444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Digital Elevation Model (DEM) market is experiencing significant growth and is expected to thrive in the coming years. DEM refers to a digital representation of the Earth’s topography, capturing elevation data across various regions. It plays a crucial role in several industries, including engineering, urban planning, agriculture, and environmental management. By providing accurate and detailed elevation information, DEM facilitates decision-making processes and supports the development of innovative solutions.

A Digital Elevation Model (DEM) is a representation of the Earth’s surface in a digital format. It consists of a grid of elevation values, typically derived from various sources such as satellite imagery, LiDAR (Light Detection and Ranging) technology, and aerial surveys. DEMs are widely used in geographic information systems (GIS) to visualize terrain, analyze landforms, and generate accurate elevation profiles. These models provide essential data for a range of applications, including flood modeling, slope analysis, and 3D visualization.

Executive Summary

The Digital Elevation Model (DEM) market is poised for substantial growth, driven by the increasing demand for accurate geospatial data and the growing adoption of DEM in various industries. This market report provides comprehensive insights into the current market scenario, key trends, market drivers, restraints, opportunities, and competitive landscape. It also offers a detailed analysis of regional dynamics, segmentation, and category-wise insights. Furthermore, this report examines the impact of the COVID-19 pandemic on the DEM market and provides future outlook and analyst suggestions to help industry participants and stakeholders make informed decisions.

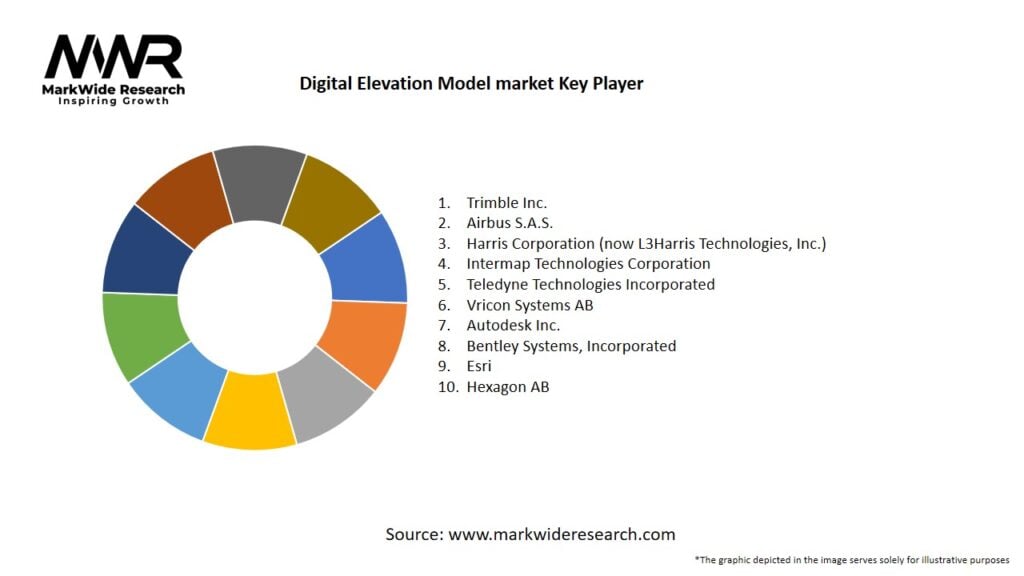

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The DEM market is characterized by dynamic factors that shape its growth and development. Technological advancements, changing user demands, government policies, and industry collaborations influence the market dynamics. The integration of DEM with other geospatial technologies and the increasing focus on data accuracy, resolution, and accessibility are key drivers of market growth. Additionally, the market is driven by the expanding applications of DEM in diverse industries and the rising need for advanced spatial analysis and decision-making tools.

Regional Analysis

The DEM market exhibits variations across different regions, influenced by factors such as infrastructure development, environmental concerns, government initiatives, and technological advancements. North America and Europe dominate the market, owing to their advanced geospatial infrastructure, extensive use of DEMs in urban planning, and strong presence of key market players. The Asia-Pacific region is witnessing significant growth, driven by rapid urbanization, infrastructure development projects, and increasing awareness about the benefits of DEMs. Latin America, the Middle East, and Africa are also emerging markets, with growing demand for DEMs in sectors like agriculture, mining, and disaster management.

Competitive Landscape

Leading Companies in the Digital Elevation Model Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

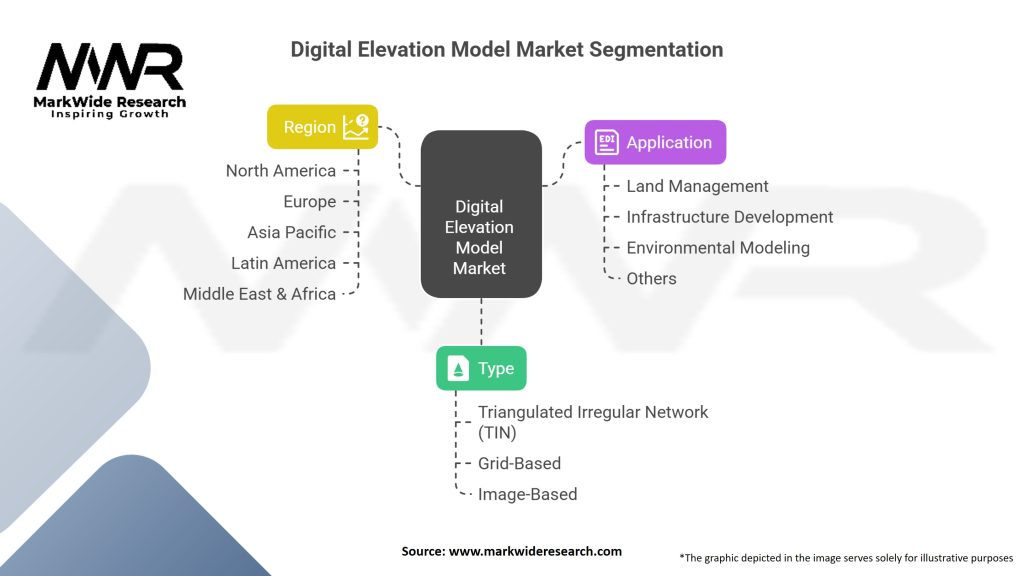

Segmentation

The DEM market can be segmented based on data acquisition methods, end-use industries, and geographic regions. By data acquisition methods, the market can be categorized into LiDAR-based DEM, satellite-based DEM, and aerial survey-based DEM. Based on end-use industries, the market can be segmented into engineering and construction, agriculture, environmental management, transportation, mining and exploration, and others. Geographically, the market can be segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the DEM market can derive several benefits from its adoption and utilization:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis of the DEM market provides a comprehensive understanding of its internal and external factors:

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the DEM market:

Positive Impact:

Negative Impact:

Key Industry Developments

Analyst Suggestions

Based on the current market trends and dynamics, analysts offer the following suggestions:

Future Outlook

The future of the DEM market looks promising, with continued growth and advancements in technology. The increasing demand for accurate elevation data, the integration of DEM with advanced technologies, and the expanding applications across industries are expected to drive market growth. The development of high-resolution and real-time DEM datasets, coupled with user-friendly platforms for data access and analysis, will further fuel market expansion. Additionally, the integration of DEMs with emerging technologies like AI, machine learning, and augmented reality will unlock new opportunities for innovation and decision-making.

Conclusion

The Digital Elevation Model (DEM) market is experiencing significant growth and offers a wide range of opportunities across industries. DEMs provide accurate elevation data, enabling informed decision making, enhancing efficiency, and supporting various applications such as precision agriculture, infrastructure development, and environmental management. While the market faces challenges like data acquisition costs and limited availability, advancements in technology, government initiatives, and industry collaborations are driving its expansion.

The COVID-19 pandemic has both positively and negatively impacted the market, emphasizing the importance of resilient solutions and disaster management. Analyst suggestions emphasize the need for data accuracy, accessibility, awareness, and the integration of emerging technologies. The future outlook for the DEM market is promising, with continued growth, technological advancements, and expanding applications across industries.

What is Digital Elevation Model?

A Digital Elevation Model (DEM) is a representation of the Earth’s surface topography or terrain. It is commonly used in geographic information systems (GIS) for applications such as land use planning, flood modeling, and environmental monitoring.

What are the key players in the Digital Elevation Model market?

Key players in the Digital Elevation Model market include companies like Esri, DigitalGlobe, and Trimble, which provide various DEM products and services for applications in urban planning, agriculture, and disaster management, among others.

What are the main drivers of growth in the Digital Elevation Model market?

The growth of the Digital Elevation Model market is driven by increasing demand for accurate terrain data in sectors such as urban planning, environmental management, and transportation. Additionally, advancements in remote sensing technologies and GIS software are enhancing the accessibility and usability of DEMs.

What challenges does the Digital Elevation Model market face?

Challenges in the Digital Elevation Model market include the high costs associated with data acquisition and processing, as well as issues related to data accuracy and resolution. Furthermore, the integration of DEMs with other geospatial data can be complex and resource-intensive.

What opportunities exist in the Digital Elevation Model market?

Opportunities in the Digital Elevation Model market include the growing use of DEMs in emerging fields such as autonomous vehicles and smart city initiatives. Additionally, the increasing availability of open-source DEM data presents new avenues for innovation and application development.

What trends are shaping the Digital Elevation Model market?

Trends in the Digital Elevation Model market include the integration of artificial intelligence and machine learning for improved data analysis and interpretation. There is also a rising interest in high-resolution DEMs for applications in climate change studies and natural resource management.

Digital Elevation Model Market

| Segmentation | Details |

|---|---|

| Type | Triangulated Irregular Network (TIN), Grid-Based, Image-Based |

| Application | Land Management, Infrastructure Development, Environmental Modeling, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Digital Elevation Model Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at