444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The De-NFT (Decentralized Non-Fungible Token) digital collection platforms market is an emerging sector within the broader blockchain and digital asset ecosystem. These platforms facilitate the creation, buying, selling, and trading of digital assets, such as artwork, music, videos, and virtual goods, in a decentralized manner. Unlike traditional NFT platforms, De-NFT platforms leverage decentralized technologies to ensure greater transparency, security, and ownership autonomy. The market is driven by the increasing popularity of digital collectibles, the growing adoption of blockchain technology, and the rising interest in decentralized finance (DeFi) applications.

Meaning

De-NFT digital collection platforms represent a new wave of digital marketplaces that operate on decentralized networks, typically using blockchain technology. Non-Fungible Tokens (NFTs) are unique digital assets verified using blockchain, ensuring their authenticity and scarcity. De-NFT platforms differ from centralized NFT platforms by eliminating intermediaries, providing users with direct control over their assets, and enhancing security through decentralized verification processes. These platforms empower creators by offering fairer revenue distribution and enable collectors to own and trade digital assets with greater confidence and autonomy. The essence of De-NFT platforms lies in their commitment to decentralization, transparency, and user empowerment.

Executive Summary

The De-NFT digital collection platforms market is rapidly expanding as blockchain technology and digital collectibles gain mainstream attention. This executive summary outlines the key drivers, such as increased demand for unique digital assets, advancements in blockchain technology, and the integration of DeFi elements. It also addresses challenges including regulatory uncertainties, technological complexities, and market volatility. The market offers substantial opportunities for innovation and growth, particularly in enhancing user experience, improving platform security, and expanding the variety of digital assets available. Key players in the market are leveraging strategic partnerships, technological advancements, and user-centric approaches to gain competitive advantages.

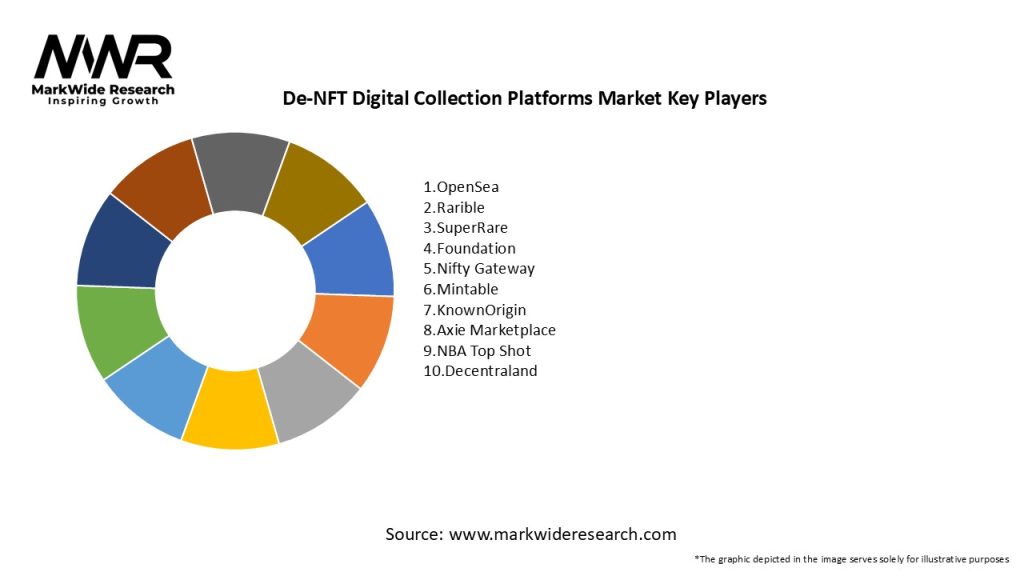

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The De-NFT digital collection platforms market is dynamic, influenced by technological advancements, regulatory changes, and shifting consumer preferences. Companies need to stay agile and innovative to capitalize on market opportunities and address challenges. Investing in research and development, ensuring compliance with evolving regulations, and focusing on user experience are critical strategies for success. Strategic partnerships and collaborations can also enhance market presence and drive growth.

Regional Analysis

Competitive Landscape

Leading Companies in the De-NFT Digital Collection Platforms Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The De-NFT digital collection platforms market can be segmented based on various criteria:

Segmentation allows for targeted marketing and product development, addressing the specific needs and preferences of different user groups.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic accelerated the adoption of digital technologies and online platforms, including De-NFT digital collection platforms. As people spent more time at home and sought new forms of entertainment and investment, the demand for digital assets and NFTs surged. The pandemic highlighted the importance of digital ownership and decentralized finance, driving interest and innovation in the De-NFT market. Additionally, online events and virtual exhibitions became popular, providing new opportunities for creators and collectors to engage and trade digital assets.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the De-NFT digital collection platforms market is promising, driven by technological advancements, increasing interest in digital ownership, and the integration of DeFi features. The market is expected to grow as more users embrace decentralized platforms and innovative digital assets. Opportunities in emerging markets and collaborations with major brands and celebrities will further drive growth. The industry must navigate regulatory challenges and address security concerns, but with a focus on user experience, sustainability, and continuous innovation, the De-NFT market is poised for sustained expansion and success.

Conclusion

The De-NFT digital collection platforms market represents a transformative segment within the digital asset and blockchain ecosystem. By leveraging decentralization, blockchain technology, and innovative features, these platforms offer unique opportunities for creators, collectors, and investors. The market’s growth is driven by the rising popularity of digital collectibles, advancements in technology, and the integration of DeFi elements. However, challenges such as regulatory uncertainties, technological complexities, and market volatility must be addressed. By focusing on user empowerment, security, and sustainability, the De-NFT digital collection platforms market can continue to thrive and redefine the landscape of digital ownership and trading.

What is De-NFT Digital Collection Platforms?

De-NFT Digital Collection Platforms are online services that facilitate the creation, buying, selling, and trading of digital assets that are not tied to non-fungible tokens (NFTs). These platforms often focus on unique digital items such as art, music, and collectibles, allowing users to engage in a decentralized marketplace.

What are the key players in the De-NFT Digital Collection Platforms Market?

Key players in the De-NFT Digital Collection Platforms Market include platforms like OpenSea, Rarible, and Foundation, which provide users with tools to create and trade digital collections. These companies are known for their user-friendly interfaces and robust community engagement, among others.

What are the growth factors driving the De-NFT Digital Collection Platforms Market?

The De-NFT Digital Collection Platforms Market is driven by increasing interest in digital art and collectibles, the rise of blockchain technology, and growing consumer acceptance of digital ownership. Additionally, the expansion of social media and online communities has fostered a vibrant ecosystem for digital creators.

What challenges does the De-NFT Digital Collection Platforms Market face?

The De-NFT Digital Collection Platforms Market faces challenges such as regulatory uncertainty, concerns over copyright infringement, and the environmental impact of blockchain technologies. These issues can hinder user trust and platform adoption.

What opportunities exist in the De-NFT Digital Collection Platforms Market?

Opportunities in the De-NFT Digital Collection Platforms Market include the potential for new revenue streams for artists, the integration of augmented reality experiences, and the development of more sustainable blockchain solutions. These advancements can enhance user engagement and broaden market appeal.

What trends are emerging in the De-NFT Digital Collection Platforms Market?

Emerging trends in the De-NFT Digital Collection Platforms Market include the rise of community-driven projects, the incorporation of gamification elements, and the increasing use of artificial intelligence in content creation. These trends are shaping the future landscape of digital collections.

De-NFT Digital Collection Platforms Market

| Segmentation Details | Description |

|---|---|

| Platform Type | Marketplace, Auction House, Social Media, Gaming |

| Content Type | Art, Music, Collectibles, Virtual Real Estate |

| Transaction Model | Fixed Price, Auction, Subscription, Royalties |

| User Type | Creators, Collectors, Investors, Brands |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the De-NFT Digital Collection Platforms Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at