444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The dental implant consumables market is a vital segment within the broader dental industry, focusing on the consumable products necessary for the successful placement and maintenance of dental implants. These consumables include but are not limited to abutments, crowns, dental implants, and various surgical instruments. As dental implants continue to gain prominence as a preferred solution for tooth replacement, the demand for associated consumables has surged, driving growth and innovation within this market segment.

Meaning

Dental implant consumables encompass a range of products essential for the placement, restoration, and maintenance of dental implants. These consumables include abutments, prosthetic components, implant tools, and biomaterials required throughout the implant treatment process. From initial surgery to final restoration, dental implant consumables play a pivotal role in ensuring the success and longevity of dental implant procedures.

Executive Summary

The dental implant consumables market has experienced robust growth in recent years, fueled by factors such as an aging population, increasing prevalence of dental disorders, and rising awareness of the benefits of dental implants. This market offers lucrative opportunities for manufacturers, suppliers, and dental practitioners alike. However, challenges such as pricing pressures, regulatory compliance, and technological advancements underscore the need for strategic planning and innovation to maintain competitiveness in this dynamic landscape.

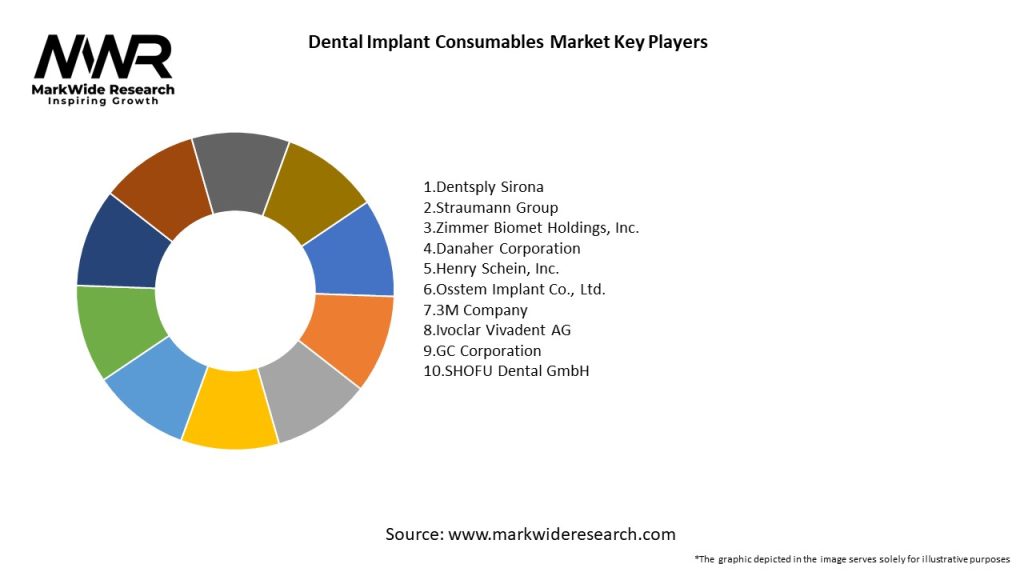

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The dental implant consumables market operates within a dynamic ecosystem influenced by demographic trends, technological advancements, regulatory frameworks, and healthcare policies. These dynamics shape market dynamics, demand patterns, and competitive landscapes, necessitating agility, innovation, and strategic planning from industry stakeholders.

Regional Analysis

The dental implant consumables market exhibits regional variations driven by factors such as healthcare infrastructure, economic development, cultural preferences, and regulatory environments. Key regions include:

Competitive Landscape

Leading Companies in the Dental Implant Consumables Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The dental implant consumables market can be segmented based on various criteria, including:

Segmentation enables a granular understanding of market dynamics and facilitates targeted marketing, product development, and sales strategies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Understanding these factors enables industry participants to capitalize on strengths, mitigate weaknesses, seize opportunities, and mitigate threats effectively.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the dental implant consumables market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The dental implant consumables market is poised for sustained growth and innovation driven by demographic trends, technological advancements, and increasing patient demand for dental implant solutions. Continued investment in research, development, and strategic partnerships, coupled with a focus on customization, digitalization, and patient-centric care, will be key to unlocking future growth opportunities and maintaining competitiveness in this dynamic market.

Conclusion

In conclusion, the dental implant consumables market represents a dynamic and rapidly evolving segment within the dental industry, driven by advancements in technology, changing patient demographics, and shifting healthcare paradigms. Despite challenges posed by regulatory complexities, pricing pressures, and market competition, the market offers significant opportunities for industry participants to innovate, differentiate, and thrive. By embracing digitalization, customization, and regenerative therapies, dental implant consumables manufacturers, suppliers, and dental professionals can continue to elevate patient care, enhance treatment outcomes, and shape the future of implant dentistry.

What is Dental Implant Consumables?

Dental Implant Consumables refer to the various materials and products used in the dental implant procedure, including implants, abutments, and surgical tools. These consumables are essential for the successful placement and integration of dental implants in patients.

What are the key players in the Dental Implant Consumables Market?

Key players in the Dental Implant Consumables Market include Straumann, Dentsply Sirona, Nobel Biocare, and Zimmer Biomet. These companies are known for their innovative products and extensive distribution networks in the dental industry, among others.

What are the growth factors driving the Dental Implant Consumables Market?

The growth of the Dental Implant Consumables Market is driven by factors such as the increasing prevalence of dental diseases, rising demand for cosmetic dentistry, and advancements in implant technology. Additionally, the growing aging population contributes to the demand for dental implants.

What challenges does the Dental Implant Consumables Market face?

The Dental Implant Consumables Market faces challenges such as high costs associated with dental procedures and the risk of complications during surgeries. Furthermore, the lack of skilled professionals in certain regions can hinder market growth.

What opportunities exist in the Dental Implant Consumables Market?

Opportunities in the Dental Implant Consumables Market include the development of innovative materials and techniques, expansion into emerging markets, and increasing awareness about oral health. These factors can lead to enhanced product offerings and market penetration.

What trends are shaping the Dental Implant Consumables Market?

Trends shaping the Dental Implant Consumables Market include the rise of digital dentistry, the use of 3D printing for custom implants, and the growing focus on minimally invasive procedures. These innovations are transforming how dental implants are designed and placed.

Dental Implant Consumables Market

| Segmentation Details | Description |

|---|---|

| Product Type | Implants, Abutments, Surgical Kits, Bone Grafts |

| Material | Titanium, Zirconia, Polymer, Composite |

| End User | Dentists, Oral Surgeons, Dental Clinics, Hospitals |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Dental Implant Consumables Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at