444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Crypto Compliance Software Market is a rapidly evolving segment within the broader cryptocurrency industry, driven by the increasing regulatory scrutiny and compliance requirements faced by cryptocurrency businesses and financial institutions. Crypto compliance software solutions help companies and organizations adhere to regulatory standards, mitigate risks related to money laundering, terrorist financing, and other illicit activities, and ensure transparency and accountability in cryptocurrency transactions. As governments and regulatory bodies worldwide introduce new regulations and guidelines for the cryptocurrency sector, the demand for advanced compliance software tools is expected to grow, presenting opportunities for software providers and stakeholders in the crypto ecosystem.

Meaning

Crypto compliance software refers to specialized software solutions designed to assist cryptocurrency businesses, financial institutions, and regulatory agencies in monitoring, detecting, and preventing illegal activities in the cryptocurrency market. These software tools leverage advanced technologies such as artificial intelligence, machine learning, blockchain analytics, and data visualization to analyze transactional data, identify suspicious patterns and behaviors, and facilitate compliance with regulatory requirements. By implementing crypto compliance software, companies can enhance their regulatory compliance efforts, mitigate operational and legal risks, and build trust and credibility in the cryptocurrency ecosystem.

Executive Summary

The Crypto Compliance Software Market is witnessing rapid growth and innovation as cryptocurrency adoption continues to expand globally. This executive summary provides an overview of the market landscape, highlighting key trends, drivers, challenges, and opportunities shaping the future of crypto compliance software. As regulators increase their oversight of the cryptocurrency industry, businesses and financial institutions are turning to advanced compliance solutions to navigate regulatory complexities, protect against financial crime, and foster trust and legitimacy in the crypto market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Crypto Compliance Software Market operates within a dynamic and evolving regulatory environment shaped by factors such as technological innovation, regulatory developments, market trends, and geopolitical considerations. These dynamics influence market behavior, competitive strategies, and customer requirements, driving innovation, collaboration, and adaptation among compliance software providers and industry participants.

Regional Analysis

Regional variations in regulatory frameworks, enforcement priorities, market maturity, and technological adoption impact the demand for crypto compliance software solutions and the strategies of software providers operating in different regions. Markets with stringent regulatory requirements and high levels of cryptocurrency activity, such as North America, Europe, and Asia-Pacific, present significant growth opportunities for compliance software providers seeking to expand their market presence and serve diverse customer needs.

Competitive Landscape

Leading companies in the Crypto Compliance Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

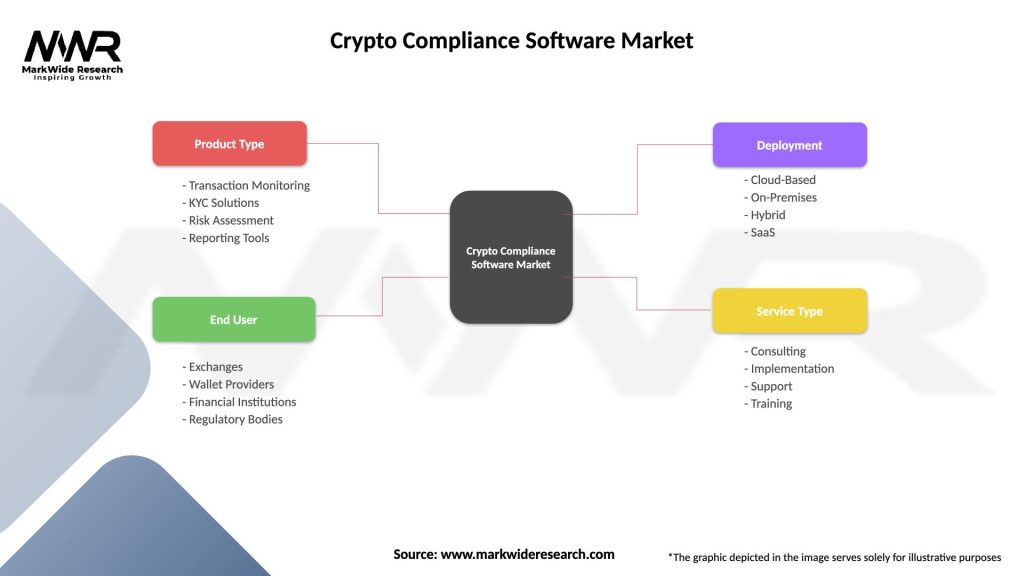

The Crypto Compliance Software Market can be segmented based on various factors such as:

Segmentation enables compliance software providers to target specific customer segments, customize their offerings, and address unique market requirements, enhancing customer satisfaction and market competitiveness.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Crypto Compliance Software Market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the Crypto Compliance Software Market provides insights into its strengths, weaknesses, opportunities, and threats:

Understanding these factors helps compliance software providers capitalize on market opportunities, address challenges, and develop strategies for sustainable growth and success in the Crypto Compliance Software Market.

Market Key Trends

Key trends shaping the Crypto Compliance Software Market include:

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of crypto compliance software solutions as companies and regulators seek to address the challenges posed by remote work, digital transformation, and evolving regulatory landscapes. The pandemic has highlighted the importance of resilient and adaptable compliance frameworks, driving demand for advanced compliance software tools that enable companies to manage compliance risks effectively in remote and distributed work environments.

Key Industry Developments

Noteworthy industry developments in the Crypto Compliance Software Market include:

Analyst Suggestions

Analyst recommendations for stakeholders in the Crypto Compliance Software Market include:

Future Outlook

The future outlook for the Crypto Compliance Software Market is promising, driven by factors such as increasing regulatory scrutiny, technological innovation, market expansion, and industry collaboration. As the cryptocurrency industry continues to evolve and mature, compliance software providers are poised to play a vital role in helping companies navigate regulatory complexities, manage compliance risks, and build trust and credibility in the crypto ecosystem.

Conclusion

In conclusion, the Crypto Compliance Software Market is witnessing significant growth and innovation as companies and regulators seek to address regulatory challenges, mitigate compliance risks, and foster trust and legitimacy in the cryptocurrency market. By leveraging advanced technologies, regulatory expertise, and industry partnerships, compliance software providers can empower companies to achieve regulatory compliance, enhance risk management, and strengthen their reputation in the crypto ecosystem. As the regulatory landscape evolves and market dynamics change, staying agile, innovative, and customer-focused will be essential for success in the dynamic and competitive Crypto Compliance Software Market.

What is Crypto Compliance Software?

Crypto Compliance Software refers to tools and platforms designed to help cryptocurrency businesses comply with regulatory requirements. These solutions typically include features for transaction monitoring, identity verification, and reporting to ensure adherence to anti-money laundering (AML) and know your customer (KYC) regulations.

What are the key players in the Crypto Compliance Software Market?

Key players in the Crypto Compliance Software Market include Chainalysis, Elliptic, and ComplyAdvantage, which provide various compliance solutions for cryptocurrency exchanges and financial institutions, among others.

What are the main drivers of growth in the Crypto Compliance Software Market?

The growth of the Crypto Compliance Software Market is driven by increasing regulatory scrutiny on cryptocurrency transactions, the rising number of digital asset users, and the need for businesses to mitigate risks associated with fraud and money laundering.

What challenges does the Crypto Compliance Software Market face?

Challenges in the Crypto Compliance Software Market include the rapidly evolving regulatory landscape, the complexity of integrating compliance solutions with existing systems, and the need for continuous updates to address new threats and compliance requirements.

What opportunities exist in the Crypto Compliance Software Market?

Opportunities in the Crypto Compliance Software Market include the expansion of decentralized finance (DeFi) platforms, the growing demand for compliance solutions in emerging markets, and the potential for partnerships with traditional financial institutions seeking to enter the cryptocurrency space.

What trends are shaping the Crypto Compliance Software Market?

Trends in the Crypto Compliance Software Market include the adoption of artificial intelligence for enhanced transaction monitoring, the integration of blockchain technology for improved transparency, and the increasing focus on user-friendly interfaces to facilitate compliance processes.

Crypto Compliance Software Market

| Segmentation Details | Description |

|---|---|

| Product Type | Transaction Monitoring, KYC Solutions, Risk Assessment, Reporting Tools |

| End User | Exchanges, Wallet Providers, Financial Institutions, Regulatory Bodies |

| Deployment | Cloud-Based, On-Premises, Hybrid, SaaS |

| Service Type | Consulting, Implementation, Support, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Crypto Compliance Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at