Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Efficiency Gains: Drone surveys can cover 500+ acres per day, replacing weeks of manual surveying.

-

Data Accuracy: LiDAR-equipped drones achieve vertical accuracy within 2–5 cm, enabling precise volume and elevation measurements.

-

Safety Improvements: Drones reduce the need for personnel to work at height or in hazardous areas, decreasing site accidents.

-

Integration Trends: Increasing API linkages between drone analytics platforms and BIM/CAD software streamline data flow into design iterations.

-

Regulatory Progress: Over 70% of major markets now offer BVLOS flight approvals, expanding drone operations beyond simple line-of-sight missions.

Market Drivers

-

Labor Shortages & Skill Gaps: With fewer skilled surveyors available, drones fill critical workforce gaps.

-

Demand for Real-Time Data: Stakeholders require up-to-date site conditions for agile decision-making and risk management.

-

Rising Infrastructure Spend: Governments and private investors are funding mega-projects that necessitate rapid, large-area data collection.

-

Cost Reduction Pressure: Construction firms seek technology that cuts waste, rework, and downtime.

-

Technological Advancements: Improvements in drone endurance, sensor miniaturization, and onboard processing power enhance capability and reliability.

Market Restraints

-

Regulatory Hurdles: Complex airspace regulations and flight permits can delay deployments.

-

Initial Investment: High upfront costs for specialized UAVs and processing software may deter SMEs.

-

Data Management Complexity: Handling and storing large volumes of high-resolution imagery and point clouds requires robust IT infrastructure.

-

Skill Requirements: Piloting drones and interpreting geospatial outputs demand specialized training and certifications.

-

Weather Sensitivity: Adverse conditions (rain, high winds) can ground drones and interrupt data capture schedules.

Market Opportunities

-

BVLOS Operations: Wider approval for beyond-visual-line-of-sight flights will enable large-scale, corridor-based inspections.

-

Autonomous Flight & AI: AI-driven object recognition and automated flight paths will reduce operator workload.

-

Inspection of Critical Assets: Bridges, towers, and high-rise façades represent high-value, safety-critical use cases.

-

Digital Twin Integration: Real-time drone data feeding digital twins will support predictive maintenance and lifecycle management.

-

Service-Based Models: Drone-as-a-Service (DaaS) offerings allow firms to outsource hardware, data capture, and analytics.

Market Dynamics

-

Ecosystem Partnerships: Collaboration between drone OEMs, software vendors, and construction management platforms is creating end-to-end solutions.

-

Standardization Efforts: Industry consortia are defining data formats and quality benchmarks to ensure interoperability.

-

Fleet Management: Larger contractors operate multiple drones and centralized control centers to coordinate survey missions across sites.

-

Data Security Focus: With sensitive infrastructure projects, encryption and secure cloud storage practices are paramount.

-

Continuous Innovation: Sensor fusion (LiDAR + photogrammetry + thermal) is enhancing multi-dimensional insights in a single flight.

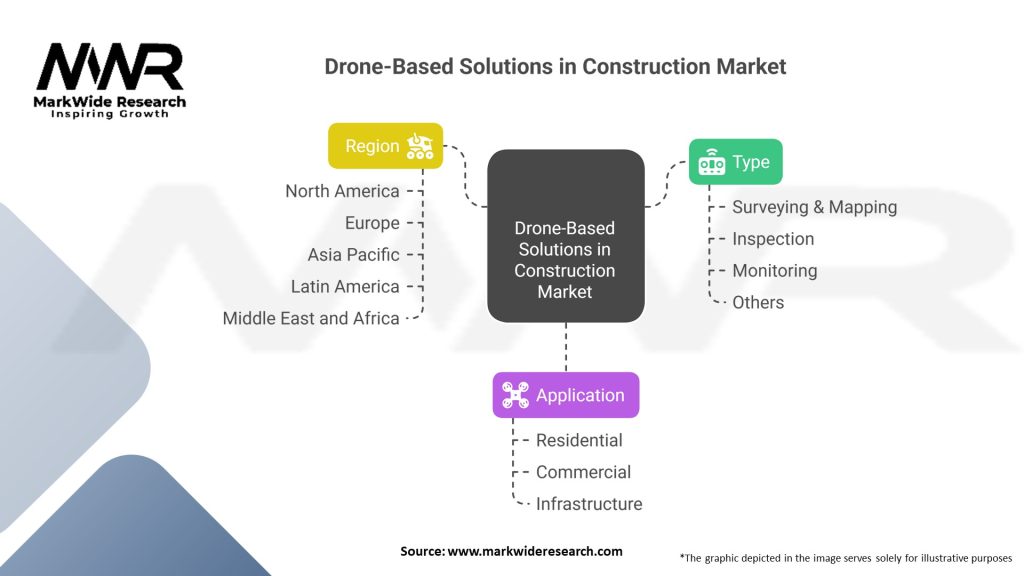

Regional Analysis

-

North America: Early adopter due to supportive regulations (FAA Part 107), high infrastructure budgets, and leading drone startups.

-

Europe: EASA’s U-space framework is accelerating commercial UAS operations, especially for large construction and energy projects.

-

Asia-Pacific: Rapid urbanization in China and India fuels massive infrastructure programs; cost-efficient drones gain appeal among local contractors.

-

Latin America: Increasing use in mining-related infrastructure; regulatory maturity is still evolving.

-

Middle East & Africa: Major investments in smart city and transportation corridors create demand, tempered by airspace restrictions and security concerns.

Competitive Landscape

Leading Companies in the Drone-based Solutions in Construction Market:

- DJI

- Kespry

- Trimble Inc.

- 3D Robotics, Inc.

- Phoenix LiDAR Systems

- PrecisionHawk Inc.

- Airware

- Skycatch Inc.

- senseFly Ltd.

- RIEGL Laser Measurement Systems GmbH

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

-

By End-Use Application: Surveying & Mapping, Progress Monitoring, Structural Inspection, Stockpile Measurement, Environmental Compliance.

-

By Drone Type: Rotary-Wing (Multi-rotor), Fixed-Wing, Hybrid VTOL.

-

By Service Model: In-House Fleet, Drone-as-a-Service (DaaS), Managed Service.

-

By Industry Vertical: Residential, Commercial, Infrastructure (roads, bridges), Energy & Utilities, Mining.

Category-wise Insights

-

Rotary-Wing Drones: Ideal for confined sites and vertical inspections; flight times of 20–40 minutes suit frequent short missions.

-

Fixed-Wing Drones: Cover large, open areas in a single flight—favored for earthworks volume calculations and linear infrastructure surveys.

-

Hybrid VTOL: Combines vertical takeoff with efficient forward flight, bridging the gap for mixed-use scenarios.

-

In-House Fleet: Larger contractors benefit from dedicated UAV teams and proprietary data workflows.

-

DaaS: Provides rapid deployment without capital expenditure—popular among small-to-mid contractors and engineering consultancies.

Key Benefits for Industry Participants and Stakeholders

-

Time Savings: Site surveys that once took days can be completed in hours, accelerating project timelines.

-

Cost Reductions: Lower labor and equipment rental costs, with typical ROI realized within 6–12 months.

-

Enhanced Safety: Remote inspections eliminate the need for personnel to access hazardous or elevated areas.

-

Improved Accuracy: Consistent, repeatable data capture reduces human error and supports precise earthwork calculations.

-

Stakeholder Transparency: High-resolution imagery and 3D models enable clear progress reports to clients and regulators.

SWOT Analysis

Strengths:

-

Rapid data capture and processing.

-

Versatility across multiple construction applications.

-

Demonstrable ROI and safety benefits.

Weaknesses:

-

Dependence on favorable weather and daylight.

-

Regulatory compliance burdens and flight permitting.

-

Upfront costs for hardware, software, and training.

Opportunities:

-

AI-powered analytics for defect detection and progress forecasting.

-

Expansion into automated material delivery and drone-based logistics.

-

Integration with 5G networks for beyond-site connectivity and real-time control.

Threats:

-

Emerging regulations restricting commercial flights over populated areas.

-

Cybersecurity risks in data transmission and storage.

-

Competition from terrestrial robotics and autonomous vehicles in site monitoring.

Market Key Trends

-

AI & Machine Learning: Automated feature recognition—detecting cracks, rebar placement, and volume changes without human review.

-

Digital Twin Enablement: Live synchronization of drone data into digital twin environments for continuous performance tracking.

-

5G-Enabled BVLOS: Low-latency control and video streaming support longer-range, beyond-visual-line-of-sight missions.

-

Swarm Operations: Coordinated fleets performing simultaneous, multi-angle data capture to accelerate large-area surveys.

-

Eco-Drone Solutions: Electrically powered UAVs with rapid battery swap systems and solar-assisted endurance improvements.

Covid-19 Impact

During the pandemic, social-distancing measures and travel restrictions accelerated drone adoption as remote site monitoring tools. Construction sites leveraged UAVs to maintain progress oversight when access was limited, ensuring continuity. The shift demonstrated the value of contactless data collection and prompted many firms to establish permanent drone programs post-pandemic.

Key Industry Developments

-

FAA’s LAANC Expansion: In 2023, the U.S. FAA expanded Low Altitude Authorization and Notification Capability (LAANC) to more airports, streamlining flight approvals for construction drones.

-

Autodesk–DJI Partnership: Integrated DJI drone data with Autodesk Construction Cloud in 2022, enabling seamless model updates.

-

Hexagon’s Digital Reality Hub: Launched in 2024 to unify UAV-captured data with terrestrial scanning for holistic site insights.

-

Wingtra’s Survey Kit: Released aVTOL solution in 2023 tailored for construction, combining high accuracy with rapid flights.

Analyst Suggestions

-

Invest in Integration: Ensure drone data platforms are tightly coupled with BIM and ERP systems to maximize utility.

-

Develop Standard Operating Procedures: Formalize flight, data processing, and QA workflows to maintain consistency and compliance.

-

Expand Pilot Training: Build in-house certification programs to deepen expertise and reduce reliance on third-party service providers.

-

Monitor Regulatory Changes: Stay informed on airspace rule updates to capitalize quickly on new operational allowances.

-

Explore Emerging Use Cases: Pilot drone deployments for equipment tracking, thermal inspections, and security patrols beyond surveying.

Future Outlook

The Drone-based Solutions in Construction market is expected to grow at a double-digit CAGR through 2030 as drone capabilities, regulations, and ecosystem integrations mature. Advancements in autonomy, sensor fusion, and network connectivity will enable fully automated, continuous site monitoring. As digital twins and smart-construction initiatives proliferate, drones will serve as the primary data-collection backbone—fueling a more sustainable, efficient, and connected construction industry.

Conclusion

Drone-based solutions are transforming construction by offering rapid, accurate, and safe site intelligence. Stakeholders that embrace integrated UAV platforms, invest in training and process standardization, and leverage AI-driven analytics will gain competitive advantage through reduced costs, improved timelines, and enhanced risk management. As the technology and regulatory landscape evolve, drones will become an indispensable component of the modern construction toolkit, enabling data-driven project delivery from groundbreaking to handover.