444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Dominican Republic container glass market represents a dynamic and rapidly evolving sector within the Caribbean region’s packaging industry. This market encompasses the production, distribution, and utilization of glass containers across various industries including beverages, food, pharmaceuticals, and cosmetics. Market dynamics indicate significant growth potential driven by increasing consumer preference for sustainable packaging solutions and the country’s strategic position as a manufacturing hub in the Caribbean.

Industrial expansion in the Dominican Republic has created substantial demand for high-quality glass containers, particularly in the beverage sector where local rum, beer, and soft drink manufacturers require reliable packaging solutions. The market demonstrates robust growth with increasing adoption rates of approximately 8.5% annually across key application segments. Manufacturing capabilities have expanded significantly, with local production facilities investing in advanced glass forming technologies to meet both domestic and export demands.

Regional positioning plays a crucial role in market development, as the Dominican Republic serves as a strategic gateway for glass container distribution throughout the Caribbean and Central American markets. The country’s established trade relationships and favorable manufacturing conditions contribute to its competitive advantage in the container glass sector.

The Dominican Republic container glass market refers to the comprehensive ecosystem of glass container manufacturing, distribution, and consumption within the Dominican Republic’s borders. This market encompasses all forms of glass packaging solutions including bottles, jars, vials, and specialty containers designed for various industrial applications. Container glass specifically denotes hollow glass products manufactured through blow molding processes, distinguished from flat glass or specialty glass applications.

Market scope includes both primary manufacturing operations where raw materials are transformed into finished glass containers, and secondary operations involving decoration, labeling, and customization services. The sector serves multiple end-use industries with varying quality requirements, from standard commercial packaging to premium pharmaceutical and cosmetic applications requiring enhanced barrier properties and aesthetic appeal.

Strategic analysis reveals that the Dominican Republic container glass market operates within a favorable economic environment characterized by steady industrial growth and increasing export opportunities. The market benefits from established manufacturing infrastructure, skilled workforce availability, and proximity to major consumer markets in North America and the Caribbean region.

Key performance indicators demonstrate consistent market expansion with beverage applications accounting for approximately 72% of total demand. The pharmaceutical and cosmetic segments show particularly strong growth potential, driven by increasing quality standards and regulatory compliance requirements. Export activities contribute significantly to market dynamics, with regional distribution networks expanding to serve neighboring Caribbean nations.

Investment trends indicate continued modernization of production facilities, with emphasis on energy efficiency, quality enhancement, and capacity expansion. Local manufacturers are increasingly adopting advanced glass forming technologies and automated quality control systems to maintain competitiveness in regional markets.

Market intelligence reveals several critical insights that define the Dominican Republic container glass landscape:

Primary growth drivers propelling the Dominican Republic container glass market include the expanding beverage industry, which continues to demonstrate strong domestic consumption and export potential. Local rum distilleries, beer manufacturers, and soft drink producers require consistent supplies of high-quality glass containers, creating stable demand patterns throughout the year.

Economic development initiatives have strengthened the country’s manufacturing sector, attracting foreign investment in packaging-dependent industries. The establishment of free trade zones and favorable business policies encourage international companies to establish operations requiring local packaging solutions. Tourism growth also contributes to market expansion, as hospitality and retail sectors demand premium packaging for local products sold to visitors.

Environmental consciousness among consumers and businesses drives preference for glass containers over plastic alternatives, particularly in premium product segments. This trend supports market growth as companies seek sustainable packaging solutions that align with corporate responsibility initiatives and consumer expectations.

Regional trade agreements facilitate export opportunities, enabling Dominican manufacturers to serve broader Caribbean and Central American markets efficiently. These agreements reduce trade barriers and create competitive advantages for locally produced glass containers in regional distribution networks.

Operational challenges facing the Dominican Republic container glass market include energy costs associated with glass melting and forming processes. High-temperature manufacturing requirements result in significant electricity consumption, impacting production costs and overall competitiveness compared to alternative packaging materials.

Transportation considerations present logistical challenges due to the fragile nature of glass containers. Shipping costs and breakage risks during distribution can affect profit margins, particularly for export operations to distant markets. Infrastructure limitations in certain regions may restrict efficient distribution networks and increase delivery costs.

Competition from alternative materials poses ongoing challenges, as plastic and metal containers offer advantages in weight, durability, and transportation efficiency. Some applications may favor alternative packaging solutions based on cost considerations or specific performance requirements.

Raw material price volatility can impact production costs, particularly for specialized glass formulations requiring imported additives or colorants. Currency fluctuations may affect the cost of imported equipment and raw materials, influencing overall market dynamics.

Emerging opportunities in the Dominican Republic container glass market center around pharmaceutical and cosmetic packaging applications, where quality requirements and regulatory standards favor glass containers over alternative materials. The growing healthcare sector and increasing consumer spending on personal care products create expanding market segments with higher value propositions.

Export expansion presents significant growth potential, particularly in serving neighboring Caribbean nations with limited glass manufacturing capabilities. Regional economic integration and trade facilitation agreements create favorable conditions for expanding market reach beyond domestic boundaries.

Premium product segments offer opportunities for value-added manufacturing, including custom bottle designs, specialized closures, and decorative treatments. Craft beverage producers and artisanal food manufacturers increasingly seek unique packaging solutions that differentiate their products in competitive markets.

Sustainability initiatives create opportunities for companies emphasizing recycling programs and circular economy principles. Partnerships with waste management organizations and recycling facilities can establish closed-loop systems that reduce raw material costs while supporting environmental objectives.

Supply chain dynamics in the Dominican Republic container glass market reflect the interplay between raw material availability, production capacity, and market demand. Local silica sand deposits provide cost advantages for basic glass formulations, while specialized additives and colorants require import coordination to maintain production schedules.

Demand fluctuations typically align with seasonal patterns in beverage consumption, tourism activities, and agricultural processing cycles. Peak demand periods during holiday seasons and tourist seasons require careful capacity planning and inventory management to meet customer requirements effectively.

Competitive dynamics involve both local manufacturers and imported products, with competition based on quality, price, delivery reliability, and service capabilities. MarkWide Research analysis indicates that successful companies focus on building strong customer relationships and maintaining consistent product quality to secure long-term contracts.

Technology evolution continues to influence market dynamics through improvements in glass forming efficiency, quality control systems, and energy management. Companies investing in modern equipment and process optimization achieve competitive advantages through reduced production costs and enhanced product consistency.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Dominican Republic container glass market. Primary research included direct interviews with industry executives, manufacturing personnel, and key customers across various application segments to gather firsthand market intelligence.

Secondary research encompassed analysis of industry publications, government statistics, trade association reports, and regulatory documentation to establish market context and validate primary findings. Data triangulation methods ensured consistency and accuracy across multiple information sources.

Market sizing methodologies utilized production capacity analysis, consumption pattern evaluation, and trade flow examination to establish comprehensive market understanding. Regional comparison studies provided context for Dominican Republic market positioning within the broader Caribbean glass container industry.

Stakeholder engagement included consultations with equipment suppliers, raw material providers, and end-use customers to understand value chain dynamics and identify emerging trends affecting market development. This multi-perspective approach ensures comprehensive coverage of market factors and influences.

Geographic distribution of container glass manufacturing in the Dominican Republic concentrates primarily in industrial zones near major cities, where infrastructure, workforce, and logistics capabilities support efficient operations. The Santo Domingo metropolitan area hosts approximately 45% of production capacity, benefiting from port access, skilled labor availability, and proximity to major consumer markets.

Santiago region represents another significant manufacturing hub, accounting for roughly 25% of market activity, with established industrial infrastructure and transportation networks supporting both domestic distribution and export operations. This region benefits from lower operational costs and available land for facility expansion.

Coastal regions demonstrate strategic importance for export-oriented operations, with port facilities enabling efficient shipping to Caribbean and Central American markets. These areas show growing investment in logistics infrastructure and specialized handling equipment for glass container transportation.

Rural areas present opportunities for raw material sourcing, particularly silica sand extraction and processing operations that supply glass manufacturing facilities. Transportation infrastructure development continues to improve connectivity between raw material sources and production centers.

Market competition in the Dominican Republic container glass sector involves both established local manufacturers and international suppliers serving specific market segments. The competitive environment emphasizes quality consistency, delivery reliability, and customer service capabilities.

Competitive strategies focus on technological advancement, quality enhancement, and customer relationship management. Companies investing in modern equipment and process optimization achieve advantages in production efficiency and product consistency, enabling competitive pricing while maintaining quality standards.

Market segmentation analysis reveals distinct categories based on application, container type, and end-use industry requirements:

By Application:

By Container Type:

Beverage category dominates market demand with consistent growth driven by local consumption and export opportunities. Rum production represents a particularly important segment, as Dominican rum enjoys international recognition and requires premium packaging solutions that reflect product quality and brand positioning.

Pharmaceutical applications show strong growth potential with increasing healthcare sector development and regulatory compliance requirements. This category demands higher quality standards and specialized manufacturing capabilities, offering opportunities for premium pricing and long-term customer relationships.

Food packaging demonstrates steady demand patterns aligned with agricultural processing cycles and tourism-related consumption. Local food producers increasingly recognize the marketing advantages of glass packaging for premium products targeting both domestic and tourist markets.

Cosmetic containers represent an emerging opportunity as personal care spending increases and international brands establish local operations. This segment requires specialized design capabilities and decorative treatments that add value to standard container production.

Manufacturing advantages in the Dominican Republic container glass market include access to raw materials, established infrastructure, and skilled workforce capabilities that support efficient production operations. Companies benefit from favorable business conditions and government support for industrial development initiatives.

Strategic location benefits enable efficient distribution to regional markets while maintaining competitive transportation costs. Port facilities and logistics infrastructure support both import of raw materials and export of finished products to Caribbean and Central American destinations.

Market diversification opportunities allow manufacturers to serve multiple industry segments, reducing dependence on single applications and providing stability during market fluctuations. This diversification capability enhances business resilience and growth potential.

Technology transfer benefits result from international partnerships and equipment suppliers providing access to advanced manufacturing technologies and quality control systems. These relationships enable continuous improvement in production efficiency and product quality standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with manufacturers implementing recycling programs and circular economy principles to reduce environmental impact. Companies are investing in energy-efficient technologies and exploring renewable energy sources to minimize carbon footprint while maintaining production efficiency.

Customization demand increases as brands seek unique packaging solutions that differentiate their products in competitive markets. This trend drives investment in flexible manufacturing capabilities and design services that can accommodate small-batch custom orders alongside standard production runs.

Quality enhancement continues as a key trend, with manufacturers adopting advanced quality control systems and certification programs to meet international standards. MWR data indicates that quality-focused companies achieve approximately 15% higher customer retention rates compared to competitors emphasizing only cost competitiveness.

Digital integration transforms manufacturing operations through implementation of automated systems, data analytics, and predictive maintenance programs. These technologies improve production efficiency while reducing waste and quality variations in glass container manufacturing.

Recent developments in the Dominican Republic container glass market include significant investments in manufacturing capacity expansion and technology upgrades. Several companies have announced modernization projects incorporating energy-efficient furnaces and automated handling systems to improve productivity and reduce operational costs.

Partnership formations between local manufacturers and international equipment suppliers facilitate technology transfer and capability enhancement. These collaborations enable access to advanced glass forming technologies and quality control systems that improve product consistency and manufacturing efficiency.

Regulatory developments include updated quality standards for pharmaceutical packaging applications and environmental regulations affecting manufacturing processes. Companies are adapting operations to comply with new requirements while maintaining competitive positioning in regulated market segments.

Market consolidation activities involve strategic acquisitions and partnerships aimed at expanding production capacity and market reach. These developments reflect industry maturation and the need for scale advantages in competitive regional markets.

Strategic recommendations for Dominican Republic container glass market participants emphasize the importance of technology investment and quality enhancement initiatives. Companies should prioritize modernization of production facilities to achieve energy efficiency improvements and maintain competitiveness in regional markets.

Market expansion strategies should focus on developing export capabilities and establishing distribution networks in neighboring Caribbean nations. This approach leverages the country’s strategic location while diversifying revenue sources beyond domestic market limitations.

Product diversification into higher-value segments such as pharmaceutical and cosmetic packaging offers opportunities for improved margins and reduced competition from alternative materials. Investment in specialized manufacturing capabilities and quality certifications supports entry into these premium market segments.

Sustainability initiatives should be integrated into business strategies to align with global environmental trends and customer preferences. Implementation of recycling programs and energy-efficient technologies enhances competitive positioning while supporting long-term market sustainability.

Long-term projections for the Dominican Republic container glass market indicate continued growth driven by expanding beverage industry, increasing export opportunities, and growing demand for sustainable packaging solutions. MarkWide Research analysis suggests the market will experience steady expansion with growth rates of approximately 6.8% annually over the next five years.

Technology advancement will continue shaping market dynamics through improved manufacturing efficiency, quality enhancement, and energy optimization. Companies investing in modern equipment and digital integration capabilities are positioned to capture increasing market share and achieve sustainable competitive advantages.

Regional integration trends support expanded export opportunities as Caribbean economies develop and packaging demand increases. Trade facilitation agreements and infrastructure improvements will enhance the Dominican Republic’s position as a regional glass container supply hub.

Sustainability focus will intensify as environmental regulations strengthen and consumer preferences shift toward recyclable packaging materials. Companies emphasizing circular economy principles and environmental responsibility will benefit from favorable market positioning and customer preference trends.

Market assessment reveals that the Dominican Republic container glass market operates within a favorable environment characterized by strategic geographic advantages, established manufacturing capabilities, and growing demand across multiple application segments. The market benefits from strong domestic beverage industry demand while offering significant export potential to regional markets with limited local production capacity.

Growth prospects remain positive despite challenges related to energy costs and competition from alternative packaging materials. Companies focusing on quality enhancement, technology advancement, and market diversification are well-positioned to capitalize on emerging opportunities in pharmaceutical, cosmetic, and premium beverage packaging applications.

Strategic positioning as a regional glass container supply hub offers long-term competitive advantages, supported by favorable trade agreements, infrastructure development, and established industry expertise. The market’s evolution toward sustainability and quality focus aligns with global packaging trends, creating opportunities for companies embracing these principles in their business strategies.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. This type of glass is known for its durability, recyclability, and ability to preserve the quality of its contents.

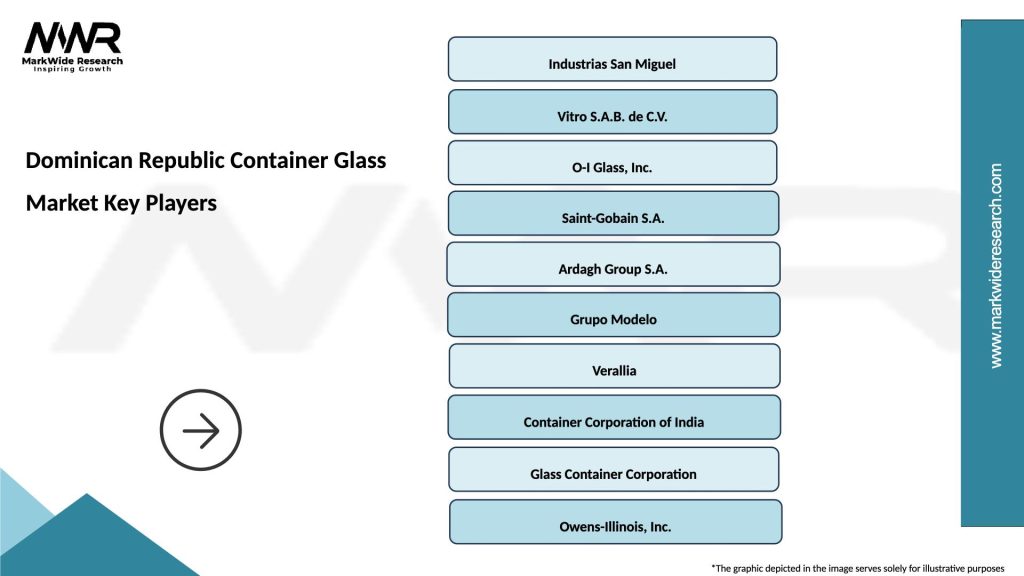

What are the key players in the Dominican Republic Container Glass Market?

Key players in the Dominican Republic Container Glass Market include companies like Vitro, O-I Glass, and Grupo Modelo, which are involved in the production and distribution of container glass products. These companies focus on innovation and sustainability in their manufacturing processes, among others.

What are the growth factors driving the Dominican Republic Container Glass Market?

The growth of the Dominican Republic Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and consumer preferences for glass over plastic. Additionally, the expansion of the food and pharmaceutical sectors contributes to market growth.

What challenges does the Dominican Republic Container Glass Market face?

The Dominican Republic Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and logistical issues related to transportation and distribution. These factors can impact the overall market dynamics and profitability.

What opportunities exist in the Dominican Republic Container Glass Market?

Opportunities in the Dominican Republic Container Glass Market include the potential for increased exports, innovations in glass recycling technologies, and the growing trend of eco-friendly packaging. These factors can enhance market competitiveness and sustainability.

What trends are shaping the Dominican Republic Container Glass Market?

Trends shaping the Dominican Republic Container Glass Market include a shift towards lightweight glass packaging, advancements in manufacturing technologies, and a growing emphasis on circular economy practices. These trends reflect the industry’s response to environmental concerns and consumer preferences.

Dominican Republic Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Recycled Grade |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Chemicals |

| Packaging Type | Rigid Packaging, Flexible Packaging, Bulk Packaging, Specialty Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Dominican Republic Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at