444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The e-brokerage market has witnessed significant growth in recent years, driven by advancements in technology and the increasing demand for online trading platforms. E-brokerage refers to the provision of brokerage services through electronic platforms, enabling individuals to trade financial securities such as stocks, bonds, options, and mutual funds electronically. These platforms offer convenience, accessibility, and real-time information to investors, revolutionizing the way people engage in trading activities.

Meaning

E-brokerage, also known as electronic brokerage or online brokerage, is a form of financial service that allows individuals to buy and sell financial securities through electronic platforms. It eliminates the need for traditional brick-and-mortar brokerage firms and enables investors to execute trades from anywhere, at any time, using internet-enabled devices such as computers, smartphones, or tablets. E-brokerage platforms provide a wide range of services, including account management, market research, trading tools, and customer support, making it easier for individuals to participate in the financial markets.

Executive Summary

The e-brokerage market has experienced rapid growth in recent years, driven by factors such as increasing internet penetration, rising smartphone adoption, and the growing interest of individuals in investment activities. The convenience and accessibility offered by e-brokerage platforms have attracted a large number of retail investors, who are now actively participating in the financial markets. Moreover, advancements in technology, such as artificial intelligence and machine learning, have further enhanced the capabilities of e-brokerage platforms, providing personalized investment recommendations and improved user experiences.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The e-brokerage market is characterized by intense competition and rapid technological advancements. Market players are continuously innovating to enhance user experiences, improve trading platforms, and differentiate their services. Additionally, regulatory developments and changing investor behavior exert significant influence on the market dynamics.

Moreover, the market dynamics are influenced by macroeconomic factors, such as interest rates, inflation, and geopolitical events, which can impact investor sentiment and trading volumes. Market participants need to closely monitor these factors and adapt their strategies accordingly to stay competitive in the evolving landscape.

Regional Analysis

The e-brokerage market exhibits regional variations due to differences in market maturity, regulatory frameworks, investor preferences, and technological infrastructure. North America, Europe, and Asia Pacific are the major regions driving market growth, with each region having its unique characteristics and market players.

Competitive Landscape

Leading Companies in the E-Brokerage Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

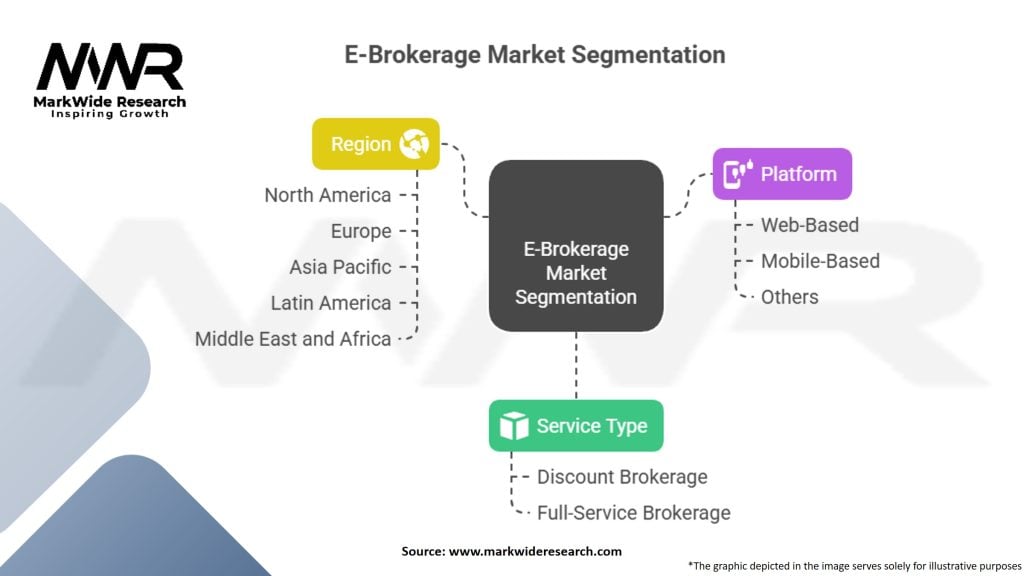

Segmentation

The e-brokerage market can be segmented based on various factors, including types of financial securities traded, target customer segments, and geographical regions. Common segments in the market include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the e-brokerage market. The global lockdowns and social distancing measures led to increased interest in online trading as individuals sought alternative ways to generate income and manage their investments. The volatility in financial markets during the pandemic further fueled trading activities, attracting both seasoned traders and new investors.

Moreover, the pandemic accelerated the adoption of digital technologies across industries, including the financial sector. E-brokerage platforms witnessed a surge in user registrations and trading volumes, as more individuals embraced online trading. This shift in investor behavior and increased reliance on e-brokerage platforms are expected to have a lasting impact on the market even beyond the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the e-brokerage market looks promising, with sustained growth expected in the coming years. Advancements in technology, changing investor preferences, and favorable regulatory environments are driving market expansion. The increasing adoption of mobile trading, integration of AI and ML, and the emergence of new investment options are anticipated to reshape the industry.

However, market participants need to address security concerns, regulatory challenges, and investor education gaps to ensure long-term sustainability. E-brokerage platforms that prioritize customer-centric approaches, embrace technological innovations, and adapt to evolving market dynamics are likely to thrive in the competitive landscape.

Conclusion

The e-brokerage market has transformed the way individuals participate in financial markets. With the convenience, accessibility, and real-time information offered by e-brokerage platforms, investors can trade a wide range of financial securities from anywhere, at any time. The market is driven by factors such as increasing internet penetration, rising smartphone adoption, and changing investor preferences.

While the market presents significant opportunities, it also faces challenges such as security risks, regulatory complexities, and the need for investor education. Market players need to continually innovate, enhance security measures, and provide value-added services to meet the evolving needs of investors.

Looking ahead, the e-brokerage market is poised for continued growth, fueled by technological advancements, expanding market reach, and the integration of advanced analytics. The future promises a more inclusive and dynamic landscape, enabling individuals to participate in the financial markets and shape their investment journeys with ease.

What is E-Brokerage?

E-Brokerage refers to the online platforms that facilitate the buying and selling of financial securities, such as stocks and bonds, through electronic means. These platforms provide investors with tools for trading, research, and portfolio management.

What are the key players in the E-Brokerage Market?

Key players in the E-Brokerage Market include companies like Charles Schwab, E*TRADE, and TD Ameritrade, which offer a range of services from stock trading to investment advice. These firms compete on technology, fees, and customer service, among others.

What are the growth factors driving the E-Brokerage Market?

The E-Brokerage Market is driven by factors such as the increasing adoption of mobile trading applications, the rise of retail investors seeking low-cost trading options, and advancements in technology that enhance user experience and accessibility.

What challenges does the E-Brokerage Market face?

Challenges in the E-Brokerage Market include regulatory compliance issues, cybersecurity threats, and the need to continuously innovate to meet changing consumer preferences. These factors can impact operational efficiency and customer trust.

What opportunities exist in the E-Brokerage Market?

Opportunities in the E-Brokerage Market include expanding into emerging markets, developing new financial products, and leveraging artificial intelligence for personalized investment strategies. These trends can attract a broader customer base.

What trends are shaping the E-Brokerage Market?

Trends in the E-Brokerage Market include the rise of commission-free trading, the integration of robo-advisors, and the increasing focus on sustainable investing. These trends are reshaping how investors engage with financial markets.

E-Brokerage Market

| Segmentation | Details |

|---|---|

| Service Type | Discount Brokerage, Full-Service Brokerage |

| Platform | Web-Based, Mobile-Based, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the E-Brokerage Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at