444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Debt financing is a fundamental aspect of the financial industry that plays a crucial role in the growth and development of businesses across various sectors. In simple terms, debt financing refers to the process of raising funds by borrowing money from external sources rather than relying solely on internal capital. These external sources can include banks, financial institutions, private investors, or even the general public through bonds or other debt instruments.

Meaning

Debt financing can take several forms, such as loans, lines of credit, corporate bonds, or convertible debt securities. The primary objective of utilizing debt financing is to acquire the necessary capital to fuel business operations, expand into new markets, invest in research and development, or undertake strategic initiatives.

Executive Summary

The debt financing market is witnessing significant growth as companies increasingly recognize the benefits of leveraging external capital to support their business objectives. This market enables businesses of all sizes, ranging from small enterprises to large corporations, to access the funds required for their growth and expansion plans.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The debt financing market operates within a dynamic ecosystem influenced by various factors, including macroeconomic conditions, regulatory frameworks, investor sentiment, and industry-specific trends. These dynamics shape the availability of debt capital, interest rates, and the overall competitiveness of the market.

Regional Analysis

The debt financing market exhibits regional variations due to differences in economic conditions, legal frameworks, and market maturity. Developed economies often have well-established debt markets with a wide range of financing options, while emerging markets offer potential growth opportunities driven by expanding business landscapes.

Competitive Landscape

Leading Companies in the Debt Financing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

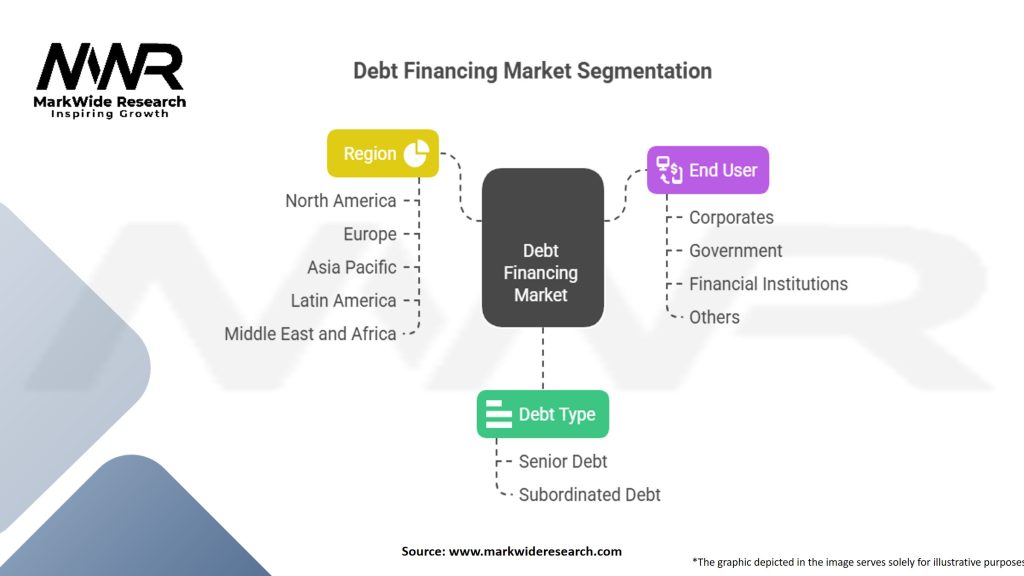

Segmentation

The debt financing market can be segmented based on multiple factors, including loan types, borrower profiles, industry sectors, and geographic regions. These segments help in understanding the diverse needs of businesses and tailoring debt financing solutions accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the debt financing market. The global economic slowdown and uncertainty led to cautious lending practices, tighter credit conditions, and reduced borrowing activities. Many businesses faced challenges in accessing debt capital as lenders focused on risk mitigation and portfolio management. Government stimulus packages and central bank interventions aimed to support businesses and maintain liquidity in financial markets during this challenging period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The debt financing market is expected to continue evolving in the coming years. Technological advancements, sustainable finance initiatives, and the growing demand for capital are likely to shape the market dynamics. The integration of ESG factors into debt financing decisions, the rise of alternative lending platforms, and the ongoing digital transformation are anticipated to drive innovation and open up new opportunities for businesses seeking external capital.

Conclusion

Debt financing serves as a vital tool for businesses to access the capital required for growth and expansion. With a wide range of financing options, businesses can tailor their debt instruments to meet their specific needs and preferences. However, careful planning, creditworthiness assessment, and adherence to regulatory requirements are essential to ensure responsible and sustainable borrowing practices. As the debt financing market continues to evolve, businesses that adapt to technological advancements, embrace sustainable finance principles, and strategically manage their financing needs will be well-positioned to capitalize on the opportunities that arise.

What is Debt Financing?

Debt financing refers to the process of raising capital through the issuance of debt instruments, such as bonds or loans, which must be repaid over time. This method is commonly used by businesses to fund operations, expansion, or acquisitions without diluting ownership.

What are the key players in the Debt Financing Market?

Key players in the Debt Financing Market include major financial institutions like JPMorgan Chase, Goldman Sachs, and Bank of America, which provide various debt products and services. Additionally, private equity firms and venture capitalists also participate in this market, among others.

What are the main drivers of the Debt Financing Market?

The main drivers of the Debt Financing Market include low interest rates, increasing demand for capital among businesses, and the need for companies to finance growth initiatives. Additionally, favorable economic conditions can lead to higher borrowing activity.

What challenges does the Debt Financing Market face?

Challenges in the Debt Financing Market include rising interest rates, which can increase borrowing costs, and regulatory changes that may impact lending practices. Additionally, economic downturns can lead to higher default rates, affecting market stability.

What opportunities exist in the Debt Financing Market?

Opportunities in the Debt Financing Market include the growing trend of sustainable financing, where companies seek green bonds and other environmentally friendly debt options. Furthermore, the rise of fintech companies is creating innovative debt solutions for borrowers.

What trends are shaping the Debt Financing Market?

Trends shaping the Debt Financing Market include the increasing use of technology in underwriting and risk assessment, as well as a shift towards more flexible financing options. Additionally, there is a growing emphasis on ESG criteria in debt issuance.

Debt Financing Market

| Segmentation | Details |

|---|---|

| Debt Type | Senior Debt, Subordinated Debt |

| End User | Corporates, Government, Financial Institutions, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Debt Financing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at