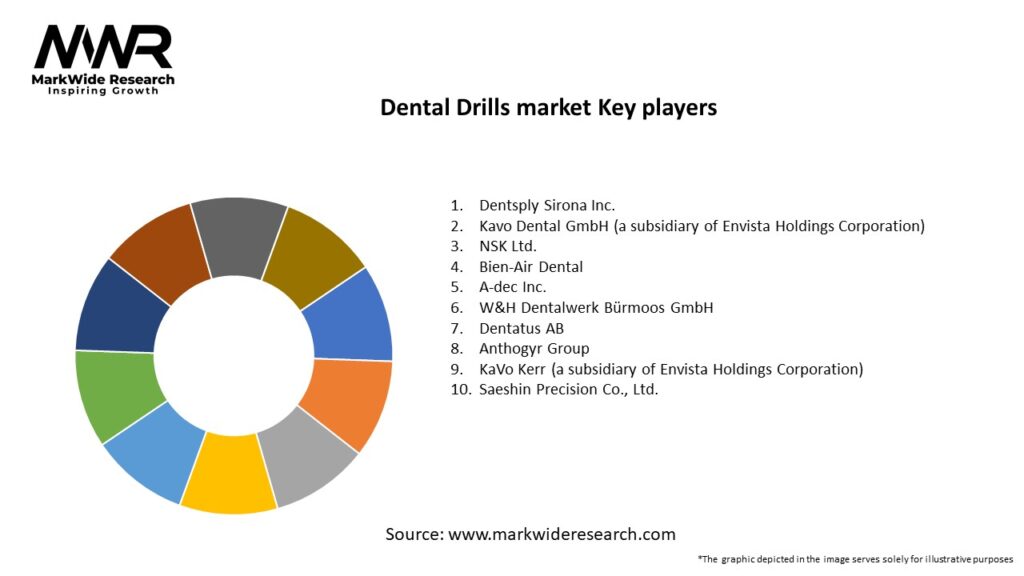

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Electric handpieces are expected to grow at a CAGR of ~7%, outpacing air-driven variants due to performance and user-comfort benefits.

-

Asia Pacific accounts for over 30% of global sales volume, driven by expanding dental infrastructure in China, India, and Southeast Asia.

-

Disposable drill burs and modular head systems are reducing cross-infection risk and turnaround time in high-volume clinics.

-

Integration of LED illumination and fiber‐optic channels is standard in premium handpieces, improving visibility and precision.

-

Digital connectivity—tracking usage hours, maintenance alerts, and sterilization cycles—is emerging as a value-add for fleet management.

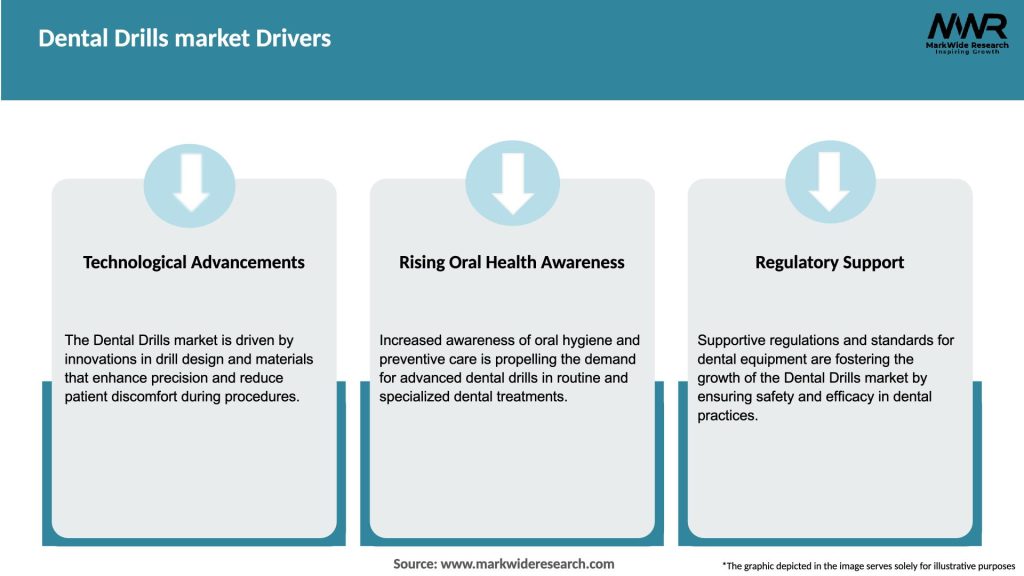

Market Drivers

-

Rising Oral Disease Burden: Increasing incidence of caries, periodontal disease, and endodontic conditions fuels procedural volumes.

-

Technological Advancements: Brushless electric motors, sound insulation, and ergonomic designs enhance dentist comfort and patient experience.

-

Infection Control Standards: Demand for anti-retraction valves, disposable heads, and validated sterilization aligns with stricter regulatory guidelines.

-

Cosmetic Dentistry Growth: Procedures like veneers and implant site preparation increase requirements for precision handpieces and specialized burs.

-

Expanding Dental Care Access: Government initiatives and private investment in dental coverage and clinics in emerging markets.

Market Restraints

-

High Equipment Cost: Electric handpieces and smart connected models carry premium prices that can deter price-sensitive clinics.

-

Maintenance Complexity: Electric models require more sophisticated servicing and parts replacement than simpler air turbines.

-

Sterilization Downtime: Longer autoclave cycles for handpiece heads can disrupt high-volume schedules.

-

Skill Gaps: Adoption of advanced handpieces requires dentist training to leverage features fully.

-

Supply Chain Disruptions: Global shortages of micro-bearings, fiber-optic components, or medical-grade plastics can impede production.

Market Opportunities

-

Smart Handpiece Platforms: Offering usage analytics, predictive maintenance alerts, and integration with practice management software.

-

Portable, Battery-Powered Units: Solutions for outreach, mobile clinics, and regions with unreliable air or power supply.

-

Specialized Burs & Attachments: Development of diamond-coated, carbide, and ceramic burs tailored for specific procedures.

-

Hybrid Air-Electric Systems: Combining benefits of both drive types in single units to appeal to mid-tier budgets.

-

Training & Service Packages: Bundling handpiece sales with maintenance contracts and interactive training modules.

-

Shift to Premiumization: Clinics upgrade from basic turbines to high-end electric handpieces to differentiate service quality.

-

Regulatory Harmonization: Convergence of ISO dental handpiece standards and FDA/CE requirements streamlines product certification.

-

E-commerce & Direct Sales: Online channels offering competitive pricing and faster delivery are gaining share over traditional distributors.

-

Consolidation Among OEMs: Mergers and acquisitions are consolidating R&D, manufacturing, and distribution networks for scale.

-

Service-Driven Models: Subscription-based access to handpieces with guaranteed uptime and replacement heads.

Regional Analysis

-

North America: High per-capita dental visits and preference for premium electric handpieces; established distributor networks.

-

Europe: Strong emphasis on infection-control regulations and sustainability; growth in modular and disposable components.

-

Asia Pacific: Rapid clinic expansion, price-competitive domestic brands, and rising investments in dental education.

-

Latin America: Growing cosmetic dentistry demand in urban centers; cost-effective air turbine dominance in smaller practices.

-

Middle East & Africa: Infrastructure investments in private dental chains; increasing adoption of portable and battery-powered units.

Competitive Landscape

Leading Companies in the Dental Drills Market:

- Dentsply Sirona Inc.

- Kavo Dental GmbH (a subsidiary of Envista Holdings Corporation)

- NSK Ltd.

- Bien-Air Dental

- A-dec Inc.

- W&H Dentalwerk Bürmoos GmbH

- Dentatus AB

- Anthogyr Group

- KaVo Kerr (a subsidiary of Envista Holdings Corporation)

- Saeshin Precision Co., Ltd.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

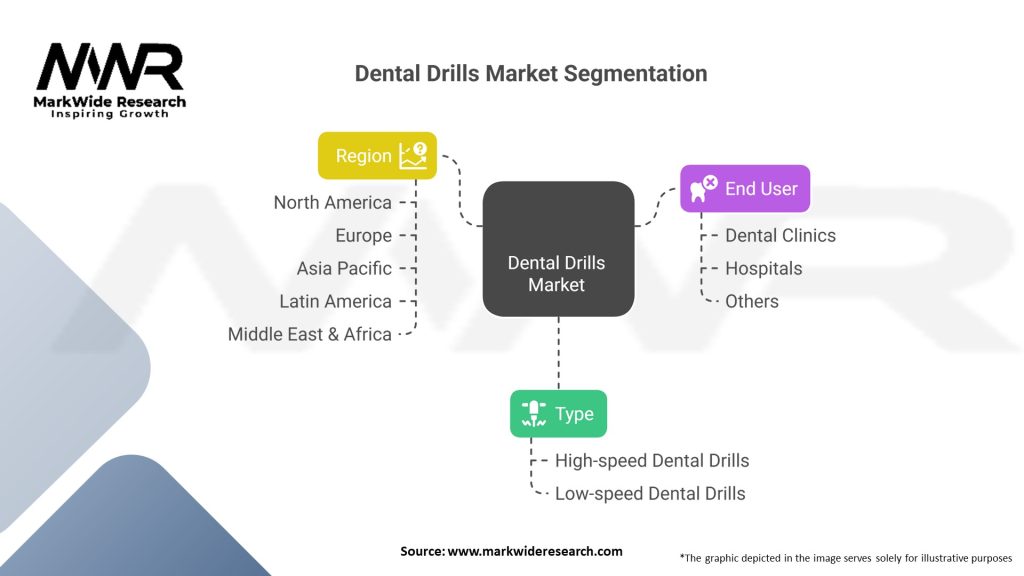

Segmentation

-

By Drive Type: Air-Driven Turbines, Electric Handpieces

-

By Speed: High-Speed (>200,000 rpm), Low-Speed (5,000–40,000 rpm)

-

By Procedure: Restorative, Endodontic, Surgical (Implantology, Oral Surgery)

-

By Distribution Channel: Distributors, Direct OEM Sales, E-commerce

Category-wise Insights

-

High-Speed Turbines: Widely used for cavity prep; lightweight but noisier and lower torque at low speeds.

-

Electric Handpieces: Preferred for implant site preparation and precision polishing; quieter with consistent torque.

-

Low-Speed Contra-Angles: Employed for finishing, polishing, and endodontic access; available in straight and contra-angle forms.

-

Surgical Handpieces: Rigid, high-torque designs compatible with external irrigation for bone cutting.

-

Disposable Heads & Burs: Single-use options reduce cross-contamination but increase consumable costs.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Clinical Precision: Stable torque and adjustable speed profiles improve treatment accuracy and reduce iatrogenic damage.

-

Improved Patient Comfort: Quieter operation and LED illumination reduce anxiety and procedural errors.

-

Streamlined Sterilization: Anti-retraction and quick-detach head designs simplify infection-control protocols.

-

Operational Efficiency: Smart handpiece data aids scheduling, maintenance planning, and cost management.

-

Competitive Differentiation: Clinics advertising state-of-the-art equipment attract higher-end clientele and command premium fees.

SWOT Analysis

Strengths:

-

Core necessity in virtually all restorative and surgical procedures.

-

Continuous innovation in drive technology, ergonomics, and infection control.

-

Strong distributor and servicing networks in developed markets.

Weaknesses:

-

Higher upfront and maintenance costs for electric models.

-

Dependence on skilled technical support for repairs.

-

Potential supply bottlenecks for precision components.

Opportunities:

-

Growing dental tourism in emerging markets demanding modern equipment.

-

Bundled sale of handpieces with consumables and service contracts.

-

AI-driven handpiece usage analytics as a new practice management tool.

Threats:

-

Price-competitive local manufacturers undercutting OEMs in Asia and Latin America.

-

Shift toward non-drill-based technologies (e.g., air abrasion, lasers) for selective procedures.

-

Regulatory changes impacting sterilization cycle times or device classification.

Market Key Trends

-

Digital Integration: Connectivity of handpieces to chair-side consoles for real-time torque/usage feedback.

-

Noise Reduction: Advanced sound-dampening designs to improve operatory environments.

-

Battery-Powered Portables: Rise of cordless handpieces for outreach and mobile dentistry.

-

Eco-Friendly Materials: Adoption of recyclable plastics and reduced metal in head assemblies.

-

Ergonomic Design: Lightweight, balanced handpieces reducing clinician fatigue and repetitive-strain injury.

Covid-19 Impact

The pandemic heightened infection-control vigilance, accelerating adoption of anti-retraction valves, single-use heads, and quick-disconnect designs to minimize aerosol-borne contamination. Tele-triage and mobile dentistry gained traction, boosting demand for portable, battery-operated drills. Supply chain disruptions prompted OEMs to localize component sourcing and expand service capacity.

Key Industry Developments

-

Dentsply Sirona launched the TiMax Z Nova Q in 2024, featuring built-in usage sensors and AI-driven maintenance alerts.

-

NSK introduced the Ti-Max X450 Scirocco electric handpiece series, offering ultra-quiet operation and hex-locking bur system.

-

KaVo Kerr unveiled the E80L brushless low-speed handpiece with integrated LED and quick-release coupling.

-

W&H released the Synea Fusion turbine with patented sound-insulation and anti-suction head technology.

Analyst Suggestions

-

Adopt Hybrid Solutions: Offer both air and electric handpieces in practice bundles to match diverse procedure needs and budgets.

-

Implement Usage Analytics: Leverage smart handpiece data to optimize scheduling, identify training gaps, and reduce downtime.

-

Expand Service Footprint: Invest in local technical support and spare-parts depots in high-growth markets to ensure rapid turnaround.

-

Diversify Burs Portfolio: Partner with burs manufacturers to include procedure-specific cutting and finishing burs alongside handpieces.

-

Monitor Emerging Tech: Evaluate air-abrasion and laser technologies for complementary offerings, maintaining competitive edge.

Future Outlook

The Dental Drills market is projected to grow at a mid-single-digit CAGR through 2030, driven by continued electrification, digitalization, and infection-control imperatives. Emerging technologies like piezoelectric surgery units and laser-assisted excavation may complement rather than replace rotary drills, broadening procedural toolkits. Manufacturers that integrate connectivity, sustainability, and ergonomic innovation will capture premium segments, while scalable, cost-effective solutions will gain share in expanding emerging-market clinics.

Conclusion

In conclusion, dental drills remain indispensable to modern dentistry, with the market transitioning toward smarter, quieter, and more hygienic solutions. Stakeholders who invest in electric-drive innovation, digital integration, and streamlined sterilization will lead the next wave of growth. By addressing diverse practice needs—from high-end specialty clinics to mobile outreach units—manufacturers can drive adoption, improve patient outcomes, and support the evolution of dental care delivery globally.