444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Denmark telecom market represents one of Europe’s most advanced and digitally sophisticated telecommunications landscapes, characterized by exceptional infrastructure development and widespread adoption of cutting-edge technologies. Danish telecommunications infrastructure demonstrates remarkable resilience and innovation, with the country consistently ranking among global leaders in digital connectivity and mobile penetration rates. The market exhibits robust growth momentum driven by increasing demand for high-speed internet services, 5G network deployment, and comprehensive digital transformation initiatives across both consumer and enterprise segments.

Market dynamics in Denmark reflect a mature telecommunications environment where operators focus on service quality enhancement, network modernization, and value-added services expansion. The Danish telecom sector benefits from strong regulatory support, favorable government policies promoting digital infrastructure development, and a tech-savvy population with high adoption rates for advanced telecommunications services. Network infrastructure investments continue to accelerate, with operators prioritizing fiber-optic expansion and 5G network rollout to meet growing bandwidth demands and support emerging technologies like Internet of Things (IoT) and artificial intelligence applications.

Consumer preferences in the Danish market increasingly favor bundled services, unlimited data plans, and premium connectivity solutions, driving operators to develop comprehensive service portfolios. The market demonstrates significant growth potential in areas such as enterprise mobility solutions, cloud-based communications, and smart city infrastructure development, positioning Denmark as a regional leader in telecommunications innovation and digital services delivery.

The Denmark telecom market refers to the comprehensive ecosystem of telecommunications services, infrastructure, and technologies operating within Danish territory, encompassing mobile communications, fixed-line services, internet connectivity, and digital communication solutions. This market includes all telecommunications operators, service providers, infrastructure companies, and technology vendors delivering voice, data, and multimedia services to residential, business, and government customers throughout Denmark.

Telecommunications services within this market span traditional voice communications, high-speed internet access, mobile data services, enterprise communication solutions, and emerging technologies such as 5G networks, fiber-optic connectivity, and cloud-based communication platforms. The Danish telecom market operates within a competitive regulatory framework designed to promote innovation, ensure fair competition, and protect consumer interests while encouraging infrastructure investment and technological advancement.

Market participants include major telecommunications operators, mobile virtual network operators (MVNOs), internet service providers, infrastructure companies, equipment manufacturers, and technology solution providers working collaboratively to deliver comprehensive telecommunications services across Denmark’s urban and rural areas.

Denmark’s telecommunications market stands as a testament to Nordic innovation and digital leadership, showcasing exceptional infrastructure quality and service delivery standards that position the country among Europe’s most connected nations. The market demonstrates sustained growth momentum driven by continuous network modernization, expanding 5G coverage, and increasing demand for high-bandwidth applications across consumer and enterprise segments.

Key market drivers include aggressive fiber-optic network expansion, comprehensive 5G deployment strategies, and growing adoption of cloud-based communication solutions. Danish telecom operators have successfully maintained competitive positioning through strategic investments in network infrastructure, service innovation, and customer experience enhancement initiatives. The market benefits from strong regulatory support, favorable investment climate, and a digitally sophisticated population that readily adopts new telecommunications technologies and services.

Strategic developments focus on network convergence, service bundling, and value-added service expansion, with operators increasingly targeting enterprise customers through comprehensive digital transformation solutions. The market exhibits strong fundamentals with stable revenue streams, healthy profit margins, and continued investment in next-generation technologies that support Denmark’s digital economy growth and smart city initiatives.

Market intelligence reveals several critical insights that define the Danish telecommunications landscape and its future trajectory. The following key insights provide comprehensive understanding of market dynamics and strategic opportunities:

Primary market drivers propelling Denmark’s telecommunications sector forward encompass technological advancement, regulatory support, and evolving consumer demands that create substantial growth opportunities for industry participants. Digital transformation initiatives across government, business, and consumer sectors generate increasing demand for high-quality telecommunications services and advanced connectivity solutions.

5G network deployment serves as a fundamental growth driver, enabling new service categories, enhanced mobile experiences, and support for emerging technologies such as autonomous vehicles, smart manufacturing, and augmented reality applications. Danish operators invest heavily in 5G infrastructure to capture market opportunities and maintain competitive advantages in next-generation service delivery.

Infrastructure investment continues as operators recognize the strategic importance of network quality and coverage in maintaining market position and customer satisfaction. Fiber-optic expansion remains a priority, with operators extending high-speed connectivity to underserved areas and upgrading existing infrastructure to support growing bandwidth demands.

Market constraints within Denmark’s telecommunications sector present challenges that operators must navigate while pursuing growth objectives and maintaining competitive positioning. Regulatory compliance requirements, while generally supportive, create operational complexities and additional costs that impact profitability and strategic flexibility.

Infrastructure investment costs represent significant financial commitments, particularly for 5G network deployment and fiber-optic expansion projects that require substantial capital expenditure with extended payback periods. Market saturation in traditional voice and basic data services limits organic growth opportunities, forcing operators to seek revenue expansion through value-added services and enterprise solutions.

Economic uncertainties and changing consumer spending patterns can impact demand for premium telecommunications services and enterprise solutions. Environmental regulations increasingly influence network operations and infrastructure development, requiring operators to balance performance objectives with sustainability commitments and energy efficiency requirements.

Strategic opportunities within Denmark’s telecommunications market present substantial potential for revenue growth, service expansion, and competitive differentiation. Enterprise digital transformation represents a particularly promising opportunity as businesses increasingly rely on advanced telecommunications solutions to support remote work, cloud computing, and digital business processes.

5G technology deployment creates numerous opportunities for innovative service development, including enhanced mobile broadband, ultra-reliable low-latency communications, and massive machine-type communications that support IoT applications. Smart city initiatives across Danish municipalities generate demand for comprehensive telecommunications infrastructure and specialized services supporting traffic management, environmental monitoring, and public safety systems.

International expansion opportunities allow Danish operators to leverage their technological expertise and service capabilities in other Nordic and European markets. Partnership strategies with technology companies, system integrators, and industry specialists enable operators to expand service portfolios and access new customer segments without significant internal investment.

Market dynamics in Denmark’s telecommunications sector reflect the interplay between technological innovation, competitive pressures, regulatory influences, and evolving customer expectations. Competitive intensity drives continuous service improvement, pricing optimization, and customer experience enhancement as operators seek to maintain market share and profitability in a mature market environment.

Technology convergence fundamentally reshapes market dynamics as traditional boundaries between telecommunications, information technology, and media services continue to blur. MarkWide Research analysis indicates that operators increasingly position themselves as comprehensive digital service providers rather than traditional telecommunications companies, expanding into cloud services, cybersecurity, and digital transformation consulting.

Customer behavior evolution influences market dynamics as consumers and businesses demand more personalized, flexible, and integrated service offerings. Service bundling trends reflect customer preferences for simplified billing, comprehensive service packages, and seamless integration across multiple communication channels and devices.

Regulatory dynamics continue to shape market structure through spectrum allocation decisions, infrastructure sharing requirements, and consumer protection measures. Investment cycles in network infrastructure create periodic opportunities and challenges as operators balance capital expenditure requirements with revenue generation objectives and shareholder expectations.

Research methodology employed in analyzing Denmark’s telecommunications market incorporates comprehensive primary and secondary research approaches designed to provide accurate, current, and actionable market intelligence. Primary research activities include structured interviews with industry executives, telecommunications operators, regulatory officials, and key market participants to gather firsthand insights into market trends, competitive dynamics, and strategic developments.

Secondary research encompasses extensive analysis of industry reports, regulatory filings, financial statements, company presentations, and market data from authoritative sources. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, fact-checking with industry experts, and verification of statistical information through official regulatory and industry databases.

Analytical frameworks applied include market segmentation analysis, competitive positioning assessment, and trend identification methodologies that provide comprehensive understanding of market structure and dynamics. Quantitative analysis incorporates statistical modeling, growth rate calculations, and market share assessments based on verified data sources and industry benchmarks.

Regional analysis of Denmark’s telecommunications market reveals distinct patterns of service adoption, infrastructure development, and competitive dynamics across different geographic areas. Copenhagen metropolitan area dominates market activity, accounting for approximately 35% of total telecommunications revenue due to high population density, business concentration, and advanced infrastructure deployment.

Urban centers including Aarhus, Odense, and Aalborg demonstrate strong telecommunications market performance with comprehensive network coverage, high-speed internet availability, and robust enterprise service demand. Rural areas present both challenges and opportunities, with ongoing government initiatives to improve connectivity and bridge digital divides through infrastructure investment and service subsidies.

Infrastructure distribution reflects Denmark’s commitment to nationwide connectivity, with fiber-optic networks reaching approximately 78% of households and 5G coverage expanding rapidly across urban and suburban areas. Regional investment patterns show continued focus on rural connectivity improvement through government-supported programs and operator infrastructure sharing initiatives.

Service adoption rates vary regionally, with urban areas demonstrating higher uptake of premium services, enterprise solutions, and advanced mobile applications. MWR data indicates that regional market dynamics increasingly influence operator strategies, with customized service offerings and localized marketing approaches becoming more prevalent across different geographic segments.

Competitive landscape in Denmark’s telecommunications market features a concentrated structure with several major operators competing across mobile, fixed-line, and enterprise service segments. Market leadership positions are established through network quality, service innovation, and customer experience excellence rather than purely price-based competition.

Major market participants include established telecommunications operators with comprehensive service portfolios, extensive infrastructure investments, and strong brand recognition among Danish consumers and businesses. Competitive strategies focus on network modernization, service differentiation, and customer retention through loyalty programs and bundled service offerings.

Competitive dynamics emphasize service quality, network performance, and customer experience as primary differentiation factors. Market consolidation trends continue as operators seek scale advantages, operational efficiencies, and enhanced competitive positioning through strategic partnerships and acquisitions.

Innovation competition drives continuous investment in new technologies, service development, and customer experience enhancement. Enterprise market competition intensifies as operators expand beyond traditional telecommunications services into cloud computing, cybersecurity, and digital transformation consulting services.

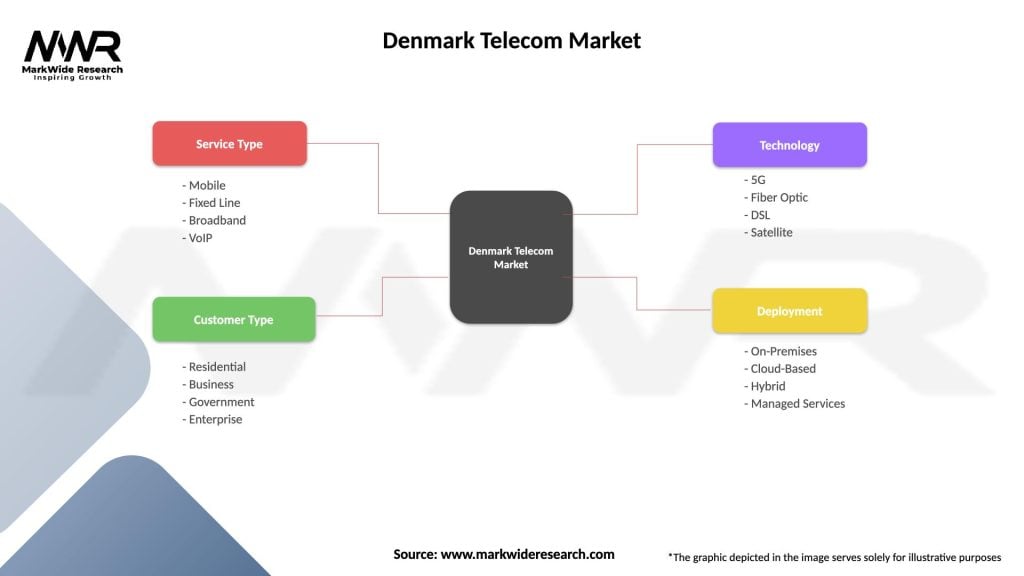

Market segmentation within Denmark’s telecommunications sector reveals distinct customer categories, service types, and technology platforms that define competitive strategies and growth opportunities. Customer segmentation encompasses residential consumers, small and medium enterprises, large corporations, and government entities, each with specific service requirements and purchasing behaviors.

Service segmentation includes mobile communications, fixed-line services, internet connectivity, enterprise solutions, and emerging technology services such as IoT, cloud communications, and managed IT services. Technology segmentation spans traditional copper networks, fiber-optic infrastructure, mobile networks, and next-generation technologies including 5G and edge computing platforms.

By Service Type:

By Customer Segment:

Geographic segmentation reflects varying service demands and infrastructure capabilities across urban, suburban, and rural areas throughout Denmark. Revenue segmentation shows enterprise services generating higher per-customer revenue despite smaller customer numbers compared to mass-market residential services.

Category-wise analysis provides detailed understanding of performance dynamics, growth patterns, and strategic opportunities across different telecommunications service categories within the Danish market. Mobile communications represents the largest revenue category, driven by high penetration rates, data usage growth, and premium service adoption among Danish consumers and businesses.

Fixed broadband services demonstrate steady growth supported by fiber-optic network expansion, work-from-home trends, and increasing bandwidth requirements for streaming, gaming, and business applications. Enterprise communications shows the highest growth potential as businesses invest in digital transformation, cloud migration, and advanced telecommunications solutions.

Mobile Communications Category:

Fixed Broadband Category:

Enterprise Solutions Category:

Industry participants in Denmark’s telecommunications market enjoy numerous strategic advantages and benefits that support sustainable growth, competitive positioning, and long-term value creation. Telecommunications operators benefit from a stable regulatory environment, advanced infrastructure foundation, and sophisticated customer base that readily adopts new technologies and services.

Market stability provides predictable revenue streams and investment returns, enabling operators to plan long-term infrastructure projects and service development initiatives with confidence. Innovation ecosystem in Denmark supports collaboration between telecommunications companies, technology vendors, research institutions, and government agencies, fostering technological advancement and market development.

Equipment vendors and technology suppliers benefit from strong demand for advanced telecommunications equipment, software solutions, and professional services supporting network modernization and service enhancement initiatives. System integrators find opportunities in complex enterprise projects requiring specialized expertise in telecommunications, IT, and digital transformation solutions.

Investors benefit from stable market conditions, predictable cash flows, and growth opportunities in emerging technology areas such as 5G, IoT, and cloud services. End customers enjoy high-quality services, competitive pricing, and continuous innovation in telecommunications solutions that support personal and business communication needs.

SWOT analysis of Denmark’s telecommunications market provides comprehensive assessment of internal strengths and weaknesses alongside external opportunities and threats that influence market dynamics and strategic decision-making for industry participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Denmark’s telecommunications landscape reflect technological evolution, changing customer expectations, and strategic industry developments that influence competitive dynamics and growth opportunities. 5G network deployment represents the most significant trend, with operators investing heavily in next-generation infrastructure to support enhanced mobile services and emerging applications.

Fiber-optic expansion continues as a critical trend, with operators extending high-speed connectivity to underserved areas and upgrading existing infrastructure to support growing bandwidth demands. Service convergence trends show operators increasingly offering integrated solutions combining telecommunications, IT services, and digital transformation consulting to enterprise customers.

Customer experience trends emphasize personalization, self-service capabilities, and omnichannel support as operators seek to differentiate through superior service delivery. MarkWide Research analysis indicates that approximately 68% of Danish consumers prioritize network quality and reliability over pricing when selecting telecommunications services, driving operator focus on infrastructure investment and service excellence.

Digital transformation trends accelerate as businesses increasingly rely on telecommunications services to support remote work, cloud computing, and digital business processes. Partnership trends show operators collaborating with technology companies, content providers, and system integrators to expand service capabilities and market reach.

Industry developments in Denmark’s telecommunications market reflect ongoing transformation driven by technological advancement, regulatory evolution, and strategic business initiatives that reshape competitive dynamics and market structure. 5G network launches by major operators mark significant milestones in network modernization and service capability enhancement.

Infrastructure sharing agreements between operators demonstrate collaborative approaches to reducing deployment costs and accelerating network coverage expansion. Merger and acquisition activities continue to reshape market structure as companies seek scale advantages and operational synergies through strategic consolidation.

Technology partnerships between telecommunications operators and international technology vendors accelerate innovation and service development capabilities. Government initiatives supporting digital infrastructure development create favorable conditions for continued market growth and technological advancement.

Regulatory developments include updated spectrum management policies, consumer protection measures, and infrastructure sharing requirements that influence operator strategies and market dynamics. International expansion activities by Danish operators demonstrate confidence in their technological capabilities and service delivery expertise.

Strategic recommendations for Denmark telecommunications market participants emphasize the importance of balanced investment approaches that address both immediate competitive pressures and long-term growth opportunities. Network infrastructure investment should prioritize 5G deployment and fiber-optic expansion while maintaining operational efficiency and cost management discipline.

Service portfolio diversification represents a critical success factor, with operators advised to expand beyond traditional telecommunications services into cloud computing, cybersecurity, and digital transformation consulting. Customer experience enhancement should focus on personalization, digital self-service capabilities, and proactive customer support to maintain competitive differentiation.

Competitive positioning should emphasize service quality, network performance, and customer experience rather than price-based competition in mature market segments. Digital transformation of internal operations can improve efficiency, reduce costs, and enhance service delivery capabilities while supporting customer experience objectives.

Risk management strategies should address cybersecurity threats, regulatory compliance requirements, and technology obsolescence risks through comprehensive planning and investment approaches. Talent development initiatives are essential for maintaining technical capabilities and supporting innovation in rapidly evolving telecommunications technologies.

Future outlook for Denmark’s telecommunications market indicates continued growth and evolution driven by technological advancement, changing customer needs, and expanding digital economy requirements. 5G technology maturation will unlock new service opportunities and revenue streams while supporting emerging applications in autonomous vehicles, smart cities, and industrial automation.

Market growth projections suggest sustained expansion in enterprise services, cloud communications, and managed IT solutions as businesses continue digital transformation initiatives. Infrastructure investment will remain a priority, with operators focusing on network quality, coverage expansion, and capacity enhancement to meet growing bandwidth demands and support new technologies.

Technology trends indicate increasing adoption of artificial intelligence, edge computing, and network automation solutions that improve operational efficiency and service delivery capabilities. Sustainability initiatives will become increasingly important as operators work to reduce environmental impact while maintaining network performance and service quality standards.

Competitive dynamics will continue evolving as operators expand service portfolios and seek differentiation through innovation and customer experience excellence. Regulatory environment is expected to remain supportive of infrastructure investment and competition while addressing emerging issues such as data privacy and network security.

International opportunities may provide growth avenues for Danish operators seeking to leverage their technological expertise and service capabilities in other markets. Partnership strategies will become increasingly important as operators collaborate with technology vendors, content providers, and system integrators to deliver comprehensive solutions to customers.

Denmark’s telecommunications market represents a mature, sophisticated, and technologically advanced sector that continues to demonstrate resilience and growth potential despite market saturation challenges. Strong infrastructure foundation, supportive regulatory environment, and digitally sophisticated customer base create favorable conditions for sustained market development and innovation.

Key success factors for market participants include strategic infrastructure investment, service portfolio diversification, customer experience excellence, and operational efficiency optimization. 5G deployment and fiber-optic expansion remain critical priorities that will determine competitive positioning and growth opportunities in the coming years.

Market evolution toward comprehensive digital service provision creates opportunities for operators to expand beyond traditional telecommunications into cloud computing, cybersecurity, and digital transformation consulting. Enterprise market growth potential offers the most promising revenue expansion opportunities as businesses continue investing in digital infrastructure and advanced communications solutions.

Future success in Denmark’s telecommunications market will depend on operators’ ability to balance infrastructure investment with service innovation, maintain competitive differentiation through quality and customer experience, and adapt to evolving technology trends and customer expectations. Strategic partnerships, sustainability initiatives, and international expansion opportunities provide additional avenues for growth and value creation in this dynamic and evolving market landscape.

What is Telecom?

Telecom refers to the transmission of information over significant distances by electronic means. It encompasses various services such as telephone, internet, and broadcasting, which are essential for communication in both personal and business contexts.

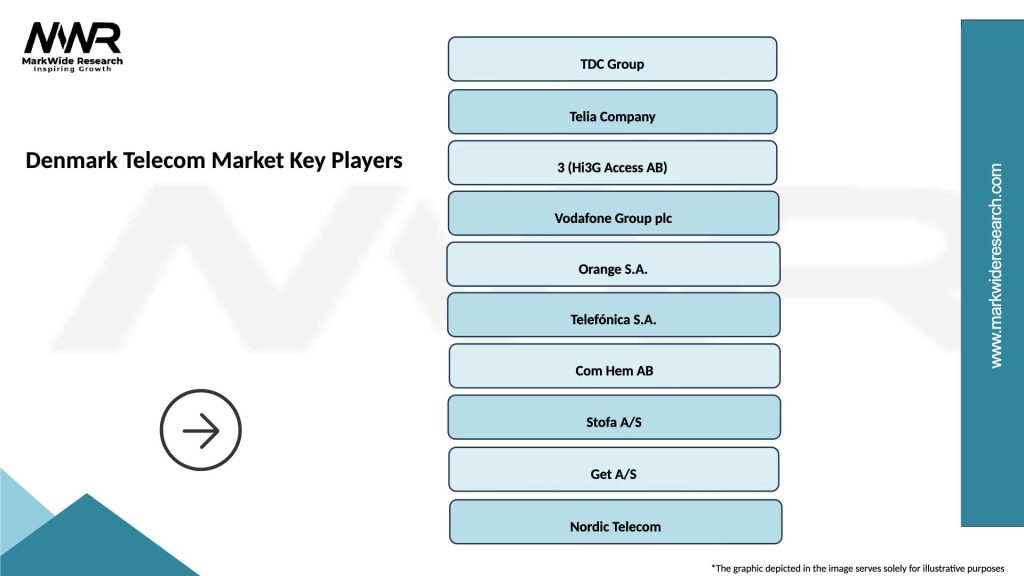

What are the key players in the Denmark Telecom Market?

The Denmark Telecom Market features several key players, including TDC Group, Telia Denmark, and 3 Denmark. These companies provide a range of services, including mobile, broadband, and television, contributing to the competitive landscape.

What are the growth factors driving the Denmark Telecom Market?

The Denmark Telecom Market is driven by factors such as the increasing demand for high-speed internet, the proliferation of mobile devices, and the growth of digital services. Additionally, advancements in technology, such as 5G deployment, are enhancing service offerings.

What challenges does the Denmark Telecom Market face?

The Denmark Telecom Market faces challenges including regulatory pressures, intense competition among providers, and the need for continuous investment in infrastructure. These factors can impact profitability and service delivery.

What opportunities exist in the Denmark Telecom Market?

Opportunities in the Denmark Telecom Market include the expansion of IoT services, the development of smart city initiatives, and the potential for enhanced customer experiences through innovative technologies. These trends can lead to new revenue streams for telecom providers.

What trends are shaping the Denmark Telecom Market?

Trends in the Denmark Telecom Market include the shift towards digitalization, the rise of cloud-based services, and the increasing importance of cybersecurity. These trends are influencing how telecom companies operate and engage with customers.

Denmark Telecom Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile, Fixed Line, Broadband, VoIP |

| Customer Type | Residential, Business, Government, Enterprise |

| Technology | 5G, Fiber Optic, DSL, Satellite |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Denmark Telecom Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at