444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The early cancer screening products market is witnessing rapid growth, driven by the increasing prevalence of cancer worldwide and the growing emphasis on early detection and prevention strategies. Early cancer screening products encompass a range of diagnostic tests, imaging modalities, and biomarker assays designed to detect cancer at its earliest stages when treatment is most effective. With advancements in technology and rising awareness of the importance of early detection, the market for early cancer screening products is poised for significant expansion in the healthcare sector.

Meaning

Early cancer screening products refer to medical devices, diagnostic tests, and screening protocols aimed at detecting cancer in its early stages, often before symptoms manifest or disease progression occurs. These products include imaging techniques such as mammography, colonoscopy, and computed tomography (CT) scans, as well as non-invasive tests such as blood tests, urine tests, and genetic screenings. By identifying cancer at an early stage, early cancer screening products enable timely intervention, personalized treatment, and improved patient outcomes.

Executive Summary

The early cancer screening products market is experiencing robust growth, driven by factors such as increasing cancer incidence, advancements in screening technology, and government initiatives promoting cancer awareness and prevention. With a focus on improving survival rates and reducing healthcare costs associated with late-stage cancer treatment, stakeholders in the healthcare industry are investing in early detection strategies and innovative screening technologies. As the demand for early cancer screening products continues to rise, there is a growing opportunity for market players to develop and commercialize novel screening solutions that address unmet needs and improve patient care.

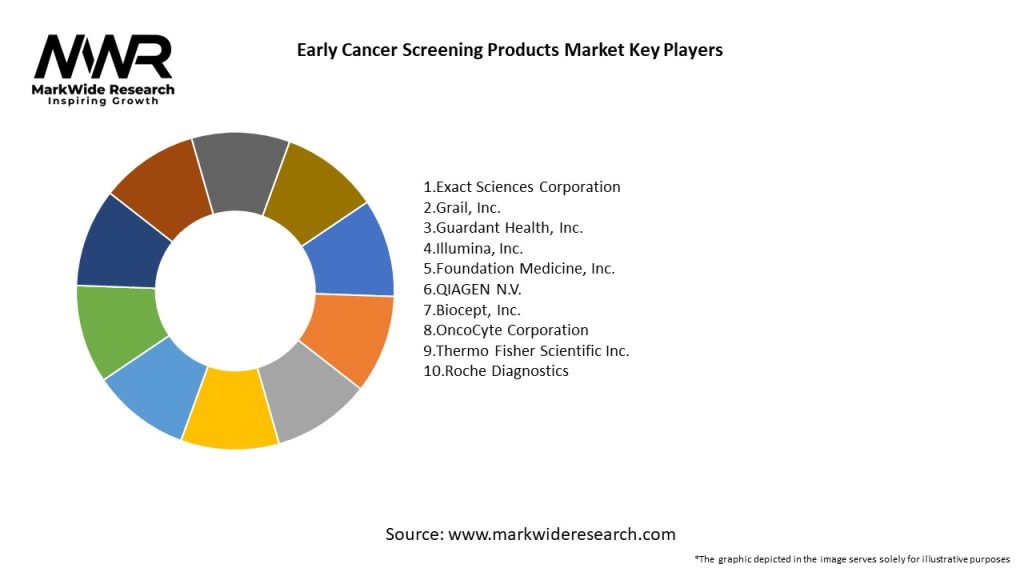

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The early cancer screening products market is characterized by dynamic trends and evolving technologies. As stakeholders seek to address unmet needs in cancer detection and prevention, there is a growing demand for innovative screening solutions that offer high sensitivity, specificity, and cost-effectiveness, while minimizing patient discomfort, healthcare resource utilization, and false-positive rates.

Regional Analysis

The early cancer screening products market exhibits regional variations in terms of cancer incidence, healthcare infrastructure, and screening guidelines. While developed economies such as North America and Europe lead the market in terms of screening uptake and technological innovation, emerging economies in Asia-Pacific and Latin America present significant growth opportunities and unmet needs in cancer detection and prevention.

Competitive Landscape

Leading Companies in the Early Cancer Screening Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

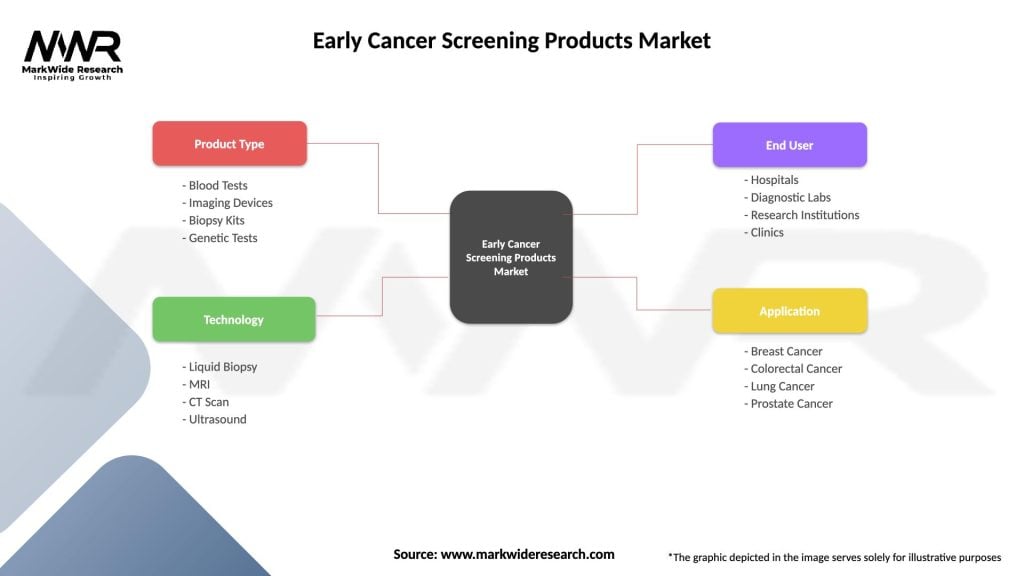

Segmentation

The early cancer screening products market can be segmented based on screening modality, cancer type, and end-user. Common screening modalities include imaging (e.g., mammography, colonoscopy, Pap smear), laboratory tests (e.g., blood tests, urine tests), and genetic screening (e.g., BRCA gene testing), with end-users including hospitals, diagnostic laboratories, and community health centers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the early cancer screening products market, disrupting screening services, delaying cancer diagnoses, and affecting treatment outcomes for cancer patients. While the pandemic has led to temporary declines in screening uptake and diagnostic procedures due to healthcare resource reallocation and patient reluctance to seek medical care, it has also highlighted the importance of early detection and prevention strategies in reducing cancer morbidity and mortality. Additionally, the pandemic has accelerated the adoption of telehealth, remote monitoring, and home-based screening approaches, offering new opportunities for expanding access to cancer screening and surveillance services in the post-pandemic era.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the early cancer screening products market looks promising, with continued advancements in screening technology, biomarker discovery, and precision oncology driving innovation and market growth. As stakeholders collaborate to address unmet needs in cancer detection and prevention, there is a growing opportunity to improve patient outcomes, reduce cancer morbidity and mortality, and advance our understanding of cancer biology and therapeutics.

Conclusion

In conclusion, the early cancer screening products market represents a critical and evolving segment of the global healthcare industry, with significant potential to improve cancer detection, prevention, and treatment outcomes. With early cancer screening products playing a vital role in identifying cancer at its earliest stages, there is a growing demand for innovative screening solutions that offer high sensitivity, specificity, and cost-effectiveness, while minimizing patient discomfort, healthcare resource utilization, and false-positive rates. As stakeholders collaborate to address challenges and capitalize on opportunities in cancer detection and prevention, there is an opportunity to transform cancer care delivery, reduce cancer health disparities, and improve public health outcomes on a global scale.

What is Early Cancer Screening Products?

Early cancer screening products are medical tools and tests designed to detect cancer at an early stage, improving treatment outcomes. These products include blood tests, imaging technologies, and genetic screening methods that help identify cancerous changes before symptoms appear.

What are the key players in the Early Cancer Screening Products Market?

Key players in the Early Cancer Screening Products Market include companies like Guardant Health, Exact Sciences, and Roche, which are known for their innovative screening technologies and diagnostic solutions. These companies focus on developing advanced tests for various types of cancer, among others.

What are the growth factors driving the Early Cancer Screening Products Market?

The Early Cancer Screening Products Market is driven by factors such as increasing cancer prevalence, advancements in technology, and growing awareness about early detection. Additionally, supportive government initiatives and funding for cancer research contribute to market growth.

What challenges does the Early Cancer Screening Products Market face?

Challenges in the Early Cancer Screening Products Market include high costs of advanced screening technologies and regulatory hurdles that can delay product approvals. Furthermore, there is a need for continuous education to ensure proper utilization of screening tests among healthcare providers.

What opportunities exist in the Early Cancer Screening Products Market?

The Early Cancer Screening Products Market presents opportunities for innovation in non-invasive testing methods and personalized screening approaches. Additionally, expanding access to screening in underserved populations can enhance early detection rates and improve overall public health.

What trends are shaping the Early Cancer Screening Products Market?

Trends in the Early Cancer Screening Products Market include the rise of liquid biopsies, which allow for less invasive cancer detection, and the integration of artificial intelligence in diagnostic processes. Moreover, there is a growing emphasis on multi-cancer early detection tests that can screen for multiple types of cancer simultaneously.

Early Cancer Screening Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blood Tests, Imaging Devices, Biopsy Kits, Genetic Tests |

| Technology | Liquid Biopsy, MRI, CT Scan, Ultrasound |

| End User | Hospitals, Diagnostic Labs, Research Institutions, Clinics |

| Application | Breast Cancer, Colorectal Cancer, Lung Cancer, Prostate Cancer |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Early Cancer Screening Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at