444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The drone software market is a rapidly growing industry that is expected to witness significant growth in the coming years. Drones are becoming increasingly popular in a wide range of industries, including agriculture, construction, defense, and more. Drone software, in particular, is becoming more advanced, allowing for greater automation and control over these flying devices.

The global drone software market was valued at USD 4.86 billion in 2020 and is expected to reach USD 31.27 billion by 2028, growing at a CAGR of 27.5% from 2021 to 2028. The growing demand for drone software is due to its ability to provide real-time data and insights, increase operational efficiency, and reduce costs.

Drone software refers to the software that controls and manages the functions of a drone. This includes software for flight planning, navigation, payload control, and data analysis. Drone software enables users to automate tasks and collect data more efficiently and accurately than traditional methods.

Executive Summary

The drone software market is growing rapidly, driven by the increasing demand for drones in a wide range of industries. The market is expected to reach USD 31.27 billion by 2028, growing at a CAGR of 27.5% from 2021 to 2028. Key market drivers include the need for real-time data and insights, increased operational efficiency, and reduced costs. The market is also facing some challenges, including regulatory hurdles and security concerns.

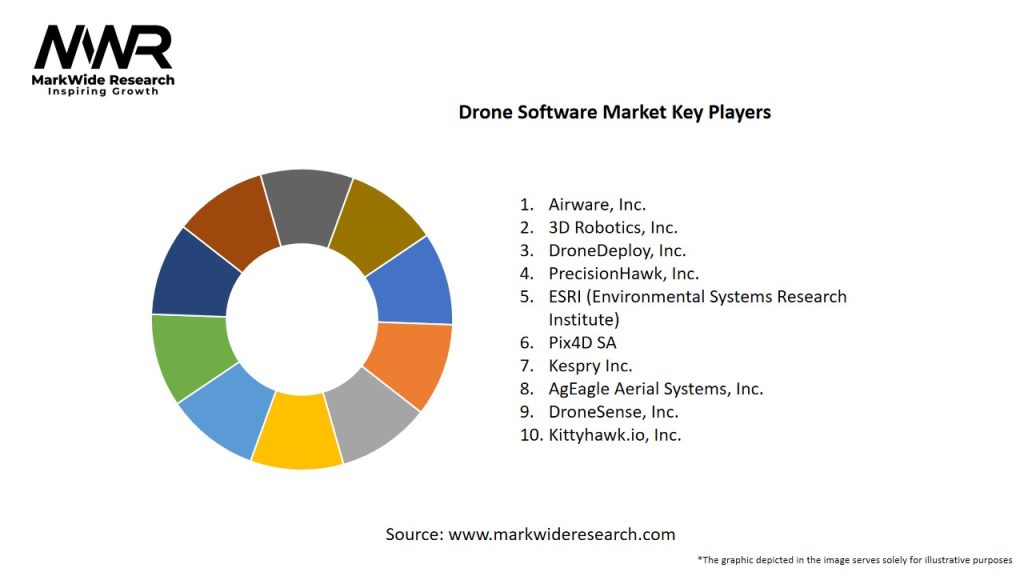

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

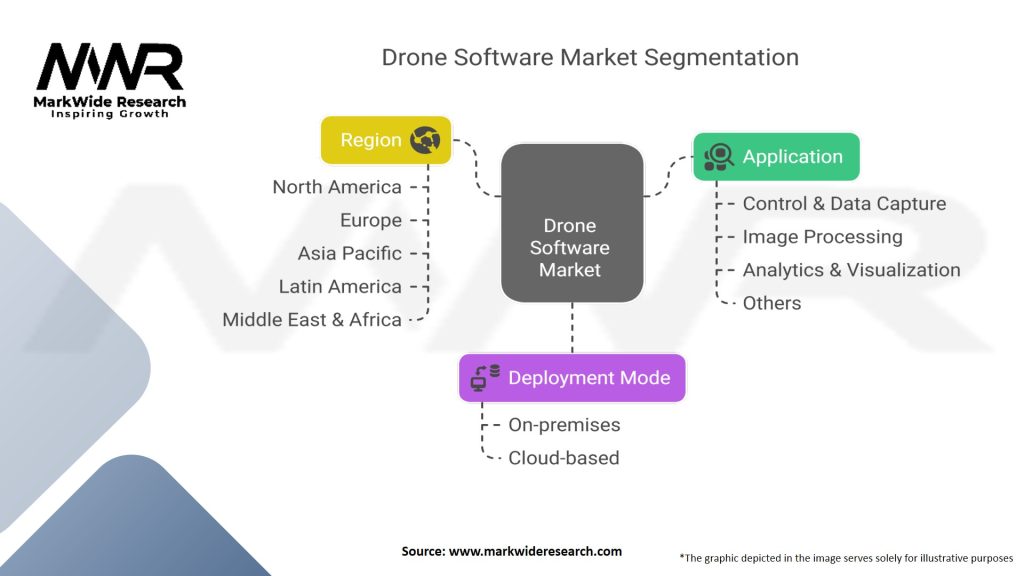

The drone software market is segmented based on application, architecture, platform, deployment, and region. The key applications of drone software include agriculture, construction, defense, energy and utilities, media and entertainment, and others. The architecture of drone software can be classified into open source and closed source. The platform of drone software includes cloud-based and on-premise. The deployment model includes software as a service (SaaS) and on-premise.

The North American region is expected to dominate the drone software market due to the presence of major drone manufacturers and increasing demand for drones in various industries. The Asia-Pacific region is also expected to witness significant growth due to the increasing adoption of drones in agriculture and construction.

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The drone software market is driven by various factors such as technological advancements, increasing demand for real-time data, and rising adoption of drones in various industries. However, the market is also facing some challenges such as regulatory hurdles and security concerns.

Technological advancements have led to the development of advanced drone software that can provide real-time data and insights, increasing efficiency and reducing costs. The rising demand for real-time data is also driving the adoption of drone software in various industries.

However, the adoption of drones is also facing regulatory hurdles, particularly in sensitive areas such as military bases and government buildings. Obtaining permits and licenses can be a time-consuming and challenging process, limiting the adoption of drones in certain industries and regions.

Security concerns are also a key challenge facing the drone software market. Drones can be used for spying or carrying out attacks, raising concerns about privacy and security.

Regional Analysis

The global drone software market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and South America. North America is expected to dominate the drone software market due to the presence of major drone manufacturers and increasing demand for drones in various industries.

The Asia-Pacific region is also expected to witness significant growth due to the increasing adoption of drones in agriculture and construction. The growth of the drone software market in the Asia-Pacific region is primarily driven by China, Japan, and South Korea, which are major manufacturers and consumers of drones.

Competitive Landscape

Leading companies in the Drone Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The drone software market is segmented based on application, architecture, platform, deployment, and region. The key applications of drone software include agriculture, construction, defense, energy and utilities, media and entertainment, and others.

The architecture of drone software can be classified into open source and closed source. The platform of drone software includes cloud-based and on-premise. The deployment model includes software as a service (SaaS) and on-premise.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The use of drone software provides several key benefits for industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the drone software market, both positively and negatively. The pandemic has led to an increased demand for drones in various industries, particularly for inspection and surveillance tasks, as they can be used to minimize human contact and improve worker safety.

However, the pandemic has also led to disruptions in the supply chain and regulatory hurdles, limiting the adoption of drones in certain industries and regions. The pandemic has also led to a slowdown in the construction industry, affecting the growth of the drone software market in this segment.

Key Industry Developments

Analyst Suggestions

Future Outlook

The drone software market is expected to witness significant growth in the coming years, driven by the increasing adoption of drones in various industries. The growth of the drone software market is expected to be particularly strong in the agriculture, construction, and energy and utilities industries.

The development of advanced drone software solutions, particularly for real-time data and insights, is expected to be a key driver of growth in the drone software market. However, regulatory hurdles and security concerns are expected to remain key challenges facing the industry.

Conclusion

The drone software market is a rapidly growing industry that is expected to witness significant growth in the coming years. The increasing adoption of drones in various industries, particularly for inspection and surveillance tasks, is driving the growth of the drone software market.

The development of advanced drone software solutions, particularly for real-time data and insights, is expected to be a key driver of growth in the drone software market. However, regulatory hurdles and security concerns are expected to remain key challenges facing the industry.

Companies should focus on developing niche drone software solutions for specific industries, working closely with regulatory authorities to address regulatory hurdles and obtain permits and licenses, and developing advanced drone software solutions to address security concerns. With these strategies in place, the drone software market is poised for significant growth in the coming years.

What is drone software?

Drone software refers to the applications and systems that control and manage drone operations, including flight planning, navigation, data collection, and analysis. It plays a crucial role in various sectors such as agriculture, construction, and surveillance.

Who are the key players in the Drone Software Market?

Key players in the Drone Software Market include companies like DJI, Parrot, and Skydio, which provide advanced software solutions for drone operation and management. Other notable companies include Airware and senseFly, among others.

What are the main drivers of growth in the Drone Software Market?

The growth of the Drone Software Market is driven by increasing demand for aerial data collection in industries such as agriculture, real estate, and logistics. Additionally, advancements in AI and machine learning are enhancing the capabilities of drone software.

What challenges does the Drone Software Market face?

The Drone Software Market faces challenges such as regulatory hurdles, privacy concerns, and the need for robust cybersecurity measures. These factors can hinder the widespread adoption of drone technology across various sectors.

What opportunities exist in the Drone Software Market?

Opportunities in the Drone Software Market include the integration of drone technology with IoT and big data analytics, which can enhance operational efficiency. Additionally, the growing interest in urban air mobility presents new avenues for software development.

What trends are shaping the Drone Software Market?

Trends in the Drone Software Market include the rise of autonomous drones, increased use of cloud-based software solutions, and the development of specialized applications for industries like emergency response and environmental monitoring.

Drone Software Market

| Segmentation | Details |

|---|---|

| Application | Control & Data Capture, Image Processing, Analytics & Visualization, Others |

| Deployment Mode | On-premises, Cloud-based |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Drone Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at