444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The Deepwater Exploration and Production (E&P) market is a crucial segment of the global oil and gas industry, focused on discovering, extracting, and producing hydrocarbons from deepwater reserves located beneath the ocean floor. Deepwater E&P involves complex engineering and technological challenges due to the extreme depths and harsh operating conditions, but it offers significant potential for accessing large untapped oil and gas resources. The market encompasses various activities, including exploration drilling, subsea infrastructure development, and offshore production operations, and it plays a vital role in meeting global energy demand.

Meaning:

Deepwater Exploration and Production refer to the process of searching for and extracting oil and gas reserves located beneath the ocean floor at depths exceeding 500 feet (approximately 150 meters). Deepwater operations typically involve the use of advanced drilling rigs, subsea equipment, and floating production systems to access and develop offshore hydrocarbon reservoirs. Despite the technical and logistical challenges associated with deepwater E&P, it remains an essential component of the global energy mix, providing access to significant reserves that are inaccessible through conventional onshore drilling.

Executive Summary:

The Deepwater Exploration and Production market represent a critical segment of the oil and gas industry, characterized by high-risk, high-reward ventures that require substantial investments in technology, expertise, and infrastructure. Despite challenges such as declining oil prices, regulatory scrutiny, and environmental concerns, deepwater E&P continues to attract interest from major oil companies, national oil companies, and independent operators due to the potential for discovering large reserves in frontier areas. With ongoing advancements in deepwater drilling technology, subsea engineering, and reservoir management, the market is poised for sustained growth and innovation in the coming years.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Deepwater Exploration and Production market is characterized by dynamic factors driving growth, including technological advancements, market competition, regulatory changes, and macroeconomic trends. Key trends such as the rise of floating production systems, the adoption of subsea processing and tie-backs, and the emergence of digital oilfield technologies are reshaping the deepwater E&P landscape and presenting new opportunities for operators and service providers.

Regional Analysis:

The global Deepwater Exploration and Production market is geographically diverse, with key regions including:

Competitive Landscape:

Leading Companies in the Deepwater Exploration and Production Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The Deepwater Exploration and Production market can be segmented based on various factors, including:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has had a significant impact on the Deepwater Exploration and Production market, leading to project delays, cost overruns, and workforce disruptions. Lockdowns, travel restrictions, and supply chain disruptions have affected drilling activities, construction projects, and operations, delaying the development of deepwater assets and reducing investment in exploration and production. However, as economies recover and oil prices stabilize, deepwater E&P activities are expected to resume, driven by long-term demand for hydrocarbons and the need to replace declining onshore reserves.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future of the Deepwater Exploration and Production market is influenced by factors such as technological advancements, market demand, regulatory frameworks, and geopolitical dynamics. While the Covid-19 pandemic and market uncertainty have posed challenges for the industry, long-term fundamentals such as growing energy demand, declining onshore reserves, and technological innovations continue to drive investment in deepwater E&P activities. As economies recover and oil prices stabilize, deepwater E&P markets are expected to rebound, with sustained growth in exploration, development, and production activities worldwide.

Conclusion:

In conclusion, the Deepwater Exploration and Production market represents a critical segment of the global oil and gas industry, offering significant potential for accessing large untapped hydrocarbon reserves in offshore basins worldwide. Despite challenges such as technical complexity, regulatory scrutiny, and market volatility, deepwater E&P activities continue to attract interest from major operators, investors, and service providers due to the long-term demand for hydrocarbons and the strategic importance of offshore resources. By investing in technology, innovation, and sustainable development practices, stakeholders can capitalize on emerging opportunities and contribute to the long-term viability and resilience of the deepwater E&P market.

What is Deepwater Exploration and Production?

Deepwater Exploration and Production refers to the processes and technologies used to locate and extract oil and gas resources from underwater reservoirs located in deep ocean waters. This sector involves advanced drilling techniques and subsea infrastructure to access resources that are often located at significant depths.

What are the key players in the Deepwater Exploration and Production Market?

Key players in the Deepwater Exploration and Production Market include companies such as BP, Royal Dutch Shell, and Chevron, which are known for their significant investments in offshore drilling and production technologies. These companies, along with others, are actively involved in exploring and developing deepwater oil and gas fields.

What are the main drivers of the Deepwater Exploration and Production Market?

The main drivers of the Deepwater Exploration and Production Market include the increasing global energy demand, advancements in drilling technologies, and the need to access untapped oil and gas reserves. Additionally, geopolitical factors and the pursuit of energy independence also contribute to market growth.

What challenges does the Deepwater Exploration and Production Market face?

The Deepwater Exploration and Production Market faces several challenges, including high operational costs, environmental concerns, and regulatory hurdles. Additionally, the technical complexities of deepwater drilling can lead to increased risks and project delays.

What opportunities exist in the Deepwater Exploration and Production Market?

Opportunities in the Deepwater Exploration and Production Market include the development of new technologies for more efficient extraction and the potential for discovering new reserves. Furthermore, the transition to cleaner energy sources may lead to innovations in subsea production systems.

What trends are shaping the Deepwater Exploration and Production Market?

Trends shaping the Deepwater Exploration and Production Market include the increasing use of digital technologies for monitoring and data analysis, a focus on sustainability practices, and the integration of renewable energy sources into offshore operations. These trends aim to enhance efficiency and reduce environmental impact.

Deepwater Exploration and Production Market

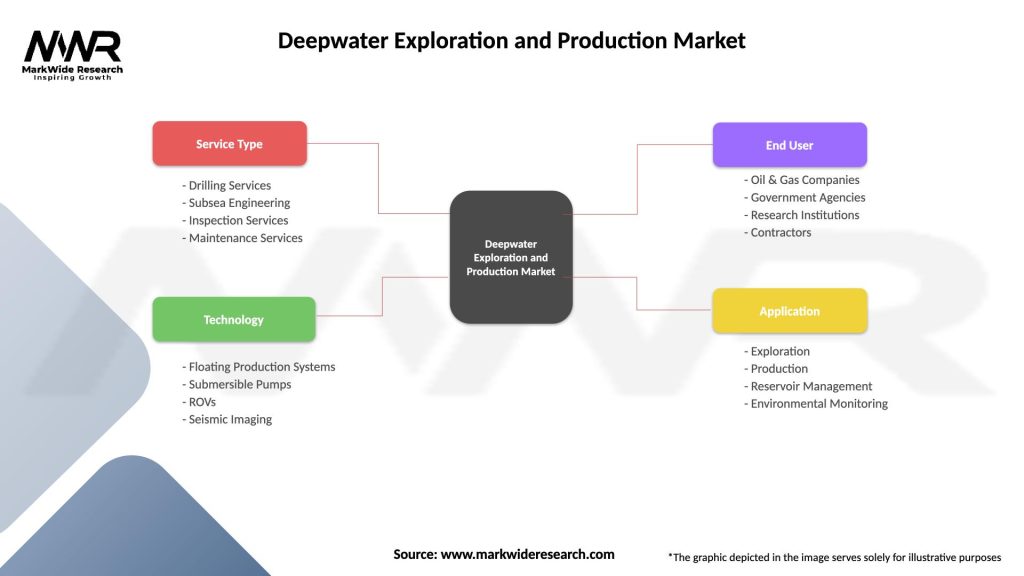

| Segmentation Details | Description |

|---|---|

| Service Type | Drilling Services, Subsea Engineering, Inspection Services, Maintenance Services |

| Technology | Floating Production Systems, Submersible Pumps, ROVs, Seismic Imaging |

| End User | Oil & Gas Companies, Government Agencies, Research Institutions, Contractors |

| Application | Exploration, Production, Reservoir Management, Environmental Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Deepwater Exploration and Production Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at