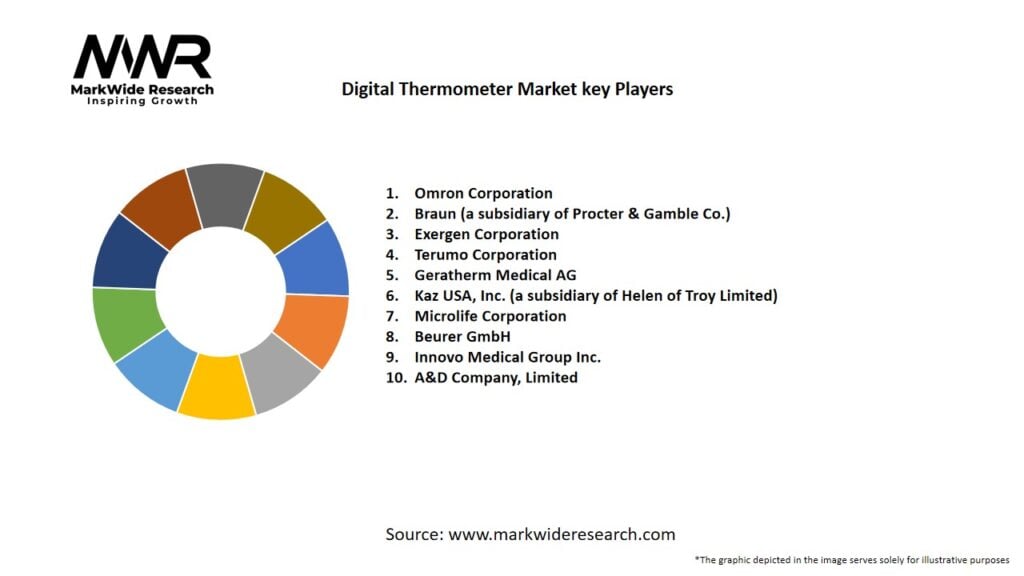

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Contactless Demand Surge: Infrared forehead thermometers grew by over 30% in 2024 as clinics and consumers prioritized non-contact screening.

-

Wearables Integration: Smartwatches and fitness bands with skin-contact thermistors are entering the RPM space, expected to capture 12% of the market by 2028.

-

Emerging Economies: Affordable oral digital thermometers are gaining traction in Asia Pacific and Latin America, where traditional thermometers once dominated.

-

Regulatory Approvals: FDA and CE clearances for medical-grade devices are facilitating hospital procurement, while ISO 13485 certification is becoming a quality benchmark.

-

Value-Added Services: Calibration and validation services contribute an estimated 8% of total market value, underscoring the importance of ongoing accuracy assurance.

Market Drivers

-

Healthcare Digitization: The shift toward electronic health records (EHR) and remote patient monitoring elevates demand for networked digital thermometers.

-

Infection Control Protocols: Stringent guidelines in hospitals and public venues (airports, schools) favor non-contact infrared devices.

-

Consumer Health Awareness: Rising self-monitoring trends and mobile-app integration encourage at-home use of smart digital thermometers.

-

Chronic Condition Management: Patients with autoimmune disorders, oncology treatments, and pediatric care require frequent temperature tracking, spurring device adoption.

-

Industrial Safety Standards: Food, pharmaceutical, and chemical industries mandate real-time temperature logging, driving uptake of high-precision industrial probes.

Market Restraints

-

Calibration Requirements: Frequent recalibration under ISO/IEC 17025 standards adds cost and complexity for professional users.

-

Battery Dependency: Device reliability is linked to battery life; disposable-battery models face user resistance, while rechargeable variants raise upfront costs.

-

Accuracy Variability: Infrared readings can be influenced by ambient temperature and distance, potentially undermining confidence among clinical users.

-

Regulatory Hurdles: Securing medical-device approvals in multiple jurisdictions can delay product launches and increase development costs.

-

Low-Cost Alternatives: In some markets, cheap analog or single-use thermometers still compete aggressively on price.

Market Opportunities

-

AI-Enhanced Analytics: Integrating machine-learning algorithms to flag abnormal temperature trends and auto-alert caregivers presents new software-service revenue.

-

Telehealth Platforms: Partnering with telemedicine providers to bundle digital thermometers with remote consultation services expands addressable markets.

-

Wearables Partnerships: Collaborating with smartwatch OEMs to embed advanced thermistors opens consumer and clinical RPM channels.

-

Industrial IIoT Integration: Offering digital probes with Modbus or Bluetooth LE connectivity for automated factory floor monitoring addresses Industry 4.0 demands.

-

Emerging Market Penetration: Developing low-cost, robust models for rural health programs in Africa and South Asia can drive social-impact and volume growth.

Market Dynamics

-

Hardware-Software Convergence: The lines between device and data platform are blurring; manufacturers increasingly offer companion apps, cloud dashboards, and analytics.

-

Distribution Shift: E-commerce channels for over-the-counter devices are outpacing traditional pharmacy sales, especially among millennials and Gen Z.

-

M&A Activity: Consolidation among mid-size instrument makers and startups is creating end-to-end RPM solution providers.

-

Customization Demand: Hospitals and labs seek devices calibrated to specific protocols (e.g., pediatric, ICU)—leading to modular design platforms.

-

Sustainability Trends: Rechargeable/solar-powered thermometers and recyclable probe covers respond to eco-friendly procurement policies.

Regional Analysis

-

North America: High adoption of connected medical devices and favorable reimbursement for RPM drives a 6% CAGR through 2028.

-

Europe: Strong regulatory framework (CE marking) and telehealth uptake in the UK and Germany accelerate market penetration.

-

Asia Pacific: Largest volume market by units; government programs in India and China are subsidizing digital thermometers for primary care.

-

Latin America: Growing private-sector healthcare and rising middle-class income spur demand for at-home digital health tools.

-

Middle East & Africa: Early-stage growth driven by hospital modernization initiatives in GCC countries and public health campaigns.

Competitive Landscape

Leading Companies in the Digital Thermometer Market:

- Omron Corporation

- Braun (a subsidiary of Procter & Gamble Co.)

- Exergen Corporation

- Terumo Corporation

- Geratherm Medical AG

- Kaz USA, Inc. (a subsidiary of Helen of Troy Limited)

- Microlife Corporation

- Beurer GmbH

- Innovo Medical Group Inc.

- A&D Company, Limited

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

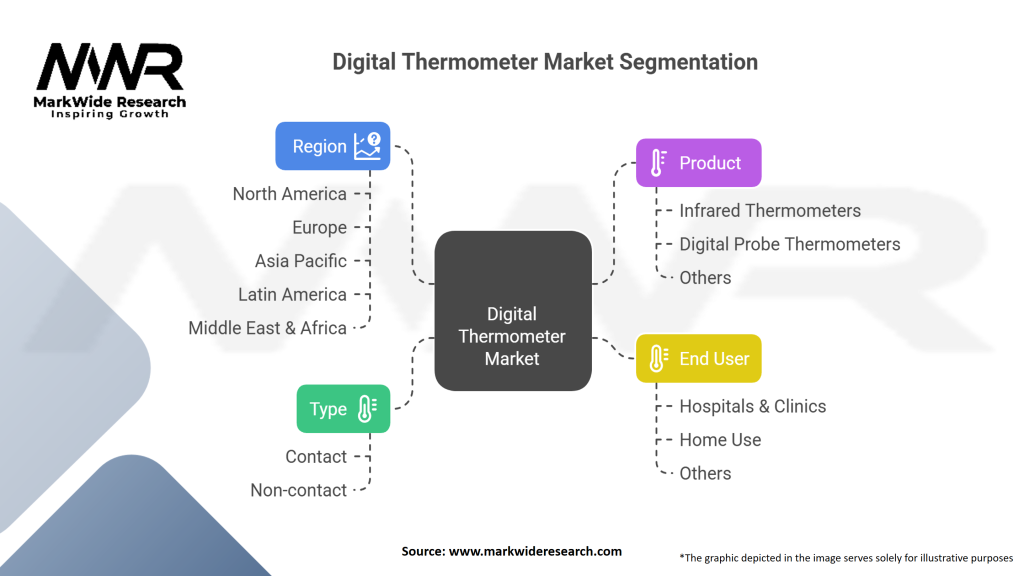

Segmentation

-

By Product Type: Oral, Ear (Tympanic), Forehead (Infrared), Temporal Artery, Industrial Probe, Wearable Patch

-

By End-User: Hospitals & Clinics, Home Healthcare, Pharmaceutical & Food Processing, Research Laboratories

-

By Connectivity: Standalone, Bluetooth-Enabled, Wi-Fi-Enabled, USB/Serial Interfaces

-

By Distribution: Pharmacy/Retail, E-commerce, Medical Distributors, Direct Institution Sales

Category-wise Insights

-

Oral Thermometers: Affordable, reliable for home use; now often combined with probe covers and quick-read circuits.

-

Ear Thermometers: Preferred in pediatric settings; accuracy depends on proper probe placement.

-

Forehead Infrared: Fast, non-invasive screening tool—especially in high-traffic areas like airports and schools.

-

Temporal Artery: Combines infrared with gentle scanning motion; gaining acceptance in NICUs and geriatric wards.

-

Industrial Probes: High-precision thermocouples and RTDs for process control in food safety and pharmaceuticals.

-

Wearable Patches: Emerging segment focused on continuous, 24/7 temperature trend monitoring in clinical trials and home care.

Key Benefits for Industry Participants and Stakeholders

-

Improved Patient Outcomes: Early fever detection and trend analysis support timely interventions.

-

Operational Efficiency: Faster readings reduce workflow bottlenecks in busy clinics and labs.

-

Remote Monitoring: Connectivity enables clinicians to track temperature remotely, reducing hospital visits and exposure risks.

-

Regulatory Compliance: Data-logging and audit trails facilitate compliance with FDA, EU MDR, and HACCP standards.

-

Cost Savings: Reduced probe-cover usage and reusable rechargeable models lower per-measure costs over device lifetimes.

SWOT Analysis

Strengths:

-

Rapid, accurate readings and broad application spectrum.

-

Strong demand in healthcare and industrial sectors.

-

Increasing integration with digital health ecosystems.

Weaknesses:

-

Accuracy challenges in certain infrared models under extreme conditions.

-

Dependence on power/battery and occasional recalibration needs.

Opportunities:

-

Expansion into telehealth and chronic disease management platforms.

-

Development of eco-friendly, rechargeable, or solar-powered devices.

Threats:

-

Competition from smartphone-based thermal cameras and smartphone attachments.

-

Regulatory changes increasing clinical-use validation requirements.

Market Key Trends

-

Edge Analytics: On-device anomaly detection algorithms flag fever patterns without cloud dependency.

-

Subscription Models: Device-as-a-Service offerings include hardware, software updates, and calibration in a bundled fee.

-

Multi-Parameter Monitors: Thermometry modules integrated with pulse oximetry and heart-rate sensors for consolidated vitals tracking.

-

AI Triage Assist: Predictive analytics models prioritize patient callbacks based on temperature trends and other symptoms.

-

Sustainable Design: Shift to bio-based plastics, long-life batteries, and minimal-waste probe covers.

Covid-19 Impact

The pandemic drove unprecedented demand for contactless infrared thermometers in public spaces and homes, leading to supply shortages and a proliferation of low-cost imports. As markets matured, quality and calibration standards rose, and buyers shifted toward FDA/CE-cleared devices. Long-term, COVID-19 accelerated telehealth adoption, embedding digital thermometers as standard home-care tools.

Key Industry Developments

-

Exergen unveiled TemporalScanner TAT-5000 Pro with improved emissivity algorithms for neonatal care in 2023.

-

Braun launched the iQ+ Forehead Thermometer in 2024, featuring smartphone integration and guided-scan feedback.

-

Omron’s MC-822 Smart Ear Thermometer introduced app-based fever management plans for parents.

-

Testo released the Testo 177-T4 Wireless Data Logger with NIST-traceable calibration for GMP-compliant environments.

Analyst Suggestions

-

Prioritize Regulatory Compliance: Invest in FDA 510(k) and CE mark approvals to access institutional buyers and international markets.

-

Enhance Connectivity: Offer seamless integration with leading EHR platforms and telehealth services to stand out in RPM applications.

-

Focus on Accuracy: Develop compensation algorithms for ambient temperature and distance variations, ensuring consistent clinical performance.

-

Expand Service Offerings: Bundle calibration, validation, and software analytics in subscription models to build recurring revenue.

-

Target Niche Segments: Customize devices for veterinary, neonatal, and sports-science applications to diversify end-use channels.

Future Outlook

The Digital Thermometer market is expected to sustain a 5–7% CAGR through 2030, underpinned by ongoing telehealth growth, wearable integration, and industrial automation demands. As healthcare shifts toward preventive care and home monitoring, digital thermometers—especially connected and AI-enhanced models—will become indispensable. In parallel, environmental and food-safety regulations will drive further adoption of industrial-grade probes and data-logging systems. Overall, the market will evolve from standalone devices to comprehensive temperature-management platforms across healthcare and industry.

Conclusion

In conclusion, the Digital Thermometer market stands at the intersection of healthcare innovation and industrial process control. By embracing digital connectivity, AI analytics, and sustainable design, manufacturers can deliver superior accuracy, user experience, and compliance support. Stakeholders who integrate hardware, software, and value-added services will lead the market, meeting the diverse temperature-monitoring needs of patients, clinicians, and industrial operators in an increasingly data-driven world.