444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Czech Republic pharmaceutical market represents a dynamic and rapidly evolving healthcare ecosystem that has undergone significant transformation since the country’s integration into the European Union. This Central European market demonstrates robust growth potential, driven by an aging population, increasing healthcare expenditure, and progressive regulatory frameworks that align with EU pharmaceutical standards. The market encompasses prescription medications, over-the-counter drugs, biotechnology products, and specialized therapeutic solutions across multiple therapeutic areas.

Market dynamics indicate substantial expansion opportunities, with the pharmaceutical sector experiencing consistent growth at approximately 4.2% CAGR over recent years. The Czech healthcare system’s modernization efforts, combined with increasing patient awareness and improved access to innovative treatments, have created favorable conditions for pharmaceutical companies seeking to establish or expand their presence in this strategically important European market.

Healthcare infrastructure improvements and digital transformation initiatives have enhanced drug distribution networks and patient care delivery systems throughout the country. The market benefits from a well-educated population, strong research and development capabilities, and strategic geographic positioning that serves as a gateway to broader Central and Eastern European markets.

The Czech Republic pharmaceutical market refers to the comprehensive ecosystem of drug development, manufacturing, distribution, and consumption within the Czech Republic’s healthcare system. This market encompasses all pharmaceutical products, including prescription medications, over-the-counter drugs, generic medicines, biosimilars, and specialty therapeutics that are developed, imported, distributed, or consumed within Czech borders.

Market participants include multinational pharmaceutical companies, domestic manufacturers, research institutions, regulatory bodies, healthcare providers, distributors, and end consumers. The market operates under strict regulatory oversight from the State Institute for Drug Control (SÚKL) and adheres to European Medicines Agency (EMA) guidelines, ensuring product safety, efficacy, and quality standards that meet international benchmarks.

Strategic positioning within the European pharmaceutical landscape makes the Czech Republic an attractive market for both established pharmaceutical giants and emerging biotechnology companies. The country’s pharmaceutical sector demonstrates remarkable resilience and growth potential, supported by government healthcare initiatives, EU funding programs, and increasing private healthcare investments.

Key market characteristics include a strong generic drug segment representing approximately 78% market share by volume, growing biosimilar adoption, and increasing demand for specialty pharmaceuticals. The market benefits from competitive pricing structures, efficient distribution networks, and comprehensive healthcare coverage that ensures broad patient access to essential medications.

Innovation drivers encompass digital health technologies, personalized medicine approaches, and collaborative research partnerships between academic institutions and pharmaceutical companies. The market’s evolution reflects broader European healthcare trends while maintaining unique characteristics shaped by local demographics, disease prevalence patterns, and healthcare delivery preferences.

Market intelligence reveals several critical insights that define the Czech pharmaceutical landscape:

Demographic transformation serves as a primary market driver, with the Czech Republic experiencing significant population aging that increases demand for chronic disease management and specialized therapeutic interventions. The proportion of citizens over 65 years continues expanding, creating sustained demand for cardiovascular medications, diabetes treatments, and oncology products.

Healthcare modernization initiatives supported by EU structural funds have enhanced medical infrastructure, expanded treatment capabilities, and improved patient access to innovative therapies. Government investments in hospital upgrades, diagnostic equipment, and digital health systems create favorable conditions for pharmaceutical market expansion.

Economic prosperity and rising disposable incomes enable increased healthcare spending, including out-of-pocket payments for premium medications and wellness products. The growing middle class demonstrates willingness to invest in preventive healthcare and quality pharmaceutical products.

Regulatory harmonization with European standards facilitates market entry for international pharmaceutical companies while ensuring patient safety and product quality. Streamlined approval processes and mutual recognition agreements reduce barriers to market access and accelerate product launches.

Pricing pressures from government healthcare policies and insurance reimbursement limitations create challenges for pharmaceutical companies seeking to maintain profitable operations. Reference pricing systems and mandatory generic substitution policies compress profit margins, particularly for branded medications facing generic competition.

Regulatory complexity despite harmonization efforts can create administrative burdens and delays in product approvals. Multiple stakeholder requirements, documentation standards, and compliance obligations may slow market entry for new pharmaceutical products.

Healthcare budget constraints limit public spending on expensive innovative therapies, creating access barriers for patients requiring specialized treatments. Budget allocation priorities may favor cost-effective generic alternatives over premium branded medications.

Market saturation in certain therapeutic categories creates intense competition and limits growth opportunities for new entrants. Established generic manufacturers maintain strong market positions that can be difficult for newcomers to challenge effectively.

Biotechnology expansion presents significant opportunities as the Czech Republic develops capabilities in biopharmaceutical manufacturing and research. Government support for biotechnology clusters and research parks creates favorable conditions for innovative drug development and production.

Digital health integration offers opportunities for pharmaceutical companies to develop connected health solutions, patient monitoring systems, and digital therapeutics that complement traditional drug treatments. The growing acceptance of telemedicine and remote patient care creates new market segments.

Specialty pharmaceuticals represent an underserved market segment with substantial growth potential. Rare diseases, oncology treatments, and personalized medicine approaches offer opportunities for companies with specialized expertise and innovative therapeutic solutions.

Export market development leverages the Czech Republic’s strategic location and manufacturing capabilities to serve broader Central and Eastern European markets. Established pharmaceutical manufacturers can expand their geographic reach and increase production volumes through regional distribution strategies.

Competitive dynamics within the Czech pharmaceutical market reflect a complex interplay between multinational corporations, domestic manufacturers, and generic drug producers. Market leaders maintain positions through product innovation, strategic partnerships, and comprehensive distribution networks that ensure broad market coverage and customer accessibility.

Supply chain evolution emphasizes efficiency, reliability, and cost optimization as key competitive advantages. Companies investing in advanced logistics capabilities, inventory management systems, and distribution partnerships gain significant market advantages through improved service delivery and reduced operational costs.

Innovation cycles drive market transformation as new therapeutic approaches, drug delivery systems, and treatment protocols emerge. Companies that successfully navigate regulatory approval processes and demonstrate clinical value proposition achieve sustainable competitive advantages in their respective therapeutic areas.

Market consolidation trends reflect broader pharmaceutical industry dynamics, with strategic acquisitions, partnerships, and licensing agreements reshaping competitive landscapes. These activities create opportunities for market expansion while potentially reducing competition in specific therapeutic segments.

Comprehensive analysis of the Czech Republic pharmaceutical market employs multiple research methodologies to ensure accuracy, reliability, and actionable insights. Primary research activities include structured interviews with industry executives, healthcare professionals, regulatory officials, and key opinion leaders across the pharmaceutical value chain.

Secondary research encompasses extensive review of government publications, regulatory filings, industry reports, academic studies, and company financial statements. Data validation processes ensure consistency and accuracy across multiple information sources and analytical frameworks.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop robust market projections and growth forecasts. Quantitative analysis combines with qualitative insights to provide comprehensive market understanding and strategic recommendations.

Expert validation through industry advisory panels and peer review processes ensures research findings meet professional standards and provide actionable intelligence for market participants and stakeholders.

Prague metropolitan area dominates pharmaceutical market activity, accounting for approximately 35% of total consumption and serving as the primary hub for pharmaceutical companies, research institutions, and regulatory bodies. The capital region’s concentration of healthcare facilities, medical specialists, and affluent population creates favorable market conditions for premium pharmaceutical products.

Moravian-Silesian region represents the second-largest pharmaceutical market, driven by industrial centers, aging population demographics, and established healthcare infrastructure. This region demonstrates strong demand for chronic disease medications and occupational health products related to industrial activities.

South Moravian region benefits from the presence of Brno, the country’s second-largest city, and significant biotechnology research activities. The region’s universities and research institutes contribute to clinical trial activities and pharmaceutical innovation initiatives.

Regional distribution patterns reflect population density, healthcare infrastructure development, and economic prosperity levels. Rural areas demonstrate different consumption patterns, with greater emphasis on generic medications and basic therapeutic categories compared to urban centers.

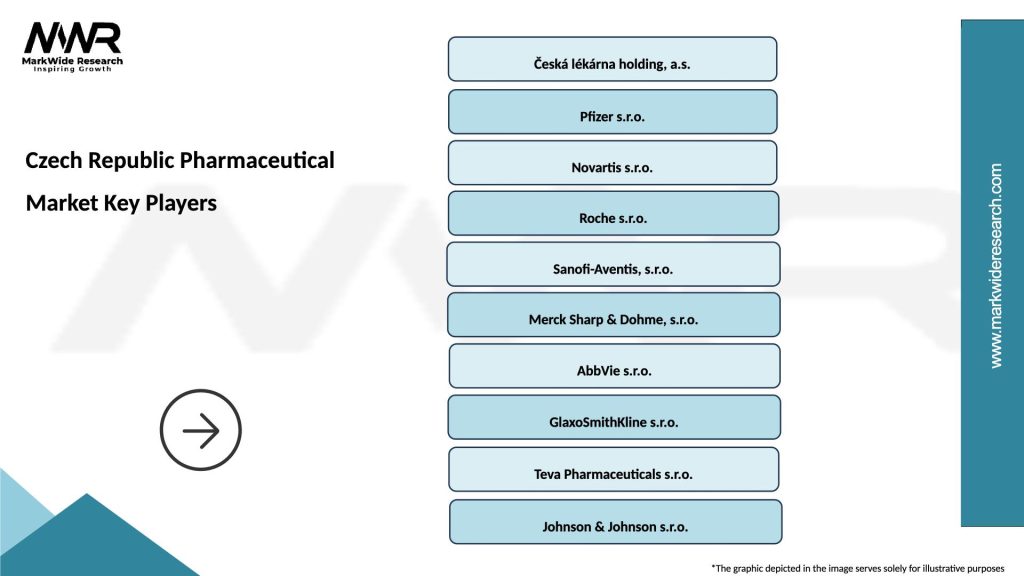

Market leadership positions are held by a combination of multinational pharmaceutical companies and domestic manufacturers that have established strong market presence through strategic investments, product portfolios, and distribution capabilities.

By Product Type:

By Therapeutic Area:

By Distribution Channel:

Generic medications dominate market volume with 78% share, reflecting cost-conscious healthcare policies and patient preferences for affordable treatment options. This segment benefits from automatic substitution policies and reference pricing systems that encourage generic drug utilization across most therapeutic categories.

Specialty pharmaceuticals represent the fastest-growing category, driven by increasing prevalence of complex diseases and availability of innovative treatment options. Oncology, immunology, and rare disease treatments demonstrate particularly strong growth potential despite higher costs and access challenges.

Biosimilar products gain market acceptance as patents expire on original biologic medications. Healthcare providers and patients increasingly recognize biosimilars as cost-effective alternatives that maintain therapeutic efficacy while reducing treatment costs.

Over-the-counter products experience steady growth as consumers take greater responsibility for self-care and preventive health management. This category benefits from aging population demographics and increasing health consciousness among Czech consumers.

Pharmaceutical companies benefit from stable regulatory environment, predictable reimbursement systems, and growing market demand driven by demographic trends. The market offers opportunities for both generic manufacturers seeking cost-competitive advantages and innovative companies developing specialized therapeutic solutions.

Healthcare providers gain access to comprehensive pharmaceutical portfolios that support evidence-based treatment protocols and improved patient outcomes. Competitive pricing and generic availability help healthcare institutions manage budget constraints while maintaining treatment quality.

Patients benefit from broad medication access, competitive pricing, and comprehensive insurance coverage that ensures affordability of essential treatments. The market’s emphasis on generic alternatives provides cost-effective treatment options without compromising therapeutic efficacy.

Government stakeholders achieve healthcare policy objectives through controlled pharmaceutical spending, improved population health outcomes, and economic benefits from domestic pharmaceutical manufacturing and export activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the pharmaceutical value chain, with electronic prescribing reaching 85% adoption among healthcare providers and digital health solutions gaining acceptance for patient monitoring and medication adherence support. This trend creates opportunities for pharmaceutical companies to develop integrated digital therapeutic solutions.

Personalized medicine approaches gain traction as genetic testing becomes more accessible and treatment protocols increasingly consider individual patient characteristics. Pharmacogenomics applications help optimize drug selection and dosing, improving treatment outcomes while reducing adverse effects.

Sustainability initiatives influence pharmaceutical manufacturing and packaging decisions as companies respond to environmental concerns and regulatory requirements. Green chemistry approaches and sustainable packaging solutions become competitive differentiators in the market.

Patient-centric care models emphasize treatment outcomes, quality of life improvements, and patient satisfaction metrics. Pharmaceutical companies increasingly focus on real-world evidence generation and patient support programs that demonstrate value beyond traditional clinical endpoints.

Regulatory modernization initiatives streamline approval processes while maintaining safety standards, with digital submission systems and expedited review pathways reducing time-to-market for innovative therapies. MarkWide Research analysis indicates these improvements enhance market attractiveness for pharmaceutical investment.

Manufacturing expansion projects by both domestic and international companies increase local production capacity and reduce import dependence. These investments strengthen supply chain resilience and create opportunities for export market development.

Research collaboration agreements between pharmaceutical companies, universities, and research institutions accelerate drug development activities and clinical trial capabilities. These partnerships leverage Czech Republic’s research expertise and patient populations for innovative therapy development.

Digital health integration initiatives connect pharmaceutical treatments with monitoring technologies, creating comprehensive care solutions that improve patient outcomes and treatment adherence rates.

Market entry strategies should emphasize generic drug portfolios and cost-competitive positioning to align with market preferences and reimbursement policies. Companies entering the Czech market benefit from partnerships with established distributors and focus on therapeutic areas with strong demand growth.

Innovation investment in biotechnology and specialty pharmaceuticals offers differentiation opportunities despite higher development costs and regulatory complexity. Companies with specialized expertise in rare diseases or complex therapeutic areas can achieve premium positioning and sustainable competitive advantages.

Digital integration capabilities become increasingly important for market success as healthcare providers and patients adopt technology-enabled care solutions. Pharmaceutical companies should develop digital health competencies and patient engagement platforms that complement traditional drug treatments.

Regional expansion strategies can leverage Czech Republic operations as a platform for broader Central and Eastern European market development. Manufacturing and distribution investments in the Czech Republic provide cost-effective access to regional markets with similar healthcare systems and regulatory frameworks.

Market evolution over the next five years will be shaped by demographic trends, technological advancement, and healthcare policy developments that create both opportunities and challenges for pharmaceutical market participants. MarkWide Research projections indicate continued market expansion driven by aging population dynamics and increasing healthcare utilization.

Growth projections suggest the market will maintain steady expansion at approximately 4.5% CAGR through 2028, with specialty pharmaceuticals and biotechnology products demonstrating above-average growth rates. Generic drug segments will continue dominating by volume while innovative therapies capture increasing value share.

Technology integration will accelerate, with digital health solutions becoming standard components of pharmaceutical care delivery. Artificial intelligence applications in drug discovery, personalized medicine approaches, and patient monitoring systems will create new market segments and competitive dynamics.

Regulatory evolution will continue aligning with European standards while potentially introducing new requirements for digital health products and real-world evidence generation. These changes will create both opportunities for innovation and compliance challenges for market participants.

The Czech Republic pharmaceutical market represents a dynamic and strategically important healthcare ecosystem that offers significant opportunities for both established pharmaceutical companies and emerging market entrants. The market’s combination of stable regulatory environment, comprehensive healthcare coverage, and growing demand driven by demographic trends creates favorable conditions for sustainable business development.

Key success factors include understanding local market preferences for cost-effective generic medications, developing appropriate pricing strategies that align with reimbursement policies, and building strong distribution partnerships that ensure comprehensive market coverage. Companies that can balance innovation with cost-effectiveness will achieve optimal market positioning.

Future market development will be characterized by continued growth in specialty pharmaceuticals, increasing adoption of digital health solutions, and expanding opportunities in biotechnology and personalized medicine. The market’s evolution reflects broader European healthcare trends while maintaining unique characteristics that require tailored strategic approaches for optimal success.

What is Pharmaceutical?

Pharmaceutical refers to the science and industry involved in the development, production, and marketing of medications. This includes various segments such as prescription drugs, over-the-counter medications, and biotechnology products.

What are the key players in the Czech Republic Pharmaceutical Market?

Key players in the Czech Republic Pharmaceutical Market include companies like Zentiva, Teva Czech Industries, and Pfizer, which are involved in the production and distribution of a wide range of pharmaceutical products, among others.

What are the growth factors driving the Czech Republic Pharmaceutical Market?

The growth of the Czech Republic Pharmaceutical Market is driven by factors such as an aging population, increasing prevalence of chronic diseases, and advancements in biotechnology and personalized medicine.

What challenges does the Czech Republic Pharmaceutical Market face?

Challenges in the Czech Republic Pharmaceutical Market include stringent regulatory requirements, pricing pressures from healthcare systems, and competition from generic drugs, which can impact profitability.

What opportunities exist in the Czech Republic Pharmaceutical Market?

Opportunities in the Czech Republic Pharmaceutical Market include the potential for growth in biopharmaceuticals, increased investment in research and development, and expanding access to innovative therapies.

What trends are shaping the Czech Republic Pharmaceutical Market?

Trends in the Czech Republic Pharmaceutical Market include a shift towards digital health solutions, increased focus on personalized medicine, and the integration of artificial intelligence in drug development processes.

Czech Republic Pharmaceutical Market

| Segmentation Details | Description |

|---|---|

| Product Type | Prescription Drugs, Over-the-Counter, Biologics, Generics |

| Therapy Area | Oncology, Cardiovascular, Neurology, Infectious Diseases |

| Delivery Mode | Injectable, Oral, Topical, Inhalation |

| End User | Hospitals, Pharmacies, Clinics, Research Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Czech Republic Pharmaceutical Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at