444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The cross-border payment service market is a dynamic and rapidly evolving sector of the financial industry. It involves the transfer of funds between different countries or regions, facilitating international trade, remittances, and global business transactions. The market is driven by the increasing globalization of businesses, the rise of e-commerce, and the growing demand for fast, secure, and cost-effective cross-border payment solutions.

Meaning

Cross-border payment services refer to the transfer of funds between individuals, businesses, and financial institutions located in different countries or regions. These services enable seamless and efficient transactions across borders, supporting international trade, remittances, and other cross-border financial activities.

Executive Summary

The cross-border payment service market is experiencing significant growth, driven by the increasing demand for fast, secure, and cost-effective payment solutions. The market is characterized by intense competition, with numerous players offering a wide range of services to meet the diverse needs of customers around the world.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The cross-border payment service market is characterized by rapid technological advancements, changing customer expectations, and evolving regulatory requirements. These dynamics are driving innovation and competition in the market, as providers seek to differentiate themselves and capture market share.

Regional Analysis

The cross-border payment service market varies by region, with developed countries leading in terms of adoption and innovation. However, emerging markets are also experiencing significant growth, driven by the increasing demand for cross-border payment services in these regions.

Competitive Landscape

Leading Companies in the Cross-Border Payment Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

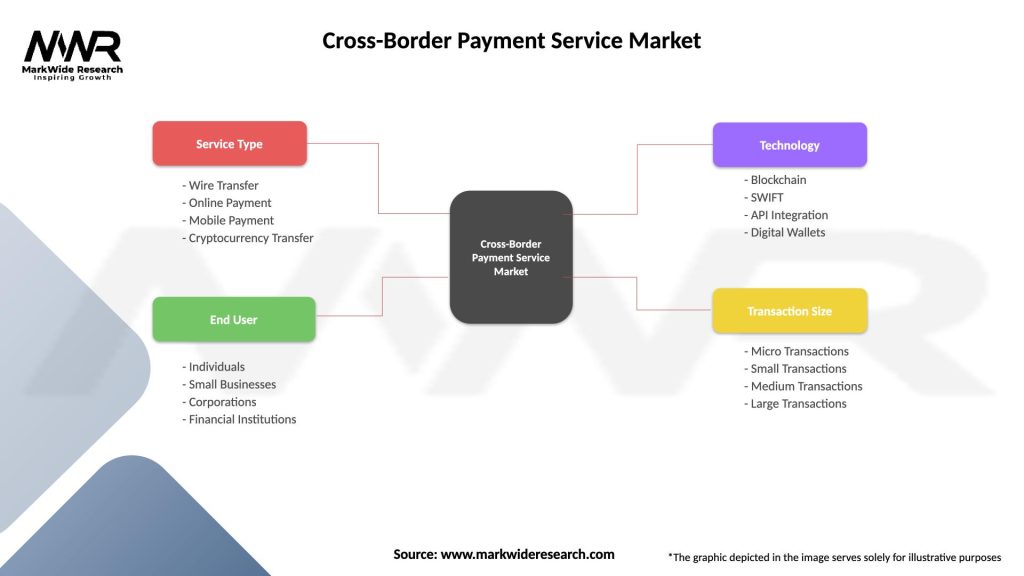

Segmentation

The cross-border payment service market can be segmented based on the type of service offered, such as remittances, business payments, and personal transfers. It can also be segmented based on the technology used, such as blockchain-based solutions, mobile payments, and traditional bank transfers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Future Outlook

The cross-border payment service market is expected to continue growing, driven by the increasing globalization of businesses, the rise of e-commerce, and the growing demand for fast, secure, and cost-effective payment solutions. Key trends such as blockchain adoption, mobile payments, and regulatory changes are expected to shape the future of the market, offering new opportunities for innovation and growth.

Conclusion

The cross-border payment service market is a dynamic and rapidly evolving sector of the financial industry, driven by the increasing demand for fast, secure, and cost-effective payment solutions. The market offers several benefits, including efficiency, cost-effectiveness, and security, making it an attractive option for businesses and individuals looking to conduct international transactions. By investing in technology, compliance, and partnerships, companies can capitalize on the growth opportunities in the cross-border payment service market and provide innovative solutions to meet the evolving needs of customers around the world.

What is Cross-Border Payment Service?

Cross-Border Payment Service refers to financial services that facilitate transactions between parties located in different countries. These services enable the transfer of funds across international borders, often involving currency conversion and compliance with various regulations.

What are the key players in the Cross-Border Payment Service Market?

Key players in the Cross-Border Payment Service Market include PayPal, TransferWise, Western Union, and Stripe, among others. These companies provide various solutions for individuals and businesses to send and receive money internationally.

What are the main drivers of growth in the Cross-Border Payment Service Market?

The growth of the Cross-Border Payment Service Market is driven by increasing globalization, the rise of e-commerce, and the demand for faster and more cost-effective payment solutions. Additionally, advancements in technology and mobile payment platforms are enhancing accessibility.

What challenges does the Cross-Border Payment Service Market face?

The Cross-Border Payment Service Market faces challenges such as regulatory compliance, currency volatility, and security concerns. These factors can complicate transactions and deter users from utilizing these services.

What opportunities exist in the Cross-Border Payment Service Market?

Opportunities in the Cross-Border Payment Service Market include the expansion of digital wallets, the integration of blockchain technology, and the increasing demand for remittance services. These trends can lead to innovative solutions and improved user experiences.

What trends are shaping the Cross-Border Payment Service Market?

Trends shaping the Cross-Border Payment Service Market include the rise of fintech companies, the adoption of real-time payment systems, and the growing importance of customer experience. These trends are influencing how services are delivered and enhancing competition in the market.

Cross-Border Payment Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Wire Transfer, Online Payment, Mobile Payment, Cryptocurrency Transfer |

| End User | Individuals, Small Businesses, Corporations, Financial Institutions |

| Technology | Blockchain, SWIFT, API Integration, Digital Wallets |

| Transaction Size | Micro Transactions, Small Transactions, Medium Transactions, Large Transactions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at