444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

E-commerce in Luxembourg represents one of Europe’s most sophisticated and rapidly evolving digital marketplaces, characterized by exceptional consumer purchasing power and advanced technological infrastructure. The Luxembourg e-commerce market demonstrates remarkable resilience and growth potential, driven by the country’s strategic position as a European financial hub and its tech-savvy population of approximately 640,000 residents.

Digital transformation has accelerated significantly across Luxembourg’s retail landscape, with online shopping penetration reaching 78% of the adult population as consumers increasingly embrace digital commerce solutions. The market benefits from Luxembourg’s multilingual environment, where French, German, and Luxembourgish languages create unique opportunities for cross-border e-commerce expansion and localized shopping experiences.

Cross-border commerce plays a pivotal role in Luxembourg’s e-commerce ecosystem, with approximately 65% of online purchases originating from international retailers, particularly from neighboring Germany, France, and Belgium. This trend reflects both the limited domestic retail options and Luxembourg residents’ preference for accessing broader product selections and competitive pricing from European markets.

Mobile commerce adoption has surged dramatically, with mobile devices accounting for 52% of all e-commerce transactions in Luxembourg. The country’s excellent 5G network coverage and high smartphone penetration rates create optimal conditions for seamless mobile shopping experiences, driving innovation in mobile payment solutions and app-based retail platforms.

The e-commerce in Luxembourg market refers to the comprehensive ecosystem of online retail activities, digital payment systems, and electronic commerce platforms operating within Luxembourg’s borders and serving its residents. This market encompasses both domestic Luxembourg-based online retailers and international e-commerce platforms that deliver products and services to Luxembourg consumers.

Digital commerce infrastructure in Luxembourg includes sophisticated logistics networks, advanced payment processing systems, and multilingual customer service capabilities that cater to the country’s diverse linguistic landscape. The market integrates traditional retail concepts with cutting-edge technology solutions, creating hybrid shopping experiences that combine online convenience with personalized customer service.

Regulatory framework governing Luxembourg’s e-commerce market aligns with European Union directives while incorporating specific national requirements for consumer protection, data privacy, and cross-border trade facilitation. This regulatory environment ensures high standards for online transactions while promoting innovation and competition among digital commerce providers.

Luxembourg’s e-commerce market stands as a testament to successful digital transformation in a small but economically powerful European nation. The market’s growth trajectory reflects broader trends toward digitalization while maintaining unique characteristics shaped by Luxembourg’s multicultural society and strategic geographic position.

Consumer behavior patterns reveal sophisticated shopping preferences, with Luxembourg residents demonstrating high comfort levels with digital payment methods and cross-border online purchases. The market exhibits strong growth in categories including fashion, electronics, home goods, and specialty products that leverage Luxembourg’s high disposable income levels.

Technology adoption rates in Luxembourg’s e-commerce sector exceed European averages, with advanced features like artificial intelligence-powered recommendations, augmented reality product visualization, and blockchain-based payment systems gaining traction among both retailers and consumers. According to MarkWide Research analysis, technology integration drives 23% higher customer satisfaction rates compared to traditional retail channels.

Market consolidation trends show increasing dominance of major international platforms while creating opportunities for specialized niche retailers serving Luxembourg’s unique market segments. Local entrepreneurs leverage advanced e-commerce tools to compete effectively against larger competitors through personalized service and specialized product offerings.

Strategic market insights reveal several critical factors driving Luxembourg’s e-commerce evolution:

Digital infrastructure excellence serves as a primary driver for Luxembourg’s e-commerce growth, with the country maintaining some of Europe’s fastest internet speeds and most reliable connectivity. This technological foundation enables sophisticated e-commerce applications, real-time inventory management, and seamless customer experiences across multiple digital touchpoints.

Consumer purchasing power significantly influences market dynamics, as Luxembourg residents possess among the highest disposable incomes in Europe. This economic strength drives demand for premium products, luxury goods, and specialized services available through e-commerce platforms, creating opportunities for high-value transaction categories.

Cross-border commerce facilitation benefits from Luxembourg’s central European location and excellent transportation infrastructure. The country’s position enables efficient logistics networks connecting to major European markets, reducing delivery times and shipping costs for international e-commerce transactions.

Government digitalization initiatives actively promote e-commerce adoption through supportive policies, digital infrastructure investments, and regulatory frameworks that encourage innovation while protecting consumers. These initiatives create favorable conditions for both domestic and international e-commerce operators.

Workforce expertise in financial services and technology sectors translates into sophisticated e-commerce capabilities, including advanced payment processing, fraud prevention systems, and customer relationship management solutions that enhance overall market competitiveness.

Limited domestic market size presents challenges for Luxembourg-based e-commerce retailers seeking to achieve economies of scale. The small population base requires businesses to expand internationally or focus on specialized niche markets to maintain sustainable growth trajectories.

High operational costs associated with Luxembourg’s premium business environment can impact e-commerce profitability, particularly for startups and smaller retailers competing against established international platforms with greater resource advantages and operational efficiencies.

Regulatory complexity arising from multilingual requirements and cross-border commerce regulations creates compliance challenges for e-commerce operators. Businesses must navigate various legal frameworks while maintaining consistent service quality across different linguistic and cultural segments.

Logistics constraints for certain product categories may limit e-commerce growth, particularly for bulky items or specialized goods requiring specific handling procedures. Limited warehouse space and high real estate costs can impact distribution efficiency and cost structures.

Competition intensity from established European e-commerce giants creates market entry barriers for new players, requiring significant investment in technology, marketing, and customer acquisition to compete effectively against well-funded international competitors.

Fintech integration opportunities leverage Luxembourg’s expertise in financial services to develop innovative payment solutions, cryptocurrency commerce platforms, and blockchain-based transaction systems that could position the country as a leader in next-generation e-commerce technologies.

Sustainable commerce initiatives align with growing consumer environmental consciousness, creating opportunities for eco-friendly e-commerce platforms, carbon-neutral delivery services, and sustainable product marketplaces that appeal to Luxembourg’s environmentally aware population.

B2B e-commerce expansion represents significant growth potential, particularly in serving Luxembourg’s numerous multinational corporations and financial institutions with specialized procurement platforms, enterprise software solutions, and professional service marketplaces.

Luxury market specialization capitalizes on Luxembourg residents’ high purchasing power and appreciation for premium products, enabling development of exclusive e-commerce platforms focused on luxury goods, artisanal products, and high-end services.

Regional hub development opportunities exist for establishing Luxembourg as a European e-commerce distribution center, leveraging the country’s strategic location, excellent infrastructure, and business-friendly environment to serve broader European markets.

Competitive dynamics in Luxembourg’s e-commerce market reflect the interplay between international giants and specialized local players, creating a diverse ecosystem where different business models can coexist successfully. Large platforms dominate volume-based categories while niche retailers excel in specialized segments requiring personalized service and local expertise.

Technology evolution continuously reshapes market dynamics, with artificial intelligence, machine learning, and automation technologies enabling more sophisticated personalization, inventory management, and customer service capabilities. These technological advances create competitive advantages for early adopters while raising performance expectations across the market.

Consumer behavior shifts toward omnichannel experiences drive retailers to integrate online and offline touchpoints seamlessly. This evolution requires significant investment in technology infrastructure and staff training while creating opportunities for innovative customer engagement strategies.

Supply chain optimization becomes increasingly critical as consumers expect faster delivery times and greater transparency regarding product origins and shipping processes. Retailers must balance efficiency improvements with cost management while maintaining service quality standards.

Payment system evolution introduces new options including cryptocurrency payments, buy-now-pay-later services, and integrated financial products that enhance customer convenience while creating additional revenue streams for e-commerce operators.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Luxembourg’s e-commerce market dynamics. Primary research includes consumer surveys, retailer interviews, and industry expert consultations conducted across Luxembourg’s diverse linguistic communities.

Data collection processes utilize both quantitative and qualitative research approaches, incorporating statistical analysis of transaction data, consumer behavior patterns, and market performance metrics alongside in-depth interviews with key stakeholders including retailers, technology providers, and regulatory officials.

Market segmentation analysis examines various dimensions including product categories, consumer demographics, geographic distribution, and technology adoption patterns to provide comprehensive understanding of market structure and growth opportunities.

Competitive intelligence gathering involves systematic monitoring of major e-commerce platforms, emerging startups, and technology innovations that influence market dynamics. This analysis includes pricing strategies, service offerings, and customer satisfaction metrics across different market segments.

Validation procedures ensure research accuracy through cross-referencing multiple data sources, conducting follow-up interviews, and applying statistical verification methods to confirm findings and eliminate potential biases or inconsistencies in the research process.

Luxembourg City dominance characterizes the geographic distribution of e-commerce activity, with the capital region accounting for approximately 45% of total online transactions. This concentration reflects the city’s role as the country’s economic center and its higher population density compared to rural areas.

Northern regions including Ettelbruck and Diekirch demonstrate growing e-commerce adoption rates, driven by improved internet infrastructure and increasing consumer comfort with digital shopping platforms. These areas show particular strength in home goods and automotive-related online purchases.

Southern districts near the French border exhibit unique cross-border shopping patterns, with residents frequently purchasing from French e-commerce platforms while also supporting local Luxembourg retailers. This region shows 38% higher cross-border transaction rates compared to other areas.

Eastern municipalities along the German border demonstrate strong adoption of German-language e-commerce platforms, reflecting linguistic preferences and cultural connections. These areas show particular growth in electronics and technology product categories purchased online.

Rural area development presents both challenges and opportunities, with lower population density offset by higher per-capita purchasing power and growing demand for convenient online shopping options that overcome geographic limitations of traditional retail access.

International platform dominance shapes Luxembourg’s e-commerce competitive environment, with major global retailers maintaining strong market positions through comprehensive product selections, competitive pricing, and efficient delivery networks.

Key market participants include:

Competitive strategies vary significantly across market segments, with large platforms competing on price and convenience while smaller retailers differentiate through specialized expertise, personalized service, and unique product offerings that appeal to specific customer segments.

Market entry barriers include high customer acquisition costs, complex regulatory requirements, and the need for multilingual customer support capabilities that can effectively serve Luxembourg’s diverse linguistic communities.

By Product Category:

By Consumer Demographics:

By Language Preference:

Fashion and Apparel represents the most dynamic e-commerce category in Luxembourg, with consumers showing strong preference for international brands and luxury items. The segment benefits from Luxembourg residents’ fashion consciousness and willingness to invest in high-quality clothing and accessories.

Electronics and Technology demonstrates consistent growth driven by early adoption of new technologies and high replacement rates for consumer electronics. Luxembourg consumers show particular interest in premium technology products and innovative gadgets from leading global brands.

Home and Garden category experiences seasonal fluctuations with peak activity during spring and summer months. The segment benefits from Luxembourg’s high homeownership rates and consumer investment in property improvement and maintenance projects.

Health and Beauty products show strong growth in organic and sustainable product subcategories, reflecting Luxembourg consumers’ environmental consciousness and willingness to pay premium prices for quality personal care items.

Automotive and Parts represents a specialized but significant segment, with Luxembourg’s high car ownership rates driving demand for automotive accessories, parts, and maintenance products purchased through e-commerce channels.

For Retailers:

For Consumers:

For Technology Providers:

For Logistics Companies:

Strengths:

Weaknesses:

Opportunities:

Threats:

Omnichannel integration emerges as a dominant trend, with retailers increasingly connecting online and offline experiences to create seamless customer journeys. This approach enables customers to research products online, experience them in physical stores, and complete purchases through their preferred channels.

Sustainability emphasis grows stronger as Luxembourg consumers prioritize environmentally responsible shopping options. E-commerce platforms respond by highlighting eco-friendly products, implementing carbon-neutral delivery options, and providing detailed sustainability information for products and services.

Personalization advancement leverages artificial intelligence and machine learning technologies to deliver highly customized shopping experiences. Retailers use sophisticated algorithms to recommend products, optimize pricing, and tailor marketing messages based on individual consumer behavior patterns and preferences.

Mobile-first strategies dominate platform development as consumers increasingly prefer mobile devices for online shopping. Retailers invest heavily in mobile app development, responsive design, and mobile payment integration to capture the growing mobile commerce segment.

Social commerce integration connects e-commerce with social media platforms, enabling consumers to discover and purchase products directly through social media interfaces. This trend particularly appeals to younger demographics who spend significant time on social platforms.

Voice commerce adoption begins gaining traction as smart speaker penetration increases in Luxembourg households. Early adopters experiment with voice-activated shopping for routine purchases and product research, creating opportunities for voice-optimized e-commerce experiences.

Digital payment innovations continue transforming Luxembourg’s e-commerce landscape, with new payment methods including cryptocurrency options, buy-now-pay-later services, and integrated banking solutions gaining consumer acceptance and merchant adoption.

Logistics network expansion sees major e-commerce platforms investing in Luxembourg-based distribution facilities and last-mile delivery capabilities to improve service quality and reduce delivery times for local consumers.

Regulatory framework updates address emerging challenges in digital commerce, including enhanced consumer protection measures, data privacy requirements, and cross-border transaction regulations that impact how e-commerce businesses operate in Luxembourg.

Technology platform upgrades enable more sophisticated e-commerce capabilities, including augmented reality product visualization, advanced search functionality, and improved mobile commerce features that enhance customer experience and conversion rates.

Partnership developments between international e-commerce platforms and local Luxembourg businesses create hybrid models that combine global reach with local expertise, enabling better service to Luxembourg’s unique market characteristics and consumer preferences.

Sustainability initiatives gain momentum as major retailers implement eco-friendly packaging, carbon-neutral delivery options, and sustainable product certification programs that appeal to Luxembourg’s environmentally conscious consumers.

Market entry strategies should prioritize understanding Luxembourg’s multilingual requirements and cultural nuances. MWR analysis indicates that businesses offering trilingual customer support achieve 31% higher customer retention rates compared to single-language operations.

Investment priorities should focus on mobile commerce capabilities and cross-border logistics optimization. Companies investing in advanced mobile platforms and efficient international shipping networks position themselves advantageously in Luxembourg’s competitive landscape.

Partnership opportunities with local financial institutions and logistics providers can accelerate market penetration while reducing operational complexity. These collaborations enable faster implementation of payment solutions and delivery networks tailored to Luxembourg market requirements.

Technology adoption recommendations emphasize artificial intelligence integration for personalization and inventory management. Early adopters of AI-powered e-commerce solutions demonstrate superior performance in customer satisfaction and operational efficiency metrics.

Regulatory compliance requires proactive attention to evolving EU directives and Luxembourg-specific requirements. Companies maintaining robust compliance programs avoid operational disruptions while building consumer trust and market credibility.

Sustainability integration becomes increasingly important for long-term success. Retailers implementing comprehensive environmental responsibility programs appeal to Luxembourg’s environmentally conscious consumers while differentiating themselves from competitors focused solely on price and convenience.

Growth trajectory for Luxembourg’s e-commerce market remains strongly positive, with continued expansion expected across all major product categories and consumer segments. The market’s evolution will be shaped by technological innovation, changing consumer preferences, and increasing integration with European e-commerce networks.

Technology integration will accelerate, with artificial intelligence, augmented reality, and blockchain technologies becoming standard features rather than competitive differentiators. These technologies will enable more sophisticated personalization, enhanced security, and improved operational efficiency across the e-commerce ecosystem.

Cross-border commerce expansion will continue strengthening Luxembourg’s position as a European e-commerce hub, with improved logistics networks and regulatory harmonization facilitating seamless international transactions and market access for both consumers and retailers.

Sustainability focus will intensify as environmental considerations become central to consumer decision-making and regulatory requirements. E-commerce platforms will need to demonstrate genuine commitment to environmental responsibility through concrete actions and measurable improvements.

Market consolidation may occur as smaller players struggle to compete against well-funded international platforms, while successful niche retailers will thrive by serving specialized market segments with exceptional service quality and unique product offerings.

Innovation opportunities will emerge in areas including voice commerce, social shopping, and integrated financial services that leverage Luxembourg’s expertise in banking and technology sectors to create next-generation e-commerce experiences.

Luxembourg’s e-commerce market represents a sophisticated and rapidly evolving digital commerce ecosystem that successfully combines international accessibility with local market expertise. The market’s strength lies in its affluent consumer base, advanced technological infrastructure, and strategic European location that facilitates cross-border commerce opportunities.

Key success factors for e-commerce operations in Luxembourg include multilingual capabilities, premium service quality, and efficient logistics networks that meet the high expectations of discerning consumers. The market rewards businesses that invest in technology innovation while maintaining personal customer relationships and cultural sensitivity.

Future development will be characterized by continued growth across all major segments, with particular strength in premium product categories, sustainable commerce initiatives, and technology-enhanced shopping experiences. The market’s evolution will create opportunities for both established international platforms and innovative local retailers that can effectively serve Luxembourg’s unique market characteristics and consumer preferences.

What is E-commerce in Luxembourg?

E-commerce in Luxembourg refers to the buying and selling of goods and services over the internet within the country. It encompasses various sectors including retail, digital services, and online marketplaces, catering to both local and international consumers.

What are the key players in the E-commerce in Luxembourg Market?

Key players in the E-commerce in Luxembourg market include companies like Amazon, eBay, and local platforms such as Fnac and Cactus. These companies offer a range of products from electronics to groceries, contributing to the growth of online shopping in the region.

What are the growth factors driving E-commerce in Luxembourg?

The growth of E-commerce in Luxembourg is driven by factors such as increasing internet penetration, a rise in mobile shopping, and changing consumer preferences towards convenience. Additionally, the expansion of logistics and payment solutions supports this growth.

What challenges does the E-commerce in Luxembourg Market face?

Challenges in the E-commerce in Luxembourg market include competition from larger international players, regulatory compliance issues, and the need for robust cybersecurity measures. These factors can impact the operational efficiency of local businesses.

What opportunities exist in the E-commerce in Luxembourg Market?

Opportunities in the E-commerce in Luxembourg market include the potential for niche markets, growth in cross-border e-commerce, and the increasing adoption of digital payment methods. Local businesses can leverage these trends to enhance their online presence.

What trends are shaping the E-commerce in Luxembourg Market?

Trends shaping the E-commerce in Luxembourg market include the rise of social commerce, personalized shopping experiences, and the integration of artificial intelligence in customer service. These innovations are enhancing user engagement and driving sales.

E-commerce in Luxembourg Market

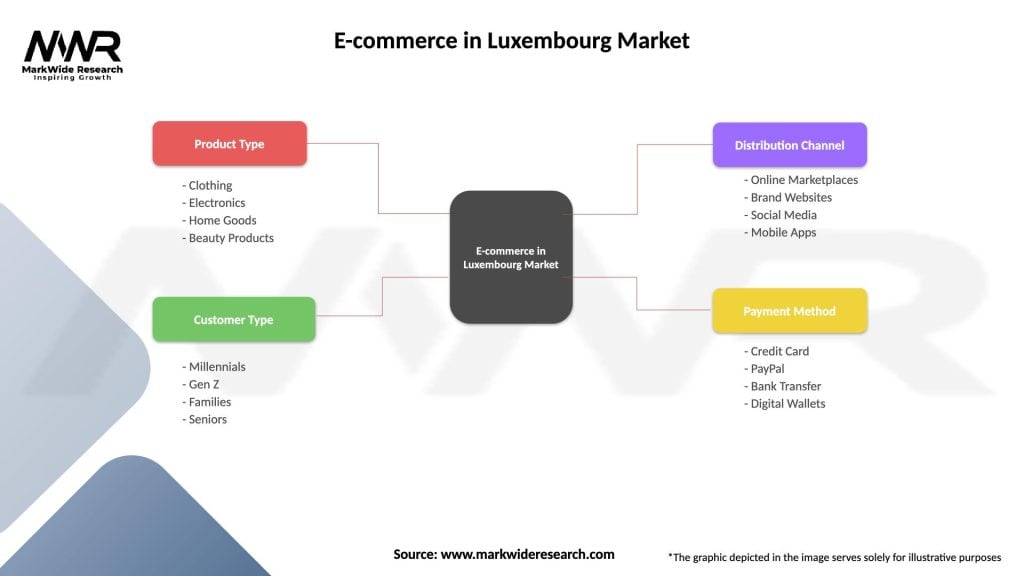

| Segmentation Details | Description |

|---|---|

| Product Type | Clothing, Electronics, Home Goods, Beauty Products |

| Customer Type | Millennials, Gen Z, Families, Seniors |

| Distribution Channel | Online Marketplaces, Brand Websites, Social Media, Mobile Apps |

| Payment Method | Credit Card, PayPal, Bank Transfer, Digital Wallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the E-commerce in Luxembourg Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at