444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The dry granulation equipment market is witnessing significant growth globally, driven by the pharmaceutical, food, and chemical industries’ increasing demand for efficient granulation processes. Dry granulation is a process used to form granules without the need for liquid binders or solvents, making it a preferred method for materials sensitive to moisture or heat. This market offers a wide range of equipment solutions designed to meet the specific needs of various industries, including roller compactors, briquetting machines, and tablet presses.

Meaning

Dry granulation equipment refers to machinery and systems used to convert powdered materials into granules without the use of liquid binders or solvents. This process involves compacting and densifying powders through mechanical compression, followed by milling or screening to produce uniform granules of controlled size and density. Dry granulation offers advantages such as improved product stability, reduced risk of contamination, and enhanced flow properties, making it suitable for a wide range of applications across industries.

Executive Summary

The dry granulation equipment market is experiencing robust growth due to the increasing adoption of dry granulation processes in pharmaceutical manufacturing, particularly for the production of oral solid dosage forms such as tablets and capsules. Key factors driving market growth include the growing demand for personalized medicine, advancements in pharmaceutical formulations, and the need for cost-effective manufacturing solutions. However, challenges such as the high initial investment cost and regulatory requirements may hinder market growth to some extent.

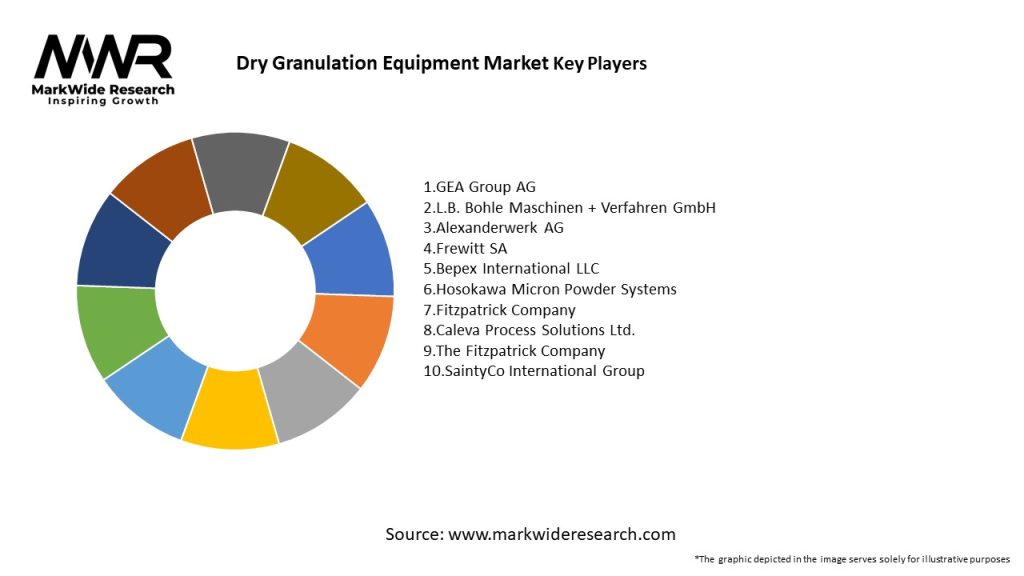

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The dry granulation equipment market is characterized by dynamic trends and factors influencing industry dynamics, including technological advancements, regulatory changes, market consolidation, and shifting customer preferences. Understanding these dynamics is essential for stakeholders to identify opportunities, mitigate risks, and formulate effective strategies to succeed in the competitive market landscape.

Regional Analysis

The dry granulation equipment market exhibits regional variations in demand, driven by factors such as pharmaceutical manufacturing capacity, regulatory environment, and economic development. Key regions include:

Competitive Landscape

Leading Companies in the Dry Granulation Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The dry granulation equipment market can be segmented based on various factors such as:

Segmentation enables a deeper understanding of market dynamics and facilitates targeted marketing and product development strategies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The dry granulation equipment market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis of the dry granulation equipment market provides insights into its strengths, weaknesses, opportunities, and threats:

Understanding these factors enables stakeholders to capitalize on market opportunities, mitigate risks, and formulate strategies for sustainable growth and competitive advantage.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the dry granulation equipment market. While the pharmaceutical industry experienced increased demand for certain products, disruptions in supply chains, workforce shortages, and regulatory challenges posed significant operational challenges for manufacturers. Key impacts of COVID-19 on the dry granulation equipment market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The dry granulation equipment market is poised for steady growth in the coming years, driven by factors such as increasing demand for pharmaceuticals, technological advancements, and regulatory compliance requirements. However, challenges such as high initial investment costs, regulatory complexities, and competition from alternative technologies may impact market growth. Continued investment in research and development, adoption of digitalization and sustainability initiatives, and collaboration across the value chain will be key to unlocking future opportunities and driving innovation in the market.

Conclusion

The dry granulation equipment market offers significant growth opportunities driven by the increasing demand for efficient granulation processes across pharmaceutical, food, and chemical industries. Despite challenges such as high initial investment costs and regulatory complexities, technological advancements, shifting customer preferences, and emerging market trends are driving market growth. By embracing digitalization, focusing on sustainability, and fostering collaborative partnerships, stakeholders can navigate market dynamics, capitalize on growth opportunities, and achieve sustainable success in the dynamic dry granulation equipment market.

What is Dry Granulation Equipment?

Dry granulation equipment refers to machinery used in the process of granulating powders without the use of liquid binders. This equipment is commonly utilized in the pharmaceutical, food, and chemical industries to produce granules that enhance flowability and improve the properties of the final product.

What are the key players in the Dry Granulation Equipment Market?

Key players in the Dry Granulation Equipment Market include companies such as Glatt, Schenck Process, and GEA Group, which are known for their innovative solutions and technologies in granulation. These companies focus on enhancing efficiency and product quality in various applications, among others.

What are the growth factors driving the Dry Granulation Equipment Market?

The growth of the Dry Granulation Equipment Market is driven by the increasing demand for efficient manufacturing processes in pharmaceuticals and the rising need for high-quality granules in food production. Additionally, advancements in technology and automation are contributing to market expansion.

What challenges does the Dry Granulation Equipment Market face?

The Dry Granulation Equipment Market faces challenges such as the high initial investment costs associated with advanced machinery and the need for skilled operators to manage complex equipment. Furthermore, competition from alternative granulation methods can hinder market growth.

What opportunities exist in the Dry Granulation Equipment Market?

Opportunities in the Dry Granulation Equipment Market include the growing trend towards sustainable manufacturing practices and the increasing adoption of granulation technologies in emerging markets. Innovations in equipment design and functionality also present avenues for growth.

What trends are shaping the Dry Granulation Equipment Market?

Trends shaping the Dry Granulation Equipment Market include the integration of smart technologies and automation in manufacturing processes, as well as a focus on energy-efficient equipment. Additionally, there is a rising interest in continuous granulation processes to enhance production efficiency.

Dry Granulation Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Roller Compactor, High-Shear Mixer, Fluid Bed Granulator, Granulation Table |

| End User | Pharmaceuticals, Food & Beverage, Chemicals, Nutraceuticals |

| Technology | Continuous Granulation, Batch Granulation, Dry Blending, Extrusion |

| Application | Tablets, Powders, Pellets, Granules |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Dry Granulation Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at