444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Cryptocurrency and Blockchain market has emerged as one of the most disruptive and transformative forces in the global economy, revolutionizing the way we perceive and transact value. Cryptocurrencies, powered by blockchain technology, offer decentralized and secure alternatives to traditional financial systems, enabling peer-to-peer transactions, smart contracts, and decentralized finance (DeFi) applications. This dynamic market segment has attracted widespread attention from investors, technologists, regulators, and businesses seeking to harness the potential of blockchain innovation.

Meaning

Cryptocurrency refers to digital or virtual currencies that utilize cryptographic techniques to secure transactions, control the creation of new units, and verify the transfer of assets. Blockchain, the underlying technology behind cryptocurrencies, is a distributed ledger system that records transactions across a network of computers in a tamper-resistant and transparent manner. Together, cryptocurrency and blockchain technology offer decentralized and trustless systems for transferring and storing value, enabling new forms of economic interaction and innovation.

Executive Summary

The Cryptocurrency and Blockchain market is experiencing exponential growth, driven by factors such as increasing adoption of digital assets, growing interest from institutional investors, and the proliferation of blockchain-based applications across various industries. While challenges such as regulatory uncertainty and scalability issues remain, key players in the market are driving innovation and adoption, pushing the boundaries of what is possible with decentralized technology.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Cryptocurrency and Blockchain market is characterized by rapid innovation, regulatory developments, and shifting market dynamics. Key players in the market are driving adoption and innovation through research and development, strategic partnerships, and community engagement. While challenges such as regulatory uncertainty and scalability issues persist, the long-term potential of blockchain technology to transform industries and reshape the global economy remains undeniable.

Regional Analysis

Competitive Landscape

Leading Companies in the Cryptocurrency and Blockchain Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

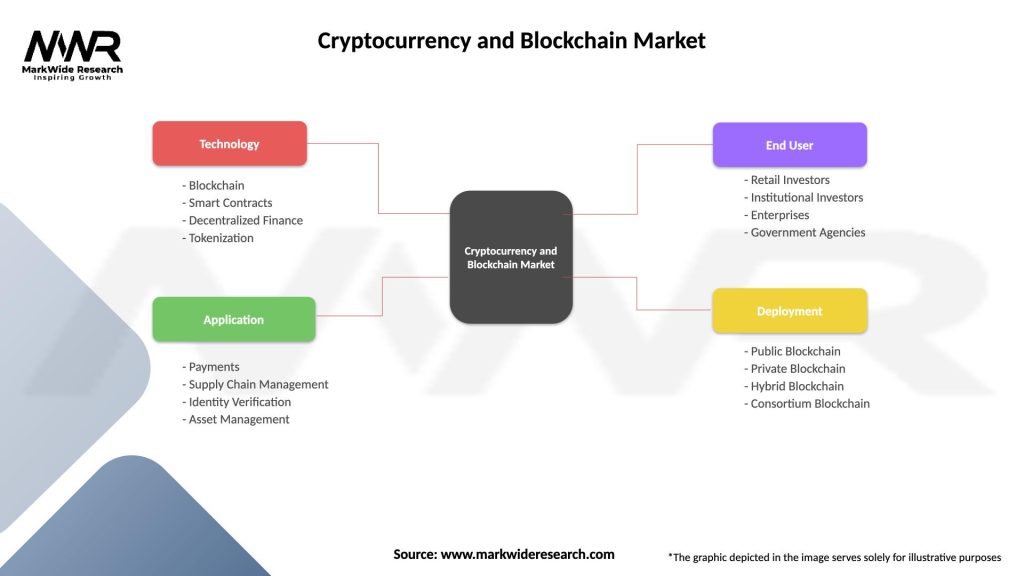

Segmentation

The cryptocurrency and blockchain market can be segmented based on various factors, including cryptocurrency type (Bitcoin, Ethereum, altcoins), blockchain platform (public, private, hybrid), application (payments, smart contracts, decentralized finance), and industry vertical (finance, supply chain, healthcare, gaming).

Category-wise Insight

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of digital assets and blockchain technology, highlighting the importance of decentralized systems, digital payments, and transparent supply chains. While the pandemic has caused economic uncertainty and volatility in financial markets, it has also underscored the resilience and potential of cryptocurrencies and blockchain technology to reshape the global economy and drive innovation.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Cryptocurrency and Blockchain market is poised for continued growth and innovation, driven by increasing adoption, regulatory clarity, and technological advancements. Key players in the market are expected to focus on scalability, interoperability, and sustainability to address challenges and unlock new opportunities for blockchain adoption and growth. With ongoing investment, collaboration, and innovation, the cryptocurrency and blockchain ecosystem is well-positioned to reshape industries, disrupt traditional financial systems, and drive economic transformation on a global scale.

Conclusion

In conclusion, the Cryptocurrency and Blockchain market is a dynamic and transformative force in the global economy, offering decentralized and secure alternatives to traditional financial systems. Cryptocurrencies and blockchain technology enable peer-to-peer transactions, smart contracts, and decentralized finance (DeFi) applications, driving innovation and adoption across various industries. While challenges such as regulatory uncertainty and scalability issues remain, the long-term potential of blockchain technology to reshape industries, drive economic transformation, and empower individuals and communities cannot be overlooked. With ongoing innovation, investment, and collaboration, the cryptocurrency and blockchain ecosystem is poised for continued growth and disruption in the years to come.

What is Cryptocurrency and Blockchain?

Cryptocurrency and Blockchain refer to digital currencies that utilize blockchain technology for secure and transparent transactions. Cryptocurrencies like Bitcoin and Ethereum operate on decentralized networks, enabling peer-to-peer exchanges without intermediaries.

What are the key companies in the Cryptocurrency and Blockchain Market?

Key companies in the Cryptocurrency and Blockchain Market include Coinbase, Binance, and Ripple, which provide platforms for trading and managing digital assets. Additionally, companies like IBM and ConsenSys are involved in developing blockchain solutions for various industries, among others.

What are the main drivers of growth in the Cryptocurrency and Blockchain Market?

The main drivers of growth in the Cryptocurrency and Blockchain Market include increasing adoption of digital currencies for transactions, the rise of decentralized finance (DeFi) applications, and growing interest from institutional investors. Additionally, advancements in blockchain technology are enhancing security and efficiency.

What challenges does the Cryptocurrency and Blockchain Market face?

The Cryptocurrency and Blockchain Market faces challenges such as regulatory uncertainty, security concerns related to hacking and fraud, and market volatility. These factors can hinder widespread adoption and investor confidence in digital currencies.

What opportunities exist in the Cryptocurrency and Blockchain Market?

Opportunities in the Cryptocurrency and Blockchain Market include the potential for new financial products, the expansion of blockchain applications in supply chain management, and the integration of cryptocurrencies in everyday transactions. As technology evolves, new use cases are likely to emerge.

What are the current trends in the Cryptocurrency and Blockchain Market?

Current trends in the Cryptocurrency and Blockchain Market include the rise of non-fungible tokens (NFTs), increased focus on regulatory compliance, and the development of central bank digital currencies (CBDCs). These trends are shaping the future landscape of digital finance.

Cryptocurrency and Blockchain Market

| Segmentation Details | Description |

|---|---|

| Technology | Blockchain, Smart Contracts, Decentralized Finance, Tokenization |

| Application | Payments, Supply Chain Management, Identity Verification, Asset Management |

| End User | Retail Investors, Institutional Investors, Enterprises, Government Agencies |

| Deployment | Public Blockchain, Private Blockchain, Hybrid Blockchain, Consortium Blockchain |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Cryptocurrency and Blockchain Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at