444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The debt negotiation market is a vital component of the financial services industry, offering solutions for individuals and businesses facing financial distress. Debt negotiation, also known as debt settlement, involves negotiating with creditors to reduce the amount owed and establish a repayment plan that is more manageable for the debtor. This market serves a diverse clientele, including individuals with credit card debt, medical bills, student loans, and small businesses struggling with loans and lines of credit.

Meaning:

Debt negotiation is a debt relief strategy that involves negotiating with creditors to settle debts for less than the full amount owed. This process typically involves a third-party debt negotiation company or a skilled negotiator who advocates on behalf of the debtor to reach a mutually agreeable settlement with creditors. Debt negotiation can help individuals and businesses avoid bankruptcy, stop harassing creditor calls, and regain control of their finances by reducing the total debt burden.

Executive Summary:

The debt negotiation market has experienced significant growth in recent years, driven by economic downturns, rising consumer debt levels, and the increasing need for debt relief solutions. This market offers opportunities for debt negotiation companies, financial advisors, and legal professionals to assist individuals and businesses in resolving their debt issues. However, the debt negotiation industry also faces challenges related to regulatory compliance, consumer protection, and creditor relations. Understanding the key market insights, trends, and dynamics is crucial for stakeholders operating in this sector to navigate the complexities and seize growth opportunities.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The debt negotiation market operates in a dynamic environment shaped by economic trends, regulatory changes, consumer behavior, and creditor practices. These dynamics influence market growth, competition, and the overall landscape of the debt negotiation industry, requiring stakeholders to adapt and innovate to remain competitive and meet evolving consumer needs.

Regional Analysis:

The debt negotiation market exhibits regional variations in demand, regulatory frameworks, and consumer preferences. While urban areas with higher population densities may have greater demand for debt negotiation services, rural and underserved communities may face unique challenges in accessing debt relief solutions due to limited service availability and awareness.

Competitive Landscape:

Leading Companies in the Debt Negotiation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

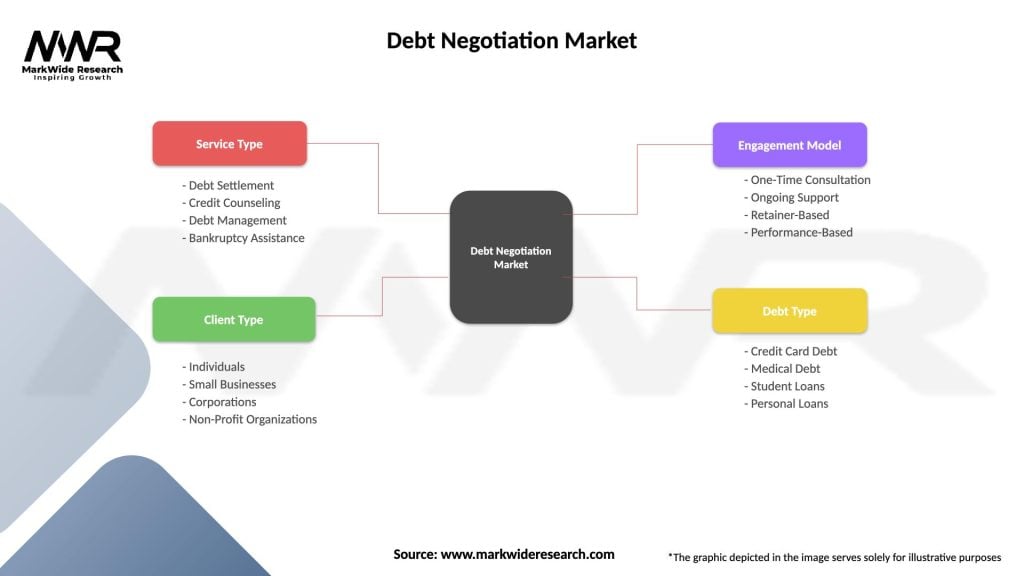

Segmentation:

The debt negotiation market can be segmented based on various factors such as target market (consumer vs. business debt), debt type (credit card debt, medical debt, student loans), service offerings (full-service vs. self-service), and geographic location (local vs. national firms).

Category-wise Insight:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has had a significant impact on the debt negotiation market, exacerbating financial distress for individuals and businesses and increasing demand for debt relief solutions. While government stimulus programs and debt payment moratoriums provided temporary relief, the long-term economic implications of the pandemic have led to a surge in demand for debt negotiation services as consumers seek assistance in managing pandemic-related debts and navigating financial uncertainty.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The debt negotiation market is poised for continued growth and evolution, driven by changing consumer preferences, technological advancements, regulatory developments, and economic trends. The increasing demand for debt relief solutions, coupled with advancements in digital technologies and regulatory compliance, presents opportunities for debt negotiation companies to expand their service offerings, enhance customer experiences, and drive industry innovation. However, challenges such as regulatory scrutiny, consumer skepticism, and economic uncertainty will require stakeholders to adapt and innovate to meet the evolving needs of clients and navigate the complexities of the debt negotiation landscape. By embracing technological innovation, adhering to compliance best practices, and maintaining ethical standards, debt negotiation companies can position themselves for success and contribute to the financial well-being of individuals and businesses seeking relief from overwhelming debt burdens.

Conclusion:

In conclusion, the debt negotiation market represents a critical segment of the financial services industry, offering relief and assistance to individuals and businesses burdened by overwhelming debt. As the market continues to evolve in response to changing consumer needs, technological advancements, and regulatory developments, stakeholders must adapt and innovate to remain competitive and meet the demands of clients seeking debt relief solutions. By embracing digital transformation, adhering to regulatory compliance, upholding ethical standards, and prioritizing customer-centricity, debt negotiation companies can position themselves for success and contribute to the financial well-being of individuals and businesses seeking to regain control of their finances and achieve lasting debt relief. As the debt negotiation market evolves, opportunities abound for industry players to drive innovation, expand market reach, and make a positive impact on the lives of clients navigating the complexities of debt.

What is Debt Negotiation?

Debt negotiation is a process where individuals or businesses work with creditors to reduce the total amount of debt owed. This can involve negotiating lower interest rates, reduced principal amounts, or extended payment terms to make debt more manageable.

What are the key players in the Debt Negotiation Market?

Key players in the Debt Negotiation Market include companies like Freedom Debt Relief, National Debt Relief, and Accredited Debt Relief, which offer services to help consumers manage and negotiate their debts. These companies often provide tailored solutions for various types of debt, including credit card debt and personal loans, among others.

What are the main drivers of growth in the Debt Negotiation Market?

The main drivers of growth in the Debt Negotiation Market include increasing consumer debt levels, rising financial literacy among consumers, and a growing awareness of debt relief options. Additionally, economic fluctuations can lead to more individuals seeking negotiation services to manage their financial obligations.

What challenges does the Debt Negotiation Market face?

The Debt Negotiation Market faces challenges such as regulatory scrutiny, potential scams, and consumer skepticism regarding the effectiveness of negotiation services. These factors can hinder market growth and consumer trust in debt relief solutions.

What opportunities exist in the Debt Negotiation Market?

Opportunities in the Debt Negotiation Market include the expansion of digital platforms for debt management and the potential for partnerships with financial institutions. Additionally, increasing demand for personalized financial advice presents avenues for growth in service offerings.

What trends are shaping the Debt Negotiation Market?

Trends shaping the Debt Negotiation Market include the rise of online debt negotiation services, the use of artificial intelligence to assess debt situations, and a focus on ethical negotiation practices. These trends reflect a shift towards more accessible and transparent debt relief options.

Debt Negotiation Market

| Segmentation Details | Description |

|---|---|

| Service Type | Debt Settlement, Credit Counseling, Debt Management, Bankruptcy Assistance |

| Client Type | Individuals, Small Businesses, Corporations, Non-Profit Organizations |

| Engagement Model | One-Time Consultation, Ongoing Support, Retainer-Based, Performance-Based |

| Debt Type | Credit Card Debt, Medical Debt, Student Loans, Personal Loans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Debt Negotiation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at