444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The DRD (Draw Redraw Double) cans market has experienced significant growth in recent years, driven by the increasing demand for sustainable packaging solutions in the beverage industry. DRD cans are made from aluminum, a lightweight and infinitely recyclable material that offers several advantages over traditional packaging formats such as glass and plastic. These cans are widely used for packaging carbonated and non-carbonated beverages, including soft drinks, energy drinks, beer, and ready-to-drink (RTD) beverages, due to their durability, portability, and environmental friendliness.

Meaning

DRD cans, also known as drawn cans, redrawn cans, or two-piece cans, are cylindrical containers made from aluminum sheets using a draw and redraw process. The manufacturing process involves drawing a flat aluminum sheet into a cup shape, followed by redrawing to achieve the desired height and diameter of the can. DRD cans are characterized by their seamless construction, lightweight design, and superior recyclability, making them a popular choice for packaging various beverages.

Executive Summary

The DRD cans market is witnessing robust growth, driven by the shift towards sustainable packaging solutions, increasing consumer preference for convenience and portability, and the growing popularity of canned beverages worldwide. Key factors contributing to market expansion include the recyclability of aluminum, which aligns with circular economy principles, and the versatility of DRD cans, which can be customized in terms of size, shape, and design to meet brand and consumer preferences.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the DRD cans market:

Market Restraints

Despite the positive market outlook, the DRD cans market faces certain challenges:

Market Opportunities

The DRD cans market presents several opportunities for growth and innovation:

Market Dynamics

The DRD cans market is characterized by dynamic trends and factors influencing growth and competitiveness:

Regional Analysis

The DRD cans market exhibits regional variations in terms of market size, growth potential, and consumption patterns:

Competitive Landscape

Leading companies in the DRD Cans market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

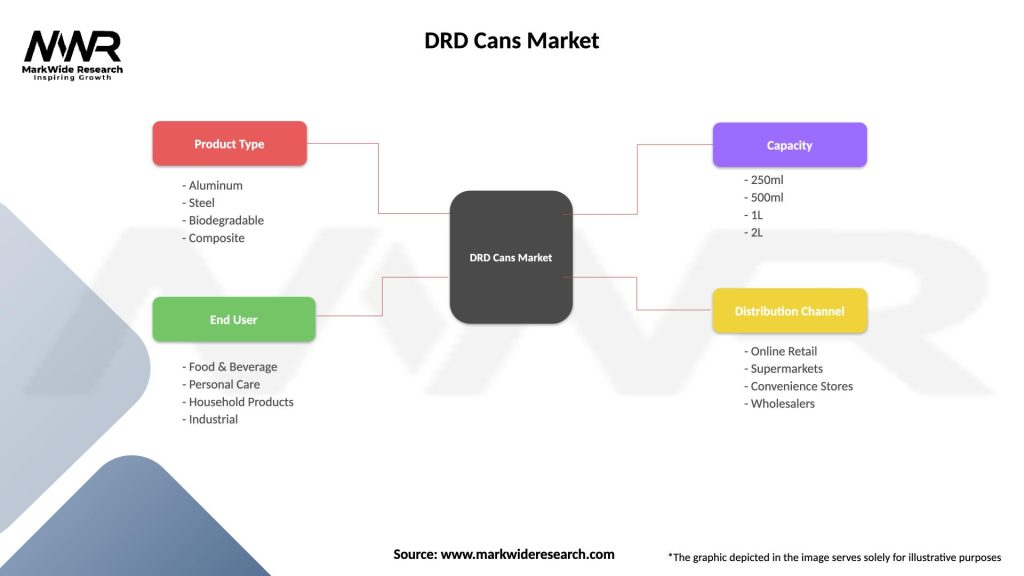

Segmentation

The DRD cans market can be segmented based on various factors, including:

Each segment has unique characteristics, requirements, and growth drivers, offering opportunities for manufacturers, suppliers, and brand owners to develop targeted solutions, address specific customer needs, and capitalize on emerging market trends and opportunities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of DRD cans offers several benefits for industry participants and stakeholders:

SWOT Analysis

Market Key Trends

Several key trends are shaping the DRD cans market:

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the DRD cans market:

Key Industry Developments

Analyst Suggestions

Based on market trends and dynamics, analysts suggest the following strategies for industry participants:

Future Outlook

The DRD cans market is poised for continued growth and innovation, driven by increasing consumer demand for sustainable, convenient, and hygienic packaging solutions in the beverage industry. Key trends shaping the market include sustainability initiatives, customization, innovation, and convenience, which are driving market adoption and preference for eco-friendly packaging formats such as DRD cans. As beverage brands continue to prioritize sustainability, product differentiation, and consumer engagement, the demand for DRD cans is expected to continue growing, presenting opportunities for manufacturers, suppliers, and brand owners to capitalize on emerging market trends and consumer preferences.

Conclusion

In conclusion, the DRD cans market offers significant growth opportunities driven by increasing consumer demand for sustainable, convenient, and hygienic packaging solutions in the beverage industry. DRD cans, made from aluminum, offer several advantages over traditional packaging formats such as glass and plastic, including lightweight, recyclable, and durable properties that meet evolving consumer preferences and market trends. While challenges such as raw material price volatility, supply chain disruptions, and regulatory compliance requirements exist, strategic investments in sustainability, innovation, and partnerships can help industry participants overcome these obstacles and capitalize on emerging opportunities in the global market. As beverage brands continue to prioritize sustainability, product differentiation, and consumer engagement, the demand for DRD cans is expected to continue growing, driving market expansion and innovation in the years to come.

What is DRD Cans?

DRD Cans, or Drawn and Redrawn Cans, are a type of metal container used primarily for packaging beverages and food products. They are known for their strength, lightweight nature, and ability to preserve the contents effectively.

What are the key players in the DRD Cans Market?

Key players in the DRD Cans Market include Ball Corporation, Crown Holdings, and Ardagh Group, which are known for their innovative packaging solutions and extensive distribution networks, among others.

What are the growth factors driving the DRD Cans Market?

The growth of the DRD Cans Market is driven by increasing demand for sustainable packaging solutions, the rise in beverage consumption, and the convenience offered by ready-to-drink products. Additionally, the shift towards lightweight packaging is also contributing to market expansion.

What challenges does the DRD Cans Market face?

The DRD Cans Market faces challenges such as fluctuating raw material prices, competition from alternative packaging materials, and regulatory pressures regarding recycling and sustainability. These factors can impact production costs and market dynamics.

What opportunities exist in the DRD Cans Market?

Opportunities in the DRD Cans Market include the growing trend of eco-friendly packaging, innovations in can design and functionality, and the expansion of the beverage industry into emerging markets. These factors present avenues for growth and product development.

What trends are shaping the DRD Cans Market?

Trends shaping the DRD Cans Market include the increasing use of lightweight materials, advancements in can manufacturing technology, and a focus on enhancing recyclability. Additionally, consumer preferences for sustainable and convenient packaging are influencing market trends.

DRD Cans Market

| Segmentation Details | Description |

|---|---|

| Product Type | Aluminum, Steel, Biodegradable, Composite |

| End User | Food & Beverage, Personal Care, Household Products, Industrial |

| Capacity | 250ml, 500ml, 1L, 2L |

| Distribution Channel | Online Retail, Supermarkets, Convenience Stores, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the DRD Cans market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at