444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Denmark data center storage market represents a critical component of the Nordic region’s digital infrastructure landscape, experiencing unprecedented growth driven by increasing digitalization across industries. Denmark’s strategic position as a technology hub in Northern Europe has positioned the country as an attractive destination for data center investments, with storage solutions forming the backbone of modern digital operations.

Market dynamics indicate robust expansion fueled by the country’s commitment to renewable energy, advanced telecommunications infrastructure, and favorable regulatory environment. The Danish government’s focus on becoming carbon-neutral by 2030 has created unique opportunities for sustainable data center storage solutions, attracting international hyperscale operators and enterprise clients seeking environmentally responsible hosting options.

Growth trajectories show the market expanding at a compound annual growth rate of 12.8%, driven by increasing demand for cloud services, edge computing applications, and data sovereignty requirements. The integration of artificial intelligence and machine learning workloads has further accelerated storage capacity requirements, with solid-state drive adoption reaching approximately 68% penetration in enterprise deployments across Danish facilities.

Regional advantages include Denmark’s stable political climate, robust fiber optic connectivity to major European markets, and access to abundant renewable energy sources. These factors have contributed to the establishment of multiple tier-three and tier-four data centers, with storage infrastructure representing a significant portion of overall facility investments and operational considerations.

The Denmark data center storage market refers to the comprehensive ecosystem of storage technologies, solutions, and services deployed within Danish data center facilities to support digital infrastructure requirements. This market encompasses various storage architectures including traditional hard disk drives, solid-state drives, hybrid storage systems, and emerging technologies such as storage-class memory and software-defined storage platforms.

Storage solutions within this market serve multiple functions including primary data storage, backup and disaster recovery, archival storage, and high-performance computing applications. The market includes both internal storage systems integrated within servers and external storage arrays, network-attached storage devices, and storage area networks that provide scalable capacity for diverse workloads.

Market participants include storage hardware manufacturers, software providers, system integrators, and data center operators who collectively deliver comprehensive storage solutions. The ecosystem supports various deployment models from on-premises infrastructure to hybrid cloud configurations, enabling Danish organizations to optimize their data management strategies while maintaining compliance with local data protection regulations.

Denmark’s data center storage market demonstrates exceptional growth potential, driven by the country’s position as a digital innovation leader and its commitment to sustainable technology infrastructure. The market benefits from strong government support for digitalization initiatives, with public sector modernization programs contributing approximately 23% of total storage demand across Danish facilities.

Key market drivers include the rapid adoption of cloud-first strategies by Danish enterprises, increasing data generation from IoT devices, and stringent data sovereignty requirements under European regulations. The financial services sector leads storage consumption, accounting for nearly 31% of enterprise storage deployments, followed by healthcare, manufacturing, and telecommunications industries.

Technology trends show accelerating adoption of NVMe-based storage solutions, with performance-critical applications driving demand for low-latency storage architectures. Software-defined storage platforms are gaining traction, representing approximately 19% of new deployments as organizations seek greater flexibility and cost optimization in their storage infrastructure investments.

Competitive dynamics feature both established international storage vendors and emerging Danish technology companies, creating a diverse ecosystem that supports innovation and competitive pricing. The market’s maturity level enables sophisticated storage solutions while maintaining accessibility for small and medium-sized enterprises seeking to modernize their data management capabilities.

Strategic insights reveal several critical factors shaping the Denmark data center storage market landscape:

Market maturation indicators suggest increasing sophistication in storage procurement decisions, with organizations prioritizing total cost of ownership, performance optimization, and environmental sustainability over initial capital expenditure considerations.

Digital transformation initiatives across Danish industries serve as the primary catalyst for data center storage market expansion. Organizations are migrating legacy systems to modern architectures, requiring substantial storage capacity increases and performance improvements to support contemporary business applications and analytics workloads.

Cloud adoption acceleration drives demand for scalable storage solutions, with Danish enterprises increasingly embracing hybrid and multi-cloud strategies. This trend necessitates flexible storage architectures capable of supporting seamless data movement between on-premises and cloud environments while maintaining performance and security standards.

Data sovereignty requirements under European and Danish regulations create strong demand for local storage infrastructure. Organizations in regulated industries such as banking, healthcare, and government services require data residency compliance, driving investments in domestic data center storage capabilities rather than relying solely on international cloud providers.

IoT proliferation generates unprecedented data volumes requiring efficient storage and processing capabilities. Danish manufacturing, agriculture, and smart city initiatives contribute to exponential data growth, necessitating advanced storage solutions capable of handling diverse data types and access patterns with optimal cost-effectiveness.

Artificial intelligence adoption creates demand for high-performance storage systems capable of supporting machine learning workloads and real-time analytics. Danish organizations implementing AI solutions require storage architectures optimized for both training and inference workloads, driving adoption of specialized storage technologies and configurations.

High capital investment requirements present significant barriers for smaller organizations seeking to implement advanced storage solutions. The cost of enterprise-grade storage systems, including hardware, software licensing, and implementation services, can strain budgets and delay adoption timelines for resource-constrained entities.

Skills shortage challenges limit market growth as organizations struggle to find qualified personnel capable of designing, implementing, and managing complex storage infrastructures. The rapid evolution of storage technologies requires continuous training and certification, creating ongoing human resource challenges for Danish companies.

Legacy system integration complexity slows storage modernization initiatives as organizations must maintain compatibility with existing applications and workflows. The need to support legacy protocols and interfaces while implementing modern storage architectures increases project complexity and implementation costs.

Energy cost considerations impact storage infrastructure decisions, particularly for high-density deployments requiring substantial cooling and power resources. While Denmark benefits from renewable energy sources, the total cost of ownership for large-scale storage systems remains a significant consideration for budget-conscious organizations.

Vendor lock-in concerns create hesitation among potential buyers who fear dependency on specific storage platforms or proprietary technologies. Organizations seek storage solutions offering flexibility and interoperability, but may encounter limitations when attempting to integrate products from multiple vendors or migrate between different storage architectures.

Sustainable technology demand creates substantial opportunities for storage vendors offering environmentally responsible solutions. Danish organizations increasingly prioritize carbon footprint reduction, creating market demand for energy-efficient storage systems and sustainable data center practices that align with national climate objectives.

Edge computing expansion presents significant growth opportunities as 5G networks and IoT applications require distributed storage capabilities. The development of edge data centers across Denmark creates demand for compact, efficient storage solutions optimized for remote deployment and autonomous operation.

Backup and disaster recovery modernization offers opportunities for advanced storage solutions as organizations update legacy protection strategies. The shift toward continuous data protection, ransomware resilience, and cloud-integrated backup creates demand for sophisticated storage architectures supporting modern data protection requirements.

Industry 4.0 initiatives in Danish manufacturing create opportunities for specialized storage solutions supporting industrial IoT, predictive maintenance, and real-time analytics applications. The integration of operational technology with information technology requires storage systems optimized for industrial environments and real-time data processing.

Research and development collaboration between Danish universities, research institutions, and industry creates opportunities for innovative storage technologies. Government funding for technology development and the country’s strong innovation ecosystem support the development of next-generation storage solutions and market differentiation opportunities.

Supply chain dynamics in the Denmark data center storage market reflect global technology trends while incorporating local requirements and preferences. The market benefits from established relationships with international storage vendors while supporting emerging Danish technology companies developing innovative solutions for specific market segments.

Pricing pressures continue to influence market dynamics as storage costs per gigabyte decline while performance requirements increase. Organizations expect improved price-performance ratios, driving vendors to optimize their offerings and develop more cost-effective solutions without compromising reliability or functionality.

Technology convergence creates dynamic market conditions as traditional storage boundaries blur with compute, networking, and software-defined infrastructure. Hyper-converged infrastructure adoption reaches approximately 24% penetration in Danish enterprises, reflecting the trend toward integrated solutions that simplify management and reduce complexity.

Competitive intensity increases as both established vendors and new market entrants compete for market share. This competition drives innovation, improves customer service, and creates favorable conditions for buyers seeking advanced storage solutions at competitive prices with comprehensive support services.

Customer expectations evolution influences market dynamics as organizations demand more sophisticated storage capabilities including automated management, predictive analytics, and seamless cloud integration. Vendors must continuously enhance their offerings to meet evolving customer requirements while maintaining competitive positioning in the Danish market.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Denmark data center storage market. Primary research includes extensive interviews with industry stakeholders, including storage vendors, data center operators, system integrators, and end-user organizations across various industry sectors.

Secondary research components encompass analysis of industry reports, government publications, regulatory documents, and financial statements from publicly traded companies operating in the Danish market. This approach provides comprehensive market understanding while validating findings through multiple independent sources and perspectives.

Data validation processes ensure research accuracy through triangulation of information sources, expert review panels, and statistical analysis of market trends. MarkWide Research employs rigorous quality control measures to verify data accuracy and eliminate potential biases that could impact research conclusions or market projections.

Market segmentation analysis utilizes both quantitative and qualitative research techniques to understand customer behavior, technology adoption patterns, and competitive dynamics. This methodology provides detailed insights into market structure, growth drivers, and emerging opportunities within specific market segments and customer categories.

Forecasting methodologies combine historical trend analysis, regression modeling, and expert opinion to develop realistic market projections. The research incorporates multiple scenarios to account for potential market variations and provides confidence intervals for key market metrics and growth projections.

Copenhagen metropolitan area dominates the Danish data center storage market, accounting for approximately 52% of total market activity due to its concentration of financial services, technology companies, and government institutions. The region benefits from excellent connectivity infrastructure, skilled workforce availability, and proximity to major European markets.

Jutland peninsula emerges as a significant growth region, particularly around Aarhus and Aalborg, where renewable energy availability and lower real estate costs attract data center investments. The region’s industrial base creates demand for specialized storage solutions supporting manufacturing and logistics applications.

Zealand region outside Copenhagen maintains steady market presence, serving as a strategic location for disaster recovery facilities and secondary data centers. Organizations leverage the region’s proximity to the capital while benefiting from reduced operational costs and improved risk diversification.

Bornholm island represents an emerging opportunity for specialized data center deployments, particularly those focused on renewable energy utilization and submarine cable connectivity. The island’s unique position creates potential for niche storage applications serving Northern European markets.

Cross-border connectivity influences regional market dynamics as Danish data centers serve broader Nordic and Northern European markets. Storage infrastructure must support low-latency connectivity to Sweden, Norway, Germany, and other regional markets, influencing technology choices and capacity planning decisions.

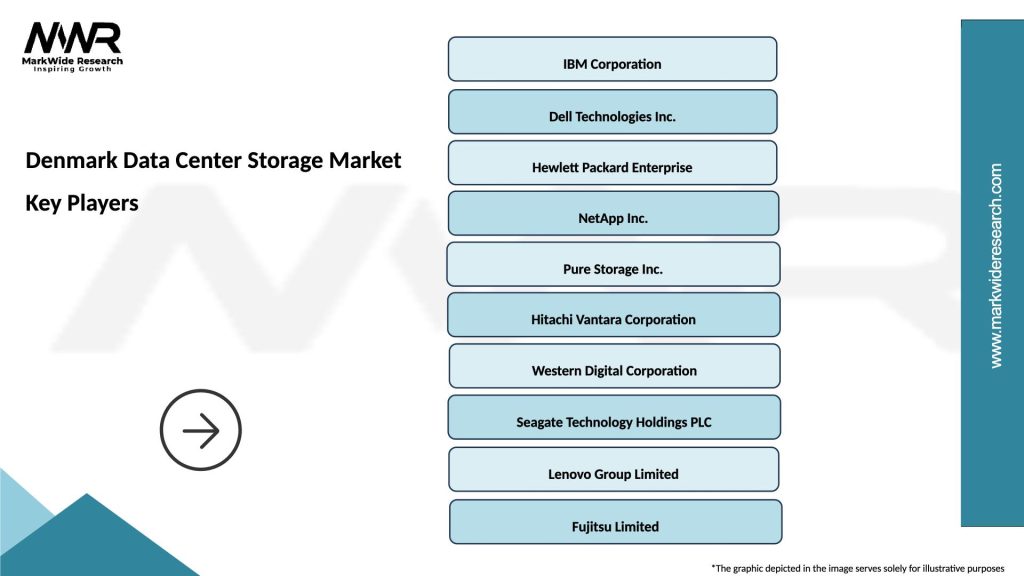

Market leadership in the Denmark data center storage market features a diverse ecosystem of international technology vendors and specialized solution providers:

Competitive strategies focus on differentiation through technology innovation, local support capabilities, and specialized solutions for Danish market requirements. Vendors emphasize sustainability credentials, energy efficiency, and compliance with European data protection regulations to gain competitive advantage.

Partnership ecosystems play crucial roles in market competition, with vendors collaborating with local system integrators, managed service providers, and consulting firms to deliver comprehensive solutions. These partnerships enable vendors to provide localized support while leveraging specialized expertise in Danish market requirements.

By Storage Type:

By Deployment Model:

By Application:

Enterprise Storage Category dominates the Danish market, representing approximately 67% of total deployments across large organizations requiring sophisticated storage capabilities. This category includes high-end storage arrays, software-defined storage platforms, and integrated infrastructure solutions supporting mission-critical applications and demanding performance requirements.

Small and Medium Business (SMB) Storage represents a growing market segment as smaller organizations modernize their IT infrastructure. Cloud-integrated storage solutions and hyper-converged infrastructure gain traction in this category, offering enterprise-class capabilities at accessible price points with simplified management requirements.

Hyperscale Storage Category experiences rapid growth as international cloud providers establish significant presence in Denmark. These deployments require massive storage capacity, optimized for specific workloads, and emphasize cost efficiency, reliability, and automation capabilities to support large-scale cloud services.

Specialized Storage Applications serve niche requirements including high-performance computing, media and entertainment, and scientific research applications. These solutions prioritize specific performance characteristics such as throughput, latency, or capacity optimization rather than general-purpose storage capabilities.

Backup and Archive Storage maintains steady demand as organizations implement comprehensive data protection strategies. Modern solutions emphasize ransomware protection, cloud integration, and automated management capabilities while supporting long-term data retention requirements and compliance obligations.

Data Center Operators benefit from advanced storage solutions through improved operational efficiency, reduced power consumption, and enhanced service offerings. Modern storage systems enable operators to provide differentiated services while optimizing facility utilization and maintaining competitive pricing structures.

Enterprise Customers gain significant advantages including improved application performance, enhanced data protection capabilities, and simplified management through automation and analytics. Advanced storage solutions enable digital transformation initiatives while reducing total cost of ownership and operational complexity.

Technology Vendors benefit from market growth opportunities, partnership development, and innovation collaboration within the Danish ecosystem. The market’s sophistication enables vendors to showcase advanced capabilities while building long-term customer relationships and expanding their regional presence.

System Integrators leverage market growth to expand service offerings, develop specialized expertise, and build recurring revenue streams through managed services. The complexity of modern storage solutions creates opportunities for value-added services and ongoing customer engagement.

Government and Public Sector organizations benefit from improved citizen services, enhanced data security, and cost-effective IT infrastructure modernization. Advanced storage solutions support digital government initiatives while maintaining compliance with data protection and sovereignty requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-Defined Storage Adoption accelerates as organizations seek greater flexibility and cost optimization in their storage infrastructure. This trend enables hardware abstraction, simplified management, and improved resource utilization while supporting diverse workload requirements and cloud integration strategies.

NVMe Technology Integration transforms storage performance capabilities, with adoption rates reaching approximately 41% in new enterprise deployments. This trend addresses latency-sensitive applications and enables new use cases requiring ultra-fast data access and processing capabilities.

Artificial Intelligence Integration in storage management systems improves operational efficiency through predictive analytics, automated optimization, and proactive maintenance. AI-powered storage solutions reduce administrative overhead while improving performance and reliability through intelligent resource allocation and problem prevention.

Sustainability Focus Intensification drives demand for energy-efficient storage solutions and carbon-neutral data center operations. Organizations prioritize environmental impact reduction, creating market opportunities for vendors offering sustainable storage technologies and supporting Denmark’s climate objectives.

Edge Computing Proliferation creates demand for distributed storage architectures supporting real-time processing and reduced latency requirements. This trend necessitates compact, reliable storage solutions optimized for remote deployment and autonomous operation in diverse environmental conditions.

Ransomware Protection Enhancement becomes critical as cyber threats evolve, driving demand for immutable storage solutions, air-gapped backup systems, and rapid recovery capabilities. Organizations invest in comprehensive data protection strategies incorporating advanced storage security features and incident response capabilities.

Major Infrastructure Investments by international hyperscale operators establish significant storage capacity in Denmark, contributing to market growth and technology advancement. These investments demonstrate confidence in the Danish market while creating opportunities for local suppliers and service providers.

Government Digital Strategy Implementation drives public sector storage modernization initiatives, creating substantial market opportunities for vendors serving government requirements. These projects emphasize data sovereignty, security, and interoperability while supporting citizen service improvement objectives.

5G Network Deployment across Denmark creates demand for edge storage solutions supporting low-latency applications and distributed computing requirements. Telecommunications operators invest in storage infrastructure to support network functions virtualization and edge computing services.

Research Collaboration Initiatives between Danish universities, research institutions, and industry players accelerate storage technology development and innovation. These partnerships create opportunities for breakthrough technologies while supporting the country’s position as a technology innovation leader.

Sustainability Certification Programs gain importance as organizations seek to validate their environmental credentials and meet stakeholder expectations. Storage vendors develop comprehensive sustainability reporting and certification capabilities to support customer requirements and regulatory compliance.

Cybersecurity Enhancement Programs across industries drive demand for secure storage solutions incorporating advanced encryption, access controls, and audit capabilities. MarkWide Research analysis indicates that security features influence approximately 78% of storage purchasing decisions in Danish organizations.

Strategic Focus Areas for market participants should emphasize sustainability credentials, local support capabilities, and specialized solutions addressing Danish market requirements. Organizations should prioritize partnerships with local system integrators and managed service providers to enhance market penetration and customer support capabilities.

Technology Investment Priorities should focus on software-defined storage platforms, NVMe integration, and AI-powered management capabilities. These technologies provide competitive differentiation while addressing evolving customer requirements for performance, flexibility, and operational efficiency in storage infrastructure.

Market Entry Strategies for new participants should leverage Denmark’s position as a Nordic hub while building local presence and expertise. Successful market entry requires understanding of regulatory requirements, customer preferences, and competitive dynamics specific to the Danish business environment.

Customer Engagement Approaches should emphasize consultative selling, proof-of-concept demonstrations, and comprehensive support services. Danish customers value technical expertise, reliability, and long-term partnerships over purely transactional relationships, requiring vendors to invest in relationship building and customer success programs.

Innovation Development should focus on addressing specific Danish market needs including renewable energy integration, cold climate optimization, and regulatory compliance requirements. Vendors should collaborate with local research institutions and customers to develop solutions addressing unique market characteristics and requirements.

Market growth projections indicate continued expansion driven by digital transformation acceleration, cloud adoption, and emerging technology requirements. The market is expected to maintain robust growth rates exceeding 11% annually through the forecast period, supported by strong fundamentals and favorable market conditions.

Technology evolution will continue transforming storage capabilities, with emerging technologies including storage-class memory, computational storage, and quantum storage solutions beginning to impact market dynamics. Organizations must prepare for technology transitions while maximizing value from existing storage investments.

Sustainability requirements will increasingly influence storage procurement decisions as organizations align with Denmark’s carbon neutrality objectives. Vendors must develop comprehensive sustainability strategies encompassing product design, manufacturing processes, and end-of-life management to remain competitive in the evolving market landscape.

Edge computing expansion will create new market segments requiring specialized storage solutions optimized for distributed deployment and autonomous operation. This trend will drive innovation in compact, efficient storage systems while creating opportunities for new business models and service offerings.

Regulatory evolution will continue shaping market requirements, particularly regarding data sovereignty, privacy protection, and cybersecurity standards. MWR analysis suggests that regulatory compliance will influence approximately 85% of storage architecture decisions in the coming years, emphasizing the importance of flexible, compliant storage solutions.

The Denmark data center storage market presents exceptional opportunities for growth and innovation, supported by strong fundamentals including renewable energy leadership, advanced infrastructure, and favorable regulatory environment. The market’s sophisticated customer base and emphasis on sustainability create unique positioning advantages for vendors offering advanced, environmentally responsible storage solutions.

Strategic success factors include local market presence, sustainability credentials, and comprehensive support capabilities addressing Danish customer requirements. Organizations must balance technology innovation with practical implementation considerations while building long-term partnerships that support customer success and market expansion objectives.

Future market dynamics will be shaped by continued digital transformation, emerging technology adoption, and evolving regulatory requirements. Participants must remain agile and responsive to market changes while investing in capabilities that support long-term competitiveness and customer value creation in this dynamic and growing market segment.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store and manage data in data centers. This includes various storage solutions such as hard drives, solid-state drives, and cloud storage services that support enterprise data management and accessibility.

What are the key players in the Denmark Data Center Storage Market?

Key players in the Denmark Data Center Storage Market include companies like Dell Technologies, IBM, and NetApp, which provide a range of storage solutions and services tailored for data centers, among others.

What are the growth factors driving the Denmark Data Center Storage Market?

The Denmark Data Center Storage Market is driven by the increasing demand for data storage due to the rise of big data analytics, the growth of cloud computing, and the need for enhanced data security and compliance.

What challenges does the Denmark Data Center Storage Market face?

Challenges in the Denmark Data Center Storage Market include the high costs associated with advanced storage technologies, the complexity of data management, and the need for continuous upgrades to keep up with evolving data storage requirements.

What opportunities exist in the Denmark Data Center Storage Market?

Opportunities in the Denmark Data Center Storage Market include the expansion of hybrid cloud solutions, the increasing adoption of artificial intelligence for data management, and the growing focus on sustainable storage practices.

What trends are shaping the Denmark Data Center Storage Market?

Trends in the Denmark Data Center Storage Market include the shift towards software-defined storage, the integration of AI and machine learning for data optimization, and the increasing emphasis on data privacy and security measures.

Denmark Data Center Storage Market

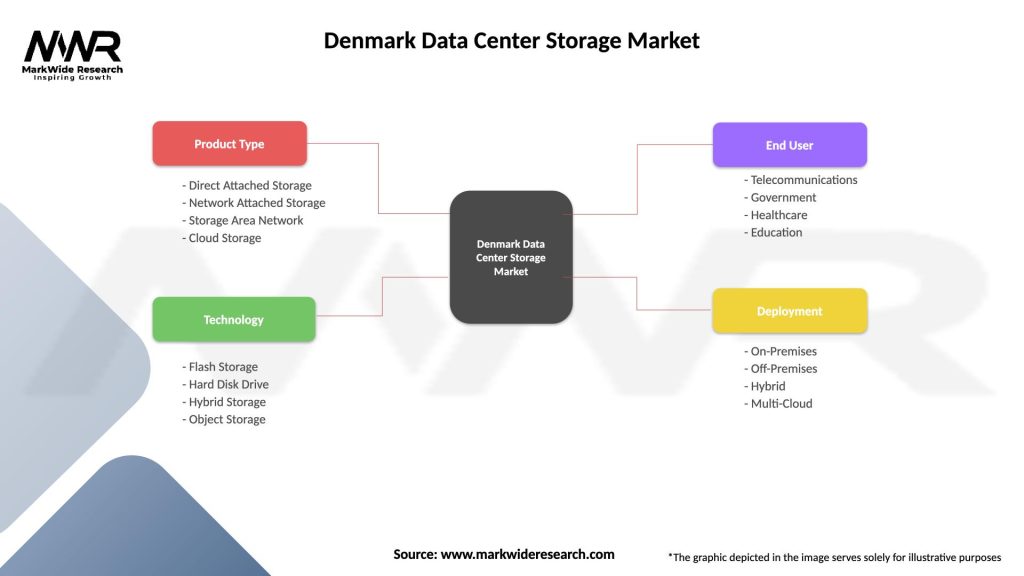

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Technology | Flash Storage, Hard Disk Drive, Hybrid Storage, Object Storage |

| End User | Telecommunications, Government, Healthcare, Education |

| Deployment | On-Premises, Off-Premises, Hybrid, Multi-Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Denmark Data Center Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at