444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global dry aluminum fluoride market is witnessing steady growth, driven by increasing demand from the aluminum production industry. Dry aluminum fluoride, also known as anhydrous aluminum fluoride, is a white crystalline powder used primarily as a flux in the production of aluminum. It serves as a catalyst in the aluminum smelting process, facilitating the removal of impurities and improving metal quality. The market for dry aluminum fluoride is influenced by factors such as the growth of the aluminum industry, technological advancements, and regulatory policies governing the use of fluoride compounds.

Meaning

Dry aluminum fluoride is a chemical compound with the formula AlF3. It is produced by reacting aluminum hydroxide with hydrofluoric acid or by the reaction of aluminum metal with fluorine gas. Dry aluminum fluoride is widely used as a flux in the aluminum smelting process, where it helps to lower the melting point of alumina and improve conductivity, resulting in higher efficiency and lower energy consumption.

Executive Summary

The global dry aluminum fluoride market is poised for moderate growth in the coming years, driven by the increasing demand for aluminum and its derivatives across various end-use industries such as automotive, aerospace, construction, and packaging. Key factors driving market growth include the expansion of aluminum production capacities, technological advancements in smelting processes, and the growing trend towards lightweight materials. However, factors such as environmental concerns, fluctuating raw material prices, and stringent regulations governing fluoride emissions may pose challenges to market growth.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global dry aluminum fluoride market is characterized by intense competition among key players, technological advancements, and shifting consumer preferences towards sustainable and eco-friendly products. Manufacturers are investing in research and development activities to develop innovative products and enhance process efficiency. Strategic collaborations, mergers, and acquisitions are also common strategies adopted by market players to strengthen their market position and expand their product portfolios.

Regional Analysis

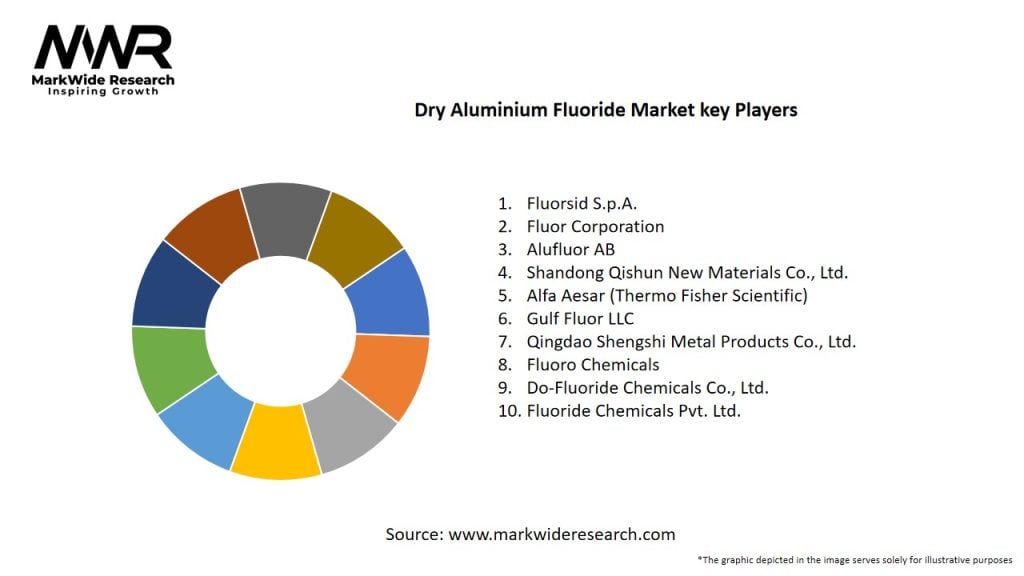

Competitive Landscape

The global dry aluminum fluoride market is highly competitive, with several key players competing on factors such as product quality, price, innovation, and customer service. Major players in the market include Fluorsid Group, Do-Fluoride Chemicals Co., Ltd., Stella Chemifa Corporation, and Solvay SA. These companies are focusing on strategic collaborations, acquisitions, and product innovations to strengthen their market presence and gain a competitive edge.

Segmentation

The global dry aluminum fluoride market can be segmented based on type, application, and region. By type, the market can be segmented into industrial grade and pharmaceutical grade dry aluminum fluoride. By application, the market can be segmented into aluminum smelting, specialty alloys, fluorinated pharmaceuticals, and others. Regionally, the market can be segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the global dry aluminum fluoride market. While demand from key end-use industries such as automotive and aerospace experienced a temporary downturn due to lockdowns and supply chain disruptions, the market rebounded quickly as economic activities resumed. The pandemic has underscored the importance of resilience and agility in supply chain management and accelerated the adoption of digital technologies for remote monitoring and optimization of manufacturing processes.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global dry aluminum fluoride market is expected to witness steady growth in the coming years, driven by the expansion of aluminum production capacities, technological advancements in smelting processes, and the growing demand for lightweight materials. However, market players need to address challenges such as environmental concerns, raw material price volatility, and regulatory compliance to capitalize on emerging opportunities and sustain growth.

Conclusion

In conclusion, the global dry aluminum fluoride market is poised for moderate growth, driven by increasing demand from the aluminum production industry and key end-use sectors such as automotive, aerospace, and construction. Manufacturers of dry aluminum fluoride are focusing on innovation, sustainability, and quality to meet evolving customer needs and regulatory requirements. Strategic partnerships, investments in research and development, and adoption of digital technologies are essential for staying competitive in the dynamic market landscape. As the aluminum industry continues to evolve, stakeholders across the value chain need to collaborate and innovate to unlock the full potential of dry aluminum fluoride in driving efficiency, quality, and sustainability in aluminum production processes.

Dry Aluminium Fluoride Market

| Segmentation Details | Description |

|---|---|

| Product Type | Granular, Powder, Pellets, Crystals |

| Application | Aluminium Smelting, Glass Manufacturing, Ceramics, Chemical Synthesis |

| End User | Metallurgical Industry, Chemical Industry, Glass Industry, Ceramics Industry |

| Distribution Channel | Direct Sales, Distributors, Online Retail, Others |

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at