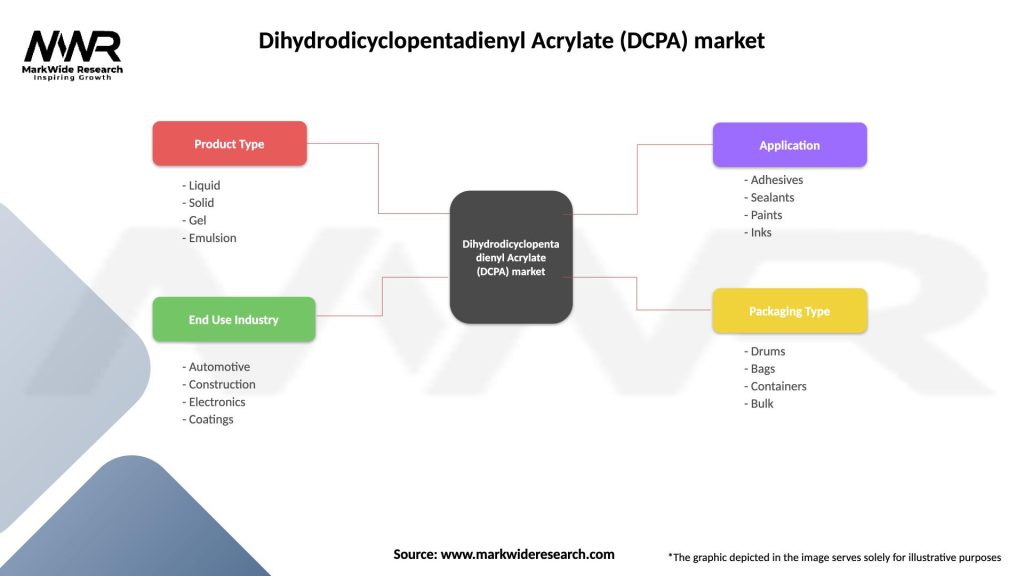

Segmentation

-

By Application: UV‑Curable Coatings & Inks; Structural Adhesives; Electronic Encapsulants; 3D‑Printing Resins; Specialty Plastics

-

By End‑Use Industry: Automotive; Electronics & Electrical; Aerospace & Defense; Industrial Maintenance; Medical & Dental

-

By Form: Liquid Monomer; Pre‑formulated Oligomer Blends

-

By Region: Asia‑Pacific; Europe; North America; Latin America; Middle East & Africa

Category‑wise Insights

-

Automotive Coatings: DCPA confers rapid cure and high gloss in refinish and OEM clearcoats, reducing line‑speed bottlenecks.

-

Electronic Encapsulants: Provides low dielectric constant and moisture resistance for PCBs and LED modules.

-

3D‑Printing Resins: High crosslink density yields strong, heat‑resistant parts for dental prosthetics and functional prototypes.

Key Benefits for Industry Participants and Stakeholders

-

Process Efficiency: Faster cure times lower energy consumption and increase throughput in UV‑curing lines.

-

Performance Enhancement: High thermal and chemical resistance extends service life of coatings and adhesives.

-

Regulatory Compliance: Low‑VOC formulations help end‑users meet stringent environmental regulations.

-

Product Differentiation: Unique monomer structure supports premium product positioning and price realization.

-

Technological Leadership: Collaboration on DCPA innovation positions suppliers as preferred partners for advanced materials.

SWOT Analysis

Strengths:

-

Exceptional thermal stability and crosslinking potential.

-

Versatility across multiple high‑growth applications.

Weaknesses:

-

Higher cost relative to commodity acrylates.

-

Handling complexities and storage requirements.

Opportunities:

-

Expansion into additive manufacturing and bio‑based chemistries.

-

Growth in emerging markets with rising industrial coatings demand.

Threats:

-

Feedstock price fluctuations (dicyclopentadiene, acrylic acid).

-

Alternative monomer technologies gaining traction.

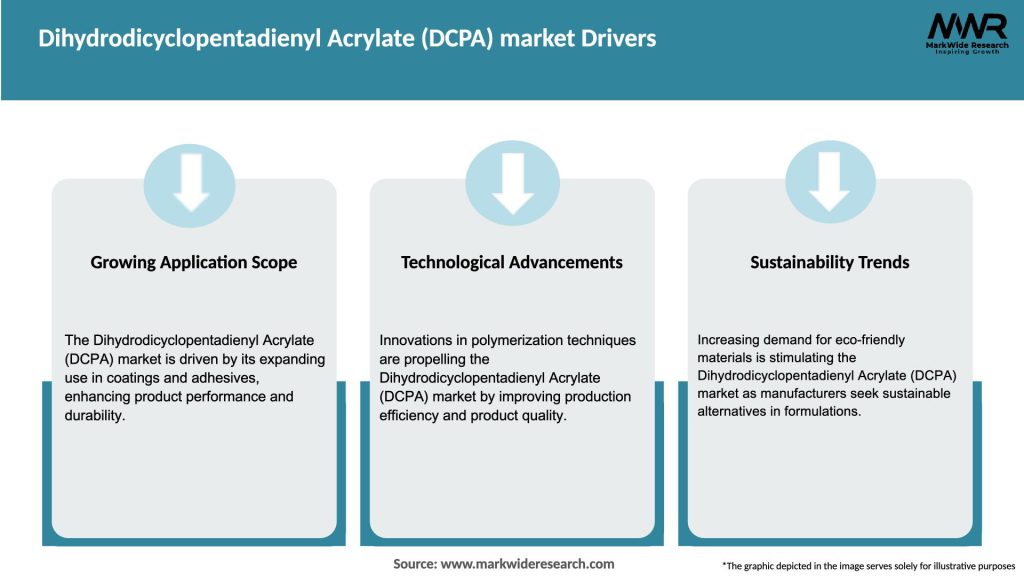

Market Key Trends

-

Hybrid Formulations: Blends of DCPA with urethane acrylates to balance flexibility and toughness.

-

Sustainable Feedstocks: Research into lignin‑ or terpene‑derived bicyclic monomers as renewable DCPA analogues.

-

Digital Manufacturing: Integration of DCPA‑based resins in continuous UV‑curing 3D‑printing platforms for industrial parts.

-

Smart Coatings: Incorporation of nanofillers and DCPA for self‑cleaning or corrosion‑inhibiting functionalities.

-

Multi‑Functional Adhesives: DCPA‑enhanced formulations providing both structural bonding and vibration damping in EV battery assemblies.

Covid‑19 Impact

-

Supply Chain Disruptions: Early 2020 shutdowns delayed DCPA feedstock imports, causing short‑term capacity constraints.

-

Shift in End‑Use Demand: Slowdown in automotive production dampened coating volumes; surge in electronics manufacturing partially offset declines.

-

Accelerated Digitalization: Remote collaboration on formulation development increased interest in high‑performance UV‑curable chemistries.

Key Industry Developments

-

Manufacturer A’s Capacity Expansion: New DCPA production line in Southeast Asia to meet growing regional demand.

-

Manufacturer B R&D Collaboration: Partnership with a leading 3D‑printer OEM to co‑develop DCPA‑based high‑temperature resins.

-

Manufacturer C Green Initiative: Launch of partially bio‑sourced DCPA monomer derived from renewable terpene feedstocks.

-

Specialty Operator’s Patent: Advanced DCPA derivative offering enhanced adhesion to metal substrates without primers.

Analyst Suggestions

-

Diversify Feedstock Sources: Secure multiple supply channels for dicyclopentadiene and acrylic acid to mitigate price volatility.

-

Invest in Application Development: Collaborate with end‑users to formulate DCPA‑based systems tailored for specific performance needs.

-

Pursue Sustainability Goals: Accelerate development of bio‑based DCPA analogues to address ESG requirements.

-

Expand Regional Footprint: Establish local blending or distribution centers in high‑growth Asia‑Pacific and Latin American markets.

-

Enhance Digital Engagement: Leverage virtual labs and online technical services to support remote formulation trials.

Future Outlook

The DCPA market is poised for sustained growth, driven by continued adoption of UV‑curable and high‑performance polymer systems across diverse industries. Innovations in bio‑based feedstocks, 3D‑printing applications, and smart coatings will open new frontiers for DCPA usage. Strategic investments in capacity, application support, and sustainability will determine the competitive landscape, as suppliers strive to meet evolving end‑user demands for performance, compliance, and environmental stewardship.

Conclusion

Dihydrodicyclopentadienyl acrylate represents a critical niche monomer enabling next‑generation coatings, adhesives, and high‑functionality polymers. As manufacturers and formulators seek to combine rapid curing, exceptional durability, and low environmental impact, DCPA’s unique bicyclic structure and polymerization characteristics will drive its incorporation into advanced material solutions. Stakeholders who align production strategies with emerging market trends—such as UV‑curable manufacturing, additive technologies, and renewable feedstocks—will unlock significant value in the evolving DCPA market.