444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Data Protection as-a-Service (DPaaS) market represents a rapidly evolving segment of the cloud computing industry, driven by increasing data volumes, stringent regulatory requirements, and growing cybersecurity concerns. Organizations across various industries are increasingly adopting DPaaS solutions to safeguard their critical business data while reducing operational complexity and infrastructure costs. The market demonstrates robust growth potential, with adoption rates accelerating at approximately 18.5% CAGR as enterprises prioritize data security and compliance initiatives.

Market dynamics indicate a significant shift from traditional on-premises data protection solutions toward cloud-based service models. This transformation is particularly evident in sectors such as healthcare, financial services, and retail, where data sensitivity and regulatory compliance requirements drive substantial investment in advanced protection technologies. The DPaaS market encompasses various service offerings including backup-as-a-service, disaster recovery-as-a-service, and archiving-as-a-service, providing comprehensive data protection capabilities through scalable cloud infrastructure.

Regional adoption patterns show North America maintaining market leadership with approximately 42% market share, followed by Europe and Asia-Pacific regions experiencing accelerated growth. The increasing frequency of cyber attacks, with organizations experiencing data breaches rising by 23% annually, has intensified focus on robust data protection strategies. Enterprise adoption of DPaaS solutions continues expanding as businesses recognize the strategic value of outsourcing data protection operations to specialized service providers.

The Data Protection as-a-Service (DPaaS) market refers to the comprehensive ecosystem of cloud-based services designed to protect, backup, recover, and manage organizational data through third-party service providers. This market encompasses various subscription-based solutions that eliminate the need for organizations to maintain complex on-premises data protection infrastructure while ensuring continuous data availability and security.

DPaaS solutions integrate multiple data protection functionalities including automated backup processes, real-time data replication, disaster recovery capabilities, and long-term data archiving services. These services are delivered through secure cloud platforms, enabling organizations to access enterprise-grade data protection capabilities without significant capital investments in hardware, software, or specialized personnel. The service model provides scalable protection for diverse data types including structured databases, unstructured files, virtual machines, and cloud-native applications.

Service delivery models within the DPaaS market typically include public cloud, private cloud, and hybrid cloud configurations, allowing organizations to select deployment options that align with their specific security, compliance, and performance requirements. The market also encompasses managed services where providers assume responsibility for monitoring, maintenance, and optimization of data protection processes, enabling organizations to focus on core business activities while ensuring comprehensive data security.

Market expansion in the Data Protection as-a-Service sector reflects fundamental shifts in enterprise IT strategies, with organizations increasingly prioritizing cloud-first approaches to data management and security. The convergence of factors including digital transformation initiatives, remote work adoption, and escalating cyber threats has created substantial demand for flexible, scalable data protection solutions that can adapt to evolving business requirements.

Technology advancement continues driving market evolution, with artificial intelligence and machine learning capabilities enhancing threat detection, automated response mechanisms, and predictive analytics for data protection optimization. Service providers are integrating advanced technologies to deliver more sophisticated protection capabilities while simplifying management complexity for end users. The integration of AI-powered analytics has improved threat detection accuracy by approximately 35% compared to traditional methods.

Competitive landscape features established cloud service providers, specialized data protection vendors, and emerging technology companies offering innovative DPaaS solutions. Market consolidation through strategic acquisitions and partnerships continues shaping the industry structure, with leading providers expanding service portfolios and geographic coverage to capture growing market opportunities. Service differentiation increasingly focuses on industry-specific solutions, compliance capabilities, and integration with existing enterprise technology stacks.

Investment trends show significant capital allocation toward DPaaS infrastructure development, with providers expanding data center capacity and enhancing service capabilities to meet growing demand. The market benefits from favorable economic conditions supporting cloud adoption, regulatory frameworks mandating data protection compliance, and increasing awareness of data security risks across all industry sectors.

Primary market drivers include the exponential growth of data volumes, increasing regulatory compliance requirements, and the need for cost-effective data protection solutions that can scale with business growth. Organizations are generating data at unprecedented rates, creating challenges for traditional backup and recovery approaches while driving demand for cloud-based alternatives.

Digital transformation initiatives across industries continue accelerating DPaaS market growth as organizations modernize IT infrastructure and adopt cloud-first strategies. The shift toward digital business models generates massive data volumes requiring sophisticated protection mechanisms that traditional solutions cannot adequately address. Cloud migration projects often include DPaaS implementation as organizations recognize the strategic value of integrated data protection services.

Cybersecurity threats represent a critical market driver, with ransomware attacks increasing by 41% annually and causing organizations to prioritize robust data protection and recovery capabilities. The evolving threat landscape requires advanced security measures including real-time monitoring, threat intelligence integration, and automated response mechanisms that specialized DPaaS providers can deliver more effectively than internal IT teams.

Regulatory compliance requirements continue expanding across industries, with new data protection laws and industry standards mandating comprehensive data security measures. Organizations face significant penalties for compliance failures, driving investment in professional-grade data protection services that ensure regulatory adherence. Compliance automation features within DPaaS solutions reduce the complexity and cost of maintaining regulatory compliance across multiple jurisdictions.

Business continuity concerns have intensified following recent global disruptions, with organizations recognizing the critical importance of maintaining data availability during unexpected events. DPaaS solutions provide geographic redundancy, automated failover capabilities, and rapid recovery processes that ensure business operations can continue despite infrastructure failures or natural disasters. The ability to maintain 99.9% uptime through redundant cloud infrastructure has become a key competitive advantage for DPaaS providers.

Data sovereignty concerns present significant challenges for DPaaS adoption, particularly among organizations operating in highly regulated industries or countries with strict data localization requirements. Some enterprises remain hesitant to store sensitive data in third-party cloud environments due to concerns about data control, jurisdiction issues, and potential access by foreign governments or unauthorized parties.

Integration complexity can impede DPaaS implementation, especially for organizations with legacy systems, complex IT environments, or custom applications that require specialized backup and recovery procedures. The technical challenges of integrating cloud-based data protection services with existing infrastructure may require significant time and resources, potentially delaying adoption or limiting service effectiveness.

Performance considerations including network bandwidth limitations, latency issues, and data transfer costs can impact DPaaS service quality and total cost of ownership. Organizations with large data volumes or strict recovery time objectives may face challenges meeting performance requirements through cloud-based services, particularly in locations with limited internet connectivity or during peak usage periods.

Vendor dependency risks concern organizations about potential service disruptions, pricing changes, or loss of data access if DPaaS providers experience business difficulties or discontinue services. The lack of standardization across DPaaS platforms can create vendor lock-in situations that limit flexibility and increase switching costs for organizations seeking to change service providers.

Artificial intelligence integration presents substantial opportunities for DPaaS providers to differentiate services and improve customer value through intelligent data management, predictive analytics, and automated optimization. AI-powered capabilities can enhance threat detection, optimize backup schedules, predict storage requirements, and automate recovery processes, providing significant competitive advantages in the evolving market landscape.

Industry-specific solutions offer significant growth potential as DPaaS providers develop specialized services tailored to unique requirements of healthcare, financial services, manufacturing, and other vertical markets. Customized solutions addressing specific compliance requirements, data types, and operational workflows can command premium pricing while building strong customer loyalty and market differentiation.

Edge computing integration creates new opportunities for DPaaS providers to extend services to distributed computing environments, IoT deployments, and remote locations where traditional centralized data protection approaches may be inadequate. The growing adoption of edge computing architectures requires innovative data protection strategies that can operate effectively across hybrid cloud-edge environments.

Small and medium enterprise (SME) market expansion represents a significant untapped opportunity, with 78% of SMEs currently lacking adequate data protection capabilities due to cost and complexity constraints. DPaaS providers can capture this market segment by offering simplified, cost-effective solutions designed specifically for smaller organizations with limited IT resources and expertise.

Competitive intensity continues increasing as established technology companies, cloud service providers, and specialized data protection vendors compete for market share through service innovation, pricing strategies, and strategic partnerships. The market demonstrates characteristics of both consolidation and fragmentation, with large providers acquiring smaller competitors while new entrants introduce innovative technologies and service models.

Technology evolution drives continuous market transformation as providers integrate emerging technologies including artificial intelligence, machine learning, blockchain, and quantum computing into data protection services. These technological advances enable new capabilities such as intelligent data classification, automated compliance reporting, and enhanced security measures that create competitive differentiation and customer value.

Customer expectations continue evolving toward more sophisticated, user-friendly services that provide comprehensive data protection with minimal administrative overhead. Organizations increasingly demand integrated solutions that combine backup, disaster recovery, archiving, and security services through unified management interfaces and automated processes. Service reliability expectations have increased, with customers requiring 99.99% availability guarantees and sub-hour recovery time objectives.

Pricing dynamics reflect market maturation with providers offering increasingly flexible pricing models including consumption-based billing, tiered service levels, and industry-specific packages. The shift toward outcome-based pricing models where customers pay based on achieved service levels rather than resource consumption is gaining traction as providers seek to align pricing with customer value realization.

Primary research methodology encompasses comprehensive surveys, interviews, and focus groups conducted with key stakeholders across the DPaaS ecosystem including service providers, enterprise customers, technology vendors, and industry experts. The research approach combines quantitative data collection through structured surveys with qualitative insights gathered through in-depth interviews to provide comprehensive market understanding.

Secondary research sources include industry reports, company financial statements, regulatory filings, technology publications, and academic research to validate primary findings and provide historical context for market trends. The methodology incorporates analysis of patent filings, merger and acquisition activities, and investment flows to identify emerging technologies and market dynamics that may impact future development.

Data validation processes ensure research accuracy through triangulation of multiple information sources, expert review panels, and statistical analysis to identify and correct potential biases or inconsistencies. The research methodology includes ongoing monitoring of market developments to maintain current and relevant insights for stakeholders making strategic decisions.

Market modeling techniques utilize advanced statistical methods including regression analysis, time series forecasting, and scenario planning to project market trends and quantify growth opportunities. According to MarkWide Research analysis, the methodology incorporates both bottom-up and top-down approaches to ensure comprehensive coverage of market segments and accurate representation of industry dynamics.

North American market maintains leadership position with approximately 45% global market share, driven by advanced cloud infrastructure, stringent regulatory requirements, and high enterprise adoption of cloud services. The region benefits from the presence of major DPaaS providers, sophisticated customer base, and favorable regulatory environment supporting cloud adoption. United States enterprises demonstrate particularly strong adoption rates across healthcare, financial services, and technology sectors.

European market shows robust growth momentum with increasing adoption driven by GDPR compliance requirements and digital transformation initiatives across EU member states. The region’s emphasis on data sovereignty and privacy protection creates demand for DPaaS solutions that can demonstrate compliance with local regulations while providing enterprise-grade protection capabilities. Germany and United Kingdom represent the largest European markets with significant investment in cloud-based data protection services.

Asia-Pacific region exhibits the highest growth rates with expanding digital economies, increasing cloud adoption, and growing awareness of data protection importance. Countries including China, Japan, and India demonstrate substantial market potential driven by large enterprise populations, government digitization initiatives, and increasing regulatory focus on data security. The region’s diverse regulatory landscape creates opportunities for providers offering flexible, multi-jurisdictional compliance capabilities.

Latin American and Middle Eastern markets represent emerging opportunities with growing enterprise cloud adoption and increasing recognition of data protection importance. These regions show 25% annual growth in DPaaS adoption as organizations modernize IT infrastructure and implement comprehensive data security strategies. Local partnerships and region-specific service offerings are becoming increasingly important for market success in these developing markets.

Market leadership is distributed among several categories of providers including hyperscale cloud platforms, specialized data protection vendors, and managed service providers, each offering distinct value propositions and targeting different customer segments. The competitive environment continues evolving through strategic acquisitions, technology partnerships, and service expansion initiatives.

Competitive strategies focus on service differentiation through advanced technology integration, industry-specific solutions, and comprehensive support services. Providers increasingly compete on factors including service reliability, recovery performance, security capabilities, and total cost of ownership rather than purely on pricing considerations.

By Service Type: The DPaaS market encompasses multiple service categories each addressing specific data protection requirements and use cases. Backup-as-a-Service represents the largest segment, providing automated data backup capabilities through cloud infrastructure. Disaster Recovery-as-a-Service focuses on business continuity with rapid recovery capabilities, while Storage-as-a-Service offers scalable data storage with integrated protection features.

By Deployment Model: Market segmentation includes public cloud deployments offering cost-effective, standardized services; private cloud solutions providing dedicated infrastructure for enhanced security and compliance; and hybrid cloud models combining on-premises and cloud resources for optimal flexibility and performance.

By Organization Size: Large enterprises represent the primary market segment with complex data protection requirements and substantial IT budgets. Small and medium enterprises constitute a rapidly growing segment seeking cost-effective, simplified data protection solutions that don’t require extensive technical expertise or infrastructure investment.

By Industry Vertical: Healthcare, financial services, retail, manufacturing, and government sectors demonstrate distinct data protection requirements driving specialized DPaaS offerings. Each vertical presents unique compliance requirements, data sensitivity levels, and operational constraints that influence service design and delivery approaches.

Backup-as-a-Service (BaaS) dominates the DPaaS market with approximately 52% segment share, driven by universal need for data backup capabilities across all organization types and sizes. This category includes automated backup scheduling, incremental backup optimization, and long-term data retention services that eliminate the complexity of managing backup infrastructure while ensuring comprehensive data protection.

Disaster Recovery-as-a-Service (DRaaS) represents a high-growth segment focused on business continuity and rapid recovery capabilities. Organizations increasingly recognize the critical importance of maintaining operations during disruptions, driving demand for services that can provide near-instantaneous failover and recovery processes. DRaaS solutions typically include replication services, failover automation, and recovery testing capabilities.

Archive-as-a-Service addresses long-term data retention requirements with cost-effective storage solutions for infrequently accessed data. This segment serves organizations with regulatory compliance requirements mandating extended data retention periods while providing search and retrieval capabilities when needed. The category benefits from increasing data volumes and expanding regulatory requirements across industries.

Security-as-a-Service integration within DPaaS offerings provides comprehensive data protection including threat detection, encryption, and access controls. This category addresses growing cybersecurity concerns by combining traditional data protection with advanced security capabilities, creating integrated solutions that protect against both accidental data loss and malicious attacks.

Enterprise customers realize significant operational and financial benefits through DPaaS adoption including reduced capital expenditures, improved data protection reliability, and enhanced business continuity capabilities. Organizations can eliminate the complexity of managing backup infrastructure while accessing enterprise-grade protection services that scale with business growth and evolving requirements.

Service providers benefit from recurring revenue models, scalable service delivery, and opportunities for service expansion through existing customer relationships. The DPaaS model enables providers to leverage cloud infrastructure investments across multiple customers while developing specialized expertise that creates competitive differentiation and customer loyalty.

Technology vendors gain access to expanded market opportunities through partnerships with DPaaS providers and integration of their solutions into cloud-based service offerings. The market provides channels for reaching customers who prefer service-based consumption models over traditional software licensing approaches.

Channel partners including system integrators, managed service providers, and consultants benefit from opportunities to provide implementation, migration, and ongoing support services for DPaaS deployments. These partners can develop specialized expertise in data protection services while building long-term customer relationships through ongoing service delivery.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend with DPaaS providers incorporating AI and machine learning capabilities to enhance service automation, improve threat detection accuracy, and optimize data management processes. These technologies enable predictive analytics for capacity planning, intelligent data classification, and automated response to security incidents, providing significant value enhancement for customers.

Zero-trust security models are increasingly integrated into DPaaS offerings as organizations adopt comprehensive security frameworks that assume no implicit trust for any system component. This trend drives demand for services that provide continuous authentication, encryption, and access monitoring throughout the data protection lifecycle, ensuring security even in compromised environments.

Multi-cloud strategies are becoming standard practice as organizations seek to avoid vendor lock-in and optimize service delivery across multiple cloud platforms. DPaaS providers are responding by developing platform-agnostic solutions that can protect data across diverse cloud environments while providing unified management and reporting capabilities.

Compliance automation continues gaining importance as regulatory requirements become more complex and penalties for non-compliance increase. MWR data indicates that organizations implementing automated compliance features achieve 67% reduction in compliance-related administrative overhead while improving audit readiness and regulatory adherence.

Strategic acquisitions continue reshaping the competitive landscape as major cloud providers and technology companies acquire specialized data protection vendors to enhance service portfolios and expand market reach. Recent acquisitions demonstrate the strategic importance of data protection capabilities in comprehensive cloud service offerings and the value of specialized expertise in this domain.

Partnership expansion between DPaaS providers and technology vendors creates integrated solutions that combine data protection with complementary services including cybersecurity, data analytics, and application management. These partnerships enable comprehensive service offerings that address broader customer requirements while leveraging specialized expertise from multiple providers.

Regulatory developments including updated data protection laws and industry-specific compliance requirements continue influencing service design and delivery approaches. Providers are investing in compliance capabilities and certifications to address evolving regulatory landscapes while ensuring customers can meet their legal obligations through service adoption.

Technology innovation in areas including quantum computing, blockchain, and advanced encryption methods is beginning to influence DPaaS service development. Early adopters are exploring how these emerging technologies can enhance data protection capabilities while preparing for future security challenges and opportunities.

Service differentiation should focus on developing specialized capabilities that address specific industry requirements, compliance needs, or technical challenges rather than competing solely on price or basic functionality. Providers that can demonstrate unique value propositions through advanced technology integration or domain expertise will achieve stronger market positions and customer loyalty.

Customer education remains critical for market expansion as many organizations lack understanding of DPaaS capabilities and benefits. Providers should invest in educational content, demonstration programs, and proof-of-concept offerings that help potential customers understand the value proposition and implementation requirements for successful service adoption.

Partnership strategies should emphasize collaboration with complementary service providers, technology vendors, and channel partners to create comprehensive solutions that address broader customer requirements. Strategic partnerships can accelerate market penetration while providing access to specialized expertise and customer relationships.

Technology investment priorities should focus on artificial intelligence, automation, and security capabilities that provide measurable customer value while creating competitive differentiation. According to MarkWide Research analysis, providers investing in advanced technology capabilities achieve 32% higher customer retention rates compared to those offering basic services.

Market expansion will continue accelerating as digital transformation initiatives drive increased data volumes and organizations recognize the strategic importance of comprehensive data protection. The convergence of factors including remote work adoption, cloud migration, and evolving threat landscapes creates sustained demand for sophisticated DPaaS solutions that can adapt to changing business requirements.

Technology evolution will enable new service capabilities including real-time data protection, intelligent threat response, and predictive analytics for data management optimization. The integration of artificial intelligence, machine learning, and advanced automation will transform DPaaS from reactive backup services to proactive data management platforms that provide strategic business value.

Market consolidation is expected to continue as larger providers acquire specialized vendors and smaller companies to expand service capabilities and geographic coverage. This consolidation will create more comprehensive service offerings while potentially reducing the number of independent providers in the market, leading to increased competition among remaining players.

Regulatory influence will continue shaping market development as governments implement new data protection laws and industry standards evolve to address emerging threats and technologies. Providers that can demonstrate compliance capabilities and adapt quickly to regulatory changes will maintain competitive advantages in increasingly regulated markets. The market is projected to maintain strong growth momentum with adoption rates increasing by approximately 22% annually through the next five years.

The Data Protection as-a-Service market represents a critical component of the evolving cloud services ecosystem, driven by fundamental shifts in how organizations approach data management, security, and business continuity. The convergence of increasing data volumes, sophisticated cyber threats, stringent regulatory requirements, and digital transformation initiatives creates a compelling value proposition for cloud-based data protection services that can scale with business growth while reducing operational complexity.

Market dynamics indicate sustained growth potential as organizations across all industries recognize the strategic importance of comprehensive data protection capabilities. The shift from capital-intensive on-premises solutions to flexible, subscription-based cloud services aligns with broader trends toward operational expenditure models and focus on core business activities rather than infrastructure management.

Competitive differentiation will increasingly depend on advanced technology integration, industry-specific expertise, and comprehensive service portfolios that address diverse customer requirements. Providers that can successfully combine data protection with complementary capabilities including cybersecurity, compliance automation, and intelligent data management will capture the greatest market opportunities while building sustainable competitive advantages in this rapidly evolving sector.

What is Data Protection as-a-Service (DPaaS)?

Data Protection as-a-Service (DPaaS) refers to cloud-based services that provide data backup, recovery, and protection solutions. It allows organizations to secure their data without the need for extensive on-premises infrastructure, making it easier to manage and scale.

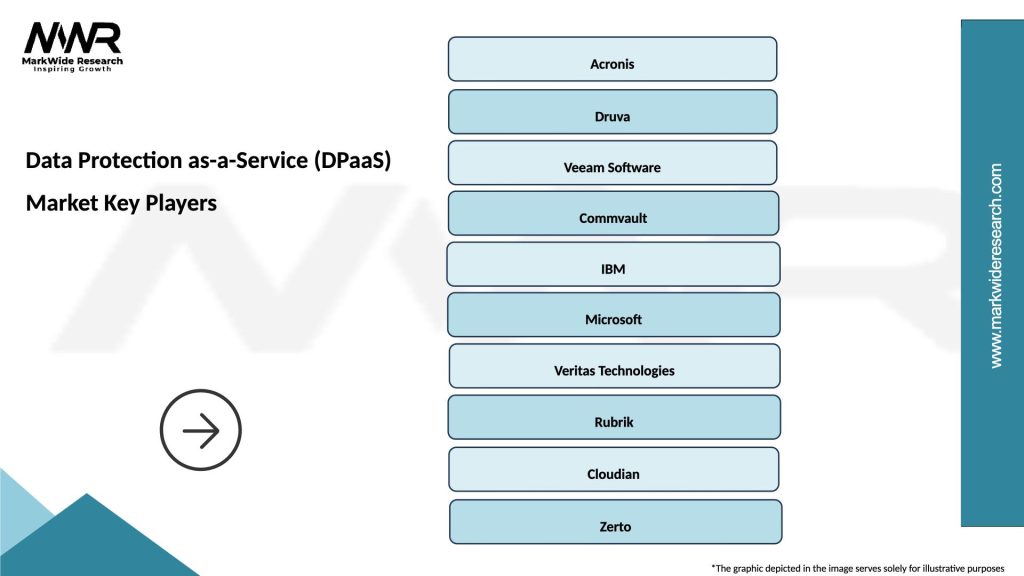

What are the key players in the Data Protection as-a-Service (DPaaS) Market?

Key players in the Data Protection as-a-Service (DPaaS) Market include companies like Veeam Software, Commvault, and Acronis, which offer various solutions for data backup and recovery. These companies focus on providing reliable and scalable services to meet the needs of businesses across different sectors, among others.

What are the main drivers of growth in the Data Protection as-a-Service (DPaaS) Market?

The growth of the Data Protection as-a-Service (DPaaS) Market is driven by the increasing volume of data generated by businesses, the rising need for compliance with data protection regulations, and the growing adoption of cloud technologies. Organizations are seeking efficient solutions to safeguard their data against breaches and loss.

What challenges does the Data Protection as-a-Service (DPaaS) Market face?

The Data Protection as-a-Service (DPaaS) Market faces challenges such as concerns over data privacy, potential service outages, and the complexity of integrating DPaaS solutions with existing IT infrastructure. These factors can hinder adoption and create hesitance among potential users.

What opportunities exist in the Data Protection as-a-Service (DPaaS) Market?

Opportunities in the Data Protection as-a-Service (DPaaS) Market include the expansion of services tailored for specific industries, such as healthcare and finance, and the integration of advanced technologies like AI and machine learning for enhanced data security. As businesses increasingly prioritize data protection, the demand for innovative solutions is expected to rise.

What trends are shaping the Data Protection as-a-Service (DPaaS) Market?

Trends in the Data Protection as-a-Service (DPaaS) Market include the shift towards hybrid cloud solutions, the increasing focus on automated backup processes, and the rise of subscription-based pricing models. These trends reflect the evolving needs of businesses seeking flexible and cost-effective data protection strategies.

Data Protection as-a-Service (DPaaS) Market

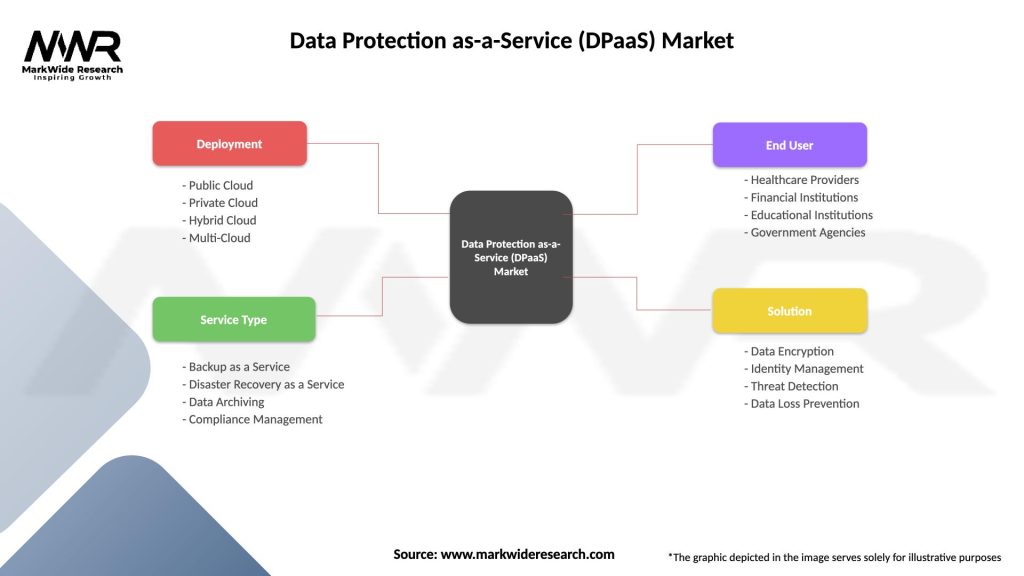

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Service Type | Backup as a Service, Disaster Recovery as a Service, Data Archiving, Compliance Management |

| End User | Healthcare Providers, Financial Institutions, Educational Institutions, Government Agencies |

| Solution | Data Encryption, Identity Management, Threat Detection, Data Loss Prevention |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Data Protection as-a-Service (DPaaS) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at