444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The delivery robot market has witnessed significant growth in recent years, driven by advancements in technology and the increasing demand for efficient and cost-effective delivery solutions. Delivery robots, also known as autonomous delivery robots or autonomous mobile robots (AMRs), are designed to transport goods from one location to another without the need for human intervention. These robots have the potential to revolutionize the logistics and e-commerce industries by offering faster and more reliable delivery services.

Meaning

Delivery robots are autonomous vehicles equipped with sensors, cameras, and artificial intelligence (AI) algorithms to navigate their surroundings and safely deliver packages. They can operate in various environments, including sidewalks, roads, and even indoor spaces like warehouses and hospitals. These robots are capable of avoiding obstacles, following designated routes, and interacting with humans to complete their delivery tasks efficiently.

Executive Summary

The delivery robot market is experiencing significant growth due to the rising demand for contactless delivery options, especially in the wake of the COVID-19 pandemic. These robots offer a safer and more hygienic delivery solution, reducing human contact and minimizing the risk of transmission of infectious diseases. Moreover, the integration of advanced technologies like AI and machine learning enables delivery robots to optimize their routes, enhance efficiency, and improve overall customer experience.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

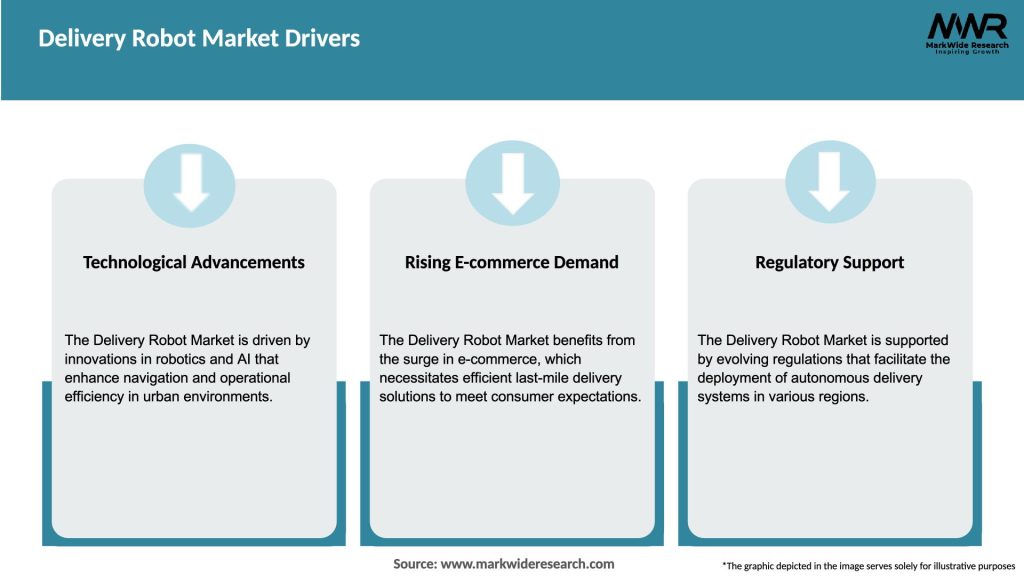

Market Drivers

The delivery robot market is primarily driven by the following factors:

Market Restraints

Despite the positive growth prospects, the delivery robot market faces certain challenges:

Market Opportunities

The delivery robot market presents several opportunities for growth and innovation:

Market Dynamics

The delivery robot market is characterized by intense competition and continuous technological advancements. Key dynamics shaping the market include:

Regional Analysis

The delivery robot market exhibits a global presence, with significant regional variations:

Competitive Landscape

Leading Companies in the Delivery Robot Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

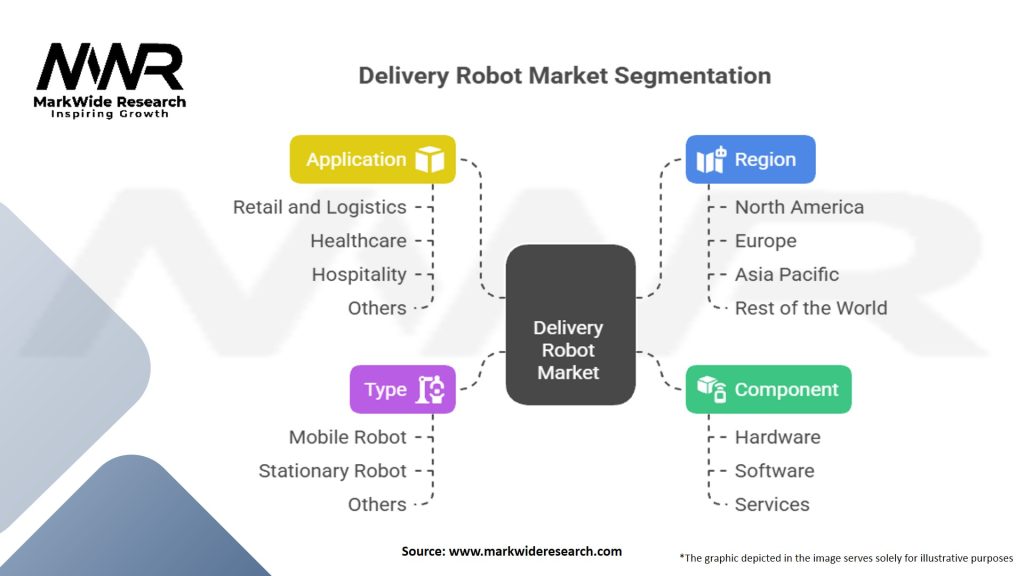

Segmentation

The delivery robot market can be segmented based on the following factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of delivery robots in the market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis of the delivery robot market provides insights into its strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the delivery robot market. The crisis has accelerated the need for contactless delivery options, as people turned to online shopping and home deliveries to minimize exposure to the virus. Delivery robots emerged as a safe and reliable solution, reducing the risk of transmission and ensuring the continuity of essential services. The pandemic has acted as a catalyst for the adoption of delivery robots, with businesses and consumers recognizing their benefits in terms of safety, efficiency, and convenience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the delivery robot market appears promising, with substantial growth potential. As technology continues to advance, delivery robots will become more sophisticated, efficient, and capable of handling a wide range of delivery tasks. With the increasing demand for contactless delivery solutions, businesses will increasingly adopt delivery robots to meet customer expectations and gain a competitive edge. However, addressing regulatory challenges and safety concerns will be crucial for the widespread adoption and acceptance of delivery robots.

Conclusion

The delivery robot market is experiencing rapid growth, driven by the need for faster, more reliable, and contactless delivery solutions. These robots offer numerous benefits, including improved efficiency, cost savings, and enhanced customer experience. Despite regulatory challenges and safety concerns, the market presents significant opportunities for innovation and expansion. With advancements in technology and increasing collaboration between industry stakeholders, the delivery robot market is poised for a promising future, transforming the way goods are delivered and revolutionizing the logistics and e-commerce industries.

What is a delivery robot?

A delivery robot is an autonomous machine designed to transport goods and packages from one location to another, often used in urban environments for last-mile delivery. These robots utilize advanced navigation systems and sensors to operate safely among pedestrians and vehicles.

Who are the key players in the Delivery Robot Market?

Key players in the Delivery Robot Market include companies like Starship Technologies, Nuro, and Amazon Robotics, which are leading the development and deployment of delivery robots for various applications, among others.

What are the main drivers of growth in the Delivery Robot Market?

The main drivers of growth in the Delivery Robot Market include the increasing demand for contactless delivery solutions, advancements in robotics and AI technology, and the rising need for efficient last-mile delivery services in urban areas.

What challenges does the Delivery Robot Market face?

The Delivery Robot Market faces challenges such as regulatory hurdles, public acceptance, and the need for robust infrastructure to support autonomous operations. Additionally, competition from traditional delivery methods poses a significant challenge.

What opportunities exist in the Delivery Robot Market?

Opportunities in the Delivery Robot Market include expanding applications in food delivery, retail logistics, and healthcare services. As technology advances, there is potential for increased integration with smart city initiatives and enhanced delivery efficiency.

What trends are shaping the Delivery Robot Market?

Trends shaping the Delivery Robot Market include the rise of contactless delivery options, the integration of AI for improved navigation and decision-making, and partnerships between technology companies and logistics providers to enhance service offerings.

Delivery Robot Market

| Segmentation | Details in the Segmentation |

|---|---|

| Component | Hardware, Software, Services |

| Type | Mobile Robot, Stationary Robot, Others |

| Application | Retail and Logistics, Healthcare, Hospitality, Others |

| Region | North America, Europe, Asia Pacific, Rest of the World |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Delivery Robot Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at