444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Denmark home insurance market represents a mature and highly regulated segment of the Nordic insurance landscape, characterized by comprehensive coverage options and strong consumer protection frameworks. Danish homeowners benefit from a sophisticated insurance ecosystem that combines traditional property protection with innovative digital solutions and sustainable housing initiatives. The market demonstrates steady growth patterns with approximately 4.2% annual expansion driven by increasing property values, climate-related risks, and evolving consumer expectations for comprehensive coverage.

Market dynamics in Denmark reflect the country’s commitment to environmental sustainability and technological advancement, with insurers increasingly incorporating green building incentives and smart home technology discounts into their policy structures. The regulatory environment, overseen by the Danish Financial Supervisory Authority, ensures robust consumer protection while fostering innovation in product development and service delivery. Digital transformation has become a key differentiator, with leading insurers investing heavily in mobile applications, artificial intelligence-driven claims processing, and personalized risk assessment tools.

Regional variations within Denmark’s home insurance market reflect diverse housing types, from urban apartments in Copenhagen and Aarhus to rural properties and coastal homes facing unique weather-related risks. The market’s maturity is evidenced by high penetration rates, with approximately 87% of Danish homeowners maintaining active home insurance policies, significantly above the European average.

The Denmark home insurance market refers to the comprehensive ecosystem of insurance products, services, and regulatory frameworks designed to protect Danish homeowners against property damage, liability risks, and personal belongings loss. This market encompasses various coverage types including building insurance, contents insurance, and liability protection, tailored to meet the specific needs of Danish households and comply with local regulatory requirements.

Home insurance in Denmark operates within a unique context of cooperative housing societies, private ownership, and rental properties, each requiring specialized coverage approaches. The market includes both mandatory and voluntary insurance components, with building insurance often required by mortgage lenders and contents insurance remaining largely optional but widely adopted. Danish insurers offer integrated solutions that combine property protection with additional services such as emergency assistance, legal support, and preventive maintenance programs.

Denmark’s home insurance market demonstrates remarkable stability and innovation, positioning itself as a leader in sustainable insurance practices and digital customer engagement. The market benefits from strong regulatory oversight, high consumer trust, and a mature understanding of risk management principles among both insurers and policyholders. Key market drivers include increasing awareness of climate-related risks, growing adoption of smart home technologies, and evolving lifestyle patterns that demand flexible coverage options.

Competitive dynamics favor established players with strong brand recognition and comprehensive distribution networks, while new entrants focus on digital-first approaches and specialized coverage segments. The market shows resilient growth potential with approximately 3.8% projected annual expansion over the next five years, supported by steady housing market activity and increasing property values across major Danish cities.

Innovation trends emphasize sustainability incentives, with insurers offering reduced premiums for energy-efficient homes and green building certifications. Digital transformation continues to reshape customer interactions, claims processing, and risk assessment methodologies, creating opportunities for enhanced customer experience and operational efficiency.

Strategic insights reveal several critical trends shaping Denmark’s home insurance landscape:

Primary market drivers propelling growth in Denmark’s home insurance sector stem from both external environmental factors and internal market dynamics. Climate change impacts have become increasingly significant, with Danish homeowners experiencing more frequent flooding, storm damage, and temperature-related property issues. This has led to heightened awareness of comprehensive coverage needs and willingness to invest in protective insurance products.

Technological advancement serves as another crucial driver, with smart home adoption rates reaching approximately 34% among Danish households. Insurers recognize the risk mitigation potential of connected devices, offering premium discounts for homes equipped with security systems, water leak detectors, and fire prevention technologies. Digital transformation has also enhanced customer expectations for seamless, on-demand insurance services accessible through mobile platforms.

Regulatory support continues to drive market expansion through consumer-friendly policies and transparent pricing requirements. The Danish government’s commitment to sustainable housing initiatives creates additional demand for insurance products that support green building practices and energy efficiency improvements. Economic stability and consistent housing market growth provide a solid foundation for sustained insurance market expansion.

Market constraints in Denmark’s home insurance sector primarily revolve around regulatory complexity and intense competitive pressures. Regulatory compliance costs continue to increase as authorities implement more stringent consumer protection measures and data privacy requirements, particularly following GDPR implementation. These compliance burdens can limit smaller insurers’ ability to compete effectively and may slow innovation in certain product areas.

Market saturation presents ongoing challenges, with high penetration rates limiting opportunities for dramatic customer base expansion. Insurers must focus on customer retention and value-added services rather than simple market share growth. Price competition remains intense, with consumers increasingly price-sensitive and willing to switch providers for marginal savings, pressuring profit margins across the industry.

Climate risk uncertainty creates challenges in accurate pricing and risk assessment, particularly for coastal properties and areas prone to flooding. Reinsurance costs have increased as global climate risks escalate, potentially impacting premium structures and coverage availability for high-risk properties.

Emerging opportunities in Denmark’s home insurance market center on technological innovation and sustainability initiatives. Smart home integration offers significant potential for risk reduction and customer engagement, with insurers developing comprehensive IoT ecosystems that provide real-time monitoring and preventive maintenance alerts. This technology integration can reduce claims frequency while enhancing customer satisfaction through proactive risk management.

Sustainability-focused products represent a growing opportunity as Danish consumers increasingly prioritize environmental responsibility. Insurers can develop specialized coverage for solar installations, energy storage systems, and sustainable building materials while offering premium discounts for certified green buildings. Carbon offset programs and environmental restoration services could become valuable differentiators in the competitive landscape.

Digital transformation opportunities extend beyond basic online services to include artificial intelligence-powered risk assessment, blockchain-based claims processing, and virtual reality property inspections. Parametric insurance products could address specific weather-related risks with faster, more transparent claim settlements based on objective weather data rather than traditional damage assessments.

Market dynamics in Denmark’s home insurance sector reflect a complex interplay of traditional insurance principles and modern technological capabilities. Customer behavior patterns show increasing demand for transparency, with approximately 68% of Danish consumers preferring insurers that provide clear, easily understandable policy terms and real-time coverage information through digital platforms.

Competitive positioning has evolved beyond traditional price-based competition to encompass service quality, digital capabilities, and sustainability credentials. MarkWide Research analysis indicates that insurers investing in comprehensive digital transformation initiatives achieve 23% higher customer retention rates compared to traditional service providers. This trend emphasizes the importance of technological investment in maintaining competitive advantage.

Risk assessment methodologies continue to evolve with the integration of big data analytics, satellite imagery, and predictive modeling capabilities. These advanced techniques enable more accurate pricing while identifying previously unknown risk factors. Claims processing efficiency has improved significantly, with leading insurers achieving average settlement times of less than 10 days for standard property damage claims.

Research methodology for analyzing Denmark’s home insurance market employs a comprehensive multi-source approach combining quantitative data analysis with qualitative market intelligence. Primary research includes structured interviews with insurance executives, regulatory officials, and consumer representatives to understand market dynamics from multiple perspectives. This approach ensures balanced insights into both industry challenges and consumer needs.

Secondary research encompasses analysis of regulatory filings, industry reports, and financial statements from major market participants. Data validation processes include cross-referencing multiple sources and conducting expert reviews to ensure accuracy and reliability of market insights. Statistical analysis employs advanced modeling techniques to identify trends and project future market developments.

Market segmentation analysis utilizes demographic data, housing statistics, and insurance penetration rates across different regions and consumer segments. Competitive intelligence gathering includes monitoring product launches, pricing strategies, and marketing initiatives across all major market participants to provide comprehensive competitive landscape analysis.

Regional analysis of Denmark’s home insurance market reveals distinct patterns reflecting geographic, demographic, and economic variations across the country. Greater Copenhagen represents approximately 42% of total market activity, driven by high property values, dense urban housing, and sophisticated consumer demands for comprehensive coverage options. The capital region shows strong adoption of digital insurance services and premium products with enhanced coverage features.

Jutland Peninsula markets demonstrate different characteristics, with rural properties requiring specialized coverage for agricultural buildings, coastal properties facing unique weather risks, and generally lower premium levels reflecting regional property values. Aarhus and surrounding areas show growing market activity with approximately 18% regional market share, supported by economic growth and increasing urbanization trends.

Coastal regions across Denmark face specific challenges related to storm damage and flooding risks, leading to specialized insurance products and higher premium levels. Island communities including Bornholm and smaller islands require tailored coverage approaches addressing limited emergency services access and unique property types. Regional insurers often maintain strong market positions in these specialized segments through local expertise and customized service offerings.

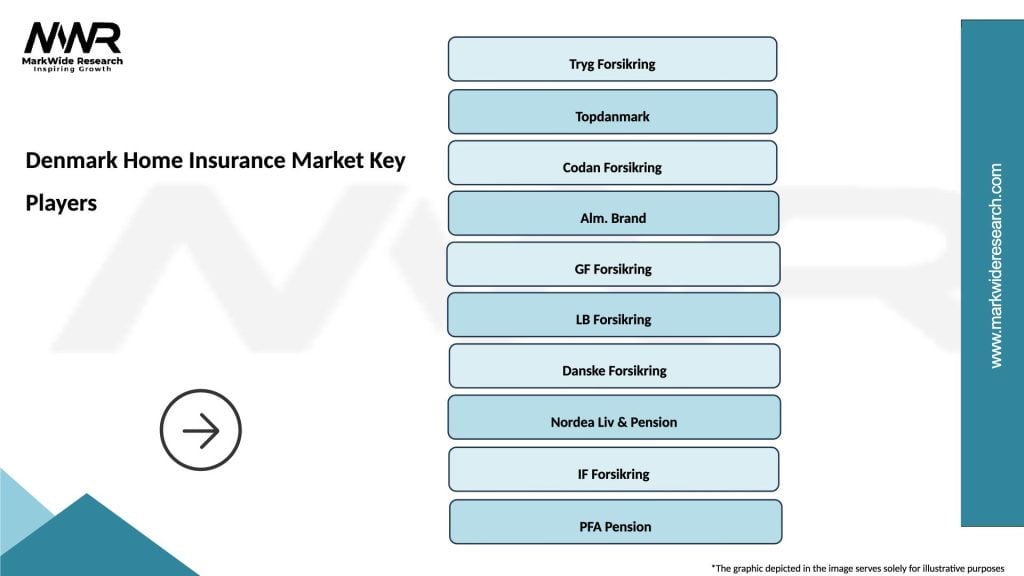

Competitive landscape analysis reveals a concentrated market structure with several dominant players maintaining significant market positions through comprehensive product portfolios and extensive distribution networks. Le ading market participants include:

ading market participants include:

Competitive strategies emphasize digital transformation, customer experience enhancement, and specialized product development. Market consolidation trends continue as larger players acquire smaller regional insurers to expand geographic coverage and customer bases. Innovation in claims processing, risk assessment, and customer engagement remains a key differentiator among leading competitors.

Market segmentation in Denmark’s home insurance sector reflects diverse consumer needs and property types across the country. By Coverage Type:

By Property Type:

By Customer Segment:

Category-wise analysis reveals distinct trends and opportunities across different segments of Denmark’s home insurance market. Building insurance remains the largest category, driven by mortgage requirements and increasing property values. This segment shows steady growth with enhanced coverage for climate-related risks becoming increasingly important. Smart building features are increasingly influencing premium calculations, with energy-efficient homes receiving favorable rates.

Contents insurance demonstrates strong growth potential as Danish households accumulate more valuable personal belongings and electronics. Digital lifestyle changes have increased the value of home contents, particularly technology equipment and home office setups. Insurers are developing more sophisticated valuation methods and replacement cost coverage options to address evolving consumer needs.

Liability coverage has gained importance as legal awareness increases and liability claims become more common. Home-based business activities and short-term rental arrangements through platforms like Airbnb create new liability exposures requiring specialized coverage solutions. Cyber liability components are increasingly integrated into home insurance policies as smart home adoption expands.

Industry participants in Denmark’s home insurance market benefit from a stable regulatory environment, sophisticated consumer base, and strong economic fundamentals supporting consistent demand growth. Insurance companies enjoy predictable cash flows, established distribution channels, and opportunities for cross-selling additional financial products to existing customers.

Technology providers benefit from increasing demand for digital solutions, smart home integration, and advanced analytics capabilities. Claims processing automation and customer service enhancement create ongoing opportunities for technology partnerships and innovation development. Data analytics companies find growing demand for risk assessment tools and predictive modeling capabilities.

Consumers benefit from competitive pricing, comprehensive coverage options, and enhanced service quality driven by market competition. Regulatory protection ensures fair treatment and transparent pricing practices. Digital convenience and 24/7 service availability improve customer experience and policy management efficiency. Sustainability incentives support environmental goals while reducing insurance costs for energy-efficient homes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key trends shaping Denmark’s home insurance market reflect broader technological and social developments influencing consumer behavior and industry practices. Digital-first customer engagement has become essential, with approximately 76% of Danish consumers preferring to manage their insurance policies through mobile applications and online platforms. This trend drives continuous investment in user experience design and digital service capabilities.

Sustainability integration represents another significant trend, with insurers developing comprehensive green insurance programs that reward environmentally responsible homeowners. Carbon footprint reduction initiatives and renewable energy system coverage are becoming standard offerings rather than specialized products. MWR research indicates that sustainability-focused insurance products show 31% higher customer satisfaction rates compared to traditional offerings.

Personalization trends emphasize customized coverage options based on individual risk profiles, lifestyle patterns, and property characteristics. Usage-based insurance models are emerging for vacation homes and seasonal properties, allowing customers to adjust coverage levels based on occupancy patterns. Predictive analytics enable more accurate risk assessment and personalized pricing strategies.

Recent industry developments highlight the dynamic nature of Denmark’s home insurance market and ongoing evolution in response to changing consumer needs and technological capabilities. Digital transformation initiatives have accelerated, with major insurers launching comprehensive mobile-first platforms offering policy management, claims reporting, and customer service through integrated applications.

Partnership strategies have expanded beyond traditional insurance relationships to include technology companies, smart home device manufacturers, and sustainability service providers. These collaborations enable insurers to offer comprehensive home protection ecosystems rather than simple coverage products. Blockchain implementation for claims processing and policy management is gaining traction among forward-thinking insurers.

Regulatory developments include enhanced consumer protection measures and transparency requirements that benefit policyholders while creating compliance challenges for insurers. Climate adaptation strategies have become mandatory considerations in product development and pricing methodologies. Cross-border insurance services within the EU continue to evolve, creating opportunities for market expansion and competitive pressure from international providers.

Strategic recommendations for success in Denmark’s home insurance market emphasize the importance of balanced innovation and operational excellence. Digital investment priorities should focus on customer experience enhancement rather than technology for its own sake, ensuring that digital solutions genuinely improve service quality and operational efficiency. MarkWide Research analysis suggests that insurers achieving optimal digital transformation balance show 28% better customer retention rates than those focusing solely on technology implementation.

Sustainability integration should extend beyond simple green product offerings to encompass comprehensive environmental responsibility programs that resonate with Danish consumers’ values. Risk management innovation through predictive analytics and IoT integration offers significant competitive advantages for insurers willing to invest in advanced capabilities.

Market positioning strategies should emphasize unique value propositions rather than price competition alone. Customer service excellence, specialized expertise, and comprehensive coverage options provide more sustainable competitive advantages than aggressive pricing strategies that may compromise profitability and service quality.

Future outlook for Denmark’s home insurance market remains positive, with steady growth projected across multiple segments and continued innovation in product development and service delivery. Market expansion is expected to continue at approximately 4.1% annual growth rate over the next five years, supported by housing market stability, increasing property values, and evolving consumer coverage needs.

Technology integration will accelerate, with artificial intelligence, machine learning, and IoT devices becoming standard components of insurance operations rather than experimental innovations. Climate adaptation will drive product development, with insurers developing more sophisticated weather-related coverage options and risk mitigation services.

Regulatory evolution will continue supporting consumer protection while encouraging innovation and competition. Sustainability requirements may become more stringent, creating opportunities for insurers with strong environmental credentials and comprehensive green product portfolios. Market consolidation trends are likely to continue as smaller players seek partnerships or acquisition opportunities to remain competitive in an increasingly sophisticated market environment.

Denmark’s home insurance market represents a mature, sophisticated, and continuously evolving sector that successfully balances traditional insurance principles with innovative technological solutions and sustainability initiatives. The market demonstrates remarkable resilience and adaptability, responding effectively to changing consumer needs, regulatory requirements, and environmental challenges while maintaining strong competitive dynamics and customer satisfaction levels.

Key success factors for market participants include digital transformation excellence, sustainability integration, personalized customer service, and comprehensive risk management capabilities. The market’s future growth potential remains strong, supported by economic stability, technological advancement, and increasing consumer awareness of comprehensive coverage benefits. Strategic positioning that emphasizes unique value propositions, operational excellence, and customer-centric innovation will determine long-term success in this dynamic and competitive market environment.

What is Home Insurance?

Home insurance, also known as homeowners insurance, is a type of property insurance that provides financial protection against various risks associated with owning a home, including damage to the structure, personal belongings, and liability for injuries that occur on the property.

What are the key players in the Denmark Home Insurance Market?

The Denmark Home Insurance Market features several key players, including Tryg, If P&C Insurance, and Codan, which offer a range of home insurance products tailored to the needs of Danish homeowners, among others.

What are the main drivers of the Denmark Home Insurance Market?

The main drivers of the Denmark Home Insurance Market include the increasing awareness of property protection, the rise in homeownership rates, and the growing incidence of natural disasters that necessitate comprehensive insurance coverage.

What challenges does the Denmark Home Insurance Market face?

The Denmark Home Insurance Market faces challenges such as rising claims costs due to climate change impacts, regulatory changes affecting coverage options, and increased competition among insurers that can lead to pricing pressures.

What opportunities exist in the Denmark Home Insurance Market?

Opportunities in the Denmark Home Insurance Market include the potential for innovative insurance products that cater to eco-friendly homes, the integration of technology for better customer service, and the expansion of coverage options for renters and short-term rental properties.

What trends are shaping the Denmark Home Insurance Market?

Trends shaping the Denmark Home Insurance Market include the adoption of digital platforms for policy management, the growing emphasis on sustainability in insurance offerings, and the increasing use of data analytics to assess risk and tailor policies.

Denmark Home Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Building Insurance, Contents Insurance, Liability Insurance, Renters Insurance |

| Customer Type | Homeowners, Tenants, Landlords, Real Estate Investors |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Basic, Natural Disaster, Theft |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Denmark Home Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at