444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The digital banking market in the Middle East represents one of the most dynamic and rapidly evolving financial technology sectors globally. This transformative landscape encompasses comprehensive digital financial services, mobile banking applications, online payment systems, and innovative fintech solutions that are reshaping traditional banking paradigms across the region. Digital banking adoption has accelerated significantly, driven by increasing smartphone penetration, government digitization initiatives, and changing consumer preferences toward convenient, accessible financial services.

Regional dynamics indicate substantial growth momentum, with the Middle East experiencing a 15.2% annual growth rate in digital banking adoption. Countries such as the United Arab Emirates, Saudi Arabia, Qatar, and Kuwait are leading this digital transformation, implementing comprehensive regulatory frameworks that support fintech innovation while maintaining robust security standards. The market encompasses various segments including retail digital banking, corporate banking solutions, Islamic digital banking, and emerging cryptocurrency services.

Technological infrastructure development across the region has created favorable conditions for digital banking expansion. Advanced telecommunications networks, widespread internet connectivity, and government-backed smart city initiatives have established the foundation for comprehensive digital financial ecosystems. Consumer behavior patterns show increasing preference for digital-first banking experiences, with mobile banking transactions representing 68% of total banking interactions in major Middle Eastern markets.

The digital banking market in the Middle East refers to the comprehensive ecosystem of technology-enabled financial services that deliver banking products and solutions through digital channels, including mobile applications, web platforms, and integrated fintech solutions across Middle Eastern countries. This market encompasses traditional banks’ digital transformation initiatives, pure digital banks, fintech startups, and innovative payment solutions that serve both retail and corporate customers throughout the region.

Digital banking services include mobile banking applications, online account management, digital payment systems, peer-to-peer transfers, digital lending platforms, investment management tools, and emerging blockchain-based financial products. The market also incorporates Islamic banking principles through Sharia-compliant digital solutions, reflecting the region’s unique cultural and religious requirements for financial services.

Market transformation in Middle Eastern digital banking demonstrates unprecedented growth driven by technological advancement, regulatory support, and evolving consumer expectations. The region’s strategic position as a global financial hub, combined with substantial government investments in digital infrastructure, has created optimal conditions for fintech innovation and digital banking adoption.

Key market drivers include increasing smartphone penetration rates of 85% across major markets, government digitization initiatives, and growing demand for convenient financial services. Traditional banks are investing heavily in digital transformation, while new market entrants are introducing innovative solutions that challenge conventional banking models. Islamic digital banking represents a significant growth segment, addressing the specific needs of Muslim consumers seeking Sharia-compliant financial products.

Competitive landscape features established regional banks, international financial institutions, and emerging fintech companies competing to capture market share through innovative product offerings and superior customer experiences. Strategic partnerships between traditional banks and technology companies are accelerating digital transformation initiatives across the region.

Market penetration analysis reveals significant opportunities for continued expansion across diverse customer segments and geographic markets. The following insights highlight critical market dynamics:

Technological advancement serves as the primary catalyst for digital banking growth throughout the Middle East. Widespread smartphone adoption, improved internet connectivity, and advanced telecommunications infrastructure create the foundation for comprehensive digital banking services. Government initiatives across the region actively promote digital transformation through supportive regulatory frameworks, investment in smart city projects, and national digitization strategies.

Consumer behavior evolution demonstrates increasing preference for convenient, accessible financial services available through digital channels. Younger demographics, representing a significant portion of the regional population, drive demand for innovative banking solutions that integrate seamlessly with their digital lifestyles. COVID-19 impact accelerated digital adoption as consumers and businesses sought contactless banking alternatives during pandemic restrictions.

Economic diversification efforts across Middle Eastern countries emphasize fintech development as a key component of reducing oil dependency and building knowledge-based economies. Cross-border trade growth increases demand for efficient international payment solutions, driving innovation in digital banking platforms that facilitate global commerce and remittance services.

Regulatory complexity presents significant challenges for digital banking expansion, as financial institutions must navigate varying compliance requirements across different Middle Eastern jurisdictions. Cybersecurity concerns remain paramount, with increasing digital transactions creating potential vulnerabilities that require substantial investment in security infrastructure and risk management systems.

Cultural resistance to digital banking adoption persists among certain demographic segments, particularly older consumers who prefer traditional banking relationships and face-to-face interactions. Digital literacy gaps limit market penetration in some regions, requiring extensive customer education and support programs to facilitate adoption.

Infrastructure limitations in certain areas constrain digital banking accessibility, while competition from established banks with significant resources and customer bases creates barriers for new market entrants. Economic volatility and geopolitical tensions can impact investment in digital banking initiatives and consumer confidence in new financial technologies.

Islamic digital banking represents substantial growth potential, addressing the specific needs of Muslim consumers seeking Sharia-compliant financial products through innovative digital platforms. Underbanked populations across the region present significant opportunities for financial inclusion through accessible digital banking solutions that reach previously underserved communities.

Corporate banking digitization offers extensive growth prospects as businesses increasingly demand sophisticated digital financial management tools, automated payment systems, and integrated accounting solutions. Cryptocurrency and blockchain integration creates opportunities for innovative financial products as regulatory frameworks evolve to accommodate digital assets.

Cross-border payment solutions present lucrative opportunities given the region’s position as a global trade hub and significant expatriate populations requiring international money transfer services. Partnership opportunities between traditional banks, fintech companies, and technology providers enable rapid market expansion and innovation development.

Competitive intensity continues increasing as traditional banks, international financial institutions, and fintech startups compete for market share through innovative product offerings and superior customer experiences. Technology evolution drives continuous innovation in digital banking platforms, with artificial intelligence, machine learning, and blockchain technologies enhancing service capabilities and operational efficiency.

Regulatory evolution shapes market development as governments balance innovation promotion with consumer protection and financial stability requirements. MarkWide Research analysis indicates that regulatory sandboxes and progressive fintech policies contribute to 23% faster market entry for new digital banking solutions.

Customer expectations continuously evolve, demanding more sophisticated, personalized, and seamless digital banking experiences. Market consolidation trends emerge as smaller players seek partnerships or acquisition opportunities to compete effectively against larger, well-resourced competitors.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Middle Eastern digital banking market dynamics. Primary research includes extensive interviews with industry executives, banking professionals, fintech entrepreneurs, and regulatory officials across major Middle Eastern markets.

Secondary research incorporates analysis of industry reports, government publications, financial statements, and regulatory documents from relevant authorities. Quantitative analysis examines market data, adoption rates, transaction volumes, and growth metrics to identify trends and patterns.

Qualitative assessment evaluates market dynamics, competitive positioning, and strategic initiatives through expert interviews and industry observation. Regional analysis considers country-specific factors including regulatory environments, economic conditions, and cultural influences affecting digital banking adoption.

United Arab Emirates leads regional digital banking adoption with 78% smartphone banking penetration and comprehensive regulatory frameworks supporting fintech innovation. Dubai and Abu Dhabi serve as regional fintech hubs, attracting international investment and fostering startup development through supportive government initiatives.

Saudi Arabia demonstrates rapid digital transformation through Vision 2030 initiatives, with substantial government investment in digital infrastructure and fintech development. Digital payment adoption has increased significantly, supported by national digitization programs and growing e-commerce activity.

Qatar and Kuwait show strong growth potential with high per capita income levels and increasing demand for sophisticated digital banking services. Bahrain positions itself as a regional fintech center through progressive regulatory frameworks and strategic initiatives to attract international financial technology companies.

Other regional markets including Oman, Jordan, and Lebanon present emerging opportunities despite varying economic conditions and regulatory environments. Cross-border collaboration increases as regional integration initiatives facilitate digital banking service expansion across multiple jurisdictions.

Market leadership involves both traditional banking institutions and innovative fintech companies competing through differentiated service offerings and technological capabilities. The competitive environment features:

By Service Type: The market segments into retail banking services, corporate banking solutions, investment management platforms, and payment processing services. Retail banking dominates market share through mobile banking applications, online account management, and digital payment solutions.

By Technology: Mobile banking applications, web-based platforms, API-driven services, and blockchain-based solutions represent key technological segments. Mobile-first approaches capture the largest market share due to high smartphone penetration and consumer preference for convenient access.

By Customer Segment: Individual consumers, small and medium enterprises, large corporations, and government entities represent distinct customer segments with specific requirements and service preferences.

By Geography: Market segmentation includes GCC countries, Levant region, and North African markets, each with unique regulatory environments and market characteristics.

Mobile Banking Applications represent the fastest-growing category, driven by widespread smartphone adoption and consumer preference for convenient financial services access. Feature sophistication continues increasing with biometric authentication, AI-powered customer service, and integrated lifestyle services.

Digital Payment Solutions experience substantial growth through e-commerce expansion, government digitization initiatives, and increasing consumer comfort with contactless transactions. Cross-border payment services gain traction among expatriate populations and international businesses.

Islamic Digital Banking emerges as a significant category, addressing specific religious requirements through Sharia-compliant digital financial products. Investment platforms attract growing interest from affluent consumers seeking digital wealth management solutions.

Corporate Banking Solutions evolve rapidly to meet business demands for automated financial management, integrated accounting systems, and sophisticated cash management tools.

Financial institutions benefit from reduced operational costs, improved customer acquisition capabilities, and enhanced service delivery through digital banking platforms. Cost efficiency improvements of up to 40% in transaction processing enable competitive pricing and improved profitability.

Consumers gain access to convenient, 24/7 banking services, reduced transaction fees, and innovative financial products tailored to their specific needs. Enhanced user experiences through personalized services and intuitive interfaces improve customer satisfaction and loyalty.

Businesses benefit from streamlined financial operations, automated payment processing, and integrated accounting solutions that improve efficiency and reduce administrative burden. SMEs particularly benefit from accessible credit solutions and simplified banking procedures.

Government stakeholders achieve economic diversification objectives, increased financial inclusion, and enhanced tax collection efficiency through digital banking adoption and fintech development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration transforms customer service delivery through chatbots, personalized recommendations, and automated financial advisory services. Machine learning algorithms enhance fraud detection capabilities and risk assessment accuracy, improving overall security and operational efficiency.

Open Banking Initiatives gain momentum as regulatory frameworks evolve to support API-driven financial services and third-party integrations. Collaboration trends emerge between traditional banks and fintech companies, creating comprehensive digital ecosystems.

Sustainability Focus influences digital banking development through green finance initiatives, carbon footprint tracking, and sustainable investment options. Social responsibility becomes increasingly important for customer attraction and retention.

Biometric Authentication adoption increases security while improving user experience through fingerprint, facial recognition, and voice authentication technologies. Blockchain implementation expands beyond cryptocurrency to include smart contracts and secure transaction processing.

Regulatory sandbox programs across multiple Middle Eastern countries enable fintech companies to test innovative solutions within controlled environments. Central bank digital currency initiatives advance as governments explore sovereign digital payment systems.

Strategic partnerships between traditional banks and technology companies accelerate digital transformation initiatives and market expansion. MWR analysis indicates that collaborative approaches result in 35% faster product development cycles compared to independent development efforts.

Investment activity increases substantially with venture capital firms and private equity investors focusing on Middle Eastern fintech opportunities. Acquisition trends emerge as larger institutions seek to acquire innovative capabilities and market presence.

Cross-border expansion accelerates as successful digital banking platforms seek regional growth opportunities through strategic partnerships and licensing agreements.

Strategic focus should prioritize customer experience enhancement through personalized services, intuitive interfaces, and comprehensive digital ecosystems. Investment in cybersecurity infrastructure remains critical for maintaining customer trust and regulatory compliance.

Partnership strategies offer optimal paths for market expansion and capability development, particularly for smaller fintech companies seeking to compete with established institutions. Regulatory engagement ensures compliance while influencing policy development to support innovation.

Technology adoption should emphasize emerging solutions including artificial intelligence, blockchain, and biometric authentication to maintain competitive advantages. Market differentiation through specialized services such as Islamic banking or SME-focused solutions creates sustainable competitive positioning.

Geographic expansion strategies should consider regulatory environments, market maturity, and competitive landscapes when entering new Middle Eastern markets.

Market evolution indicates continued acceleration in digital banking adoption driven by technological advancement, regulatory support, and changing consumer preferences. Growth projections suggest sustained expansion with digital banking transactions expected to represent 85% of total banking interactions within the next five years.

Innovation trends will focus on artificial intelligence integration, blockchain implementation, and enhanced cybersecurity measures. MarkWide Research forecasts indicate that AI-powered banking services will achieve 60% adoption rates among digital banking users by 2028.

Regulatory development will continue supporting fintech innovation while ensuring consumer protection and financial stability. Market consolidation may occur as competitive pressures intensify and smaller players seek strategic partnerships or acquisition opportunities.

Regional integration will facilitate cross-border digital banking services and create opportunities for pan-Middle Eastern financial platforms. Emerging technologies including quantum computing and advanced biometrics will further transform the digital banking landscape.

The digital banking market in the Middle East represents a transformative force reshaping the regional financial services landscape through technological innovation, regulatory support, and evolving consumer preferences. Substantial growth momentum continues driving market expansion across diverse segments including retail banking, corporate solutions, and Islamic financial services.

Strategic opportunities abound for financial institutions, fintech companies, and technology providers willing to invest in innovative solutions that address specific regional requirements and customer needs. Success factors include comprehensive cybersecurity measures, regulatory compliance, customer experience focus, and strategic partnership development.

Future market development will be characterized by continued technological advancement, increased competition, and expanding service offerings that further integrate digital banking into consumers’ daily lives. Organizations that effectively navigate regulatory complexities while delivering superior customer experiences will capture the greatest opportunities in this dynamic and rapidly evolving market.

What is Digital Banking?

Digital banking refers to the digitization of all traditional banking activities and services that were previously only available to customers when physically present at a bank branch. This includes online banking, mobile banking, and the use of digital wallets, among other services.

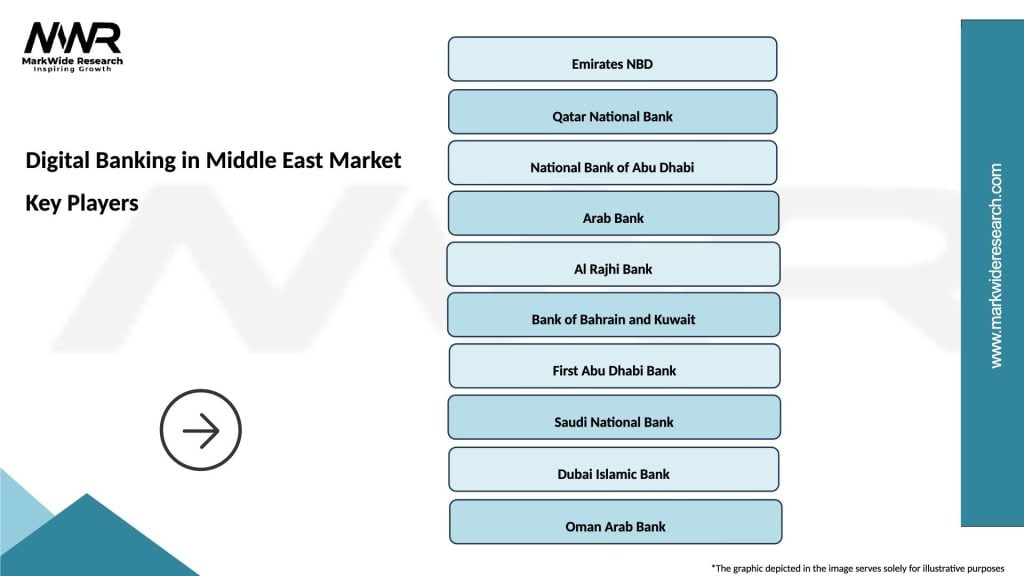

What are the key players in the Digital Banking in Middle East Market?

Key players in the Digital Banking in Middle East Market include Emirates NBD, Qatar National Bank, and Mashreq Bank, which are leading the way in offering innovative digital banking solutions and services to their customers.

What are the growth factors driving the Digital Banking in Middle East Market?

The growth of the Digital Banking in Middle East Market is driven by increasing smartphone penetration, a growing preference for online transactions, and the rising demand for enhanced customer experiences through digital platforms.

What challenges does the Digital Banking in Middle East Market face?

The Digital Banking in Middle East Market faces challenges such as regulatory compliance, cybersecurity threats, and the need for significant investment in technology infrastructure to keep up with evolving consumer expectations.

What opportunities exist in the Digital Banking in Middle East Market?

Opportunities in the Digital Banking in Middle East Market include the expansion of fintech solutions, partnerships with technology companies, and the potential for personalized banking experiences through data analytics and artificial intelligence.

What trends are shaping the Digital Banking in Middle East Market?

Trends shaping the Digital Banking in Middle East Market include the rise of neobanks, increased adoption of blockchain technology, and a focus on sustainability and green banking initiatives to attract environmentally conscious consumers.

Digital Banking in Middle East Market

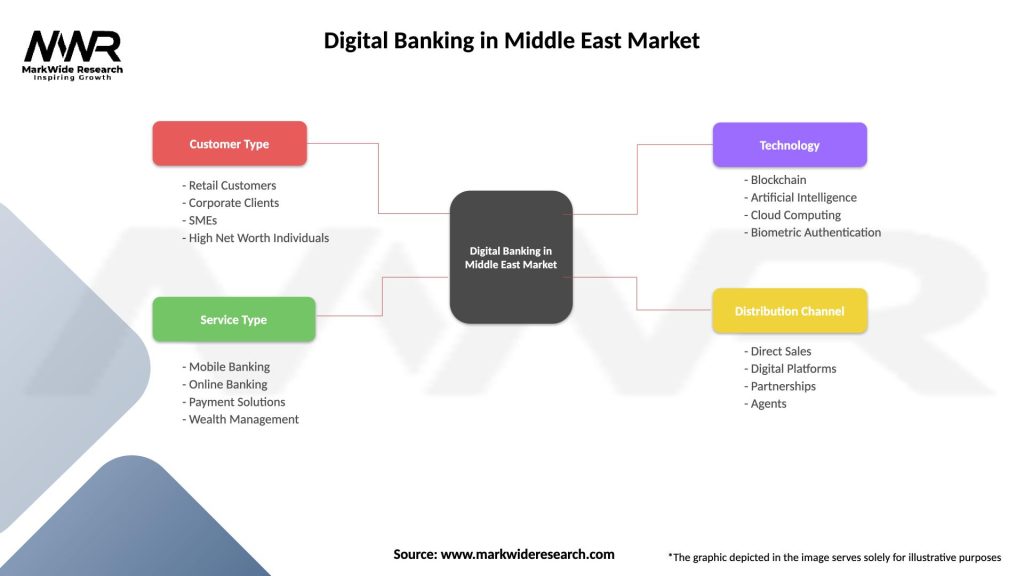

| Segmentation Details | Description |

|---|---|

| Customer Type | Retail Customers, Corporate Clients, SMEs, High Net Worth Individuals |

| Service Type | Mobile Banking, Online Banking, Payment Solutions, Wealth Management |

| Technology | Blockchain, Artificial Intelligence, Cloud Computing, Biometric Authentication |

| Distribution Channel | Direct Sales, Digital Platforms, Partnerships, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Digital Banking in Middle East Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at