444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Denmark Software as a Service (SaaS) market represents one of the most dynamic and rapidly evolving technology sectors in the Nordic region. This comprehensive market encompasses cloud-based software solutions delivered through subscription models, enabling businesses across Denmark to access sophisticated applications without traditional infrastructure investments. The Danish SaaS landscape demonstrates remarkable growth momentum, driven by increasing digital transformation initiatives, government support for technology adoption, and a robust startup ecosystem that continues to foster innovation.

Market dynamics in Denmark reflect the country’s position as a technology leader in Europe, with businesses increasingly embracing cloud-first strategies. The market experiences significant growth across multiple sectors including healthcare, finance, manufacturing, and public administration. Danish organizations are particularly focused on solutions that enhance operational efficiency, improve customer experiences, and support remote work capabilities. According to MarkWide Research analysis, the market demonstrates strong adoption rates with 78% of Danish enterprises now utilizing at least one SaaS solution in their operations.

Growth trajectories indicate sustained expansion driven by several key factors including increased internet penetration, mobile device adoption, and changing business preferences toward flexible, scalable software solutions. The market benefits from Denmark’s advanced digital infrastructure, high levels of technology literacy, and supportive regulatory environment that encourages cloud adoption across industries.

The Denmark Software as a Service (SaaS) market refers to the comprehensive ecosystem of cloud-based software applications and services delivered to Danish businesses and consumers through internet-based platforms. This market encompasses subscription-based software solutions that eliminate the need for traditional on-premises installations, providing users with access to applications through web browsers or mobile devices.

Core characteristics of the Danish SaaS market include multi-tenant architecture, automatic updates, scalable infrastructure, and pay-as-you-use pricing models. These solutions span across various categories including customer relationship management, enterprise resource planning, human resources management, collaboration tools, and industry-specific applications tailored to Danish market requirements.

Market participants include both international SaaS providers establishing strong presences in Denmark and domestic companies developing solutions specifically for Danish and Nordic markets. The ecosystem supports businesses of all sizes, from small startups to large enterprises, providing flexible technology solutions that adapt to changing business needs and market conditions.

Strategic market positioning places Denmark among the leading European countries in SaaS adoption and innovation. The market demonstrates exceptional growth potential driven by strong economic fundamentals, advanced technological infrastructure, and progressive business culture that embraces digital transformation. Danish companies increasingly prioritize cloud-based solutions to enhance competitiveness, reduce operational costs, and improve business agility.

Key market segments experiencing robust growth include business productivity software, customer engagement platforms, financial management solutions, and specialized industry applications. The market benefits from high levels of English proficiency, facilitating adoption of international SaaS platforms while supporting the growth of local providers offering Danish-language solutions and localized features.

Investment trends show significant capital flowing into Danish SaaS startups and established providers expanding their operations. The market attracts both domestic and international investors recognizing the potential for sustainable growth in the Danish technology sector. Government initiatives supporting digitalization further enhance market attractiveness and growth prospects.

Primary market drivers shaping the Denmark SaaS landscape include several critical factors that continue to accelerate adoption and market expansion:

Technological advancement serves as a fundamental driver propelling the Denmark SaaS market forward. The country’s exceptional digital infrastructure, including widespread high-speed internet connectivity and advanced mobile networks, creates an ideal environment for cloud-based software adoption. Danish businesses benefit from reliable connectivity that supports seamless SaaS application performance and user experiences.

Government digitalization initiatives significantly contribute to market growth through policies encouraging digital transformation across public and private sectors. These initiatives include funding programs, regulatory frameworks supporting cloud adoption, and public sector modernization projects that demonstrate SaaS benefits and drive broader market acceptance.

Economic efficiency considerations motivate Danish organizations to embrace SaaS solutions as cost-effective alternatives to traditional software licensing and infrastructure management. The subscription-based model allows businesses to convert capital expenditures to operational expenses while accessing enterprise-grade software capabilities previously available only to large corporations.

Workforce mobility trends drive demand for cloud-based solutions supporting flexible work arrangements. Danish companies increasingly adopt SaaS applications that enable employees to access business systems from any location, supporting productivity and work-life balance priorities that are particularly important in Danish business culture.

Data sovereignty concerns present challenges for some Danish organizations, particularly those in regulated industries or handling sensitive information. Despite strong European data protection frameworks, some businesses remain cautious about storing critical data in cloud environments, preferring on-premises solutions for certain applications.

Integration complexity can limit SaaS adoption among organizations with extensive legacy systems or highly customized business processes. The challenge of connecting cloud-based applications with existing infrastructure sometimes requires significant technical resources and expertise that may not be readily available to all Danish businesses.

Subscription cost accumulation becomes a concern as organizations adopt multiple SaaS solutions, potentially leading to higher total technology costs than anticipated. Danish businesses must carefully manage their SaaS portfolios to avoid subscription sprawl and ensure cost-effective technology investments.

Vendor dependency risks create hesitation among some Danish organizations concerned about relying heavily on external providers for critical business functions. The potential for service disruptions, vendor changes, or platform discontinuation influences decision-making processes, particularly for mission-critical applications.

Artificial intelligence integration presents substantial opportunities for SaaS providers targeting the Danish market. The incorporation of AI and machine learning capabilities into cloud-based applications can deliver enhanced functionality, automation benefits, and competitive advantages that appeal to technology-forward Danish businesses.

Industry-specific solutions offer significant growth potential, particularly in sectors where Denmark maintains strong global positions such as renewable energy, pharmaceuticals, agriculture, and maritime industries. SaaS providers developing specialized applications for these sectors can capture substantial market share and establish strong competitive positions.

Small and medium enterprise (SME) market expansion represents a major opportunity as these businesses increasingly recognize SaaS benefits. Danish SMEs seek affordable, easy-to-implement solutions that provide enterprise-level capabilities without requiring extensive technical resources or infrastructure investments.

Cross-border expansion opportunities emerge as successful Danish SaaS providers leverage their domestic market success to expand into other Nordic and European markets. The similar business cultures and regulatory environments across the region facilitate expansion strategies and market penetration efforts.

Competitive landscape evolution shapes market dynamics as both international giants and local innovators compete for Danish market share. Global SaaS providers bring extensive resources and proven solutions, while Danish companies offer localized features, language support, and deep understanding of local business requirements and regulatory frameworks.

Technology convergence trends influence market development as SaaS solutions increasingly incorporate emerging technologies including artificial intelligence, Internet of Things connectivity, and advanced analytics capabilities. These technological integrations create more sophisticated and valuable solutions that justify higher subscription costs and drive market growth.

Customer expectations evolution drives continuous innovation as Danish businesses demand more intuitive, powerful, and integrated SaaS solutions. User experience requirements continue to rise, pushing providers to invest in design, functionality, and performance improvements that differentiate their offerings in competitive markets.

Regulatory compliance requirements create both challenges and opportunities as SaaS providers must ensure their solutions meet Danish and European regulatory standards. Companies that successfully address compliance requirements gain competitive advantages and access to regulated industries with substantial growth potential.

Comprehensive market analysis employs multiple research methodologies to provide accurate and reliable insights into the Denmark SaaS market. Primary research includes extensive surveys of Danish businesses across various industries, in-depth interviews with technology decision-makers, and focus groups exploring user preferences and adoption patterns.

Secondary research components encompass analysis of industry reports, government publications, financial statements of key market participants, and technology trend assessments. This research foundation ensures comprehensive market understanding and validates primary research findings through multiple data sources and analytical approaches.

Data validation processes include cross-referencing information from multiple sources, statistical analysis of survey responses, and expert review of findings by industry professionals with extensive Danish market experience. These validation steps ensure research accuracy and reliability for strategic decision-making purposes.

Market modeling techniques utilize advanced analytical tools to project market trends, assess growth scenarios, and evaluate competitive dynamics. These models incorporate economic indicators, technology adoption patterns, and business cycle considerations specific to the Danish market environment.

Copenhagen metropolitan area dominates the Danish SaaS market, accounting for approximately 45% of total market activity. The capital region benefits from the highest concentration of technology companies, startups, and multinational corporations establishing Nordic headquarters. This area demonstrates the most advanced SaaS adoption rates and serves as the primary hub for innovation and market development.

Aarhus region represents the second-largest market segment, contributing roughly 22% of market share driven by its strong university presence, growing technology sector, and concentration of manufacturing companies adopting digital solutions. The region shows particular strength in industrial SaaS applications and business process automation solutions.

Odense and surrounding areas account for approximately 15% of market activity, with notable strength in healthcare and life sciences SaaS applications. The region benefits from its position as a healthcare technology hub and demonstrates growing adoption of specialized industry solutions.

Northern and western Denmark collectively represent the remaining 18% of market share, showing steady growth in SaaS adoption across agriculture, renewable energy, and maritime industries. These regions demonstrate increasing recognition of cloud-based solutions’ benefits for businesses operating in traditional industries.

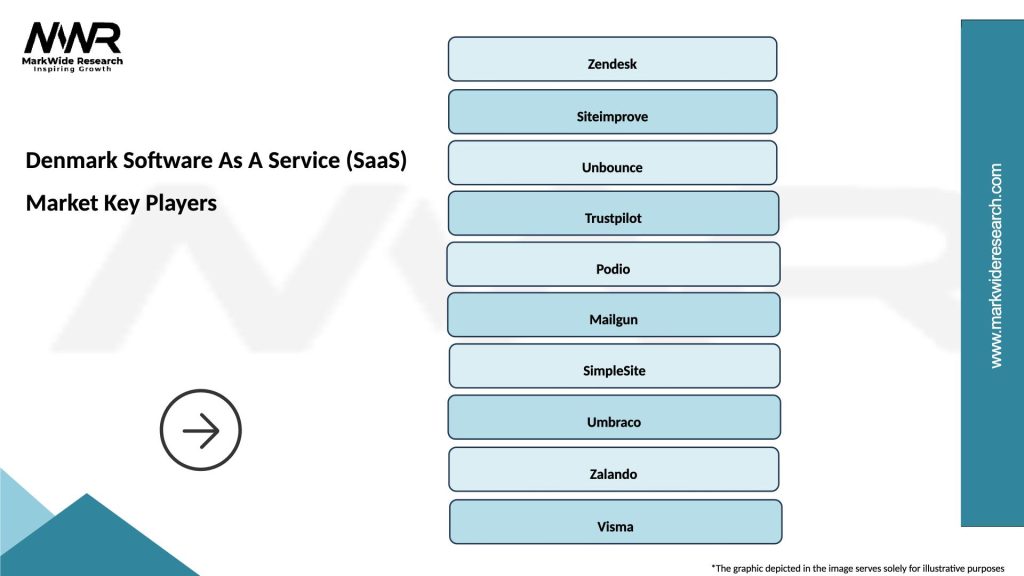

Market leadership in the Denmark SaaS sector includes a diverse mix of international technology giants and innovative local providers, each contributing unique strengths and capabilities to the competitive landscape:

Competitive strategies focus on localization, industry specialization, and integration capabilities that address specific Danish market requirements and business practices.

By Deployment Model:

By Application Type:

By Organization Size:

Business productivity applications demonstrate the strongest adoption rates among Danish organizations, with 85% of surveyed companies utilizing cloud-based productivity suites. These solutions provide essential functionality for document creation, collaboration, and communication while supporting the Danish preference for efficient, streamlined business processes.

Customer engagement platforms show remarkable growth as Danish businesses prioritize customer experience improvements and digital marketing capabilities. The segment benefits from increasing e-commerce adoption and the need for sophisticated customer relationship management tools that support personalized interactions and data-driven decision making.

Financial management solutions gain traction among Danish SMEs seeking professional-grade accounting and financial reporting capabilities without the complexity and cost of traditional enterprise software. These solutions particularly appeal to businesses requiring compliance with Danish accounting standards and tax regulations.

Industry-specific applications represent a high-growth category as SaaS providers develop specialized solutions for Denmark’s key industries including renewable energy, agriculture, maritime, and life sciences. These applications offer deep functionality tailored to specific industry workflows and regulatory requirements.

For Software Providers:

For Danish Businesses:

For Technology Ecosystem:

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a dominant trend transforming the Danish SaaS landscape. Providers increasingly incorporate AI capabilities including machine learning, natural language processing, and predictive analytics into their solutions. Danish businesses show strong interest in AI-powered features that automate routine tasks, provide intelligent insights, and enhance decision-making capabilities.

Industry-specific solution development gains momentum as SaaS providers recognize opportunities to serve Denmark’s specialized industries with tailored applications. This trend includes solutions for renewable energy management, agricultural optimization, maritime logistics, and pharmaceutical research that address unique Danish market requirements and regulatory frameworks.

Mobile-first design approaches become standard as Danish users increasingly access SaaS applications through mobile devices. Providers prioritize responsive design, mobile-optimized interfaces, and offline capabilities that support Denmark’s mobile-centric business culture and flexible work arrangements.

Integration platform development responds to growing demand for seamless connectivity between multiple SaaS applications. Danish businesses seek solutions that eliminate data silos and provide unified workflows across different software platforms, driving development of integration tools and API-first architectures.

Sustainability focus influences SaaS provider strategies as Danish businesses prioritize environmental responsibility. This trend includes green hosting solutions, carbon footprint reduction initiatives, and sustainability reporting features that align with Denmark’s environmental leadership and corporate responsibility expectations.

Strategic partnerships between international SaaS providers and Danish system integrators accelerate market penetration and localization efforts. These collaborations combine global technology capabilities with local market knowledge, creating more effective go-to-market strategies and customer support capabilities.

Venture capital investment in Danish SaaS startups reaches record levels, with both domestic and international investors recognizing the potential for innovative solutions developed in Denmark. This funding supports product development, market expansion, and talent acquisition efforts that strengthen the overall ecosystem.

Government digitalization projects demonstrate SaaS capabilities and drive broader market adoption through high-profile implementations in public sector organizations. These projects showcase the benefits of cloud-based solutions and create confidence among private sector decision-makers considering similar transitions.

Acquisition activity increases as larger technology companies seek to acquire Danish SaaS providers with specialized capabilities or strong market positions. These transactions provide growth capital and market access while validating the strength of Danish SaaS innovation and market potential.

Regulatory framework evolution continues to shape market development as European and Danish authorities refine data protection, cybersecurity, and cloud computing regulations. These developments create both challenges and opportunities for SaaS providers operating in the Danish market.

Market entry strategies should prioritize localization and partnership development for international SaaS providers seeking Danish market success. MWR analysis indicates that companies investing in Danish language support, local customer service, and partnerships with established system integrators achieve 40% higher adoption rates compared to those using standardized international approaches.

Product development focus should emphasize integration capabilities and industry-specific features that address unique Danish market requirements. Successful providers invest in API development, pre-built integrations with popular Danish business systems, and specialized functionality for key industries including renewable energy, agriculture, and life sciences.

Pricing strategies must balance competitive positioning with value demonstration, particularly in the price-sensitive SME segment. Flexible pricing models, transparent cost structures, and clear return-on-investment demonstrations prove most effective in converting prospects to customers in the Danish market.

Customer success initiatives should emphasize onboarding support, training programs, and ongoing relationship management that align with Danish business culture preferences for collaborative partnerships and long-term relationships. These efforts significantly impact customer retention and expansion opportunities.

Compliance preparation requires ongoing investment in security, data protection, and regulatory compliance capabilities that meet or exceed Danish and European requirements. Providers that proactively address compliance concerns gain competitive advantages and access to regulated industries with substantial growth potential.

Growth trajectory projections indicate continued strong expansion in the Denmark SaaS market driven by accelerating digital transformation initiatives, increasing cloud adoption, and growing recognition of SaaS benefits across all business sizes and industries. The market demonstrates resilience and adaptability that support sustained growth even during economic uncertainty periods.

Technology evolution will significantly impact market development as artificial intelligence, machine learning, and automation capabilities become standard features rather than premium additions. Danish businesses increasingly expect intelligent functionality that provides actionable insights and automates routine processes, driving innovation requirements for SaaS providers.

Market consolidation trends suggest increasing acquisition activity as successful providers seek to expand their capabilities and market reach through strategic acquisitions. This consolidation creates opportunities for specialized providers while potentially reducing overall market competition in certain segments.

International expansion opportunities will grow as successful Danish SaaS providers leverage their domestic market success to enter other Nordic and European markets. The similar business cultures and regulatory environments across the region facilitate expansion strategies and create larger addressable markets for Danish innovations.

Emerging market segments including artificial intelligence applications, Internet of Things integration, and sustainability management solutions present substantial growth opportunities. These segments align with Denmark’s technology leadership and environmental priorities, creating favorable conditions for market development and innovation.

The Denmark Software as a Service market represents a dynamic and rapidly evolving sector that demonstrates exceptional growth potential and innovation capabilities. The combination of advanced digital infrastructure, progressive business culture, and strong government support creates an ideal environment for SaaS adoption and market expansion across all industry sectors and business sizes.

Strategic market positioning places Denmark among the European leaders in cloud computing adoption and SaaS innovation, with businesses increasingly recognizing the competitive advantages provided by flexible, scalable, and cost-effective software solutions. The market benefits from high levels of technology literacy, strong economic fundamentals, and supportive regulatory frameworks that encourage digital transformation initiatives.

Future market development will be shaped by continued technology advancement, increasing integration requirements, and growing demand for industry-specific solutions that address unique Danish market needs. The successful providers will be those that combine global capabilities with local market understanding, delivering solutions that align with Danish business culture and regulatory requirements while providing clear value propositions and competitive advantages.

What is Software As A Service (SaaS)?

Software As A Service (SaaS) refers to a cloud-based service where applications are hosted and made available to users over the internet. This model allows businesses to access software without the need for installation or maintenance, making it a flexible solution for various industries.

What are the key companies in the Denmark Software As A Service (SaaS) Market?

Key companies in the Denmark Software As A Service (SaaS) Market include Zendesk, Sitecore, and Trustpilot, among others. These companies provide a range of SaaS solutions that cater to customer service, content management, and online reviews.

What are the drivers of growth in the Denmark Software As A Service (SaaS) Market?

The growth of the Denmark Software As A Service (SaaS) Market is driven by the increasing demand for remote work solutions, the need for cost-effective software deployment, and the rising adoption of cloud technologies across various sectors.

What challenges does the Denmark Software As A Service (SaaS) Market face?

The Denmark Software As A Service (SaaS) Market faces challenges such as data security concerns, compliance with regulations, and the need for continuous innovation to meet evolving customer expectations.

What opportunities exist in the Denmark Software As A Service (SaaS) Market?

Opportunities in the Denmark Software As A Service (SaaS) Market include the expansion of AI-driven applications, the growth of niche SaaS solutions tailored for specific industries, and the increasing focus on customer experience enhancements.

What trends are shaping the Denmark Software As A Service (SaaS) Market?

Trends shaping the Denmark Software As A Service (SaaS) Market include the rise of subscription-based pricing models, the integration of advanced analytics and machine learning, and the growing emphasis on user-friendly interfaces and customer support.

Denmark Software As A Service (SaaS) Market

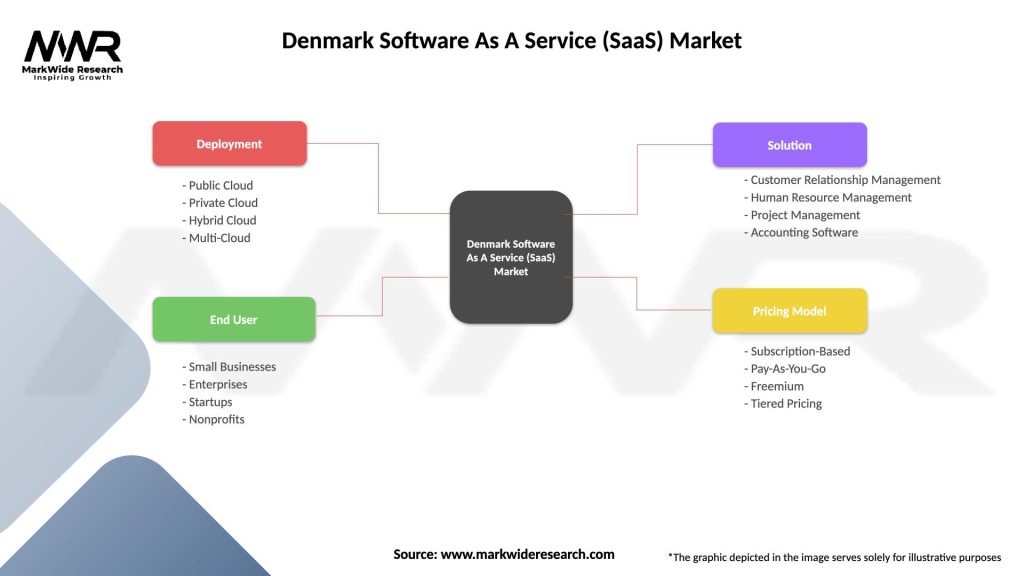

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| End User | Small Businesses, Enterprises, Startups, Nonprofits |

| Solution | Customer Relationship Management, Human Resource Management, Project Management, Accounting Software |

| Pricing Model | Subscription-Based, Pay-As-You-Go, Freemium, Tiered Pricing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Denmark Software As A Service (SaaS) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at