444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Diamond mining is a significant sector within the mining industry, involving the extraction and processing of diamonds from various geological formations. Diamonds hold immense value due to their rarity, beauty, and diverse range of industrial applications. The market for diamond mining is dynamic, with global demand driven by jewelry consumption, industrial usage, and investment purposes. This comprehensive analysis aims to provide insights into the diamond mining market, including key trends, market drivers, restraints, opportunities, and future outlook.

Diamond mining refers to the process of extracting diamonds from the earth’s surface or beneath it. These precious gemstones are formed under extreme pressure and heat deep within the Earth’s mantle, eventually making their way to the surface through volcanic eruptions or other geological processes. Diamond mining involves several stages, including exploration, mining, sorting, and processing. The final product can be used in various industries, such as jewelry, electronics, cutting tools, and abrasives.

Executive Summary

The diamond mining market has experienced significant growth over the years, driven by increasing consumer demand for diamonds and expanding industrial applications. However, the market also faces challenges, such as environmental concerns, geopolitical factors, and the emergence of lab-grown diamonds. This report provides a comprehensive overview of the market, highlighting key insights, market dynamics, regional analysis, competitive landscape, and future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The diamond mining market is driven by several factors:

Market Restraints

The diamond mining market faces the following challenges:

Market Opportunities

Despite the challenges, the diamond mining market presents several opportunities:

Market Dynamics

The diamond mining market is influenced by a combination of macroeconomic factors, industry-specific trends, and consumer behavior. These dynamics shape the supply and demand dynamics, pricing, and overall market performance.

Global economic conditions, including GDP growth, consumer spending patterns, and geopolitical stability, play a crucial role in determining the demand for diamond jewelry. Fluctuations in currency exchange rates and trade policies also impact the market dynamics, as diamonds are a globally traded commodity.

Consumer preferences and trends, such as changing fashion styles, evolving purchasing channels (online retail, branded stores), and increasing emphasis on sustainability and ethical sourcing, significantly impact the market. Shifts in consumer sentiment, cultural influences, and marketing efforts also influence the demand for diamonds.

Supply-side dynamics are influenced by factors such as mining regulations, exploration activities, technological advancements, labor availability, and operational costs. Additionally, industry consolidation, mergers and acquisitions, and partnerships among mining companies shape the competitive landscape and market structure.

Regional Analysis

The diamond mining market is geographically diverse, with significant production and consumption centers across the globe. Key regions contributing to the market include:

Regional factors such as geological formations, mining regulations, infrastructure, labor availability, and political stability influence the production and market dynamics within each region.

Competitive Landscape

Leading Companies in the Diamond Mining Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

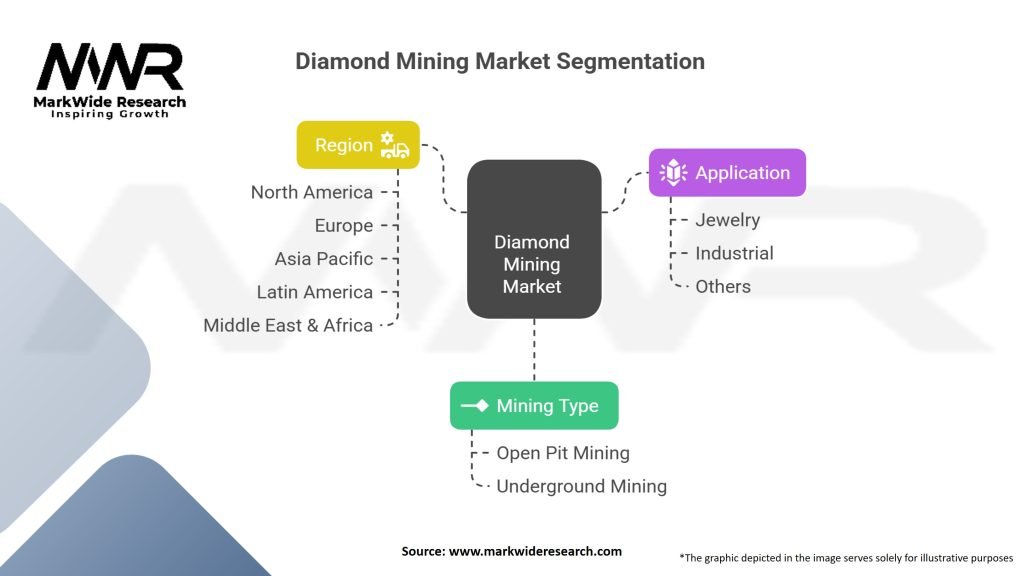

Segmentation

The diamond mining market can be segmented based on various factors:

Segmentation allows for a deeper understanding of specific market segments, their unique characteristics, and targeted strategies for each segment.

Category-wise Insights

Understanding the demand, pricing, and market dynamics specific to each diamond category is crucial for mining companies to optimize their production and marketing strategies.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The diamond mining market, like many other industries, has been significantly affected by the Covid-19 pandemic. The pandemic led to temporary mine closures, disruptions in the supply chain, and a decline in consumer demand for luxury goods, including diamond jewelry. Travel restrictions and lockdown measures also impacted diamond trading activities, such as auctions and international diamond shows.

However, as the global economy recovers and restrictions are gradually lifted, the diamond mining market is expected to rebound. The pent-up demand for luxury goods, including diamonds, is anticipated to drive market growth. Furthermore, the increased focus on sustainable and ethically sourced diamonds, as a result of the pandemic, presents opportunities for the industry to align with changing consumer values and preferences.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the diamond mining market holds both challenges and opportunities. The industry will need to navigate changing consumer preferences, the rise of lab-grown diamonds, and evolving environmental and social expectations. However, as global economies recover from the impact of the Covid-19 pandemic, the demand for diamonds is expected to rebound, driven by the recovery of the luxury goods market and increasing consumer confidence.

To stay competitive, diamond mining companies will need to embrace sustainability, adopt advanced technologies, and ensure transparency and traceability throughout the supply chain. Investing in research and development will be crucial to drive innovation, improve operational efficiency, and discover new applications for diamonds.

The continued growth of e-commerce and online retail presents opportunities for diamond mining companies to expand their market reach and engage directly with consumers. Personalization and customization will play a significant role in meeting the evolving demands of customers seeking unique and tailored diamond jewelry.

Conclusion

In conclusion, the diamond mining market is poised for growth despite the challenges it faces. By embracing sustainability, leveraging technology, adapting to changing consumer preferences, and fostering collaboration, diamond mining companies can thrive in a dynamic and evolving industry. The future outlook remains positive, with opportunities for innovation, expansion into emerging markets, and the continued allure of diamonds as a symbol of luxury and beauty.

In summary, the diamond mining market is a dynamic industry driven by consumer demand for diamonds in various applications, including jewelry and industrial uses. While the market faces challenges such as environmental concerns, geopolitical risks, and the emergence of lab-grown diamonds, there are significant opportunities for growth.

The key to success in the diamond mining market lies in adopting sustainable practices, embracing technological advancements, and catering to evolving consumer preferences. Mining companies that prioritize responsible mining, reduce their environmental footprint, and ensure ethical sourcing will gain a competitive edge and meet the demands of socially conscious consumers.

What is Diamond Mining?

Diamond mining refers to the process of extracting diamonds from the earth, typically through open-pit or underground mining methods. This industry involves various stages, including exploration, extraction, and processing of diamond-bearing ore.

What are the key companies in the Diamond Mining market?

Key companies in the Diamond Mining market include De Beers Group, Alrosa, and Rio Tinto, which are known for their significant contributions to diamond production and exploration activities, among others.

What are the main drivers of the Diamond Mining market?

The main drivers of the Diamond Mining market include the increasing demand for diamonds in jewelry, the growth of luxury goods markets, and advancements in mining technologies that enhance extraction efficiency.

What challenges does the Diamond Mining market face?

The Diamond Mining market faces challenges such as environmental concerns related to mining practices, fluctuating diamond prices, and regulatory pressures that can impact operations and profitability.

What opportunities exist in the Diamond Mining market?

Opportunities in the Diamond Mining market include the exploration of new mining sites, the development of synthetic diamonds, and the potential for technological innovations that improve sustainability and reduce environmental impact.

What trends are shaping the Diamond Mining market?

Trends shaping the Diamond Mining market include a growing focus on ethical sourcing, increased investment in automation and digital technologies, and a shift towards more sustainable mining practices.

Diamond Mining Market

| Segmentation | Details |

|---|---|

| Mining Type | Open Pit Mining, Underground Mining |

| Application | Jewelry, Industrial, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Diamond Mining Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at