444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The E-Scooter Financing market has experienced significant growth in recent years, driven by the increasing demand for convenient and eco-friendly transportation solutions. E-scooters have emerged as a popular mode of transportation in urban areas, offering a cost-effective and efficient way to travel short distances. With the rising concerns about traffic congestion and environmental pollution, e-scooters have gained traction as a sustainable alternative to traditional modes of transportation.

Meaning

E-Scooter Financing refers to the provision of financial services and solutions specifically tailored for the acquisition and ownership of e-scooters. As e-scooters are typically expensive, many individuals and businesses opt for financing options to make their purchase more affordable. E-scooter financing enables customers to spread out the cost of acquiring an e-scooter over a period of time, making it more accessible to a wider range of consumers.

Executive Summary

The E-Scooter Financing market has witnessed substantial growth in recent years, driven by the increasing adoption of e-scooters as a popular mode of transportation. The market offers a range of financing options, allowing individuals and businesses to acquire e-scooters without having to bear the full upfront cost. This report provides a comprehensive analysis of the E-Scooter Financing market, including key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and a conclusion.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The E-Scooter Financing market is poised for significant growth in the coming years, driven by several key market insights. Firstly, the increasing popularity of e-scooters as a sustainable and convenient mode of transportation is expected to drive the demand for e-scooter financing. Additionally, the advancements in technology, such as improved battery life and increased range, are making e-scooters more attractive to consumers, further fueling the market growth. Moreover, the rising focus on reducing carbon emissions and promoting green transportation initiatives by governments across the globe is creating favorable market conditions for e-scooter financing.

Market Drivers

Several market drivers are contributing to the growth of the E-Scooter Financing market. Firstly, the growing urbanization and increasing population in cities have led to significant traffic congestion, prompting individuals to seek alternative transportation options. E-scooters offer a convenient and efficient mode of travel, allowing users to navigate through congested areas easily. Additionally, the cost-effectiveness of e-scooters compared to traditional modes of transportation, such as cars or motorcycles, is driving the demand for e-scooter financing. Moreover, the rising environmental concerns and the need to reduce carbon emissions are propelling the adoption of e-scooters as a sustainable transportation solution.

Market Restraints

Despite the promising growth prospects, the E-Scooter Financing market faces certain restraints that could hinder its growth. One of the significant challenges is the lack of awareness and understanding about e-scooter financing options among potential customers. Many individuals may not be aware of the availability of financing solutions for e-scooters, which limits the market potential. Additionally, the regulatory landscape surrounding e-scooters and their financing varies across different regions, creating uncertainties for market players. Moreover, the limited charging infrastructure for e-scooters in some areas may pose challenges to the widespread adoption of e-scooters and subsequently affect the demand for financing.

Market Opportunities

The E-Scooter Financing market presents several opportunities for industry participants and stakeholders. Firstly, the expansion of e-scooter sharing services provides an avenue for financing companies to collaborate with fleet operators and offer attractive financing solutions. The growth of shared e-scooter services in urban areas opens up new markets and creates a demand for financing options tailored to the unique needs of fleet operators. Moreover, the integration of e-scooters with emerging technologies, such as Internet of Things (IoT) and artificial intelligence, presents opportunities for innovative financing models and value-added services.

Market Dynamics

The E-Scooter Financing market is characterized by dynamic factors that influence its growth and development. The market dynamics are shaped by various factors, including technological advancements, regulatory policies, consumer preferences, and competitive forces. The rapid evolution of e-scooter technology, such as improvements in battery life and connectivity features, influences the market dynamics by enhancing the appeal and usability of e-scooters. Additionally, the regulatory landscape and government initiatives aimed at promoting green transportation play a crucial role in shaping the market dynamics. The competitive landscape, with the presence of established players and new entrants, further contributes to the market dynamics by driving innovation and offering diverse financing options.

Regional Analysis

The E-Scooter Financing market exhibits regional variations in terms of adoption and market dynamics. North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa are the key regions analyzed in this report. North America and Europe have witnessed significant adoption of e-scooters, driven by the presence of established e-scooter sharing services and favorable regulatory frameworks. The Asia Pacific region, particularly countries like China and India, presents immense growth potential due to the large population, increasing urbanization, and rising awareness about sustainable transportation solutions. Latin America, the Middle East, and Africa are also emerging markets for e-scooter financing, driven by the need for efficient and eco-friendly transportation options.

Competitive Landscape

Leading Companies in the E-Scooter Financing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

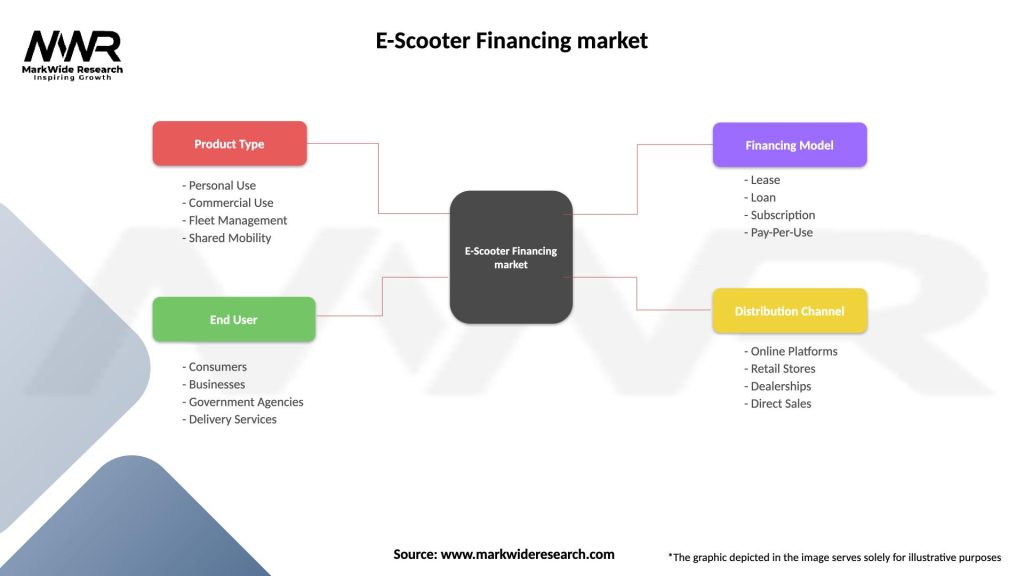

Segmentation

The E-Scooter Financing market can be segmented based on various factors, including financing type, end-user, and region. Based on financing type, the market can be segmented into lease financing, loan financing, and subscription-based financing. Lease financing allows customers to use an e-scooter for a specified period in exchange for regular lease payments. Loan financing involves borrowing funds to purchase an e-scooter and repaying the loan amount with interest over time. Subscription-based financing offers a flexible ownership model where customers pay a monthly subscription fee to access e-scooters. The market segmentation based on end-users includes individual consumers, businesses, and fleet operators.

Category-wise Insights

E-Scooter Financing offers unique insights across different categories. For individual consumers, e-scooter financing provides an affordable way to own an e-scooter without bearing the full upfront cost. It enables individuals to enjoy the benefits of e-scooters, such as reduced commuting time, cost savings, and environmental friendliness. For businesses, e-scooter financing opens up opportunities for last-mile delivery services, enhancing operational efficiency and reducing transportation costs. Fleet operators can leverage e-scooter financing to expand their fleet and cater to the growing demand for shared e-scooter services in urban areas.

Key Benefits for Industry Participants and Stakeholders

The E-Scooter Financing market offers several benefits for industry participants and stakeholders.

For financing companies, the E-Scooter Financing market presents a lucrative opportunity to expand their product offerings and tap into a growing market segment. By providing tailored financing solutions for e-scooters, these companies can attract new customers and generate additional revenue streams. Moreover, by collaborating with e-scooter manufacturers and sharing service providers, financing companies can establish strategic partnerships and enhance their market presence.

For e-scooter manufacturers, the availability of financing options can boost their sales and customer base. By partnering with financing companies, manufacturers can offer attractive financing packages to their customers, making e-scooters more affordable and accessible. This, in turn, can drive higher sales volumes and brand loyalty.

Individual consumers and businesses also benefit from e-scooter financing. For individual consumers, financing options enable them to own an e-scooter without the need for a large upfront payment. This flexibility makes e-scooters more affordable and allows individuals to experience the convenience and benefits of e-scooters. Similarly, businesses can leverage e-scooter financing to acquire e-scooters for their operations, such as last-mile delivery services. Financing options help businesses manage their cash flow and reduce the financial burden of purchasing a fleet of e-scooters.

Stakeholders such as governments and environmental organizations also stand to gain from the growth of the E-Scooter Financing market. E-scooters offer a sustainable and eco-friendly transportation solution, contributing to reduced carbon emissions and improved air quality in urban areas. By supporting and promoting e-scooter financing initiatives, governments and environmental organizations can accelerate the adoption of e-scooters and achieve their sustainability goals.

SWOT Analysis

A SWOT analysis of the E-Scooter Financing market provides a comprehensive understanding of its strengths, weaknesses, opportunities, and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the E-Scooter Financing market:

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the E-Scooter Financing market. Initially, the market experienced a decline in demand as people reduced their mobility and outdoor activities due to lockdowns and restrictions. However, as the restrictions eased and people sought alternative transportation options to avoid crowded public transport, the demand for e-scooters and related financing options started to rebound.

The pandemic also accelerated the adoption of e-scooter sharing services as a safe and socially distanced mode of transportation. This led to increased collaboration between financing companies and e-scooter sharing service providers to cater to the growing demand.

Moreover, the pandemic highlighted the importance of sustainable transportation and reduced carbon emissions. Governments and urban planners are now more focused on promoting eco-friendly modes of transportation, including e-scooters, which presents opportunities for the E-Scooter Financing market.

Key Industry Developments

The E-Scooter Financing market has witnessed several key industry developments in recent years:

Analyst Suggestions

Based on the analysis of the E-Scooter Financing market, several suggestions can be made for industry participants and stakeholders:

Future Outlook

The future outlook for the E-Scooter Financing market is highly promising. The market is expected to witness significant growth in the coming years, driven by the increasing adoption of e-scooters as a sustainable transportation solution. Factors such as technological advancements, favorable regulatory frameworks, and the expanding e-scooter sharing economy will contribute to the market’s growth.

The integration of e-scooters with emerging technologies, such as IoT and AI, will further enhance the market’s potential. This integration will enable innovative financing models, personalized customer experiences, and value-added services.

Moreover, the growing awareness about the environmental benefits of e-scooters and the need to reduce carbon emissions will drive the demand for e-scooter financing. Governments and organizations worldwide are expected to continue supporting sustainable transportation initiatives, creating a conducive environment for the market’s growth.

Conclusion

In conclusion, the E-Scooter Financing market presents immense opportunities for industry participants and stakeholders. By leveraging the market drivers, addressing the market restraints, and capitalizing on the market opportunities, stakeholders can position themselves for success in this rapidly growing market. Continuous innovation, strategic partnerships, and a focus on sustainability will be crucial for long-term success in the E-Scooter Financing market.

What is E-Scooter Financing?

E-Scooter Financing refers to the financial services and products that enable consumers to purchase or lease electric scooters. This can include loans, leasing options, and payment plans tailored for e-scooter buyers.

What are the key players in the E-Scooter Financing market?

Key players in the E-Scooter Financing market include companies like Klarna, Affirm, and PayPal, which provide financing solutions for e-scooter purchases. Additionally, manufacturers like Bird and Lime may offer financing options directly to consumers, among others.

What are the growth factors driving the E-Scooter Financing market?

The E-Scooter Financing market is driven by the increasing popularity of electric scooters as a sustainable transportation option, urban congestion, and the rising demand for convenient mobility solutions. Additionally, government incentives for electric vehicles contribute to market growth.

What challenges does the E-Scooter Financing market face?

Challenges in the E-Scooter Financing market include regulatory hurdles, fluctuating consumer demand, and competition from alternative mobility solutions. Additionally, concerns about the safety and reliability of e-scooters can impact financing decisions.

What opportunities exist in the E-Scooter Financing market?

Opportunities in the E-Scooter Financing market include the expansion of e-scooter sharing programs, partnerships with urban mobility initiatives, and the development of innovative financing models. As cities invest in sustainable transport, financing options can become more attractive.

What trends are shaping the E-Scooter Financing market?

Trends in the E-Scooter Financing market include the rise of subscription-based models, increased integration of technology in financing processes, and a focus on eco-friendly transportation solutions. Additionally, consumer preferences are shifting towards flexible payment options.

E-Scooter Financing market

| Segmentation Details | Description |

|---|---|

| Product Type | Personal Use, Commercial Use, Fleet Management, Shared Mobility |

| End User | Consumers, Businesses, Government Agencies, Delivery Services |

| Financing Model | Lease, Loan, Subscription, Pay-Per-Use |

| Distribution Channel | Online Platforms, Retail Stores, Dealerships, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the E-Scooter Financing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at