bonds, development finance institutions, and blended finance structures that address traditional financing constraints while supporting sustainable development objectives.

Technology Standardization efforts are gaining traction as regional operators seek to harmonize technical specifications, safety standards, and operational protocols to facilitate cross-border operations and reduce compliance costs.

Significant developments across the East Africa natural oil and gas midstream market demonstrate accelerating investment momentum and strategic positioning by major industry participants seeking to capitalize on regional growth opportunities.

East African Crude Oil Pipeline Progress represents the most transformative development, with construction advancing on the 1,443-kilometer pipeline connecting Uganda’s oil fields to Tanzania’s coast. This landmark project is catalyzing additional infrastructure investments and establishing new operational standards for regional pipeline development.

Tanzania LNG Project Advancement continues to progress with international partners developing comprehensive natural gas processing and export infrastructure. Recent project developments include finalized engineering designs, environmental approvals, and long-term offtake agreements that support project financing and implementation.

Kenya Pipeline Expansion initiatives are enhancing the country’s refined product distribution capabilities through new pipeline segments, storage terminal upgrades, and cross-border connections that serve regional markets. These developments support Kenya’s position as a regional energy hub and transportation corridor.

Mozambique Gas Infrastructure development has resumed following security improvements, with operators advancing onshore and offshore gas processing facilities that will support both domestic consumption and export markets. Recent developments include enhanced security protocols and community engagement programs.

Regional Regulatory Harmonization efforts are progressing through the East African Community framework, with member countries working to standardize technical specifications, safety requirements, and operational protocols that facilitate cross-border infrastructure development and operations.

Technology Partnership Agreements between international operators and regional entities are facilitating knowledge transfer and capacity building while introducing advanced technologies that enhance operational efficiency and environmental performance.

Strategic recommendations for stakeholders in the East Africa natural oil and gas midstream market emphasize the importance of long-term planning, risk management, and stakeholder engagement to maximize value creation and operational success.

MarkWide Research analysis indicates that successful market participants should prioritize integrated development approaches that combine multiple infrastructure components and create operational synergies. This strategy reduces individual project risks while enhancing overall returns through economies of scale and operational efficiency.

Investment timing considerations suggest that early-stage positioning in key infrastructure segments offers the greatest potential returns, particularly for cross-border projects and strategic terminal locations. However, investors should carefully evaluate regulatory environments and ensure adequate risk mitigation measures are in place.

Partnership strategies should emphasize collaboration with national oil companies and government entities to ensure alignment with national development objectives and regulatory requirements. Successful partnerships often include technology transfer, local content commitments, and capacity building programs that create mutual value.

Technology adoption should focus on proven solutions that enhance operational efficiency and environmental performance while building local technical capabilities. Digital technologies and automated systems offer particular value in remote locations where operational challenges are greatest.

Risk management approaches should address political, regulatory, environmental, and commercial risks through comprehensive due diligence, insurance coverage, and contingency planning. Diversification across multiple projects and countries can reduce concentration risks while maintaining growth potential.

Stakeholder engagement programs should prioritize transparency, community consultation, and environmental stewardship to build social license and ensure project sustainability. Early and ongoing engagement with local communities and civil society organizations is essential for long-term success.

Long-term prospects for the East Africa natural oil and gas midstream market remain highly positive, supported by substantial resource endowments, growing regional energy demand, and increasing international recognition of the region’s strategic importance in global energy markets.

Growth trajectory projections indicate sustained expansion over the next decade, with the market expected to experience 11.8% compound annual growth driven by major infrastructure projects reaching operational status and new discoveries requiring additional midstream capacity. This growth rate positions East Africa among the world’s fastest-growing energy infrastructure markets.

Infrastructure development will continue to accelerate as current projects reach completion and demonstrate the viability of large-scale regional energy infrastructure. Success of pioneering projects like the East African Crude Oil Pipeline will likely catalyze additional cross-border initiatives and shared infrastructure development.

Market maturation is expected to bring improved operational efficiency, standardized technical specifications, and enhanced regulatory frameworks that reduce project risks and attract broader international participation. This maturation process will likely result in 35% reduction in development timelines for new projects as lessons learned are applied and regulatory processes are streamlined.

Export market development will become increasingly important as regional production capacity exceeds domestic consumption requirements. Natural gas exports, particularly through liquefied natural gas facilities, offer substantial revenue potential and will likely drive the next phase of infrastructure investment.

Technology integration will continue to transform operational capabilities, with advanced monitoring systems, automated operations, and predictive maintenance becoming standard practice across the region. These technological advances will enhance safety, reduce operational costs, and improve environmental performance.

Regional integration initiatives will deepen as the benefits of shared infrastructure and coordinated development become apparent. Future developments may include regional energy trading mechanisms, standardized technical specifications, and joint financing arrangements that further enhance market efficiency and attractiveness to international investors.

The East Africa natural oil and gas midstream market represents one of the most compelling energy infrastructure investment opportunities globally, characterized by substantial resource endowments, supportive government policies, and growing regional energy demand that create favorable conditions for sustained market growth and development.

Market fundamentals remain strong, with major hydrocarbon discoveries across the region necessitating comprehensive midstream infrastructure development to unlock resource value and serve both domestic and international markets. The successful advancement of landmark projects demonstrates the viability of large-scale infrastructure investments while establishing operational precedents for future developments.

Strategic positioning of the region as a potential energy hub for African and global markets creates compelling long-term value propositions for investors and operators willing to navigate the complexities of emerging market infrastructure development. The combination of resource abundance, strategic location, and government support provides a foundation for sustained market growth and profitability.

Investment opportunities span multiple segments and geographical areas, offering diverse risk-return profiles that can accommodate different investor preferences and capabilities. From large-scale pipeline projects to specialized terminal facilities, the market provides numerous entry points for strategic participation and value creation.

Future success in the East Africa natural oil and gas midstream market will depend on effective stakeholder management, appropriate risk mitigation strategies, and commitment to sustainable development practices that align with regional development objectives and international best practices. Organizations that can navigate these requirements while delivering operational excellence will be well-positioned to capture the substantial opportunities that this dynamic market offers.

What is East Africa Natural Oil and Gas Midstream?

East Africa Natural Oil and Gas Midstream refers to the infrastructure and processes involved in the transportation, storage, and processing of oil and gas resources in East Africa. This includes pipelines, terminals, and processing facilities that facilitate the movement of hydrocarbons from production sites to markets.

What are the key players in the East Africa Natural Oil and Gas Midstream Market?

Key players in the East Africa Natural Oil and Gas Midstream Market include companies such as TotalEnergies, Tullow Oil, and Africa Oil Corp. These companies are involved in various aspects of midstream operations, including pipeline construction and management, among others.

What are the growth factors driving the East Africa Natural Oil and Gas Midstream Market?

The growth of the East Africa Natural Oil and Gas Midstream Market is driven by increasing energy demand, the discovery of new oil and gas reserves, and investments in infrastructure development. Additionally, regional economic growth and the need for energy security are significant factors.

What challenges does the East Africa Natural Oil and Gas Midstream Market face?

The East Africa Natural Oil and Gas Midstream Market faces challenges such as political instability, regulatory hurdles, and environmental concerns. These factors can hinder investment and complicate project execution in the region.

What opportunities exist in the East Africa Natural Oil and Gas Midstream Market?

Opportunities in the East Africa Natural Oil and Gas Midstream Market include the potential for new pipeline projects, partnerships with international investors, and advancements in technology for more efficient operations. The growing focus on renewable energy integration also presents new avenues for development.

What trends are shaping the East Africa Natural Oil and Gas Midstream Market?

Trends in the East Africa Natural Oil and Gas Midstream Market include the increasing adoption of digital technologies for monitoring and management, a shift towards sustainable practices, and the development of regional supply chains. These trends are influencing how companies operate and invest in the sector.

East Africa Natural Oil and Gas Midstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Storage, Processing, Distribution |

| Technology | Pipelines, LNG Terminals, Compression Stations, Metering Systems |

| End User | Utilities, Industrial, Power Generation, Refining |

| Application | Natural Gas Supply, Oil Transportation, Petrochemical Feedstock, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the East Africa Natural Oil and Gas Midstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at