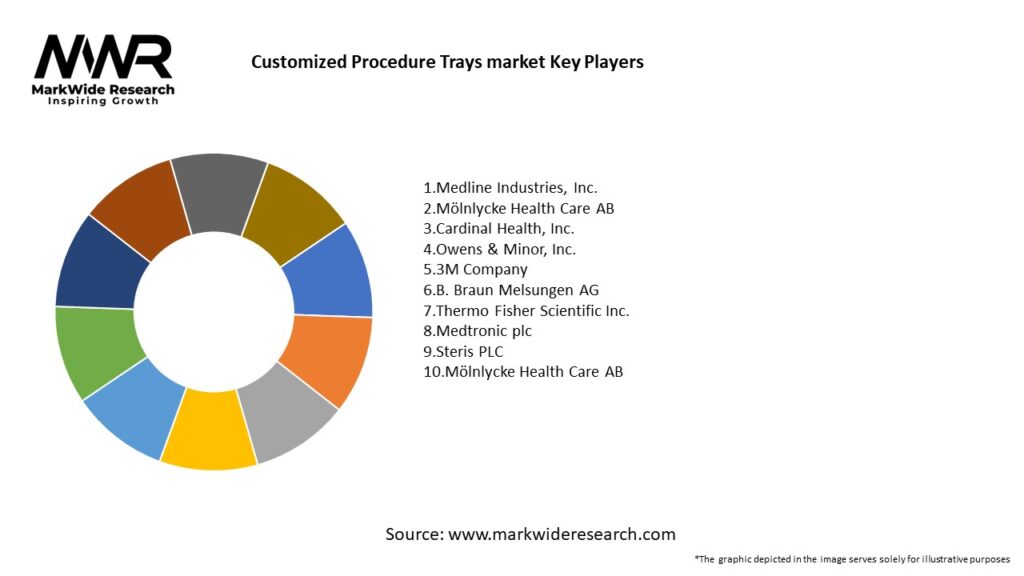

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

OR Efficiency Gains: Facilities report up to 20% reductions in tray setup time and 15% fewer missing instrument incidents after adopting customized trays.

-

Infection Control: Pre-packaged, sterile kits lower cross-contamination risk, helping achieve up to 30% fewer surgical site infections (SSIs) compared to loose instrument sets.

-

Cost Savings: Disposable tray solutions can reduce instrument-reprocessing costs by 25–40%, while reusable systems—with higher upfront investment—offer breakeven within 12–18 months.

-

Technology Integration: RFID- and barcode-enabled trays are becoming standard, enabling real-time inventory tracking and automated restocking alerts.

-

Procedure Coverage: Orthopedic and cardiovascular segments account for over 50% of customized tray revenues, reflecting high volumes and instrument complexity.

Market Drivers

-

Rising Surgical Volumes: Aging populations and increasing prevalence of chronic conditions are driving higher procedure counts across specialties.

-

Value-Based Care: Reimbursements linked to quality metrics incentivize hospitals to reduce SSIs and OR inefficiencies.

-

Staffing Constraints: Nursing and sterile processing shortages push administrators to adopt labor-saving tray solutions.

-

Outsourcing Trends: Demand for outsourced tray assembly and sterilization services is growing among small and mid-size facilities lacking in-house capacity.

-

Digital Workflow: Integration of tray management software with hospital information systems streamlines procurement, reduces overstock, and improves cost visibility.

Market Restraints

-

CapEx Requirements: Investment in RFID systems, sterilization equipment, or disposable tray contracts can strain capital budgets.

-

Change Management: Transitioning surgeons and OR staff to new tray configurations requires training and workflow adaptation.

-

Regulatory Oversight: Reusable tray systems must comply with stringent reprocessing and validation standards (e.g., AAMI, FDA).

-

Environmental Concerns: Surge in single-use kits raises waste-management issues, prompting scrutiny over disposables.

-

Customization Complexity: High variability in surgeon preferences and procedure protocols can complicate standardization and scale-up.

Market Opportunities

-

Sustainability Initiatives: Development of recyclable tray components and biodegradable packaging addresses environmental pressures.

-

AI-Driven Optimization: Analytics platforms can predict tray utilization patterns to refine kit contents and minimize waste.

-

Emerging Markets: Growing surgical capacity in Asia-Pacific and Latin America represents significant untapped demand for tray solutions.

-

Point-of-Use Sterilization: Miniaturized EO and low-temperature sterilizers enable decentralized tray reprocessing in remote or small facilities.

-

Modular Tray Designs: Interchangeable insert systems allow rapid reconfiguration for multiple procedure types using a common base tray.

Market Dynamics

-

Service-Based Models: Suppliers are shifting from product sales to subscription-based services, bundling trays, sterilization, and inventory management.

-

Consolidation: Mergers among instrument manufacturers, sterile processing service providers, and software firms are creating full-suite OR logistics platforms.

-

Collaboration with GPOs: Group Purchasing Organizations negotiate large-scale tray contracts, securing volume pricing and standardizing kits across health systems.

-

Customization vs. Standardization: Balancing the need for surgeon-specific trays with operational simplicity drives hybrid approaches—core tray plus procedure-specific add-ons.

-

Digital Integration: Connectivity with EMR and ERP systems facilitates automated ordering, cost tracking, and compliance reporting.

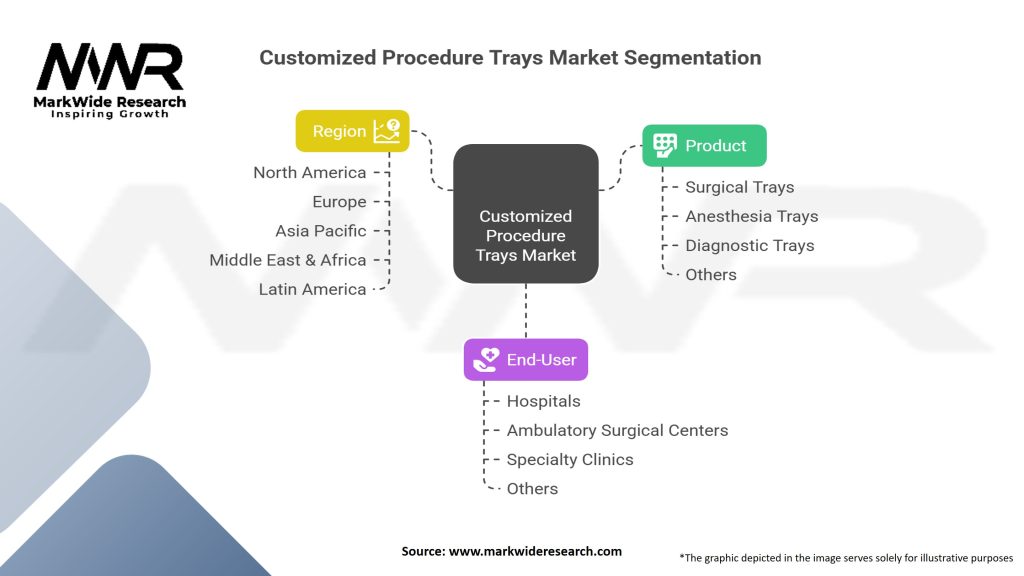

Regional Analysis

-

North America: Largest market due to advanced OR infrastructure, high outsourcing rates, and stringent infection-control mandates.

-

Europe: Growth fueled by bundled procurement through hospital networks and environmental regulations favoring reusable systems.

-

Asia-Pacific: Rapid expansions in private hospital chains and ambulatory surgery centers are driving adoption of cost-effective disposable trays.

-

Latin America: Gradual uptake led by leading urban hospitals; partnerships with global tray assemblers help overcome local sterilization capacity gaps.

-

Middle East & Africa: Limited by infrastructure constraints, but major tertiary centers are investing in turnkey tray solutions for specialty procedures.

Competitive Landscape

Leading Companies in the Customized Procedure Trays Market:

- Medline Industries, Inc.

- Mölnlycke Health Care AB

- Cardinal Health, Inc.

- Owens & Minor, Inc.

- 3M Company

- B. Braun Melsungen AG

- Thermo Fisher Scientific Inc.

- Medtronic plc

- Steris PLC

- Mölnlycke Health Care AB

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

-

By Tray Type: Disposable (Single-Use) Trays, Reusable (Sterilizable) Trays, Hybrid (Core + Disposable Inserts)

-

By Specialty: Orthopedic, Cardiovascular, General Surgery, Neurosurgery, Ophthalmic, ENT, Gynecological

-

By End-User: Hospitals, Ambulatory Surgery Centers, Specialty Clinics, Dental and Veterinary Practices

-

By Service Model: In-House Assembly & Sterilization, Outsourced Tray Assembly, Subscription-Based Tray Services

Category-wise Insights

-

Disposable Trays: Offer predictable sterility and minimal reprocessing burden; favored in high-volume or outbreak scenarios.

-

Reusable Trays: Lower long-term cost and waste; require robust SPD workflows and sterilization validation.

-

Hybrid Trays: Balance flexibility and efficiency—core instrument set is reusable, while high-risk or procedure-specific items are single-use.

-

Orthopedic Trays: Among the most complex, often containing implants, power tool attachments, and multiple instrument sets—high value per tray.

-

Cardiovascular Trays: Include delicate cannulas, catheters, and suture materials; tight configuration requirements drive customization.

-

General Surgery Trays: High turnover and varied instrument needs favor disposable or hybrid models to simplify inventory.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Workflow Efficiency: Pre-configured trays reduce OR setup time and instrument count reconciliation by up to 30%.

-

Improved Patient Safety: Single-use components and validated sterilization lower the risk of SSIs and instrument-related errors.

-

Cost Control: Analytics-driven tray optimization eliminates unnecessary items, reduces reprocessing costs, and limits instrument loss.

-

Regulatory Compliance: Traceable barcodes/RFID ensure full visibility of tray contents, sterilization dates, and expiry, aiding accreditation.

-

Scalability: Service-based and subscription models allow facilities to adjust tray volumes according to surgical demand.

SWOT Analysis

Strengths:

-

Clear ROI through labor savings, reduced infection rates, and lower instrument reprocessing costs.

-

Strong demand from high-volume specialties with complex instrument needs.

-

Advanced analytics and digital integration enhance value proposition.

Weaknesses:

-

Upfront investment in software, RFID, or outsourcing contracts can deter smaller facilities.

-

Surgeon preference variability can complicate standardization and scale.

-

Environmental pushback against single-use disposables requires mitigation strategies.

Opportunities:

-

Expansion of tray services into emerging markets with growing surgical capacity.

-

Development of eco-friendly disposable tray materials and reusable-tray recycling programs.

-

AI-enabled recommendation engines to automate tray-content optimization.

Threats:

-

Potential supply-chain disruptions for critical tray components and sterilization consumables.

-

Competitive pressure from in-house SPD improvements and low-cost local assemblers.

-

Evolving regulatory requirements for SPD validation and disposable medical waste.

Market Key Trends

-

Value-Based Bundling: Suppliers offering outcome-linked pricing—e.g., SSIs per 1,000 cases guarantees—are gaining traction.

-

Remote Monitoring: Cloud-based dashboards monitoring tray utilization, sterilizer cycles, and inventory levels in real time.

-

Surgeon-Centric Apps: Mobile interfaces allowing surgeons to review and adjust tray contents digitally before assembly.

-

Eco-Innovation: Biodegradable tray liners and compostable packaging materials to address sustainability mandates.

-

Pop-Up ORs: Portable tray solutions for temporary or field-hospital setups, especially used in disaster and pandemic response.

Covid-19 Impact

The pandemic accelerated adoption of disposable procedure trays to minimize cross-contamination risks and reduce SPD burdens during staffing shortages. Many facilities pivoted to outsourced tray assembly to free internal resources. Remote training and virtual onboarding tools became essential to train OR staff on new tray configurations. As elective surgeries rebounded, the benefits of pre-assembled kits—in terms of sterility assurance and rapid turnover—solidified their place in the standard OR toolkit.

Key Industry Developments

-

Cardinal Health expanded its PeriChart™ suite in 2023 to include AI-driven tray-content forecasting, reducing stockouts by 45%.

-

STERIS partnered with a major health system to deploy RFID-enabled reusable trays across 15 hospitals, cutting instrument loss by 60%.

-

3M launched EcoTrays™, a line of disposable kits using 80% post-consumer recycled plastics and compostable wraps.

-

Metrex introduced AutoTray™, an automated assembly line capable of building and sterilizing up to 500 custom trays per shift.

Analyst Suggestions

-

Pilot Hybrid Models: Test core-reusable plus disposable-insert trays in high-volume ORs to balance cost, flexibility, and waste reduction.

-

Invest in Training: Deploy e-learning modules and simulation labs to onboard surgeons and SPD staff on new tray systems.

-

Measure Outcomes: Track key performance indicators—setup time, SSI rates, cost per case—to quantify tray program ROI.

-

Leverage Data: Use analytics to identify under- or over-utilized items, then refine kit contents iteratively.

-

Engage Sustainability Teams: Collaborate with hospital environmental services to design recycling protocols for disposable components.

Future Outlook

The Customized Procedure Trays market is projected to grow at a double-digit CAGR over the next five years as healthcare facilities prioritize efficiency, safety, and cost containment. Convergence of tray assembly services, digital inventory platforms, and sustainability innovations will redefine OR logistics. Hybrid tray models and AI-driven content optimization will emerge as best practices, while emerging markets—particularly in Asia Pacific and Latin America—offer significant greenfield opportunities. Suppliers who deliver end-to-end solutions—combining trays, software, analytics, and environmental stewardship—will lead the next wave of adoption.

Conclusion

In conclusion, customized procedure trays represent a transformative approach to OR management—delivering streamlined workflows, enhanced patient safety, and measurable cost savings. As market participants embrace hybrid service models, digital integration, and eco-innovations, the tray-centric OR will become the new standard for high-quality, efficient, and sustainable surgical care. Stakeholders who align technology, training, and environmental goals are best positioned to capture the full value of this rapidly evolving market.