444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The E-bus charging infrastructure market is experiencing significant growth in recent years. With the increasing adoption of electric buses worldwide, the need for a robust and efficient charging infrastructure has become crucial. The market is witnessing rapid development and innovation to cater to the growing demand for electric buses and support their widespread deployment. The E-bus charging infrastructure comprises charging stations, charging management systems, and associated hardware and software components.

Meaning

E-bus charging infrastructure refers to the network of charging stations and related infrastructure designed specifically to cater to the charging requirements of electric buses. It encompasses various components such as charging stations, power distribution systems, charging management systems, and communication systems. The charging infrastructure plays a pivotal role in facilitating the adoption and operation of electric buses by providing a reliable and efficient means of charging.

Executive Summary

The E-bus charging infrastructure market is witnessing robust growth globally. The increasing concern for environmental sustainability and the need to reduce greenhouse gas emissions have led to the rapid adoption of electric buses as an alternative to conventional buses. This, in turn, has fueled the demand for an efficient and reliable charging infrastructure to support the growing fleet of electric buses. The market is characterized by intense competition among key players, with a focus on technological advancements and strategic partnerships to gain a competitive edge.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

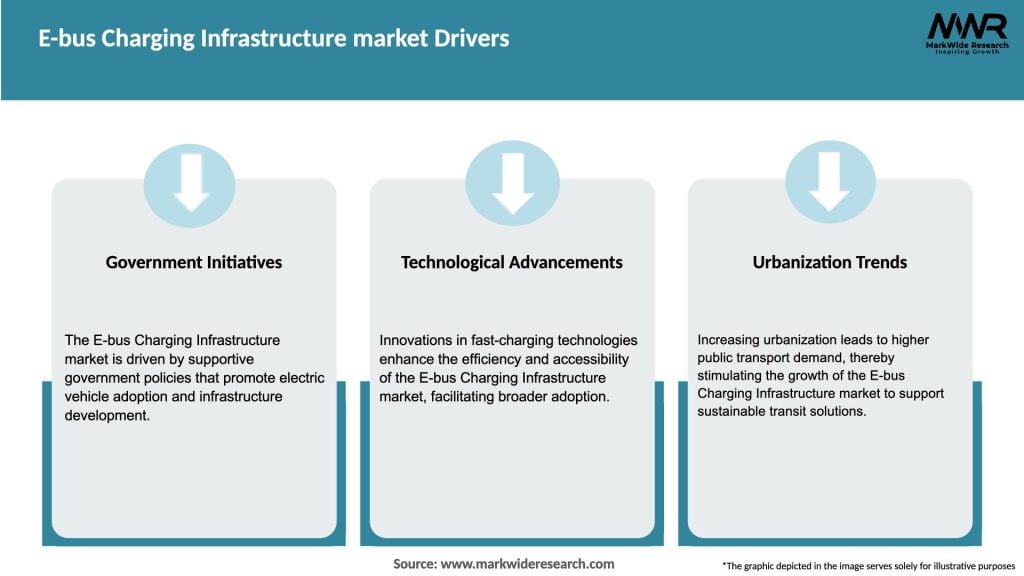

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The E-bus charging infrastructure market is driven by a combination of factors, including government regulations, technological advancements, and environmental concerns. The market is characterized by intense competition among key players, with a focus on innovation, strategic partnerships, and geographic expansion. The demand for E-bus charging infrastructure is expected to grow significantly in the coming years as electric buses gain prominence as a sustainable transportation solution.

Regional Analysis

The E-bus charging infrastructure market is experiencing substantial growth across various regions. North America and Europe are leading in terms of market share, primarily driven by favorable government initiatives and robust charging infrastructure development. Asia Pacific is witnessing rapid growth due to the increasing adoption of electric buses in countries like China and India. The Middle East and Africa, along with Latin America, are also expected to offer significant growth opportunities in the coming years.

Competitive Landscape

Leading Companies in the E-bus Charging Infrastructure Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The E-bus charging infrastructure market can be segmented based on charging infrastructure type, power output, connectivity, and end-use application.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the E-bus charging infrastructure market. The initial phase of the pandemic led to a temporary slowdown in the market as various industries faced disruptions. However, the market quickly rebounded as governments and organizations recognized the importance of sustainable transportation and green recovery.

The pandemic also highlighted the importance of clean air and sustainable mobility, leading to increased interest in electric buses and their associated charging infrastructure. Governments implemented stimulus packages and green recovery plans that included investments in electric buses and charging infrastructure. These initiatives provided a boost to the market and accelerated the transition towards electric buses.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the E-bus charging infrastructure market looks promising. The increasing adoption of electric buses, coupled with supportive government policies and investments, will continue to drive market growth. Technological advancements, such as high-power charging and intelligent charging solutions, will further enhance the efficiency and convenience of charging operations.

The market is expected to witness significant expansion in emerging economies, particularly in Asia Pacific, as countries like China and India prioritize sustainable transportation solutions. The integration of renewable energy sources and the development of charging infrastructure as a service (CaaS) are expected to open up new opportunities for market players.

Conclusion

In conclusion, the E-bus charging infrastructure market is poised for substantial growth in the coming years. The market offers lucrative opportunities for industry participants and stakeholders, driven by the increasing adoption of electric buses, government support, and technological advancements. Companies that focus on innovation, strategic partnerships, and geographical expansion are well-positioned to capitalize on the market’s growth potential.

What is E-bus Charging Infrastructure?

E-bus Charging Infrastructure refers to the network of charging stations and related technologies that support the operation of electric buses. This infrastructure is essential for the efficient and sustainable deployment of electric public transport systems.

What are the key players in the E-bus Charging Infrastructure market?

Key players in the E-bus Charging Infrastructure market include companies like Siemens, ABB, and ChargePoint, which provide various charging solutions and technologies for electric buses, among others.

What are the main drivers of the E-bus Charging Infrastructure market?

The main drivers of the E-bus Charging Infrastructure market include the increasing demand for sustainable public transport, government initiatives promoting electric vehicles, and advancements in charging technology that enhance efficiency and reduce downtime.

What challenges does the E-bus Charging Infrastructure market face?

Challenges in the E-bus Charging Infrastructure market include the high initial investment costs for charging stations, the need for standardization across different bus models, and the integration of charging infrastructure with existing public transport systems.

What opportunities exist in the E-bus Charging Infrastructure market?

Opportunities in the E-bus Charging Infrastructure market include the expansion of urban electric bus fleets, the development of fast-charging technologies, and potential partnerships between public transport authorities and private companies to enhance infrastructure.

What trends are shaping the E-bus Charging Infrastructure market?

Trends shaping the E-bus Charging Infrastructure market include the rise of smart charging solutions that optimize energy use, the integration of renewable energy sources into charging stations, and the growing focus on sustainability and reducing carbon emissions in urban transport.

E-bus Charging Infrastructure market

| Segmentation Details | Description |

|---|---|

| Technology | DC Fast Charging, AC Charging, Wireless Charging, Smart Charging |

| End User | Public Transport, Fleet Operators, Private Operators, Municipalities |

| Installation | On-street, Depot, Commercial, Residential |

| Power Rating | High Power, Medium Power, Low Power, Ultra-Fast |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the E-bus Charging Infrastructure Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at