444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The EAS (Electronic Article Surveillance) security detection market is experiencing significant growth, driven by the increasing need for retail security solutions to combat theft, shoplifting, and organized retail crime. EAS systems are widely deployed in retail stores, supermarkets, and libraries to protect merchandise and assets from theft and unauthorized removal. With advancements in technology and the emergence of integrated security solutions, the EAS security detection market is witnessing innovation and adoption of next-generation systems that offer enhanced detection capabilities, seamless integration with existing security infrastructure, and actionable insights for loss prevention and asset protection.

Meaning

The EAS (Electronic Article Surveillance) security detection market refers to the industry segment dedicated to providing security solutions for retail stores, supermarkets, and libraries to prevent theft, shoplifting, and organized retail crime. EAS systems employ various technologies such as electromagnetic, radio frequency, and acousto-magnetic to detect unauthorized removal of merchandise and assets from retail premises. These systems typically consist of detection antennas, security tags or labels, and deactivation devices, offering retailers an effective and efficient means of protecting inventory, reducing shrinkage, and improving overall store security.

Executive Summary

The EAS security detection market is witnessing robust growth, driven by the increasing demand for retail security solutions to mitigate losses due to theft, shoplifting, and organized retail crime. Key market players are focusing on product innovation, integration capabilities, and data analytics to provide retailers with advanced security solutions that offer improved detection rates, operational efficiency, and actionable insights for loss prevention and asset protection. Additionally, the expansion of retail chains, the rise of e-commerce, and the growing complexity of retail environments are driving the adoption of EAS security detection systems worldwide.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The EAS security detection market is characterized by dynamic shifts in consumer behavior, retail trends, and technological advancements, shaping the strategies and operations of key market players. EAS system providers must adapt to changing market dynamics by innovating product features, expanding distribution channels, and engaging with retailers through educational initiatives, compatibility testing, and industry partnerships. Additionally, collaboration with retail chains, loss prevention professionals, and industry associations is essential for EAS system providers to develop integrated security solutions, compatibility guides, and best practices that address the evolving needs and preferences of retailers seeking effective and efficient solutions for loss prevention and asset protection in an increasingly complex and challenging retail landscape.

Regional Analysis

The EAS security detection market exhibits a global presence, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe are significant markets for EAS systems, driven by the presence of large retail chains, stringent regulations for loss prevention, and high levels of consumer awareness about store security. Asia Pacific is witnessing rapid market growth, fueled by emerging economies such as China, India, and Southeast Asian countries, where rising urbanization, retail expansion, and consumer spending are driving demand for EAS security detection systems that offer effective and efficient solutions for loss prevention and asset protection. Latin America and the Middle East and Africa regions are also expanding markets with growing retail sectors, offering opportunities for EAS system providers to address local needs and preferences for retail security solutions in diverse geographic and cultural environments.

Competitive Landscape

Leading Companies in the EAS Security Detection Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

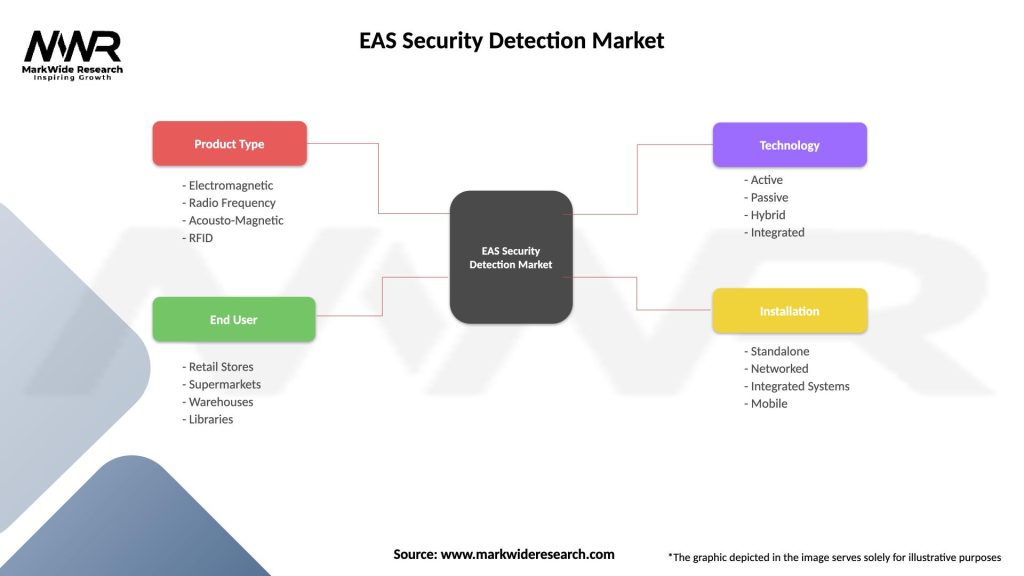

Segmentation

The EAS security detection market can be segmented based on technology platforms, product types, end-user segments, and geographic regions. Technology platforms encompass electromagnetic, radio frequency, and acousto-magnetic technologies, offering different detection capabilities, operational efficiencies, and compatibility with existing security infrastructure for retailers seeking effective and efficient solutions for loss prevention and asset protection. Product types include detection antennas, security tags or labels, deactivation devices, and software solutions, providing retailers with a comprehensive suite of security solutions for store security, inventory management, and customer safety. End-user segments encompass retail stores, supermarkets, libraries, and other commercial establishments, each seeking EAS systems that meet their specific needs and preferences for store security, operational efficiency, and customer satisfaction. Geographic regions encompass key markets such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, where retailers seek advanced security solutions that offer reliable performance, compatibility, and scalability for loss prevention and asset protection in diverse retail environments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of EAS security detection systems in the retail industry, as retailers seek effective and efficient solutions for loss prevention, asset protection, and customer safety in an increasingly challenging and uncertain business environment. With disruptions to supply chains, changes in consumer behavior, and economic uncertainties, retailers are investing in EAS systems that offer reliable performance, compatibility, and scalability for store security, operational efficiency, and customer satisfaction. Additionally, the shift towards online shopping, contactless payments, and curbside pickup has driven demand for EAS systems that provide retailers with real-time visibility into inventory movements, customer behavior, and security risks, enabling proactive monitoring, alerting, and response to emerging threats and opportunities in an evolving retail landscape.

Key Industry Developments

Analyst Suggestions

Future Outlook

The EAS security detection market is expected to continue its significant growth trajectory in the coming years, driven by the increasing demand for retail security solutions to combat theft, shoplifting, and organized retail crime. Key market players are likely to invest in research and development, product innovation, and strategic partnerships to differentiate their offerings and gain a competitive edge in the market, leveraging their expertise, resources, and global presence to capture market share and drive growth in an increasingly competitive and dynamic landscape. Additionally, collaboration with retail chains, loss prevention professionals, and industry associations is essential for EAS system providers to develop integrated security solutions, compatibility guides, and best practices that address the evolving needs and preferences of retailers seeking comprehensive solutions for loss prevention and asset protection in an increasingly complex and challenging retail landscape.

Conclusion

In conclusion, the EAS (Electronic Article Surveillance) security detection market is experiencing significant growth globally, driven by the increasing need for retail security solutions to combat theft, shoplifting, and organized retail crime. EAS systems serve as a critical component of loss prevention strategies for retailers, offering reliable detection capabilities, operational efficiency, and actionable insights for asset protection and store security. With advancements in technology and the emergence of integrated security solutions, the EAS security detection market is witnessing innovation and adoption of next-generation systems that provide retailers with enhanced detection capabilities, integration with existing security infrastructure, and actionable insights for loss prevention and asset protection.

What is EAS Security Detection?

EAS Security Detection refers to systems and technologies designed to prevent theft and ensure the security of retail environments. These systems typically include electronic tags, detection antennas, and alarm systems that work together to deter shoplifting and protect merchandise.

What are the key players in the EAS Security Detection Market?

Key players in the EAS Security Detection Market include Checkpoint Systems, Tyco Integrated Security, and Sentry Technology Corporation, among others. These companies provide a range of solutions, including RFID systems and traditional electromagnetic tags.

What are the main drivers of growth in the EAS Security Detection Market?

The main drivers of growth in the EAS Security Detection Market include the increasing incidence of retail theft, the rising demand for advanced security solutions, and the growing adoption of automated retail technologies. Additionally, the expansion of the retail sector globally contributes to market growth.

What challenges does the EAS Security Detection Market face?

Challenges in the EAS Security Detection Market include the high cost of advanced security systems and the need for continuous technological upgrades. Furthermore, the effectiveness of EAS systems can be compromised by sophisticated theft techniques, requiring ongoing innovation.

What opportunities exist in the EAS Security Detection Market?

Opportunities in the EAS Security Detection Market include the integration of artificial intelligence and machine learning for enhanced security analytics. Additionally, the growing trend of e-commerce presents opportunities for developing solutions tailored to online retail environments.

What trends are shaping the EAS Security Detection Market?

Trends shaping the EAS Security Detection Market include the shift towards RFID technology for better inventory management and loss prevention. Moreover, the increasing focus on customer experience is driving retailers to adopt less intrusive security measures that still effectively deter theft.

EAS Security Detection Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electromagnetic, Radio Frequency, Acousto-Magnetic, RFID |

| End User | Retail Stores, Supermarkets, Warehouses, Libraries |

| Technology | Active, Passive, Hybrid, Integrated |

| Installation | Standalone, Networked, Integrated Systems, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the EAS Security Detection Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at