444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Denmark data center construction market represents a rapidly evolving sector driven by increasing digitalization, cloud adoption, and stringent sustainability requirements. Denmark’s strategic position as a Nordic technology hub, combined with its commitment to renewable energy and favorable climate conditions, has positioned the country as an attractive destination for data center investments. The market is experiencing robust growth with a projected CAGR of 8.2% through 2030, reflecting the nation’s digital transformation initiatives and increasing demand for edge computing solutions.

Key market characteristics include Denmark’s advanced telecommunications infrastructure, stable political environment, and progressive regulatory framework that supports digital innovation. The country’s abundant renewable energy resources, particularly wind power, make it an ideal location for energy-intensive data center operations. Major international players are increasingly recognizing Denmark’s potential, leading to significant investments in hyperscale facilities and colocation services.

Geographic advantages such as Denmark’s proximity to major European markets, excellent submarine cable connectivity, and cool climate conditions that reduce cooling costs contribute to the market’s attractiveness. The government’s digital agenda and support for Industry 4.0 initiatives further strengthen the foundation for sustained market growth in the data center construction sector.

The Denmark data center construction market refers to the comprehensive ecosystem encompassing the planning, design, construction, and deployment of data center facilities across Denmark. This market includes various facility types ranging from enterprise data centers and colocation facilities to hyperscale cloud infrastructure and edge computing nodes. Construction activities involve specialized building techniques, advanced cooling systems, power infrastructure, and security implementations tailored to meet the unique requirements of digital infrastructure.

Market participants include construction companies, engineering firms, technology integrators, facility management providers, and equipment suppliers who collaborate to deliver state-of-the-art data center solutions. The sector encompasses both greenfield developments and brownfield conversions, with emphasis on energy efficiency, sustainability, and scalability to meet evolving business requirements.

Technological integration within this market involves implementing cutting-edge solutions such as modular construction techniques, advanced power distribution systems, intelligent cooling technologies, and comprehensive monitoring platforms that ensure optimal performance and reliability of data center operations.

Denmark’s data center construction market is experiencing unprecedented growth driven by digital transformation initiatives, cloud migration trends, and increasing demand for low-latency computing solutions. The market benefits from Denmark’s strategic advantages including renewable energy abundance, favorable climate conditions, and robust telecommunications infrastructure that supports next-generation data center development.

Market dynamics indicate strong investment momentum with 65% of new projects focusing on sustainable construction practices and energy-efficient designs. The sector is characterized by increasing adoption of modular construction approaches, advanced cooling technologies, and integrated renewable energy solutions that align with Denmark’s carbon neutrality goals.

Key growth drivers include the expansion of cloud services, proliferation of IoT applications, increasing data sovereignty requirements, and the need for edge computing infrastructure to support emerging technologies. Regional distribution shows concentration in the Greater Copenhagen area and strategic locations near renewable energy sources and submarine cable landing points.

Future prospects remain highly positive with anticipated growth in hyperscale facilities, edge data centers, and specialized facilities supporting artificial intelligence and machine learning workloads. The market’s evolution toward sustainable and efficient infrastructure positions Denmark as a leading destination for data center investments in Northern Europe.

Strategic market insights reveal several critical trends shaping the Denmark data center construction landscape:

Primary market drivers propelling the Denmark data center construction market include the accelerating digital transformation across industries and increasing cloud adoption rates. Enterprise digitalization initiatives are creating substantial demand for reliable, scalable data center infrastructure that can support modern business operations and emerging technologies.

Renewable energy abundance serves as a significant competitive advantage, with Denmark’s wind power capacity providing sustainable energy solutions that attract environmentally conscious organizations and hyperscale operators. The country’s commitment to achieving carbon neutrality creates a favorable environment for green data center investments and sustainable construction practices.

Geographic positioning as a gateway to Nordic markets and proximity to major European business centers drives demand for data center facilities that can serve regional and international customers. Submarine cable infrastructure connecting Denmark to global networks enhances the country’s appeal as a strategic data center location.

Government initiatives supporting digital infrastructure development, including favorable regulatory frameworks and investment incentives, create an enabling environment for market growth. Industry 4.0 adoption across manufacturing, logistics, and other sectors generates increasing demand for edge computing capabilities and localized data processing solutions.

Market constraints affecting the Denmark data center construction sector include high initial capital requirements and complex regulatory compliance processes. Construction costs in Denmark are generally higher compared to other European markets, potentially impacting project economics and return on investment calculations for some operators.

Skilled labor availability presents challenges as the specialized nature of data center construction requires experienced professionals in areas such as critical infrastructure design, advanced cooling systems, and high-voltage electrical installations. Competition for talent with other construction sectors and neighboring countries can impact project timelines and costs.

Land availability in prime locations, particularly near existing infrastructure and renewable energy sources, may become increasingly limited as market demand grows. Zoning restrictions and environmental considerations can complicate site selection and development processes for new data center projects.

Technology evolution creates ongoing challenges as rapid changes in computing requirements, cooling technologies, and efficiency standards may require frequent infrastructure updates and modifications. Grid capacity limitations in certain regions may constrain the development of large-scale facilities without significant utility infrastructure investments.

Significant opportunities exist in the Denmark data center construction market through the development of specialized facilities supporting artificial intelligence, machine learning, and high-performance computing applications. AI infrastructure demand is creating requirements for purpose-built facilities with enhanced cooling capabilities and specialized power distribution systems.

Edge computing expansion presents substantial growth potential as 5G network deployment and IoT proliferation drive demand for distributed computing infrastructure. Micro data centers and edge facilities positioned strategically across Denmark can capture this emerging market segment and provide low-latency services to end users.

Sustainability innovation offers opportunities for companies that can deliver cutting-edge green construction solutions, including advanced cooling technologies, renewable energy integration, and circular economy principles. Carbon-neutral facilities are becoming increasingly important for attracting environmentally conscious customers and meeting corporate sustainability goals.

International expansion opportunities exist for Danish construction companies and technology providers to leverage their expertise in sustainable data center development for projects in other Nordic countries and European markets. Export potential for innovative construction techniques and energy-efficient solutions can drive additional revenue streams and market growth.

Market dynamics in the Denmark data center construction sector reflect the interplay between technological advancement, regulatory requirements, and evolving customer demands. Supply chain optimization has become increasingly important as global component shortages and logistics challenges impact project timelines and costs.

Competitive pressures are intensifying as international construction firms and technology providers enter the Danish market, bringing advanced capabilities and competitive pricing. Local partnerships between international players and Danish companies are becoming common strategies to navigate regulatory requirements and leverage local expertise.

Technology integration is accelerating with 42% of new projects incorporating advanced automation systems, predictive maintenance capabilities, and intelligent infrastructure management platforms. Digital twin technology adoption is growing, enabling better design optimization, construction planning, and operational efficiency.

Customer expectations continue to evolve toward higher reliability standards, improved energy efficiency, and enhanced security features. Service level agreements are becoming more stringent, requiring construction companies to deliver facilities that meet demanding uptime and performance requirements from day one of operations.

Comprehensive research methodology employed for analyzing the Denmark data center construction market combines primary and secondary research approaches to ensure accuracy and reliability of market insights. Primary research includes structured interviews with industry executives, construction professionals, technology providers, and end-user organizations to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market baselines and validate primary research findings. Data triangulation techniques ensure consistency and reliability across multiple information sources.

Market modeling utilizes advanced analytical frameworks to project growth trends, assess competitive dynamics, and evaluate market opportunities. Quantitative analysis includes statistical modeling of market drivers, correlation analysis of key variables, and scenario planning for different growth trajectories.

Expert validation processes involve review of research findings by industry specialists and academic experts to ensure accuracy and relevance. Continuous monitoring of market developments and regular updates to research findings maintain the currency and reliability of market intelligence throughout the analysis period.

Regional distribution across Denmark shows distinct patterns with the Greater Copenhagen region commanding approximately 55% market share due to its concentration of businesses, excellent connectivity, and proximity to submarine cable landing points. Zealand region benefits from strategic positioning and access to renewable energy sources, making it attractive for large-scale data center developments.

Jutland peninsula is emerging as a significant growth area with 28% of new project investments focusing on locations near wind energy installations and industrial clusters. Western Jutland particularly benefits from abundant wind resources and available land for hyperscale facility development.

Funen region represents a growing market segment with strategic advantages including central location, transportation connectivity, and competitive land costs. Regional development initiatives are supporting infrastructure improvements and attracting data center investments to diversify the local economy.

Northern Denmark is experiencing increased interest from operators seeking locations with optimal cooling conditions and renewable energy access. Cross-border connectivity with Sweden and Norway creates additional opportunities for facilities serving broader Nordic markets and international customers.

Competitive landscape in the Denmark data center construction market features a mix of international construction giants, specialized data center contractors, and local engineering firms. Market leadership is distributed among several key players who bring different strengths and capabilities to the sector.

Strategic partnerships between construction companies and technology providers are becoming increasingly common to deliver integrated solutions that meet evolving customer requirements and technical specifications.

Market segmentation analysis reveals distinct categories based on facility type, construction approach, and target customer segments. By Facility Type: The market encompasses hyperscale data centers, colocation facilities, enterprise data centers, and edge computing nodes, each with specific construction requirements and market dynamics.

By Construction Approach: Segmentation includes traditional stick-built construction, modular/prefabricated solutions, and hybrid approaches that combine different construction methodologies. Modular construction is gaining 35% adoption rate due to faster deployment times and cost efficiencies.

By Power Capacity: Facilities are categorized into small-scale (under 1MW), medium-scale (1-10MW), and large-scale (over 10MW) installations, with different construction requirements and market positioning strategies.

By End-User Segment: Market segmentation includes cloud service providers, telecommunications companies, financial services, government agencies, and enterprise customers, each with distinct requirements for security, compliance, and performance specifications.

By Technology Focus: Specialized segments include AI/ML facilities, high-performance computing centers, edge computing nodes, and general-purpose data centers, reflecting the diversification of computing requirements across different applications and industries.

Hyperscale facilities represent the fastest-growing category with significant investment momentum from major cloud providers seeking to establish regional presence in Denmark. Construction characteristics include large floor plates, high-density power distribution, and advanced cooling systems designed for maximum efficiency and scalability.

Colocation centers continue to show steady growth as enterprises seek flexible, cost-effective alternatives to building dedicated facilities. Multi-tenant designs require sophisticated security systems, flexible space configurations, and diverse connectivity options to serve various customer requirements.

Edge data centers are emerging as a high-growth category driven by 5G deployment and IoT applications requiring low-latency processing capabilities. Distributed deployment strategies focus on smaller facilities positioned strategically across urban and industrial areas.

Enterprise facilities remain important for organizations with specific security, compliance, or performance requirements that cannot be met through shared infrastructure. Custom construction approaches address unique business needs and regulatory requirements across different industry sectors.

Specialized facilities supporting artificial intelligence, machine learning, and high-performance computing applications represent emerging opportunities with unique construction requirements including enhanced cooling capabilities and specialized power infrastructure.

Construction companies benefit from the growing data center market through access to high-value, technically complex projects that showcase advanced capabilities and generate substantial revenue streams. Specialization opportunities in critical infrastructure construction create competitive advantages and premium pricing potential.

Technology providers gain opportunities to integrate cutting-edge solutions including advanced cooling systems, power management technologies, and intelligent infrastructure platforms. Partnership opportunities with construction firms enable comprehensive solution delivery and expanded market reach.

End-user organizations benefit from access to world-class data center infrastructure that supports digital transformation initiatives, improves operational efficiency, and enables adoption of emerging technologies. Sustainability benefits align with corporate environmental goals and regulatory compliance requirements.

Local communities benefit from job creation, economic development, and infrastructure improvements associated with data center construction projects. Tax revenue generation and indirect economic benefits support regional development and public services.

Government stakeholders benefit from enhanced digital infrastructure that supports economic competitiveness, attracts international investment, and advances national digitalization objectives. Strategic positioning as a regional technology hub creates long-term economic advantages.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the Denmark data center construction market, with 78% of new projects incorporating renewable energy systems and advanced energy efficiency measures. Green building certifications are becoming standard requirements as organizations prioritize environmental responsibility and regulatory compliance.

Modular construction adoption is accelerating as operators seek faster deployment times and improved cost predictability. Prefabricated solutions enable parallel construction activities, reduced on-site labor requirements, and enhanced quality control through factory-based manufacturing processes.

Artificial intelligence integration is transforming both construction processes and facility operations through predictive analytics, automated systems management, and intelligent infrastructure optimization. Smart building technologies enable real-time monitoring, predictive maintenance, and dynamic resource allocation.

Edge computing proliferation is driving demand for distributed data center infrastructure positioned closer to end users and connected devices. Micro data centers and containerized solutions are becoming popular for edge deployments requiring rapid deployment and flexible configurations.

Liquid cooling adoption is increasing as high-density computing requirements exceed the capabilities of traditional air cooling systems. Advanced cooling technologies including immersion cooling and direct-to-chip solutions are becoming more prevalent in specialized applications.

Recent industry developments highlight the dynamic nature of the Denmark data center construction market and emerging trends shaping its future direction. Major cloud providers have announced significant expansion plans, including new hyperscale facilities and regional infrastructure investments that will drive construction activity.

Government initiatives supporting digital infrastructure development include updated planning guidelines, streamlined permitting processes, and investment incentives for sustainable construction projects. Regulatory frameworks are evolving to address data sovereignty requirements and environmental standards.

Technology partnerships between construction companies and equipment manufacturers are creating integrated solutions that combine advanced building techniques with cutting-edge infrastructure technologies. Innovation collaborations focus on developing next-generation cooling systems, energy management platforms, and automated construction processes.

International investments from global data center operators and real estate investment trusts are increasing market competition and driving innovation in construction approaches and facility designs. Cross-border partnerships are facilitating knowledge transfer and best practice sharing across Nordic markets.

Sustainability certifications and green building standards are becoming increasingly important for project approval and customer acceptance. Industry standards are evolving to address emerging requirements for carbon neutrality, circular economy principles, and lifecycle environmental impact assessment.

Strategic recommendations for market participants include focusing on sustainability leadership and developing specialized capabilities in green construction technologies. MarkWide Research analysis suggests that companies investing in renewable energy integration and energy efficiency solutions will gain competitive advantages in the evolving market landscape.

Partnership strategies should emphasize collaboration between construction firms, technology providers, and renewable energy companies to deliver comprehensive solutions that meet customer requirements for sustainability and performance. Integrated service offerings combining construction, commissioning, and ongoing maintenance services can create additional value streams.

Geographic expansion opportunities exist for companies that can leverage Danish expertise in sustainable data center construction for projects in other Nordic countries and European markets. Export potential for innovative construction techniques and energy-efficient solutions represents significant growth opportunities.

Technology investment in areas such as modular construction, advanced cooling systems, and intelligent infrastructure management will be critical for maintaining competitiveness. Digital transformation of construction processes through BIM, digital twins, and automated project management systems can improve efficiency and reduce costs.

Talent development initiatives should focus on building specialized skills in critical infrastructure construction, sustainable building practices, and emerging technologies. Training programs and certification processes can help address skilled labor shortages and maintain quality standards.

Future market prospects for the Denmark data center construction sector remain highly positive with sustained growth expected through 2030 and beyond. Digital transformation acceleration across industries will continue driving demand for advanced data center infrastructure capable of supporting emerging technologies and evolving business requirements.

Sustainability requirements will become increasingly stringent, creating opportunities for companies that can deliver carbon-neutral facilities and innovative green construction solutions. Circular economy principles will influence design approaches, material selection, and construction methodologies throughout the market.

Edge computing expansion is projected to account for 40% of new facility deployments by 2028 as 5G networks mature and IoT applications proliferate. Distributed infrastructure requirements will create new market segments and construction approaches tailored to smaller, more numerous facilities.

Artificial intelligence integration will transform both construction processes and facility operations, enabling predictive maintenance, automated systems management, and dynamic resource optimization. Smart infrastructure capabilities will become standard requirements for new data center developments.

International competitiveness of the Danish market will strengthen as renewable energy advantages, technical expertise, and strategic positioning create compelling value propositions for global data center operators and their customers seeking sustainable, reliable infrastructure solutions.

Denmark’s data center construction market represents a dynamic and rapidly evolving sector positioned for sustained growth through the convergence of digital transformation, sustainability leadership, and strategic geographic advantages. The market’s foundation built on renewable energy abundance, technical expertise, and supportive regulatory frameworks creates compelling opportunities for construction companies, technology providers, and end-user organizations.

Key success factors include embracing sustainability innovation, developing specialized capabilities in critical infrastructure construction, and forming strategic partnerships that enable comprehensive solution delivery. MWR analysis indicates that companies focusing on green construction technologies, modular approaches, and advanced cooling solutions will capture the greatest market opportunities.

Future growth trajectory will be shaped by emerging trends including edge computing proliferation, artificial intelligence infrastructure requirements, and increasingly stringent environmental standards. The market’s evolution toward distributed, intelligent, and sustainable infrastructure positions Denmark as a leading destination for next-generation data center investments in Northern Europe and beyond.

What is Data Center Construction?

Data Center Construction refers to the process of building facilities that house computer systems and associated components, such as telecommunications and storage systems. These constructions are critical for supporting cloud computing, data storage, and processing needs across various industries.

What are the key players in the Denmark Data Center Construction Market?

Key players in the Denmark Data Center Construction Market include companies like A.P. Moller-Maersk, NCC Group, and Caverion. These firms are involved in various aspects of data center construction, including design, engineering, and project management, among others.

What are the growth factors driving the Denmark Data Center Construction Market?

The Denmark Data Center Construction Market is driven by factors such as the increasing demand for cloud services, the rise of big data analytics, and the need for enhanced data security. Additionally, Denmark’s favorable regulatory environment and commitment to sustainability further boost market growth.

What challenges does the Denmark Data Center Construction Market face?

Challenges in the Denmark Data Center Construction Market include high construction costs, regulatory compliance issues, and the need for skilled labor. Additionally, the environmental impact of large data centers poses significant challenges for developers.

What opportunities exist in the Denmark Data Center Construction Market?

Opportunities in the Denmark Data Center Construction Market include the expansion of renewable energy sources for powering data centers and the increasing trend of edge computing. These developments can lead to more efficient and sustainable data center operations.

What trends are shaping the Denmark Data Center Construction Market?

Trends in the Denmark Data Center Construction Market include the adoption of modular construction techniques, the integration of advanced cooling technologies, and a focus on energy efficiency. These trends are essential for meeting the growing demands of data processing and storage.

Denmark Data Center Construction Market

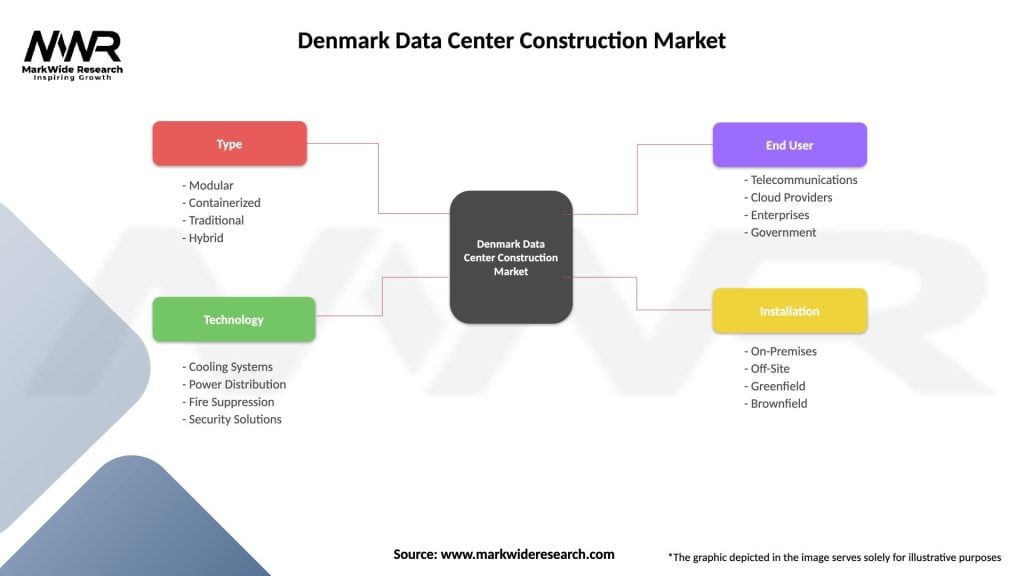

| Segmentation Details | Description |

|---|---|

| Type | Modular, Containerized, Traditional, Hybrid |

| Technology | Cooling Systems, Power Distribution, Fire Suppression, Security Solutions |

| End User | Telecommunications, Cloud Providers, Enterprises, Government |

| Installation | On-Premises, Off-Site, Greenfield, Brownfield |

Please note: The segmentation can be entirely customized to align with our client’s needs.

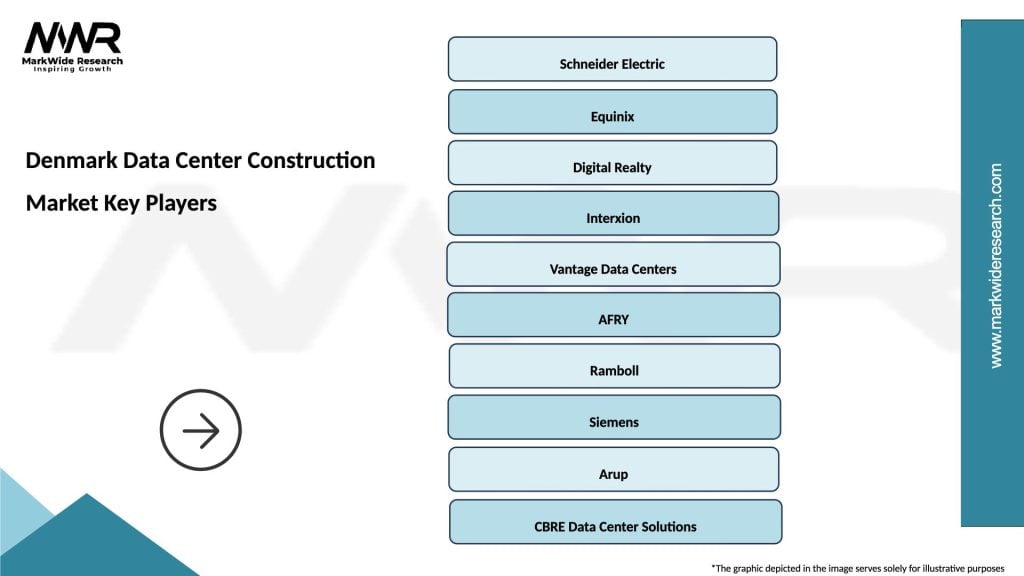

Leading companies in the Denmark Data Center Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at