444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Czech Republic road freight market represents a critical component of Central Europe’s transportation infrastructure, serving as a strategic hub connecting Western and Eastern European trade routes. Road freight transportation dominates the country’s logistics landscape, accounting for approximately 75% of total freight movement within the Czech Republic. The market has experienced robust growth driven by the country’s strategic geographical position, well-developed highway network, and increasing integration with European Union trade systems.

Market dynamics indicate strong performance across multiple sectors, with the Czech Republic serving as a vital transit corridor for goods moving between Germany, Poland, Slovakia, and Austria. The domestic road freight sector benefits from the country’s industrial diversification, including automotive manufacturing, machinery production, and consumer goods distribution. Transportation companies operating in this market range from large international logistics providers to specialized regional carriers, creating a competitive and dynamic business environment.

Infrastructure development continues to support market expansion, with ongoing investments in highway modernization and digital logistics technologies. The market demonstrates resilience and adaptability, particularly in response to evolving supply chain requirements and sustainability initiatives. Growth projections suggest continued expansion at a CAGR of 6.2% over the forecast period, driven by increasing e-commerce activities, industrial production growth, and enhanced cross-border trade facilitation.

The Czech Republic road freight market refers to the comprehensive ecosystem of transportation services, infrastructure, and logistics operations involved in moving goods via road networks within and through the Czech Republic. This market encompasses domestic freight distribution, international transit services, last-mile delivery operations, and specialized transportation solutions across various industry sectors.

Road freight services include full truckload (FTL) and less-than-truckload (LTL) transportation, express delivery, temperature-controlled logistics, hazardous materials transport, and oversized cargo handling. The market integrates traditional trucking operations with modern logistics technologies, including fleet management systems, route optimization software, and real-time tracking capabilities. Service providers range from owner-operators and small regional carriers to multinational logistics corporations offering comprehensive supply chain solutions.

Market participants include freight forwarders, logistics service providers, transportation companies, warehouse operators, and technology solution providers. The ecosystem also encompasses regulatory bodies, infrastructure developers, fuel suppliers, and financial service providers supporting the road freight industry’s operational requirements and growth initiatives.

Market performance in the Czech Republic road freight sector demonstrates strong fundamentals supported by strategic geographical advantages and robust economic growth. The market benefits from the country’s position as a central European logistics hub, facilitating efficient goods movement between major European markets. Industry consolidation trends indicate increasing market share concentration among larger logistics providers, while specialized niche operators continue to serve specific market segments effectively.

Technology adoption accelerates across the market, with approximately 68% of major operators implementing advanced fleet management systems and digital logistics platforms. These technological investments enhance operational efficiency, reduce transportation costs, and improve service quality for customers across various industry sectors. Sustainability initiatives gain prominence, with companies investing in fuel-efficient vehicles, alternative fuel technologies, and carbon footprint reduction programs.

Regulatory compliance remains a critical factor, with operators adapting to evolving European Union transportation regulations, environmental standards, and safety requirements. The market demonstrates strong resilience and adaptability, positioning Czech road freight operators for continued growth in an increasingly competitive and technology-driven logistics environment.

Strategic positioning analysis reveals several critical insights shaping the Czech Republic road freight market landscape:

Economic growth serves as a primary driver for the Czech Republic road freight market, with expanding industrial production and consumer spending generating increased demand for transportation services. The country’s robust manufacturing sector, particularly in automotive and machinery production, creates consistent freight volumes requiring reliable road transportation solutions. Export activities continue to expand, with Czech products reaching international markets through efficient road freight networks.

E-commerce expansion significantly impacts market dynamics, with online retail growth driving demand for last-mile delivery services and flexible logistics solutions. The increasing consumer preference for rapid delivery options creates opportunities for specialized road freight operators offering express and same-day delivery services. Supply chain optimization initiatives by businesses across various sectors drive demand for integrated logistics solutions combining transportation, warehousing, and distribution services.

Infrastructure development continues to support market growth through highway network improvements, border crossing efficiency enhancements, and logistics facility expansion. Government investments in transportation infrastructure reduce transit times and operational costs for road freight operators. European Union integration facilitates seamless cross-border trade, eliminating barriers and creating opportunities for Czech road freight companies to expand their service territories and customer base.

Driver shortage represents a significant challenge for the Czech Republic road freight market, with an aging workforce and limited new entrants affecting operational capacity. The shortage of qualified professional drivers constrains growth potential and increases labor costs for transportation companies. Regulatory complexity creates operational challenges, particularly for smaller operators struggling to comply with evolving European Union transportation regulations, environmental standards, and safety requirements.

Fuel price volatility impacts operational costs and profit margins, requiring companies to implement dynamic pricing strategies and fuel efficiency measures. Rising fuel costs can significantly affect transportation economics, particularly for long-haul operations and price-sensitive market segments. Infrastructure congestion in urban areas and major transportation corridors creates delays and increases operational costs for road freight operators.

Environmental regulations impose additional compliance costs and operational constraints, requiring investments in cleaner vehicles and emission reduction technologies. The transition to more sustainable transportation solutions involves significant capital investments that may strain smaller operators’ financial resources. Competition intensity from both domestic and international operators creates pricing pressure and margin compression across various market segments.

Digital transformation presents substantial opportunities for Czech road freight operators to enhance operational efficiency and service quality through technology adoption. Implementation of advanced fleet management systems, route optimization software, and real-time tracking capabilities can significantly improve customer satisfaction and operational performance. Automation technologies offer potential for reducing operational costs and addressing driver shortage challenges through autonomous vehicle development and smart logistics solutions.

Sustainability initiatives create opportunities for companies investing in environmentally friendly transportation solutions, including electric and hybrid vehicles, alternative fuel technologies, and carbon-neutral logistics services. Growing customer demand for sustainable transportation options provides competitive advantages for early adopters of green logistics technologies. Cross-border expansion opportunities exist for Czech operators to leverage their strategic location and develop services throughout Central and Eastern Europe.

Specialized services development offers growth potential in niche markets such as temperature-controlled transportation, hazardous materials handling, oversized cargo transport, and high-value goods logistics. Partnership opportunities with e-commerce platforms, manufacturing companies, and retail chains can provide stable revenue streams and long-term growth prospects for road freight operators.

Supply and demand dynamics in the Czech Republic road freight market reflect broader economic trends and seasonal variations across different industry sectors. Manufacturing activity levels directly influence freight volumes, with automotive and industrial production cycles creating predictable demand patterns. Seasonal fluctuations occur in retail and consumer goods transportation, with peak periods during holiday seasons and promotional events driving increased logistics activity.

Competitive dynamics involve both price competition and service differentiation strategies, with operators focusing on reliability, speed, and specialized capabilities to maintain market position. Large international logistics providers leverage economies of scale and comprehensive service offerings, while smaller regional operators compete through specialized services and local market knowledge. Technology adoption rates vary across market participants, creating competitive advantages for early adopters of digital logistics solutions.

Regulatory dynamics continue to evolve with European Union policy changes affecting transportation standards, environmental requirements, and cross-border trade facilitation. Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to achieve scale advantages and expand service capabilities. According to MarkWide Research analysis, approximately 42% of market participants are actively pursuing strategic partnerships or acquisition opportunities to strengthen their competitive position.

Primary research methodology encompasses comprehensive interviews with industry executives, transportation company managers, logistics professionals, and regulatory officials across the Czech Republic road freight sector. Data collection includes structured surveys with fleet operators, freight forwarders, and logistics service providers to gather insights on market trends, operational challenges, and growth strategies. Field research involves site visits to major logistics facilities, transportation hubs, and distribution centers to observe operational practices and technology implementation.

Secondary research incorporates analysis of industry reports, government statistics, trade association publications, and regulatory documentation related to Czech transportation and logistics sectors. Financial analysis of publicly traded companies provides insights into market performance, profitability trends, and investment patterns. Market modeling utilizes statistical analysis and forecasting techniques to project market growth, segment performance, and competitive dynamics.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification to ensure accuracy and reliability of market insights. Quantitative analysis combines with qualitative assessments to provide comprehensive understanding of market dynamics, competitive landscape, and future growth prospects. Continuous monitoring of market developments ensures research findings remain current and relevant for strategic decision-making purposes.

Prague region dominates the Czech Republic road freight market, accounting for approximately 35% of total market activity due to its role as the economic and logistics center. The capital region benefits from concentrated industrial activity, major distribution centers, and excellent highway connectivity to other European markets. Logistics infrastructure in Prague includes modern warehouse facilities, intermodal terminals, and advanced cargo handling capabilities supporting diverse freight transportation requirements.

Moravian-Silesian region represents a significant market segment with strong industrial base and cross-border trade activities with Poland and Slovakia. The region’s manufacturing concentration in automotive, steel, and chemical industries generates substantial freight volumes requiring specialized transportation services. Brno region serves as a secondary logistics hub with growing importance in technology and manufacturing sectors, contributing approximately 18% of regional market share.

Border regions play crucial roles in international transit operations, with specialized facilities and services supporting cross-border freight movement. The western border areas facilitate trade with Germany and Austria, while eastern regions handle significant volumes of goods moving to and from Slovakia and Poland. Rural areas require specialized distribution services connecting smaller communities to major logistics networks, creating opportunities for regional transportation providers.

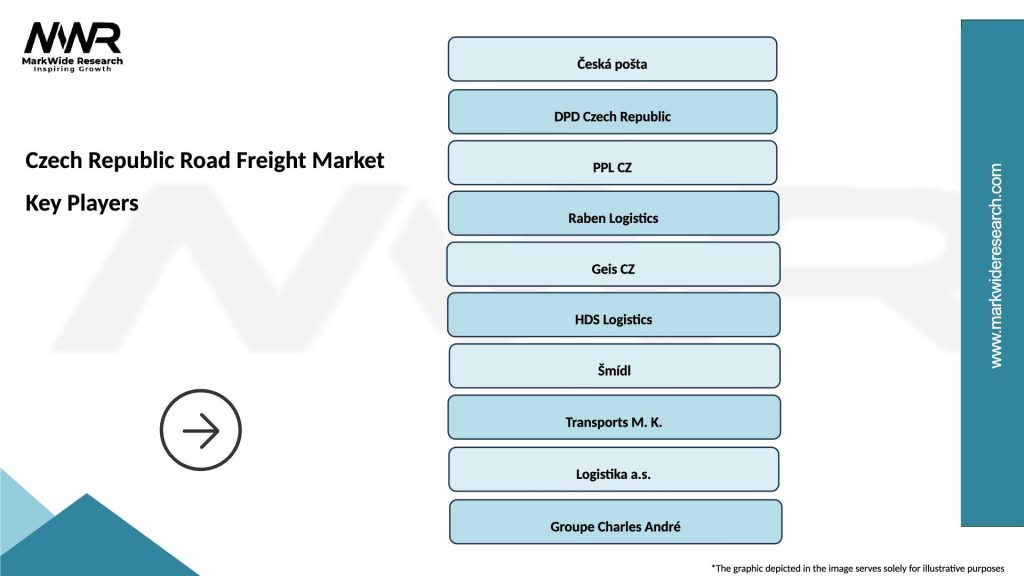

Market leadership in the Czech Republic road freight sector involves both international logistics giants and strong domestic operators competing across various service segments:

Competitive strategies focus on service differentiation, technology adoption, and specialized capabilities development. Companies invest in digital platforms, sustainable transportation solutions, and customer service excellence to maintain competitive advantages in an increasingly demanding market environment.

By Service Type:

By End-User Industry:

By Geographic Scope:

Full Truckload Services represent the largest market segment, serving industrial customers requiring dedicated vehicle capacity for large shipments. This category benefits from strong demand in automotive and manufacturing sectors, with companies preferring direct transportation for high-value or time-sensitive cargo. Service reliability and competitive pricing remain key differentiators in this segment, with operators investing in modern fleet equipment and driver training programs.

Express Delivery Services experience rapid growth driven by e-commerce expansion and customer demands for faster delivery options. This segment commands premium pricing but requires significant investment in logistics infrastructure, technology systems, and urban distribution capabilities. Last-mile delivery operations become increasingly important as online retail continues expanding throughout Czech Republic.

Specialized Transportation offers higher profit margins through technical expertise and specialized equipment requirements. Temperature-controlled logistics serves growing food and pharmaceutical sectors, while hazardous materials transportation requires specialized certifications and safety protocols. Oversized cargo transportation supports construction and industrial project requirements, demanding specialized equipment and route planning expertise.

Cross-border Services leverage Czech Republic’s strategic location to facilitate international trade flows. These services require expertise in customs procedures, regulatory compliance, and multi-country logistics coordination. Transit operations benefit from the country’s excellent highway connectivity and efficient border crossing procedures with neighboring European Union countries.

Transportation Companies benefit from diverse market opportunities, strategic geographic positioning, and growing demand across multiple industry sectors. The Czech Republic’s central European location provides access to major markets within efficient delivery timeframes, enabling competitive service offerings. Operational efficiency improvements through technology adoption and infrastructure development reduce costs and enhance service quality for customers.

Shippers and Customers gain access to reliable, cost-effective transportation solutions supporting their supply chain requirements and business growth objectives. Competitive market dynamics ensure favorable pricing and service options across various freight transportation categories. Service flexibility allows customers to select appropriate transportation solutions based on specific requirements, budget constraints, and delivery timeframes.

Economic Development benefits include job creation, infrastructure investment, and enhanced trade facilitation supporting overall economic growth. The road freight sector contributes significantly to employment opportunities across various skill levels, from professional drivers to logistics management positions. Supply chain efficiency improvements support business competitiveness and attract foreign investment in manufacturing and distribution operations.

Technology Providers find growing market opportunities for logistics software, fleet management systems, and transportation optimization solutions. Digital transformation initiatives by road freight operators create demand for innovative technology solutions addressing operational challenges and customer service requirements. Innovation partnerships between technology companies and logistics operators drive development of advanced transportation solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration transforms Czech Republic road freight operations through implementation of advanced logistics technologies, real-time tracking systems, and automated dispatch solutions. Companies invest in digital platforms to enhance customer service, optimize route planning, and improve operational transparency. Data analytics applications enable predictive maintenance, demand forecasting, and performance optimization across fleet operations.

Sustainability focus drives adoption of environmentally friendly transportation solutions, including electric and hybrid vehicles, alternative fuel technologies, and carbon footprint reduction programs. Customers increasingly prioritize sustainable logistics options, creating competitive advantages for operators investing in green transportation technologies. Circular economy principles influence logistics operations through waste reduction, packaging optimization, and reverse logistics services.

Last-mile innovation addresses growing e-commerce demands through development of urban distribution centers, alternative delivery methods, and flexible delivery options. Companies experiment with drone delivery, autonomous vehicles, and crowd-sourced logistics solutions to improve last-mile efficiency and customer satisfaction. Urban logistics challenges drive innovation in delivery consolidation, off-peak delivery services, and sustainable urban transportation solutions.

Supply chain resilience becomes increasingly important following global disruptions, with companies diversifying transportation options and developing contingency planning capabilities. MWR research indicates that 73% of logistics operators have implemented enhanced risk management protocols and backup transportation arrangements to ensure service continuity during disruptions.

Infrastructure investments continue with government funding for highway modernization projects, border crossing improvements, and logistics facility development. Recent completions of major highway sections enhance connectivity between Czech Republic and neighboring countries, reducing transit times and operational costs for road freight operators. Smart infrastructure initiatives include implementation of intelligent transportation systems and digital traffic management solutions.

Regulatory updates reflect evolving European Union transportation policies, including revised driver working time regulations, vehicle emission standards, and digital tachograph requirements. Companies adapt operations to comply with new regulations while maintaining service quality and operational efficiency. Mobility packages introduced by EU authorities affect cross-border transportation operations and competitive dynamics.

Technology partnerships between logistics operators and technology providers accelerate innovation in fleet management, route optimization, and customer service solutions. Major operators invest in proprietary technology platforms and strategic partnerships to enhance competitive positioning. Startup collaborations bring innovative solutions to traditional logistics challenges through agile development and implementation approaches.

Market consolidation activities include strategic acquisitions, partnerships, and joint ventures as companies seek to achieve scale advantages and expand service capabilities. International logistics providers continue investing in Czech operations through facility expansion and local partnership development. Domestic operators pursue growth strategies through regional expansion and specialized service development.

Technology investment should be prioritized by road freight operators to remain competitive in an increasingly digital marketplace. Companies should focus on implementing comprehensive fleet management systems, customer portal development, and data analytics capabilities to improve operational efficiency and service quality. Digital transformation initiatives require strategic planning and phased implementation to maximize return on investment while minimizing operational disruption.

Sustainability strategies should be developed proactively to address evolving environmental regulations and customer expectations. Operators should evaluate alternative fuel technologies, vehicle efficiency improvements, and carbon offset programs to reduce environmental impact while maintaining cost competitiveness. Green logistics certifications and sustainability reporting can provide competitive advantages in customer acquisition and retention.

Workforce development programs should address driver shortage challenges through recruitment initiatives, training programs, and retention strategies. Companies should invest in driver training, career development opportunities, and competitive compensation packages to attract and retain qualified personnel. Automation technologies should be evaluated as long-term solutions to labor shortage challenges while maintaining service quality standards.

Strategic partnerships can provide growth opportunities and competitive advantages through collaboration with technology providers, complementary service providers, and customer organizations. MarkWide Research analysis suggests that companies pursuing strategic partnerships achieve 23% higher growth rates compared to those relying solely on organic growth strategies.

Market expansion prospects remain positive for the Czech Republic road freight sector, supported by continued economic growth, infrastructure development, and increasing integration with European logistics networks. The market is projected to maintain steady growth momentum with expanding opportunities in e-commerce logistics, specialized transportation services, and cross-border operations. Technology adoption will accelerate operational efficiency improvements and service quality enhancements across the industry.

Industry evolution will be characterized by increasing consolidation, technology integration, and sustainability focus as companies adapt to changing market requirements and regulatory environments. Successful operators will differentiate through service excellence, operational efficiency, and innovative solutions addressing customer needs. Digital platforms will become essential for competitive positioning and customer relationship management.

Sustainability transformation will reshape industry operations through adoption of cleaner transportation technologies, emission reduction programs, and circular economy principles. Companies investing early in sustainable solutions will gain competitive advantages as environmental regulations tighten and customer preferences shift toward green logistics options. Alternative fuel adoption is expected to reach 35% penetration among major fleet operators by the end of the forecast period.

Regional integration will continue expanding as Czech Republic strengthens its position as a Central European logistics hub. Cross-border services will grow in importance as trade volumes increase and supply chains become more integrated across European markets. Infrastructure improvements and regulatory harmonization will further enhance the country’s attractiveness for international logistics operations.

The Czech Republic road freight market demonstrates strong fundamentals and positive growth prospects supported by strategic geographic positioning, robust infrastructure, and diverse economic base. Market participants benefit from the country’s central European location, excellent highway connectivity, and seamless integration with European Union trade systems. Technology adoption and sustainability initiatives will drive future competitiveness and operational efficiency improvements across the industry.

Growth opportunities exist across multiple market segments, including e-commerce logistics, specialized transportation services, and cross-border operations. Companies that invest in digital transformation, sustainable solutions, and workforce development will be best positioned to capitalize on market expansion and changing customer requirements. Strategic partnerships and market consolidation will continue shaping competitive dynamics and industry structure.

The market’s resilience and adaptability position Czech road freight operators for continued success in an evolving logistics landscape. Future success will depend on companies’ ability to embrace innovation, maintain operational excellence, and respond effectively to changing market conditions while delivering superior customer value and sustainable business growth.

What is Road Freight?

Road freight refers to the transportation of goods and cargo using road vehicles. It plays a crucial role in logistics, enabling the movement of products across various sectors such as retail, manufacturing, and agriculture.

What are the key players in the Czech Republic Road Freight Market?

Key players in the Czech Republic Road Freight Market include companies like ČD Cargo, Raben Group, and DPD, which provide a range of logistics and transportation services, among others.

What are the main drivers of the Czech Republic Road Freight Market?

The main drivers of the Czech Republic Road Freight Market include the growth of e-commerce, increasing demand for just-in-time delivery, and the expansion of the manufacturing sector, which requires efficient logistics solutions.

What challenges does the Czech Republic Road Freight Market face?

Challenges in the Czech Republic Road Freight Market include rising fuel costs, regulatory compliance issues, and a shortage of skilled drivers, which can impact service efficiency and operational costs.

What opportunities exist in the Czech Republic Road Freight Market?

Opportunities in the Czech Republic Road Freight Market include the adoption of advanced technologies like GPS tracking and automation, as well as the potential for expanding services in cross-border logistics due to the country’s strategic location.

What trends are shaping the Czech Republic Road Freight Market?

Trends shaping the Czech Republic Road Freight Market include a shift towards sustainable transportation practices, increased use of digital platforms for logistics management, and a focus on enhancing supply chain resilience.

Czech Republic Road Freight Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Trucks, Vans, Trailers, Tankers |

| Service Type | Full Truck Load, Less Than Truck Load, Intermodal, Expedited |

| End User | Manufacturers, Retailers, Distributors, E-commerce |

| Fuel Type | Diesel, Electric, Hybrid, Compressed Natural Gas |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Czech Republic Road Freight Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at