444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The crowdfunding solutions market has emerged as a dynamic and rapidly growing sector of the financial industry, offering innovative funding options for entrepreneurs, startups, and creative projects. Crowdfunding platforms connect project creators with a large pool of potential investors or donors, enabling them to raise funds for their ventures or initiatives. This market has witnessed significant growth in recent years, driven by the increasing popularity of crowdfunding as a viable alternative to traditional financing sources.

Meaning

Crowdfunding refers to the practice of funding a project or venture by raising small amounts of money from a large number of people, typically via the internet. It allows individuals, businesses, and organizations to access capital without the need for traditional financial intermediaries, such as banks or venture capitalists. Crowdfunding can take various forms, including donation-based crowdfunding, reward-based crowdfunding, equity crowdfunding, and debt crowdfunding, each offering unique benefits and challenges for project creators and investors.

Executive Summary

The crowdfunding solutions market has experienced explosive growth, fueled by the democratization of finance, the rise of digital platforms, and the increasing demand for alternative investment opportunities. As more individuals and businesses turn to crowdfunding to fund their projects, the market is expected to continue expanding, offering new opportunities for both investors and project creators.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The crowdfunding solutions market is characterized by rapid technological advancements, changing regulatory landscapes, and evolving investor and consumer preferences. These dynamics create both opportunities and challenges for crowdfunding platforms, requiring them to adapt and innovate to stay competitive.

Regional Analysis

The crowdfunding solutions market varies by region, with factors such as regulatory environments, cultural attitudes toward finance, and levels of internet penetration influencing market dynamics. Developed regions like North America and Europe have well-established crowdfunding ecosystems, while emerging markets in Asia-Pacific and Latin America offer significant growth potential.

Competitive Landscape

Leading companies in the Crowdfunding Solutions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

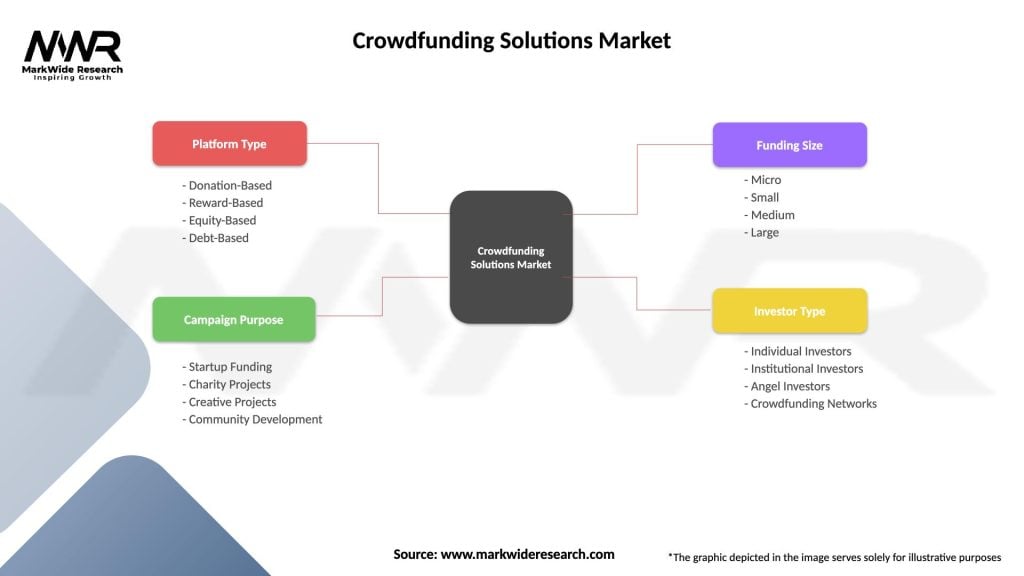

Segmentation

The crowdfunding solutions market can be segmented based on various factors, including the type of crowdfunding (donation-based, reward-based, equity, debt), the industry or sector (creative projects, technology startups, social impact initiatives), and the geographic region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the crowdfunding solutions market. While some sectors, such as healthcare, technology, and social impact, have seen increased interest from investors, others, such as travel and hospitality, have faced challenges due to reduced consumer spending and economic uncertainty.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the crowdfunding solutions market looks promising, with continued growth expected as more individuals and businesses turn to crowdfunding for financing. Technological innovations, regulatory changes, and evolving investor preferences will shape the market’s future, creating new opportunities and challenges for industry participants.

Conclusion

The crowdfunding solutions market has emerged as a dynamic and rapidly growing sector of the financial industry, offering innovative funding options for individuals, businesses, and organizations. As the market continues to evolve, crowdfunding platforms will need to adapt and innovate to meet the changing needs of project creators and investors, ensuring the continued growth and success of the crowdfunding industry.

What is Crowdfunding Solutions?

Crowdfunding Solutions refer to platforms and services that enable individuals or organizations to raise funds from a large number of people, typically via the internet. These solutions can be used for various purposes, including startup funding, creative projects, and charitable causes.

What are the key players in the Crowdfunding Solutions Market?

Key players in the Crowdfunding Solutions Market include Kickstarter, Indiegogo, and GoFundMe, which provide diverse platforms for different types of crowdfunding campaigns. These companies cater to various sectors such as technology, arts, and social causes, among others.

What are the growth factors driving the Crowdfunding Solutions Market?

The Crowdfunding Solutions Market is driven by the increasing popularity of online fundraising, the rise of entrepreneurial ventures, and the growing acceptance of crowdfunding as a legitimate funding method. Additionally, social media’s role in promoting campaigns significantly enhances visibility and engagement.

What challenges does the Crowdfunding Solutions Market face?

Challenges in the Crowdfunding Solutions Market include regulatory hurdles, the risk of fraud, and the saturation of platforms leading to increased competition. These factors can affect trust and participation rates among potential backers.

What opportunities exist in the Crowdfunding Solutions Market?

The Crowdfunding Solutions Market presents opportunities for niche platforms targeting specific industries, such as real estate or renewable energy. Additionally, advancements in technology, such as blockchain, could enhance transparency and security in crowdfunding transactions.

What trends are shaping the Crowdfunding Solutions Market?

Trends in the Crowdfunding Solutions Market include the rise of equity crowdfunding, where investors receive shares in return for their contributions, and the increasing use of social media for campaign promotion. Furthermore, there is a growing focus on sustainability and social impact projects, attracting a new demographic of backers.

Crowdfunding Solutions Market

| Segmentation Details | Description |

|---|---|

| Platform Type | Donation-Based, Reward-Based, Equity-Based, Debt-Based |

| Campaign Purpose | Startup Funding, Charity Projects, Creative Projects, Community Development |

| Funding Size | Micro, Small, Medium, Large |

| Investor Type | Individual Investors, Institutional Investors, Angel Investors, Crowdfunding Networks |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Crowdfunding Solutions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at