444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Denmark data center physical security market represents a rapidly evolving sector driven by increasing digitalization, cloud adoption, and stringent data protection requirements across Danish enterprises. Denmark’s strategic position as a Nordic technology hub has accelerated demand for robust physical security solutions that protect critical data infrastructure from unauthorized access, environmental threats, and potential security breaches.

Market dynamics indicate substantial growth potential, with the sector experiencing a 12.3% compound annual growth rate as organizations prioritize comprehensive security frameworks. The integration of advanced technologies including biometric access controls, intelligent surveillance systems, and environmental monitoring solutions has transformed traditional data center security approaches into sophisticated, multi-layered protection ecosystems.

Danish enterprises are increasingly investing in physical security infrastructure to comply with GDPR regulations and meet international security standards. The market encompasses various security components including perimeter protection, access control systems, video surveillance, fire suppression systems, and environmental monitoring technologies that collectively ensure comprehensive data center protection.

Regional factors such as Denmark’s stable political environment, advanced telecommunications infrastructure, and commitment to renewable energy have attracted significant international data center investments, further driving demand for sophisticated physical security solutions across the country’s expanding digital infrastructure landscape.

The Denmark data center physical security market refers to the comprehensive ecosystem of hardware, software, and service solutions designed to protect data center facilities from physical threats, unauthorized access, and environmental hazards within the Danish territory. This market encompasses integrated security systems that safeguard critical IT infrastructure through multiple layers of protection.

Physical security solutions include perimeter defense systems, biometric access controls, video surveillance networks, intrusion detection systems, fire suppression technologies, and environmental monitoring platforms. These components work synergistically to create secure environments where sensitive data and critical computing resources remain protected from both external threats and internal security risks.

Market scope extends beyond traditional security measures to include intelligent automation, AI-powered threat detection, and integrated management platforms that provide real-time monitoring and response capabilities. Modern data center physical security encompasses both preventive measures and reactive systems that ensure business continuity and regulatory compliance.

Denmark’s data center physical security market demonstrates robust expansion driven by accelerating digital transformation initiatives and increasing cybersecurity awareness among Danish organizations. The market benefits from strong government support for digitalization, substantial foreign investment in data center infrastructure, and growing demand for cloud services across various industry sectors.

Key growth drivers include mandatory compliance with European data protection regulations, rising concerns about data breaches, and the need for comprehensive security frameworks that address both physical and logical threats. Organizations are investing heavily in integrated security solutions that provide 360-degree protection for their critical data assets.

Market segmentation reveals strong demand across multiple categories including access control systems, surveillance technologies, environmental monitoring, and fire suppression solutions. The integration of artificial intelligence and machine learning capabilities has enhanced threat detection accuracy by approximately 45%, making advanced security systems increasingly attractive to Danish data center operators.

Competitive landscape features both international security technology providers and specialized Danish companies offering localized solutions. The market’s future trajectory indicates continued growth supported by ongoing digital infrastructure investments and evolving security requirements across enterprise and colocation data center segments.

Strategic market insights reveal several critical trends shaping Denmark’s data center physical security landscape:

Market maturity varies across different security categories, with traditional surveillance systems showing steady growth while emerging technologies like behavioral analytics and predictive threat detection experience rapid adoption rates among forward-thinking Danish organizations.

Primary market drivers propelling Denmark’s data center physical security sector include escalating cybersecurity threats, stringent regulatory requirements, and increasing digitalization across Danish industries. Organizations recognize that comprehensive physical security forms the foundation of effective data protection strategies.

Regulatory compliance serves as a fundamental driver, with GDPR enforcement requiring organizations to implement robust security measures protecting personal data. Danish companies face significant penalties for data breaches, creating strong incentives for investing in comprehensive physical security infrastructure that demonstrates due diligence in data protection.

Digital transformation initiatives across Danish enterprises have increased reliance on data center infrastructure, making physical security investments critical for business continuity. The growing adoption of cloud services, IoT technologies, and digital business models has elevated the importance of secure data center environments.

International investment in Danish data center infrastructure has created demand for world-class security standards that meet global compliance requirements. Foreign companies establishing data center operations in Denmark require security solutions that align with international best practices and regulatory frameworks.

Threat landscape evolution continues driving security investments, with physical threats becoming more sophisticated and requiring advanced countermeasures. The integration of physical and cyber security approaches has become essential for comprehensive threat protection.

Market constraints affecting Denmark’s data center physical security sector include high implementation costs, complex integration requirements, and skills shortages in specialized security technologies. These challenges can slow adoption rates and limit market expansion in certain segments.

Capital investment requirements for comprehensive physical security systems can be substantial, particularly for smaller organizations with limited budgets. The need for integrated solutions spanning multiple security domains often requires significant upfront investments that may deter some potential adopters.

Technical complexity associated with modern security systems can create implementation challenges, requiring specialized expertise that may not be readily available in the Danish market. Integration with existing infrastructure and legacy systems often presents additional complications that increase project costs and timelines.

Regulatory uncertainty regarding emerging security technologies can slow adoption rates, as organizations prefer proven solutions with clear compliance pathways. The rapid evolution of security regulations may create hesitation among potential buyers waiting for regulatory clarity.

Vendor fragmentation in the security market can complicate procurement decisions, with organizations struggling to identify optimal solutions from numerous competing technologies and providers offering varying capabilities and integration approaches.

Significant opportunities exist within Denmark’s data center physical security market, driven by emerging technologies, expanding infrastructure requirements, and evolving security paradigms. The convergence of physical and cyber security creates new solution categories with substantial growth potential.

Artificial intelligence integration presents major opportunities for security solution providers, with AI-powered threat detection and automated response systems showing exceptional market potential. Danish organizations increasingly seek intelligent security platforms that reduce manual monitoring requirements while improving threat detection accuracy.

Edge computing expansion creates new security requirements for distributed data center infrastructure, opening opportunities for scalable, remotely managed security solutions. The proliferation of edge facilities requires cost-effective security approaches that maintain high protection standards.

Sustainability initiatives offer opportunities for energy-efficient security solutions that align with Denmark’s environmental goals. Green security technologies that reduce power consumption while maintaining effectiveness appeal to environmentally conscious Danish organizations.

Service-based models including Security-as-a-Service offerings present opportunities for recurring revenue streams and reduced customer capital expenditure requirements. Managed security services can address skills shortages while providing comprehensive protection.

Market dynamics within Denmark’s data center physical security sector reflect the interplay between technological advancement, regulatory requirements, and evolving threat landscapes. The market demonstrates strong momentum driven by increasing security awareness and substantial infrastructure investments.

Technology convergence represents a key dynamic, with traditional physical security systems integrating with IT infrastructure and cybersecurity platforms. This convergence creates more comprehensive security ecosystems but also increases complexity and integration requirements for end users.

Competitive intensity continues increasing as both established security vendors and emerging technology companies compete for market share. Innovation cycles have accelerated, with new security technologies reaching market maturity more rapidly than in previous years.

Customer expectations have evolved significantly, with Danish organizations demanding integrated solutions that provide centralized management, automated responses, and predictive capabilities. The shift toward proactive security approaches has influenced product development priorities across the vendor ecosystem.

Investment patterns show increasing focus on scalable, future-ready security architectures that can adapt to changing requirements. Organizations prioritize solutions offering flexibility and upgrade paths rather than point solutions with limited expansion capabilities.

Comprehensive research methodology employed for analyzing Denmark’s data center physical security market incorporates multiple data collection approaches, industry expert interviews, and quantitative analysis techniques to ensure accurate market assessment and reliable insights.

Primary research includes structured interviews with key stakeholders across the Danish data center ecosystem, including facility operators, security vendors, system integrators, and end-user organizations. These interviews provide qualitative insights into market trends, challenges, and growth opportunities.

Secondary research encompasses analysis of industry reports, regulatory documents, company financial statements, and technology specifications to validate primary findings and establish quantitative market parameters. Government statistics and industry association data provide additional market context.

Market modeling utilizes statistical analysis techniques to project market trends and identify growth patterns across different security categories and customer segments. Regression analysis and time-series forecasting support quantitative market projections.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. Quality assurance protocols maintain research integrity throughout the analysis process.

Regional distribution within Denmark’s data center physical security market shows concentration in major metropolitan areas, with Copenhagen region accounting for approximately 58% market share due to high data center density and enterprise headquarters locations.

Greater Copenhagen serves as the primary market hub, hosting numerous international data center facilities and major Danish enterprises requiring sophisticated security solutions. The region benefits from excellent telecommunications infrastructure and proximity to international connectivity points.

Aarhus region represents the second-largest market segment, capturing approximately 22% market share through growing technology sector presence and expanding data center infrastructure. The region’s universities and research institutions drive demand for advanced security technologies.

Odense and Aalborg markets show steady growth supported by regional business centers and distributed data center requirements. These markets typically favor cost-effective security solutions while maintaining compliance with national security standards.

Rural areas present emerging opportunities for edge data center security solutions, with distributed infrastructure requirements creating demand for remotely managed security systems. According to MarkWide Research analysis, rural market segments show accelerating growth potential driven by digital infrastructure expansion.

Competitive environment within Denmark’s data center physical security market features diverse participants ranging from global security technology leaders to specialized Danish solution providers offering localized expertise and support services.

Market positioning strategies vary significantly, with some vendors focusing on comprehensive integrated platforms while others specialize in specific security domains. Danish companies like Milestone Systems leverage local market knowledge and regulatory expertise to compete effectively against international providers.

Innovation focus areas include AI-powered analytics, cloud-based management platforms, and sustainable security technologies that align with Danish environmental priorities. Competitive differentiation increasingly depends on solution integration capabilities and local support services.

Market segmentation analysis reveals distinct categories within Denmark’s data center physical security market, each with unique characteristics, growth patterns, and customer requirements that influence vendor strategies and solution development priorities.

By Component:

By Data Center Type:

By Organization Size:

Access control systems represent the largest market category, driven by increasing adoption of biometric authentication and multi-factor access controls. Danish organizations prioritize sophisticated access management that provides detailed audit trails and supports compliance requirements.

Video surveillance solutions show strong growth momentum, with intelligent analytics capabilities gaining widespread adoption. The integration of AI-powered video analysis has improved threat detection effectiveness by approximately 38%, making advanced surveillance systems increasingly valuable for Danish data center operators.

Environmental monitoring systems experience accelerating demand due to increasing focus on equipment protection and energy efficiency. Danish data centers prioritize comprehensive environmental controls that support both security objectives and sustainability goals.

Perimeter security solutions demonstrate steady growth, with organizations investing in layered defense approaches that combine physical barriers with electronic detection systems. The emphasis on comprehensive perimeter protection reflects growing security awareness among Danish enterprises.

Fire suppression systems maintain consistent demand driven by regulatory requirements and insurance considerations. Advanced suppression technologies that minimize environmental impact while providing effective fire protection align with Danish sustainability priorities.

Industry participants within Denmark’s data center physical security market realize substantial benefits through comprehensive security investments that enhance operational efficiency, regulatory compliance, and business continuity capabilities.

Data Center Operators benefit from reduced security incidents, improved compliance posture, and enhanced customer confidence. Comprehensive physical security systems provide operational efficiency gains through automated monitoring and reduced manual security requirements.

Enterprise Customers gain peace of mind through robust data protection, regulatory compliance assurance, and business continuity protection. Physical security investments demonstrate due diligence in data protection and support corporate risk management objectives.

Security Vendors access growing market opportunities driven by increasing security awareness and regulatory requirements. The Danish market offers stable demand patterns and customers willing to invest in advanced security technologies.

System Integrators benefit from complex integration projects that require specialized expertise and ongoing support services. The trend toward comprehensive security platforms creates opportunities for value-added services and long-term customer relationships.

Government Stakeholders achieve improved national cybersecurity posture through enhanced critical infrastructure protection. Strong data center security supports Denmark’s digital economy objectives and international competitiveness in technology sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping Denmark’s data center physical security market reflect broader technology evolution, changing threat landscapes, and evolving customer expectations for comprehensive, intelligent security solutions.

Artificial Intelligence Integration represents the most significant trend, with AI-powered security systems providing enhanced threat detection, automated response capabilities, and predictive analytics. Danish organizations increasingly seek intelligent security platforms that reduce manual monitoring while improving accuracy.

Cloud-Based Security Management gains momentum as organizations prefer centralized, remotely accessible security platforms. Cloud-based solutions offer scalability, reduced infrastructure requirements, and simplified management that appeals to Danish enterprises.

Biometric Authentication Expansion continues accelerating, with advanced biometric technologies replacing traditional access control methods. Multi-modal biometric systems provide enhanced security while improving user experience and audit capabilities.

Sustainability Integration becomes increasingly important, with Danish organizations prioritizing energy-efficient security solutions that align with environmental goals. Green security technologies that reduce power consumption gain competitive advantages.

Zero Trust Architecture adoption influences physical security design, with organizations implementing layered security approaches that verify every access request regardless of location or user credentials.

Recent industry developments within Denmark’s data center physical security market demonstrate accelerating innovation, strategic partnerships, and technology advancement that reshape competitive dynamics and customer expectations.

Technology Partnerships between security vendors and data center operators have increased, creating integrated solutions that combine multiple security domains into comprehensive platforms. These partnerships accelerate innovation and improve solution effectiveness.

Regulatory Updates continue influencing market development, with new security standards and compliance requirements driving technology adoption. Danish authorities actively promote cybersecurity best practices that include physical security components.

Investment Activities in Danish data center infrastructure have intensified, with international companies establishing facilities that require world-class security standards. These investments drive demand for sophisticated security solutions.

Product Launches featuring AI-powered analytics, cloud-based management, and sustainable technologies address evolving customer requirements. Vendors increasingly focus on integrated platforms rather than point solutions.

Acquisition Activities among security vendors create larger, more comprehensive solution providers capable of addressing complex customer requirements. Market consolidation trends influence competitive dynamics and customer choice.

Strategic recommendations for stakeholders in Denmark’s data center physical security market emphasize the importance of comprehensive planning, technology integration, and long-term security architecture development that addresses evolving threats and requirements.

For Data Center Operators: Invest in integrated security platforms that combine multiple protection domains while providing centralized management capabilities. Prioritize solutions offering scalability and future upgrade paths to accommodate changing requirements.

For Security Vendors: Focus on developing comprehensive platforms rather than point solutions, emphasizing AI integration and cloud-based management capabilities. Establish strong local partnerships to address Danish market requirements effectively.

For Enterprise Customers: Develop comprehensive security strategies that align physical and cyber security approaches. Consider managed security services to address skills shortages while maintaining high protection standards.

For System Integrators: Build expertise in emerging technologies including AI analytics and cloud-based security management. Develop service capabilities that support ongoing security operations and maintenance requirements.

For Government Stakeholders: Continue promoting cybersecurity awareness and best practices while supporting industry development through favorable policies and infrastructure investments that enhance Denmark’s competitive position.

Future prospects for Denmark’s data center physical security market appear highly favorable, with multiple growth drivers supporting sustained expansion and technology advancement over the coming years. MWR projections indicate continued market momentum driven by increasing digitalization and security awareness.

Technology evolution will continue reshaping market dynamics, with artificial intelligence, machine learning, and automation becoming standard components of comprehensive security solutions. The integration of physical and cyber security approaches will accelerate, creating more holistic protection frameworks.

Market expansion is expected across all customer segments, with small and medium enterprises increasingly adopting sophisticated security solutions previously reserved for large organizations. Service-based delivery models will make advanced security technologies more accessible to broader market segments.

Regulatory developments will continue driving security investments, with evolving compliance requirements creating ongoing demand for security system updates and enhancements. Danish organizations will maintain focus on comprehensive security approaches that address multiple regulatory frameworks.

Innovation acceleration will bring new security technologies to market more rapidly, with vendors competing on integration capabilities, intelligence features, and sustainability characteristics. The market will favor solutions that provide comprehensive protection while minimizing environmental impact and operational complexity.

Growth projections suggest the market will maintain robust expansion, with compound annual growth rates exceeding 11% through 2028 as digital transformation initiatives continue driving security infrastructure investments across Danish organizations.

Denmark’s data center physical security market represents a dynamic and rapidly expanding sector characterized by strong growth fundamentals, technological innovation, and increasing customer sophistication. The market benefits from favorable regulatory environment, substantial infrastructure investments, and growing security awareness among Danish organizations.

Key success factors for market participants include comprehensive solution development, strong local partnerships, and focus on emerging technologies that address evolving customer requirements. The integration of artificial intelligence, cloud-based management, and sustainable technologies will continue driving competitive differentiation and market growth.

Strategic opportunities abound for vendors, integrators, and service providers willing to invest in advanced capabilities and local market development. The Danish market’s emphasis on quality, compliance, and long-term relationships creates favorable conditions for companies committed to comprehensive customer support and ongoing innovation.

Market outlook remains highly positive, with multiple growth drivers supporting sustained expansion across all customer segments and security categories. The convergence of physical and cyber security approaches, combined with increasing digitalization, ensures continued demand for sophisticated security solutions that protect Denmark’s critical data infrastructure.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

What are the key players in the Denmark Data Center Physical Security Market?

Key players in the Denmark Data Center Physical Security Market include companies like Schneider Electric, Cisco Systems, and IBM, which provide various security solutions and technologies for data centers, among others.

What are the main drivers of growth in the Denmark Data Center Physical Security Market?

The main drivers of growth in the Denmark Data Center Physical Security Market include the increasing frequency of cyber threats, the rising demand for data storage, and the need for compliance with data protection regulations.

What challenges does the Denmark Data Center Physical Security Market face?

Challenges in the Denmark Data Center Physical Security Market include the high costs associated with advanced security technologies, the complexity of integrating various security systems, and the evolving nature of security threats.

What opportunities exist in the Denmark Data Center Physical Security Market?

Opportunities in the Denmark Data Center Physical Security Market include the adoption of AI and machine learning for enhanced security analytics, the growth of cloud computing requiring robust security measures, and the increasing focus on sustainability in security practices.

What trends are shaping the Denmark Data Center Physical Security Market?

Trends shaping the Denmark Data Center Physical Security Market include the integration of IoT devices for real-time monitoring, the shift towards remote management of security systems, and the emphasis on physical security as part of a broader cybersecurity strategy.

Denmark Data Center Physical Security Market

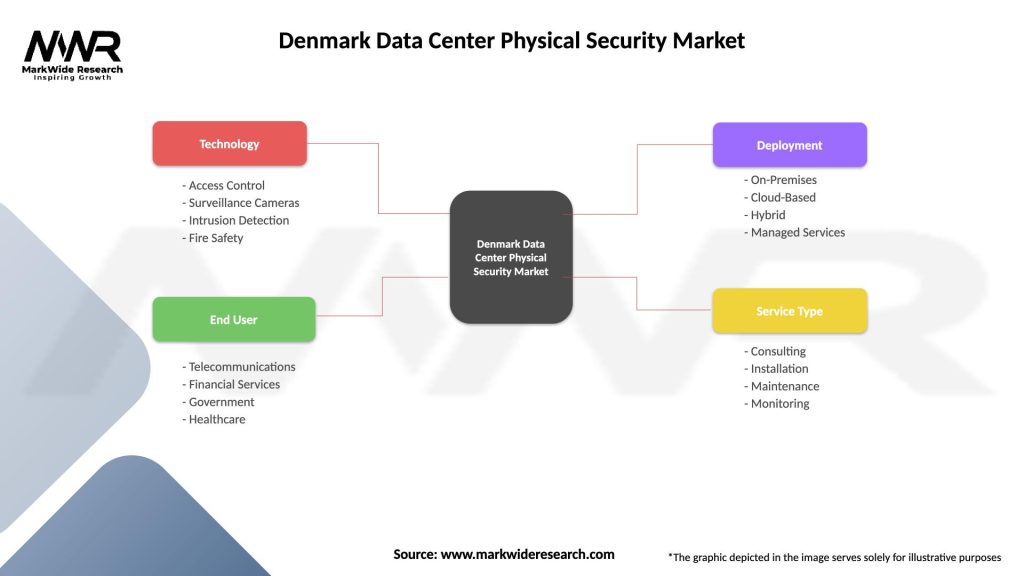

| Segmentation Details | Description |

|---|---|

| Technology | Access Control, Surveillance Cameras, Intrusion Detection, Fire Safety |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Service Type | Consulting, Installation, Maintenance, Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Denmark Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at