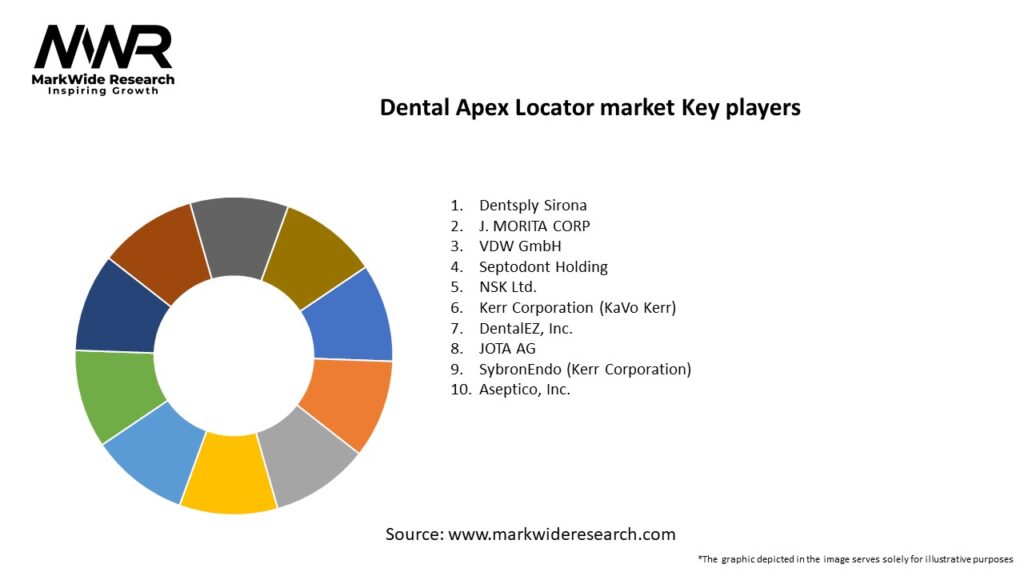

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Device Integration: Apex locators combined with endodontic motors account for over 25% of sales, offering workflow efficiency and single-footprint solutions.

-

Cordless Designs: Battery-operated, rechargeable models are preferred for portability and reduced infection-control steps, capturing significant uptake in private clinics.

-

Accuracy Advances: Multi-frequency apex locators deliver ±0.5 mm accuracy even in the presence of blood and irrigants, improving clinician confidence.

-

Software Connectivity: Bluetooth-enabled devices that export working-length data to practice management systems enhance digital record-keeping and case planning.

-

Regulatory Approvals: CE marking and FDA 510(k) clearances underpin product credibility, with growing emphasis on ISO 6876 and ISO 3630-1 compliance for performance.

Market Drivers

-

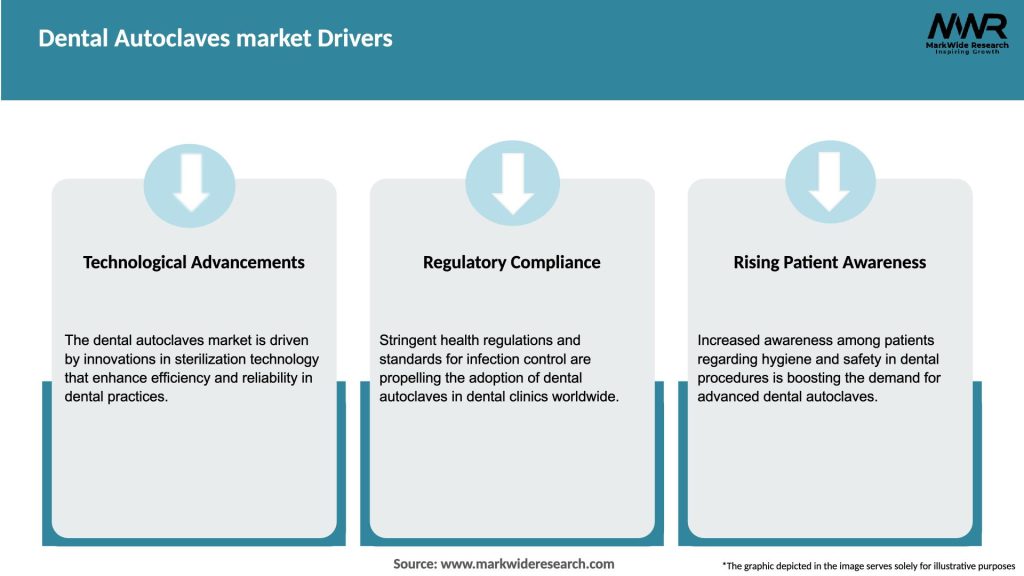

Rising Endodontic Procedures: Growing incidence of dental decay and increased longevity of the dentition drive demand for root canal interventions.

-

Technological Innovation: Evolution of miniaturized electronics, adaptive signal processing, and user-friendly interfaces enhances device adoption.

-

Digital Dentistry Integration: Apex locators that seamlessly link to CBCT imaging and digital treatment planning software support the trend toward comprehensive digital workflows.

-

Professional Training: Expanded endodontic education programs and continuing education increase clinician proficiency and device utilization.

-

Patient Awareness: Improved patient knowledge of conservative therapies and fear reduction strategies promote acceptance of root canal treatments.

Market Restraints

-

High Device Costs: Advanced, integrated apex-motor systems carry premium price tags, limiting adoption in cost-sensitive regions and small practices.

-

Competition from Radiography: Some clinicians rely on traditional periapical radiographs for working-length determination, delaying tech replacement.

-

Learning Curve: Effective use of apex locators requires training; reluctance to adopt new protocols can hamper uptake.

-

Device Calibration Needs: Periodic calibration and maintenance add to total cost of ownership and require practice infrastructure.

-

Regulatory Requirements: Varying regional device registration processes can delay market entry for new products.

Market Opportunities

-

Emerging Markets Expansion: Growth in Asia, Latin America, and the Middle East as dental infrastructure develops and disposable incomes increase.

-

Wireless & App-Based Models: Apex locators that connect to smartphones/tablets via apps can lower entry costs and enhance portability.

-

Aftermarket Accessories: Consumables such as disposable lip clips and file holders represent ancillary revenue streams.

-

Training & Service Bundles: Manufacturers offering bundled training, extended warranties, and remote support can differentiate in competitive markets.

-

Hybrid Devices: Combination units that integrate apex location with ultrasonic activation or irrigation functions can command premium pricing.

Market Dynamics

-

Strategic Alliances: Partnerships between device makers and dental training academies accelerate clinician adoption and product familiarity.

-

Mergers & Acquisitions: Consolidation among dental equipment companies expands product portfolios and distribution networks.

-

Subscription Models: Device leasing and software-as-a-service (SaaS) models reduce upfront costs for smaller practices.

-

OEM Partnerships: Dental motor manufacturers integrating third-party apex location modules broaden market reach.

-

Regulatory Harmonization: Efforts to align device standards (e.g., MDR in Europe, FDA guidelines) streamline approval processes.

Regional Analysis

-

North America: Largest market share, with high adoption of advanced, integrated apex locators and digital dentistry workflows.

-

Europe: Mature market emphasizing high-precision devices and strong regulatory compliance; growth driven by private practice modernization.

-

Asia Pacific: Fastest-growing region, led by China, India, and Southeast Asia; expanding dental education and infrastructure fuel demand.

-

Latin America: Emerging market with increasing root canal volumes; price-sensitive segment favors standalone, mid-range devices.

-

Middle East & Africa: Niche growth tied to private clinics in GCC countries and South Africa; potential for affordable wireless models.

Competitive Landscape

Leading Companies in the Dental Apex Locator Market:

- Dentsply Sirona

- J. MORITA CORP

- VDW GmbH

- Septodont Holding

- NSK Ltd.

- Kerr Corporation (KaVo Kerr)

- DentalEZ, Inc.

- JOTA AG

- SybronEndo (Kerr Corporation)

- Aseptico, Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

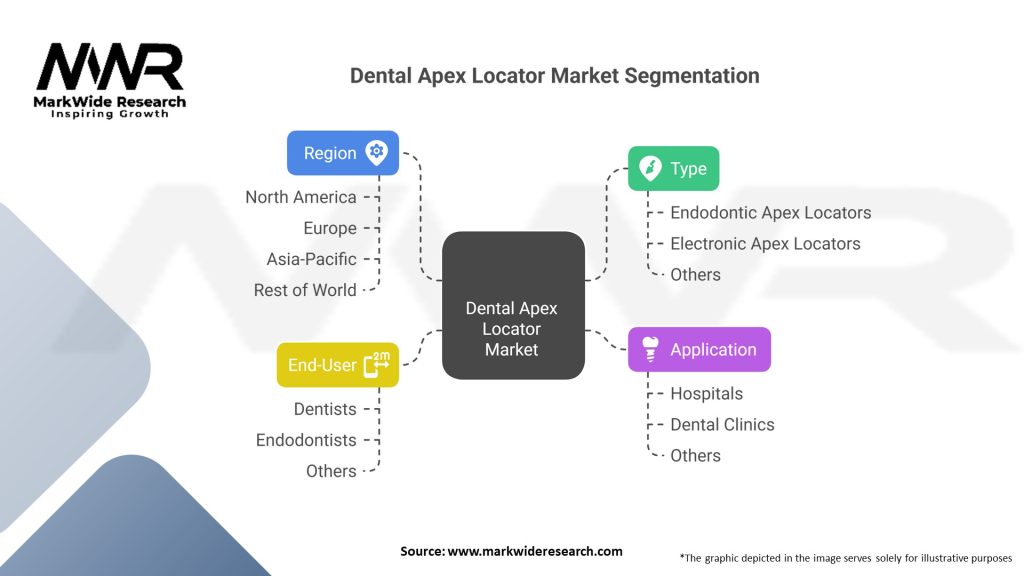

Segmentation

-

By Product Type: Standalone Apex Locators, Integrated Apex Locator–Motor Units, Cordless Wireless Models

-

By Technology: Single-Frequency, Dual-Frequency, Multi-Frequency Adaptive

-

By End User: General Dental Practices, Specialist Endodontic Clinics, Dental Hospitals & Academies

-

By Distribution Channel: Direct OEM Sales, Distributors/Dealers, Online Dental Retailers

Category-wise Insights

-

Standalone Units: Lower cost, modular use, preferred by cost-conscious practices; often paired with existing motor units.

-

Integrated Systems: Higher capital outlay but deliver workflow efficiency and single-device footprint; popular in specialist centers.

-

Wireless Models: Offer ultimate portability and minimal cross-infection risk; growing interest among mobile and outreach clinics.

-

Software-Enabled Devices: Provide data storage, treatment reports, and integration with patient records; positioned toward high-tech practices.

Key Benefits for Industry Participants and Stakeholders

-

Improved Treatment Outcomes: Accurate working-length determination reduces procedural errors and improves long-term success rates.

-

Enhanced Efficiency: Integrated units and real-time readings shorten procedure times and increase chair throughput.

-

Reduced Radiation Exposure: Electronic measurement minimizes reliance on multiple radiographs, benefiting patient and staff safety.

-

Data Management: Connectivity features facilitate digital documentation, case analysis, and patient communication.

-

Training & Support: Manufacturers offering comprehensive training and service strengthen practitioner confidence and loyalty.

SWOT Analysis

Strengths

-

Proven clinical benefits and high adoption among endodontists.

-

Continuous innovation in accuracy, connectivity, and ergonomics.

Weaknesses

-

High initial cost for advanced integrated devices.

-

Need for clinician training and device calibration.

Opportunities

-

Expansion into under-penetrated emerging markets.

-

Development of low-cost, app-based apex locators.

Threats

-

Competition from low-cost, unbranded imports.

-

Potential technological obsolescence with rapid digital dentistry advances.

Market Key Trends

-

Digital Integration: Apex locators embedded within fully digital endo workflows, linking to CBCT and CAD/CAM systems.

-

AI-Assisted Measurement: Early R&D in artificial-intelligence algorithms to predict working length and canal morphology.

-

Disposable Sensor Accessories: Single-use file holders and lip clips reducing cross-infection risk and sterilization burden.

-

Tele-Endodontics: Cloud-enabled devices allowing remote supervision by specialists for practices in remote regions.

-

Ergonomic Design: Slim, lightweight handpieces and foot-controlled interfaces improving clinician comfort.

Covid-19 Impact

The pandemic slowed elective dental procedures early in 2020, temporarily reducing device sales. However, heightened infection-control protocols accelerated interest in cordless, disposable accessory-based apex locators. Virtual training webinars and remote device support emerged as key service differentiators, sustaining market momentum despite reduced clinical volumes.

Key Industry Developments

-

New Product Launches: Introduction of rechargeable, Bluetooth-enabled apex locators with built-in data-logging capabilities.

-

Collaborations: Alliances between apex locator manufacturers and dental motor companies to co-develop seamless integrated solutions.

-

Regulatory Clearances: Recent FDA 510(k) approvals for next-generation multi-frequency devices expanding U.S. market access.

-

Training Initiatives: OEM-led endodontic academies and online certification programs boosting operator proficiency.

Analyst Suggestions

-

Focus on Affordability: Develop cost-effective, app-driven apex locators for entry-level and emerging-market practices.

-

Enhance Connectivity: Integrate with popular dental practice management software and imaging platforms to deepen digital value.

-

Expand Service Models: Offer subscription-based device leasing and remote calibration services to lower barriers to adoption.

-

Localize Support: Establish regional training centers and service hubs in Asia Pacific and Latin America to accelerate market penetration.

Future Outlook

The Dental Apex Locator market is poised for continued growth as endodontic treatment volumes increase globally and digital dentistry accelerates. Innovation will center on miniaturization, AI-driven measurement accuracy, and seamless integration with comprehensive endo-motor and imaging ecosystems. Providers who balance advanced functionality with affordability and strong clinical support will capture the largest market share in both mature and emerging regions.

Conclusion

Dental apex locators have revolutionized endodontic practice by enabling precise, efficient, and less-invasive root canal treatments. As the global dentistry landscape shifts toward fully digital workflows and patient-centric care, apex locators will remain a cornerstone technology—evolving through AI-enhanced analytics, wireless connectivity, and novel accessory designs. Stakeholders who invest in accessible, integrated, and service-driven offerings will lead the market’s next phase of innovation and adoption.