444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

In today’s globalized economy, currency exchange plays a vital role in facilitating international trade and financial transactions. Currency exchange software has emerged as a crucial tool for businesses and individuals to efficiently manage their foreign exchange needs. This comprehensive report provides an in-depth analysis of the currency exchange software market, including its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, impact of Covid-19, industry developments, analyst suggestions, future outlook, and a conclusive summary.

Currency exchange software refers to specialized technology solutions that enable individuals and businesses to exchange one currency for another at the prevailing exchange rate. These software applications streamline the process of converting currencies, providing real-time exchange rate information, facilitating transactions, and managing risk associated with foreign exchange fluctuations. Currency exchange software can be utilized by banks, financial institutions, currency exchange service providers, multinational corporations, travel agencies, and individuals who engage in international transactions.

Executive Summary

The currency exchange software market has experienced significant growth in recent years, driven by the increasing globalization of businesses, rising international travel, and the need for efficient currency conversion services. The market is characterized by intense competition and the presence of both established players and new entrants offering innovative solutions. With technological advancements and the growing adoption of digital payment systems, the currency exchange software market is expected to witness further expansion in the coming years.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

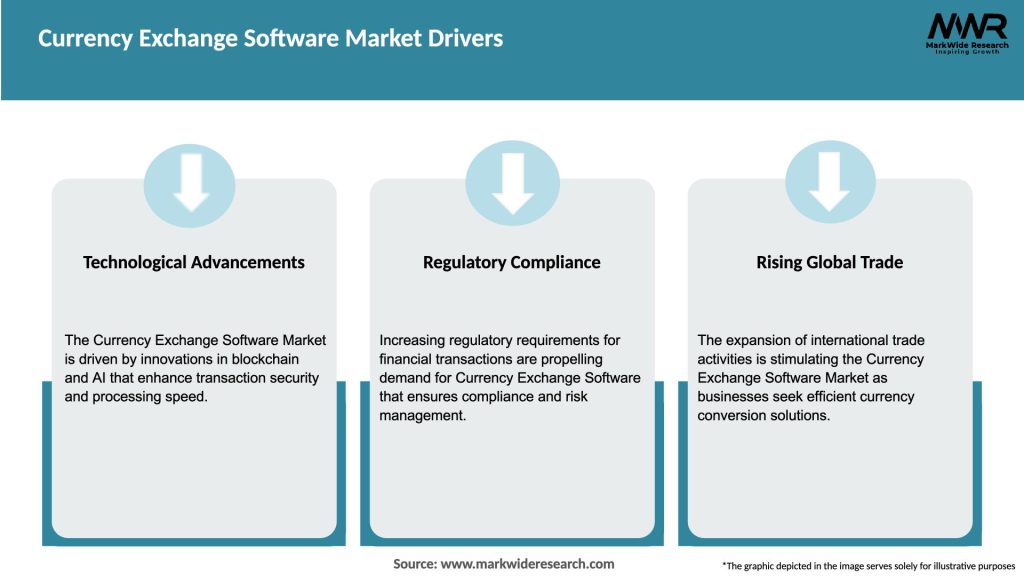

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The currency exchange software market is highly dynamic and influenced by various factors. The market is characterized by intense competition, rapid technological advancements, changing customer preferences, and evolving regulatory landscapes. To stay competitive, market players need to continuously innovate and adapt to emerging trends such as mobile applications, AI, ML, and blockchain technology integration. The market dynamics also include the impact of macroeconomic factors, geopolitical events, and financial market conditions on currency exchange rates and demand for currency exchange software.

Regional Analysis

The currency exchange software market exhibits significant regional variations due to differences in economic conditions, regulatory frameworks, and cultural factors. North America and Europe are mature markets with high adoption of currency exchange software, driven by established financial sectors and international trade. Asia Pacific is a rapidly growing market, fueled by the region’s economic development, increasing cross-border investments, and rising tourism. Latin America, the Middle East, and Africa offer untapped potential, presenting opportunities for market expansion in these regions.

Competitive Landscape

Leading Companies in the Currency Exchange Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

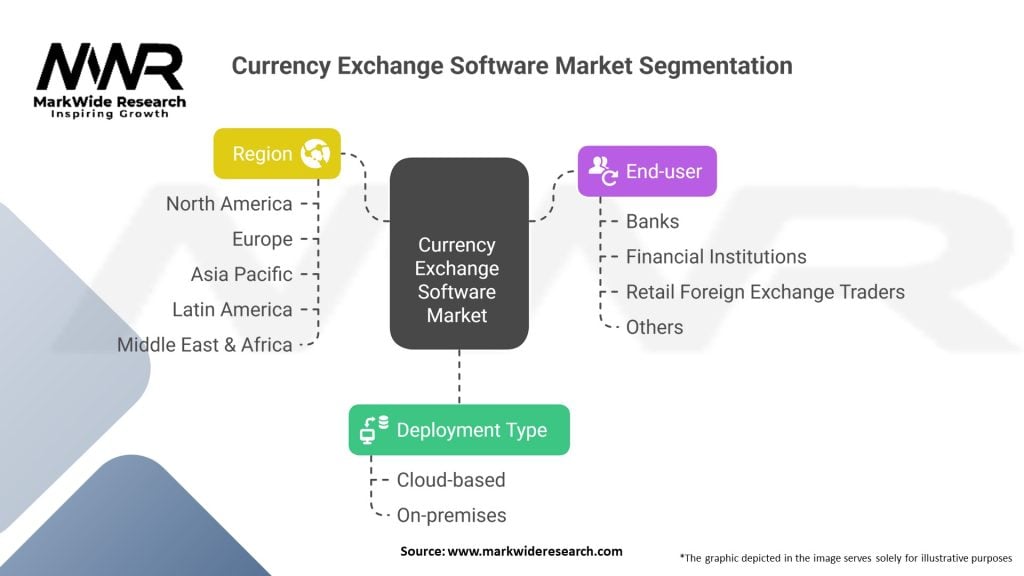

Segmentation

The currency exchange software market can be segmented based on deployment type, end-user, and geography. By deployment type, the market can be categorized into on-premises and cloud-based solutions. End-users of currency exchange software include banks, financial institutions, currency exchange service providers, multinational corporations, travel agencies, and individuals. Geographically, the market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the currency exchange software market. The global travel restrictions, lockdown measures, and economic uncertainties resulted in reduced international travel and disrupted cross-border trade. Currency exchange software providers experienced a decline in demand during the pandemic due to reduced transaction volumes. However, the crisis also accelerated the adoption of digital payment systems, increasing the demand for contactless currency exchange solutions. As economies recover and international travel resumes, the currency exchange software market is expected to regain momentum.

Key Industry Developments

AI-Driven Rate Engines: Introduction of real-time, machine-learning-powered pricing algorithms is improving spread management and profit margins.

Banking Partnerships: Integrations with major European banks and fintechs are offering seamless API-based FX services to corporate clients.

Cloud SaaS Adoption: Growing shift to cloud-hosted currency platforms is reducing on-premises IT costs and accelerating feature rollouts.

PSD2 Compliance: Enhancement of strong customer authentication (SCA) and open banking features is ensuring regulatory alignment.

Client Education Portals: Launch of interactive dashboards and learning modules helps treasurers understand hedging strategies and software functionalities.

Analyst Suggestions

Future Outlook

The currency exchange software market is poised for significant growth in the coming years. Factors such as increasing cross-border trade, rising international travel, digital payment adoption, and technological advancements will drive market expansion. The integration of AI, ML, and blockchain technologies will continue to enhance the efficiency, accuracy, and security of currency exchange software. Emerging markets and the growing popularity of mobile applications present lucrative opportunities for market players. However, challenges related to regulatory compliance, security, and exchange rate volatility need to be addressed for sustained growth.

Conclusion

The currency exchange software market is witnessing rapid growth and transformation, driven by globalization, digitalization, and evolving customer needs. Currency exchange software providers play a crucial role in facilitating seamless currency conversion, risk management, and financial operations for businesses and individuals. With the integration of advanced technologies, personalized experiences, and expansion into emerging markets, the market is poised for a bright future. By staying agile, embracing innovation, and addressing regulatory and security concerns, currency exchange software providers can position themselves for success in this dynamic and competitive market.

What is Currency Exchange Software?

Currency Exchange Software refers to applications and platforms that facilitate the buying, selling, and trading of currencies. These systems are used by financial institutions, forex brokers, and individual traders to manage currency transactions efficiently.

Who are the key players in the Currency Exchange Software Market?

Key players in the Currency Exchange Software Market include companies like MetaTrader, OANDA, and Forex.com, which provide robust trading platforms and tools for currency exchange. Other notable companies include IG Group and Saxo Bank, among others.

What are the main drivers of growth in the Currency Exchange Software Market?

The growth of the Currency Exchange Software Market is driven by increasing globalization, the rise of online trading platforms, and the growing demand for real-time currency data. Additionally, advancements in technology and mobile applications are enhancing user accessibility and engagement.

What challenges does the Currency Exchange Software Market face?

The Currency Exchange Software Market faces challenges such as regulatory compliance, cybersecurity threats, and market volatility. These factors can impact the reliability and security of trading platforms, affecting user trust and adoption.

What opportunities exist in the Currency Exchange Software Market?

Opportunities in the Currency Exchange Software Market include the integration of artificial intelligence for predictive analytics, the expansion of cryptocurrency trading features, and the development of more user-friendly interfaces. These innovations can attract a broader range of users and enhance trading experiences.

What trends are shaping the Currency Exchange Software Market?

Trends in the Currency Exchange Software Market include the increasing use of mobile trading applications, the rise of algorithmic trading, and the growing importance of data analytics for decision-making. Additionally, the shift towards decentralized finance is influencing how currency exchange is conducted.

Currency Exchange Software Market:

| Segmentation Details | Description |

|---|---|

| Deployment Type | Cloud-based, On-premises |

| End-user | Banks, Financial Institutions, Retail Foreign Exchange Traders, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Currency Exchange Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at