444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Croatia pharmaceutical market represents a dynamic and evolving sector within the broader European pharmaceutical landscape. This market encompasses a comprehensive range of pharmaceutical products, including prescription medications, over-the-counter drugs, generic pharmaceuticals, and specialty medicines. Croatia’s pharmaceutical industry has experienced significant transformation following its European Union accession, leading to enhanced regulatory alignment and increased market opportunities.

Market dynamics in Croatia reflect a combination of domestic pharmaceutical manufacturing capabilities and substantial import activities from international pharmaceutical companies. The country’s strategic position in Southeast Europe, coupled with its EU membership status, has positioned it as an attractive market for pharmaceutical investments and expansion strategies. Healthcare infrastructure improvements and rising healthcare expenditure have contributed to sustained market growth, with the sector demonstrating resilience even during challenging economic periods.

Regulatory harmonization with EU standards has significantly impacted market operations, creating opportunities for international pharmaceutical companies while ensuring higher quality standards for domestic consumers. The market exhibits strong growth potential, driven by an aging population, increasing prevalence of chronic diseases, and expanding healthcare access across urban and rural areas. Generic pharmaceutical adoption has reached approximately 78% market penetration, reflecting cost-conscious healthcare policies and consumer preferences.

The Croatia pharmaceutical market refers to the comprehensive ecosystem of pharmaceutical products, services, and activities within Croatia’s healthcare sector. This market encompasses the development, manufacturing, distribution, and consumption of medicinal products, including prescription drugs, over-the-counter medications, generic pharmaceuticals, biosimilars, and specialty therapeutics designed to prevent, treat, or cure various medical conditions.

Market participants include domestic pharmaceutical manufacturers, international pharmaceutical companies, distributors, wholesalers, retail pharmacies, hospital pharmacies, and healthcare providers. The market operates under strict regulatory oversight from Croatian health authorities, ensuring compliance with European Medicines Agency standards and maintaining high-quality pharmaceutical care for the Croatian population of approximately 3.9 million people.

Croatia’s pharmaceutical market demonstrates robust growth characteristics, driven by demographic trends, healthcare modernization, and increased therapeutic demand. The market benefits from a well-established healthcare system, comprehensive insurance coverage, and strategic geographic positioning within the European pharmaceutical supply chain. Key growth drivers include an aging population demographic, with citizens over 65 representing approximately 22% of the total population, creating sustained demand for chronic disease management medications.

Generic pharmaceuticals dominate market share, accounting for a significant portion of total pharmaceutical consumption, while innovative branded medications continue to gain traction in specialized therapeutic areas. The market exhibits strong import dependency, with approximately 85% of pharmaceutical products sourced from international suppliers, primarily from other EU member states. Digital health initiatives and e-pharmacy developments are emerging as significant market trends, supported by government digitalization programs.

Competitive landscape features a mix of international pharmaceutical giants and domestic companies, with market consolidation trends evident in recent years. Healthcare expenditure allocation toward pharmaceuticals represents approximately 18% of total healthcare spending, indicating substantial market opportunity for continued expansion and innovation.

Strategic market insights reveal several critical factors shaping Croatia’s pharmaceutical landscape:

Primary market drivers propelling Croatia’s pharmaceutical sector include demographic, economic, and regulatory factors that create sustained growth momentum. The country’s aging population represents the most significant long-term driver, with demographic projections indicating continued population aging over the next decade. Chronic disease prevalence is increasing, particularly cardiovascular diseases, diabetes, and cancer, driving demand for specialized therapeutic interventions.

Healthcare infrastructure modernization initiatives supported by EU structural funds have improved pharmaceutical access and distribution capabilities across the country. Government healthcare policies emphasizing preventive care and early intervention create opportunities for pharmaceutical companies to develop comprehensive treatment solutions. Insurance coverage expansion and improved reimbursement policies enhance pharmaceutical affordability and accessibility for Croatian citizens.

Economic stability and EU membership benefits have attracted international pharmaceutical investments, leading to improved market competition and product availability. Tourism industry growth creates additional demand for pharmaceutical products, particularly in coastal regions during peak tourist seasons. Digital health adoption accelerated by recent global health challenges has created new channels for pharmaceutical distribution and patient engagement.

Market restraints present challenges that pharmaceutical companies must navigate to achieve sustainable growth in Croatia. Economic constraints and healthcare budget limitations create pressure for cost containment, leading to aggressive generic substitution policies and pricing pressures on branded pharmaceuticals. Regulatory complexity associated with EU compliance requirements can create barriers for smaller pharmaceutical companies seeking market entry.

Population decline in certain regions, particularly rural areas, affects pharmaceutical distribution economics and market potential. Brain drain phenomena, where healthcare professionals emigrate to other EU countries, can impact pharmaceutical market development and clinical expertise availability. Healthcare system inefficiencies and bureaucratic processes may delay pharmaceutical approvals and market access for innovative treatments.

Limited domestic manufacturing capacity creates dependency on imports and potential supply chain vulnerabilities. Currency fluctuations and economic uncertainties can impact pharmaceutical pricing and profitability for international companies. Market fragmentation across different therapeutic areas and distribution channels requires significant investment in market development and relationship building.

Significant market opportunities exist within Croatia’s pharmaceutical sector, driven by unmet medical needs, technological advancement, and market expansion potential. The growing prevalence of chronic diseases creates opportunities for innovative pharmaceutical solutions, particularly in areas such as personalized medicine, digital therapeutics, and combination therapies. Specialty pharmaceutical segments represent high-growth opportunities, with oncology, immunology, and rare disease treatments showing strong market potential.

E-commerce and digital health platforms present opportunities for pharmaceutical companies to reach consumers directly and improve medication adherence through digital tools. Medical tourism development creates opportunities for pharmaceutical companies to serve international patients seeking treatment in Croatia. Biosimilar market expansion offers opportunities for companies to provide cost-effective alternatives to expensive biologic medications.

Regional expansion opportunities exist for companies using Croatia as a hub to serve broader Southeast European markets. Public-private partnerships in healthcare innovation create opportunities for pharmaceutical companies to collaborate on research and development initiatives. Preventive healthcare emphasis opens opportunities for pharmaceutical companies to develop wellness and prevention-focused products and services.

Market dynamics in Croatia’s pharmaceutical sector reflect complex interactions between regulatory, economic, and competitive forces. The interplay between government healthcare policies, EU regulations, and market competition creates a dynamic environment requiring strategic adaptation from pharmaceutical companies. Pricing pressures from healthcare authorities and insurance providers drive companies to demonstrate clear value propositions and cost-effectiveness.

Competitive intensity varies significantly across therapeutic areas, with generic segments experiencing intense price competition while specialty pharmaceuticals maintain higher margins through differentiation. Supply chain dynamics have evolved to emphasize reliability and efficiency, with companies investing in robust distribution networks to ensure product availability. Innovation cycles in pharmaceutical development create opportunities for companies to gain competitive advantages through first-mover advantages in emerging therapeutic areas.

Regulatory dynamics continue to evolve with EU harmonization efforts, creating both opportunities and challenges for market participants. Patient advocacy and healthcare professional influence on treatment decisions create additional dynamics that pharmaceutical companies must consider in their market strategies. Technology adoption in healthcare delivery is reshaping pharmaceutical market dynamics, creating new channels for patient engagement and treatment monitoring.

Comprehensive research methodology employed in analyzing Croatia’s pharmaceutical market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research activities include structured interviews with key market participants, including pharmaceutical company executives, healthcare providers, regulatory officials, and industry experts. Secondary research encompasses analysis of government healthcare statistics, regulatory filings, company annual reports, and industry publications.

Data triangulation methods ensure research findings accuracy by cross-referencing information from multiple independent sources. Quantitative analysis includes statistical modeling of market trends, growth projections, and competitive positioning assessments. Qualitative research provides insights into market dynamics, competitive strategies, and emerging trends that quantitative data alone cannot capture.

Market segmentation analysis employs both top-down and bottom-up approaches to ensure comprehensive market coverage and accurate sizing estimates. Expert validation processes involve review by industry specialists and healthcare professionals to ensure research conclusions align with market realities. Continuous monitoring of regulatory changes, competitive developments, and market trends ensures research findings remain current and relevant for strategic decision-making purposes.

Regional analysis of Croatia’s pharmaceutical market reveals significant variations in consumption patterns, healthcare infrastructure, and market opportunities across different geographic areas. The Zagreb metropolitan area represents the largest pharmaceutical market concentration, accounting for approximately 35% of total pharmaceutical consumption due to its population density, healthcare facilities, and economic activity levels.

Coastal regions demonstrate unique market characteristics influenced by tourism seasonality, with pharmaceutical demand fluctuating significantly during peak tourist months. These areas show higher consumption of certain therapeutic categories, including dermatological products, pain management medications, and emergency care pharmaceuticals. Split-Dalmatia County represents the second-largest regional market, benefiting from both permanent population needs and tourism-related demand.

Eastern Croatia faces challenges related to population decline and economic constraints, resulting in lower pharmaceutical consumption per capita compared to western regions. However, these areas present opportunities for cost-effective generic pharmaceutical penetration and telemedicine-supported pharmaceutical care. Northern regions benefit from proximity to European markets and demonstrate higher adoption rates for innovative pharmaceutical products, representing approximately 28% of specialty pharmaceutical consumption.

Rural healthcare access initiatives supported by EU funding create opportunities for pharmaceutical companies to expand distribution networks and improve medication accessibility in underserved areas. Regional healthcare infrastructure investments continue to reshape pharmaceutical market dynamics, with new hospitals and healthcare centers creating additional demand centers.

Competitive landscape analysis reveals a diverse mix of international pharmaceutical companies, domestic manufacturers, and specialized distributors operating within Croatia’s pharmaceutical market. The market structure reflects both global pharmaceutical industry trends and local market characteristics that influence competitive positioning and strategic approaches.

Market consolidation trends continue to shape competitive dynamics, with larger companies acquiring smaller players to expand market coverage and product portfolios. Strategic partnerships between international companies and local distributors remain common approaches for market entry and expansion.

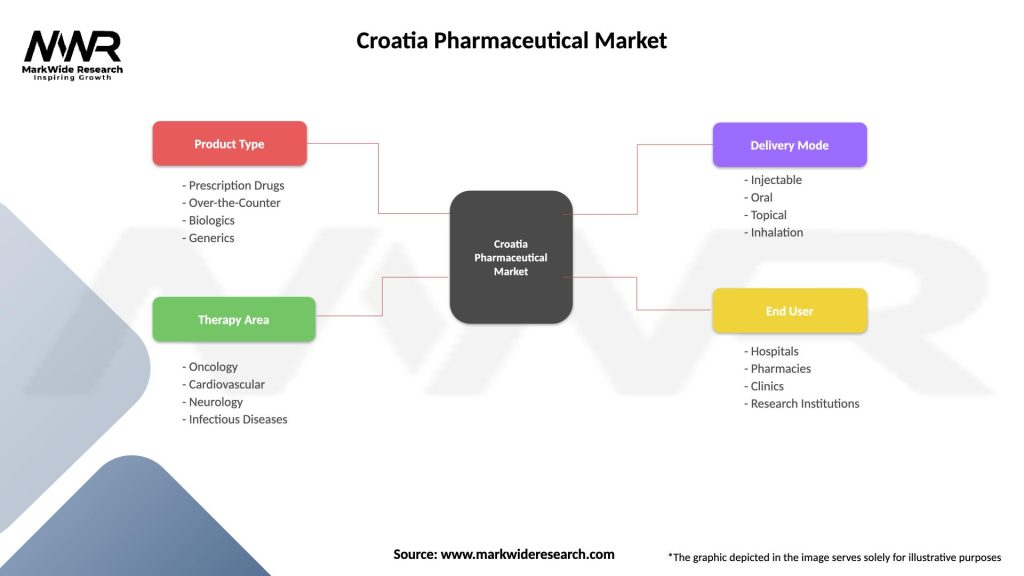

Market segmentation analysis provides detailed insights into Croatia’s pharmaceutical market structure across multiple dimensions, enabling targeted strategic approaches for different market segments.

By Product Type:

By Therapeutic Area:

By Distribution Channel:

Category-wise analysis reveals distinct market characteristics and growth patterns across different pharmaceutical segments within Croatia’s market. Cardiovascular pharmaceuticals maintain market leadership due to high disease prevalence and established treatment protocols, with generic alternatives capturing significant market share through cost-effectiveness and proven efficacy profiles.

Oncology pharmaceuticals represent the fastest-growing category, driven by increasing cancer incidence, improved diagnostic capabilities, and innovative treatment options. This segment demonstrates strong growth potential with adoption rates of new cancer therapies reaching approximately 15% annually. Immunology and rheumatology categories show substantial growth driven by biologic medication adoption and improved disease management approaches.

Central nervous system pharmaceuticals maintain steady demand driven by mental health awareness and aging population needs. Antidepressant and anxiolytic medications show consistent consumption patterns, while neurological treatments for conditions such as Alzheimer’s disease and Parkinson’s disease demonstrate growing market importance. Diabetes care represents a critical growth category, with insulin and oral antidiabetic medication consumption increasing due to rising diabetes prevalence.

Anti-infective medications show seasonal variation patterns, with higher consumption during winter months and respiratory infection seasons. Antibiotic stewardship programs influence prescribing patterns and create opportunities for targeted infection management solutions. Preventive healthcare categories, including vitamins and supplements, demonstrate growing consumer interest and market expansion potential.

Industry participants in Croatia’s pharmaceutical market benefit from multiple strategic advantages that support sustainable business growth and market expansion. EU market access provides pharmaceutical companies with streamlined regulatory pathways and harmonized approval processes, reducing time-to-market for new pharmaceutical products and enabling efficient resource allocation across European markets.

Healthcare providers benefit from improved pharmaceutical access, enhanced treatment options, and competitive pricing driven by market competition. Patients receive advantages through expanded medication choices, improved affordability through generic alternatives, and access to innovative treatments previously unavailable in the Croatian market. Government stakeholders benefit from increased healthcare system efficiency, improved population health outcomes, and economic development through pharmaceutical industry investments.

Distributors and retailers gain from market expansion opportunities, diversified product portfolios, and improved supply chain efficiency through EU integration. Research institutions benefit from collaboration opportunities with pharmaceutical companies, access to clinical trial opportunities, and technology transfer initiatives. Economic benefits include job creation, foreign investment attraction, and export potential development for domestic pharmaceutical manufacturers.

Innovation ecosystem development creates benefits for startups, biotechnology companies, and research organizations through increased funding opportunities, partnership possibilities, and market access support. Healthcare insurance providers benefit from improved cost management through generic pharmaceutical adoption and value-based healthcare approaches.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Croatia’s pharmaceutical landscape reflect broader healthcare industry evolution and local market characteristics. Digital transformation represents the most significant trend, with e-prescription adoption reaching approximately 68% of total prescriptions, streamlining pharmaceutical distribution and improving patient convenience. Telemedicine integration creates new opportunities for pharmaceutical companies to engage with patients and healthcare providers.

Personalized medicine adoption is accelerating, driven by advances in pharmacogenomics and precision therapy approaches. Pharmaceutical companies are investing in companion diagnostics and targeted therapies to address individual patient needs more effectively. Biosimilar market expansion continues as healthcare systems seek cost-effective alternatives to expensive biologic medications, with adoption rates increasing across multiple therapeutic areas.

Sustainability initiatives are gaining prominence, with pharmaceutical companies implementing environmentally responsible manufacturing and packaging practices. Green pharmacy concepts and medication disposal programs reflect growing environmental awareness. Patient-centric care models emphasize medication adherence, patient education, and outcome-based treatment approaches, creating opportunities for pharmaceutical companies to develop comprehensive care solutions.

Artificial intelligence and machine learning applications in drug discovery, clinical trials, and patient monitoring are creating new possibilities for pharmaceutical innovation and efficiency improvements. Supply chain digitalization enhances transparency, traceability, and efficiency in pharmaceutical distribution networks.

Recent industry developments highlight the dynamic nature of Croatia’s pharmaceutical market and emerging opportunities for market participants. Regulatory modernization initiatives have streamlined pharmaceutical approval processes, reducing time-to-market for innovative treatments while maintaining safety and efficacy standards. Digital health infrastructure investments supported by EU recovery funds are creating new platforms for pharmaceutical distribution and patient engagement.

Strategic partnerships between international pharmaceutical companies and Croatian healthcare institutions have expanded clinical trial capabilities and research collaboration opportunities. MarkWide Research analysis indicates increasing investment in pharmaceutical manufacturing capabilities, with several companies announcing expansion plans for production facilities in Croatia.

Market consolidation activities continue with mergers and acquisitions reshaping competitive dynamics across different therapeutic segments. Generic pharmaceutical companies are expanding their portfolios through strategic acquisitions and licensing agreements. Innovation hubs development in major Croatian cities is attracting biotechnology startups and pharmaceutical research organizations.

Healthcare digitalization programs have accelerated pharmaceutical e-commerce adoption and created new channels for patient medication management. Public-private partnerships in healthcare innovation are fostering collaboration between pharmaceutical companies and healthcare providers to develop comprehensive treatment solutions.

Strategic recommendations for pharmaceutical companies operating in Croatia emphasize the importance of adapting to local market characteristics while leveraging EU integration benefits. Companies should prioritize generic portfolio development to capitalize on cost-conscious healthcare policies and strong generic acceptance among Croatian healthcare providers and patients.

Digital transformation investments should focus on e-commerce capabilities, patient engagement platforms, and data analytics to improve market responsiveness and competitive positioning. Companies should consider regional hub strategies using Croatia as a base for Southeast European market expansion, leveraging geographic advantages and EU membership benefits.

Partnership strategies with local healthcare institutions, distributors, and research organizations can accelerate market penetration and reduce entry barriers. Companies should invest in specialty pharmaceutical capabilities to capture high-growth opportunities in oncology, immunology, and rare disease treatment areas.

Regulatory compliance excellence remains critical for sustainable market success, requiring ongoing investment in quality systems and regulatory expertise. Companies should develop value-based pricing strategies that demonstrate clear clinical and economic benefits to healthcare stakeholders. Supply chain resilience investments are essential to mitigate import dependency risks and ensure reliable product availability.

Future outlook for Croatia’s pharmaceutical market indicates sustained growth driven by demographic trends, healthcare modernization, and continued EU integration benefits. Market expansion is projected to continue at a steady pace, with specialty pharmaceuticals and digital health solutions representing the highest growth potential segments. Demographic aging will create sustained demand for chronic disease medications, particularly cardiovascular, diabetes, and oncology treatments.

Innovation adoption is expected to accelerate, with personalized medicine, biosimilars, and digital therapeutics gaining market traction. MWR projections indicate that specialty pharmaceutical adoption could reach 25% of total pharmaceutical consumption within the next five years, driven by improved healthcare infrastructure and treatment innovation.

Digital transformation will continue reshaping pharmaceutical distribution and patient engagement, with e-pharmacy services and telemedicine integration becoming standard market features. Regulatory harmonization with EU standards will facilitate continued market access for international pharmaceutical companies while supporting domestic industry development.

Regional market integration opportunities will expand as Croatia strengthens its position as a pharmaceutical distribution hub for Southeast Europe. Healthcare system efficiency improvements and outcome-based care models will create new opportunities for pharmaceutical companies to demonstrate value and achieve sustainable growth in the Croatian market.

Croatia’s pharmaceutical market presents significant opportunities for growth and expansion, driven by favorable demographic trends, EU integration benefits, and healthcare system modernization. The market’s strategic position within Europe, combined with established healthcare infrastructure and regulatory alignment, creates an attractive environment for pharmaceutical companies seeking sustainable growth opportunities.

Key success factors include understanding local market dynamics, developing appropriate product portfolios that balance innovation with cost-effectiveness, and building strong relationships with healthcare stakeholders. Companies that can effectively navigate regulatory requirements while delivering value-based solutions will be best positioned to capture market opportunities and achieve long-term success.

Future market development will be shaped by continued digital transformation, specialty pharmaceutical adoption, and regional market integration. The Croatia pharmaceutical market offers compelling prospects for companies prepared to invest in local market development while leveraging broader European opportunities for sustainable growth and market leadership.

What is Pharmaceutical?

Pharmaceutical refers to the branch of medicine that deals with the development, production, and distribution of drugs and medications used for treating various health conditions. It encompasses a wide range of products, including prescription medications, over-the-counter drugs, and vaccines.

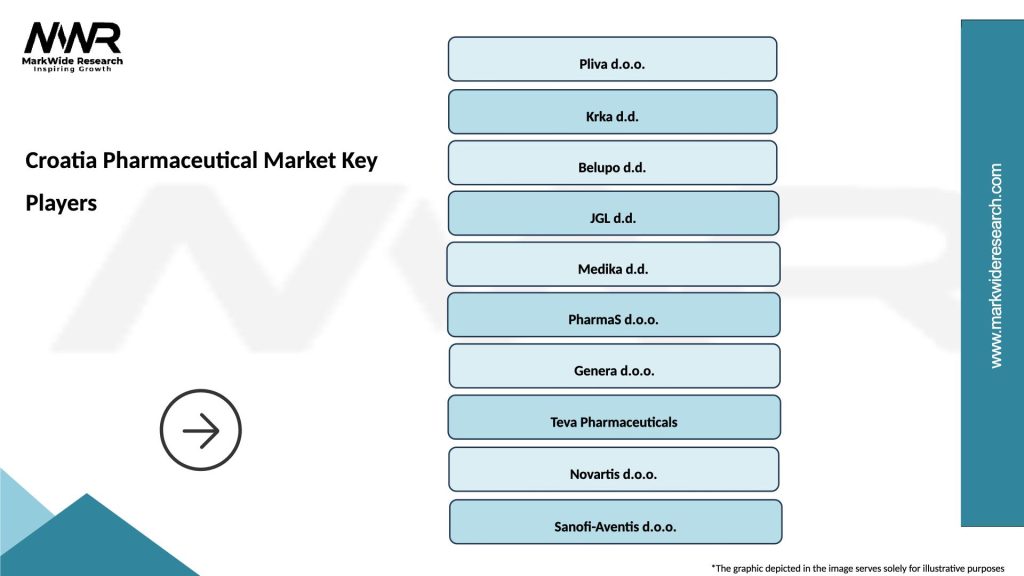

What are the key players in the Croatia Pharmaceutical Market?

Key players in the Croatia Pharmaceutical Market include companies such as Pliva, JGL, and Belupo, which are involved in the production and distribution of pharmaceuticals. These companies focus on various therapeutic areas, including oncology, cardiology, and infectious diseases, among others.

What are the growth factors driving the Croatia Pharmaceutical Market?

The Croatia Pharmaceutical Market is driven by factors such as an increasing aging population, rising prevalence of chronic diseases, and advancements in drug development technologies. Additionally, the growing demand for innovative therapies and personalized medicine contributes to market growth.

What challenges does the Croatia Pharmaceutical Market face?

The Croatia Pharmaceutical Market faces challenges such as regulatory hurdles, pricing pressures, and competition from generic drugs. Additionally, market access and reimbursement issues can hinder the introduction of new products.

What opportunities exist in the Croatia Pharmaceutical Market?

Opportunities in the Croatia Pharmaceutical Market include the potential for growth in biopharmaceuticals and biosimilars, as well as the expansion of telemedicine and digital health solutions. Furthermore, increasing investment in research and development can lead to innovative drug discoveries.

What trends are shaping the Croatia Pharmaceutical Market?

Trends shaping the Croatia Pharmaceutical Market include a focus on personalized medicine, the integration of artificial intelligence in drug discovery, and the rise of telehealth services. Additionally, sustainability practices in pharmaceutical manufacturing are gaining importance.

Croatia Pharmaceutical Market

| Segmentation Details | Description |

|---|---|

| Product Type | Prescription Drugs, Over-the-Counter, Biologics, Generics |

| Therapy Area | Oncology, Cardiovascular, Neurology, Infectious Diseases |

| Delivery Mode | Injectable, Oral, Topical, Inhalation |

| End User | Hospitals, Pharmacies, Clinics, Research Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Croatia Pharmaceutical Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at