444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Croatia container glass market represents a dynamic and evolving segment within the country’s packaging industry, characterized by steady growth and increasing demand across multiple sectors. Container glass manufacturing in Croatia has experienced significant transformation over recent years, driven by rising consumer preferences for sustainable packaging solutions and robust demand from the food and beverage industry. The market encompasses various glass container types including bottles, jars, and specialty packaging solutions that serve diverse applications ranging from alcoholic beverages to pharmaceutical products.

Market dynamics indicate that Croatia’s strategic location within Southeast Europe positions it as a crucial hub for glass container distribution throughout the Balkans region. The industry benefits from established manufacturing infrastructure, skilled workforce, and proximity to key European markets. Growth trajectories show consistent expansion with the market experiencing approximately 4.2% annual growth over the past five years, reflecting strong domestic consumption and export opportunities.

Sustainability initiatives have become increasingly important drivers, with Croatian glass manufacturers investing in eco-friendly production processes and recycling technologies. The market demonstrates resilience through its ability to adapt to changing consumer preferences while maintaining competitive pricing structures that support both domestic and international market penetration.

The Croatia container glass market refers to the comprehensive ecosystem of glass packaging production, distribution, and consumption within Croatian borders, encompassing manufacturing facilities, supply chain networks, and end-user applications across various industries. This market includes all forms of glass containers designed for packaging purposes, from traditional bottles and jars to specialized pharmaceutical vials and cosmetic containers.

Container glass specifically denotes hollow glass products manufactured through molding processes that create vessels capable of holding liquids, solids, or other materials while providing protection, preservation, and presentation benefits. The Croatian market segment focuses on both clear and colored glass containers that meet international quality standards and regulatory requirements for food safety, pharmaceutical compliance, and environmental sustainability.

Market scope extends beyond simple manufacturing to include value-added services such as custom design, labeling, and specialized coatings that enhance product functionality and aesthetic appeal. The definition encompasses the entire value chain from raw material sourcing through final product delivery to end consumers.

Croatia’s container glass market demonstrates robust performance characterized by steady growth, technological advancement, and increasing export capabilities. The market benefits from strong domestic demand driven by the country’s thriving food and beverage sector, particularly wine production and craft brewing industries. Manufacturing capabilities have expanded significantly, with local producers investing in modern equipment and sustainable production methods.

Key market drivers include rising consumer awareness of environmental sustainability, with approximately 78% of Croatian consumers expressing preference for glass packaging over plastic alternatives. The market shows particular strength in premium beverage packaging, where glass containers command higher margins and support brand differentiation strategies. Export performance has improved substantially, with Croatian glass containers gaining acceptance in neighboring markets.

Competitive landscape features a mix of established domestic manufacturers and international players, creating a dynamic environment that promotes innovation and quality improvements. The market faces challenges related to energy costs and raw material availability, but these are offset by growing demand and improved operational efficiencies. Future prospects remain positive with projected growth rates maintaining momentum through expanding applications and market diversification.

Strategic market insights reveal several critical factors shaping the Croatia container glass market landscape. The following key insights provide comprehensive understanding of market dynamics:

Primary market drivers propelling growth in Croatia’s container glass market stem from multiple interconnected factors that create sustained demand across various application segments. Environmental consciousness represents the most significant driver, as consumers increasingly prefer glass packaging due to its recyclability, chemical inertness, and premium perception compared to alternative materials.

Food and beverage industry expansion continues driving substantial demand, particularly from Croatia’s growing wine industry and emerging craft beer segment. The country’s wine production has experienced renaissance, with premium wines requiring high-quality glass bottles that preserve product integrity and enhance brand image. Tourism growth also contributes significantly, as increased visitor numbers boost demand for packaged beverages and local specialty products.

Regulatory support for sustainable packaging solutions creates favorable market conditions, with government initiatives promoting circular economy principles and waste reduction. Export opportunities within the European Union provide additional growth avenues, as Croatian manufacturers leverage competitive production costs and strategic geographic positioning to serve broader regional markets.

Technological advancement in glass manufacturing enables production of lighter, stronger containers that reduce transportation costs while maintaining product protection capabilities. These innovations support market expansion by improving cost competitiveness and opening new application possibilities across various industries.

Market restraints affecting Croatia’s container glass industry primarily center around operational challenges and competitive pressures that impact growth potential and profitability. Energy costs represent the most significant constraint, as glass manufacturing requires substantial energy input for melting and forming processes, making producers vulnerable to fluctuating energy prices and supply disruptions.

Raw material availability poses ongoing challenges, particularly regarding high-quality silica sand and other essential components required for premium glass production. Transportation costs also impact competitiveness, especially for export markets where shipping expenses can erode profit margins and limit market reach.

Competition from alternative packaging materials, including advanced plastics and aluminum, creates pressure on certain market segments where cost considerations outweigh sustainability benefits. Capital intensity of glass manufacturing operations requires substantial investment in equipment and infrastructure, creating barriers for new market entrants and limiting expansion capabilities for existing players.

Skilled labor shortage in specialized glass manufacturing roles constrains production capacity and quality consistency. Environmental regulations, while generally supportive of glass packaging, impose compliance costs and operational requirements that smaller manufacturers may struggle to meet effectively.

Emerging opportunities in Croatia’s container glass market present significant potential for growth and market expansion across multiple dimensions. Premium packaging demand continues growing as Croatian brands seek to differentiate products through sophisticated glass containers that convey quality and sustainability messages to increasingly discerning consumers.

Pharmaceutical and cosmetic applications offer high-value growth opportunities, as these sectors require specialized glass containers with precise specifications and stringent quality standards. Export expansion within Southeast Europe and broader European markets provides substantial growth potential, leveraging Croatia’s competitive manufacturing costs and EU membership advantages.

Circular economy initiatives create opportunities for developing closed-loop recycling systems and partnerships with waste management companies. Technology integration enables smart packaging solutions incorporating sensors and tracking capabilities that add value for specific applications.

Custom manufacturing services present opportunities for serving niche markets requiring specialized container designs, colors, or features. Sustainable production methods including renewable energy adoption and waste heat recovery systems offer competitive advantages while reducing operational costs. Strategic partnerships with international brands seeking reliable European manufacturing partners provide stable long-term growth opportunities.

Market dynamics within Croatia’s container glass sector reflect complex interactions between supply-side capabilities, demand patterns, and external influences that shape competitive positioning and growth trajectories. Supply chain optimization has become increasingly important as manufacturers seek to reduce costs while maintaining quality standards and delivery reliability.

Demand volatility across different application segments creates challenges for production planning and inventory management. Seasonal fluctuations particularly affect beverage packaging demand, requiring flexible manufacturing approaches and strategic inventory positioning. Price sensitivity varies significantly across market segments, with premium applications supporting higher margins while commodity segments face intense cost pressure.

Innovation cycles drive continuous product development, with manufacturers investing in new designs, improved functionality, and enhanced sustainability features. Customer consolidation in key end-user industries affects negotiating power and contract terms, requiring glass manufacturers to demonstrate clear value propositions and operational excellence.

Regulatory evolution continues shaping market dynamics through environmental standards, food safety requirements, and trade policies. Economic conditions influence both domestic consumption patterns and export opportunities, creating cyclical variations in market performance that require adaptive strategies and financial flexibility.

Comprehensive research methodology employed for analyzing Croatia’s container glass market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, manufacturing specialists, and key stakeholders across the value chain to gather firsthand perspectives on market trends and competitive dynamics.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements to establish quantitative baselines and historical trends. Market surveys conducted among end-users provide insights into purchasing decisions, preference factors, and future requirements across different application segments.

Data validation processes include cross-referencing multiple sources, statistical analysis of trends, and expert review to ensure information accuracy and relevance. Quantitative analysis employs statistical modeling techniques to project market trends and identify correlation patterns between various market factors.

Qualitative assessment incorporates industry expert opinions, competitive intelligence, and strategic analysis to provide context and interpretation for quantitative findings. MarkWide Research methodology emphasizes comprehensive market coverage while maintaining analytical rigor and objectivity throughout the research process.

Regional distribution within Croatia’s container glass market reveals distinct patterns reflecting economic development, industrial concentration, and logistical considerations. Northern Croatia dominates manufacturing activity, accounting for approximately 60% of production capacity, benefiting from proximity to European markets, established industrial infrastructure, and skilled workforce availability.

Central Croatia including the Zagreb metropolitan area represents the largest consumption market, driven by high population density, tourism activity, and concentration of food and beverage companies. Coastal regions show strong seasonal demand patterns linked to tourism, with summer months generating significant increases in beverage packaging requirements.

Eastern Croatia demonstrates growing importance as a production hub, with lower operational costs and available industrial sites attracting new investment. Export corridors through major transportation routes influence regional market dynamics, with facilities located near highways and rail connections enjoying competitive advantages.

Regional specialization has emerged, with certain areas focusing on specific container types or applications based on local expertise and customer proximity. Investment patterns show continued concentration in established industrial zones while new capacity development targets strategic locations offering logistical advantages and workforce availability.

Competitive landscape in Croatia’s container glass market features a structured hierarchy of manufacturers ranging from large-scale integrated producers to specialized niche players. Market leadership is established through combination of production capacity, technological capabilities, and customer relationships that create sustainable competitive advantages.

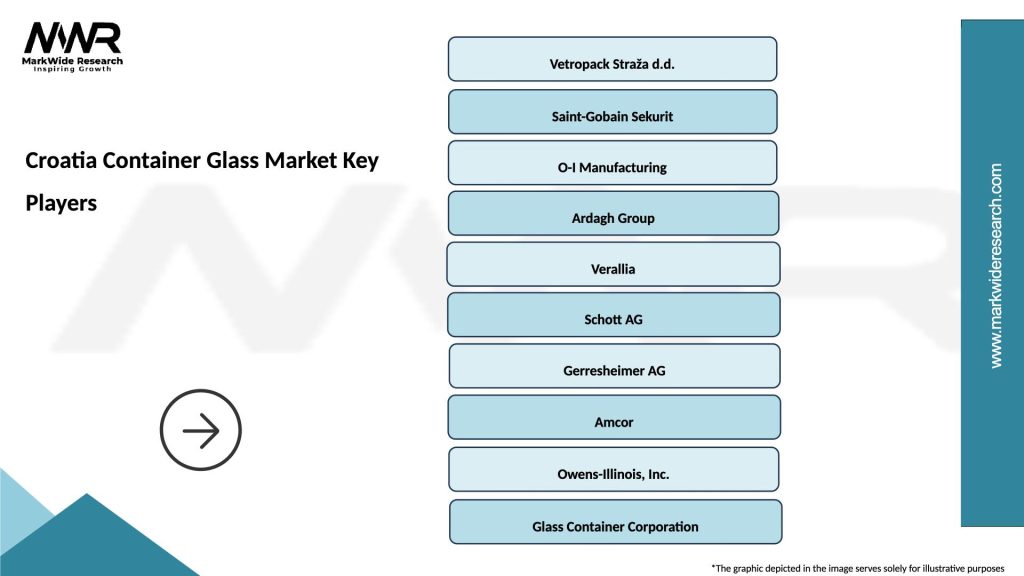

Key market players include:

Competitive strategies emphasize operational excellence, customer service, and innovation capabilities. Market positioning varies from cost leadership in commodity segments to differentiation through specialized products and services. Strategic alliances and partnerships enable companies to expand capabilities and market reach while sharing development costs and risks.

Market segmentation within Croatia’s container glass industry reflects diverse application requirements and customer needs across multiple dimensions. By Product Type, the market divides into bottles, jars, vials, and specialty containers, each serving distinct applications with specific technical requirements and performance characteristics.

By Application:

By Glass Type:

By End-User:

Category-specific analysis reveals distinct performance patterns and growth drivers across different container glass segments within the Croatian market. Beverage containers represent the dominant category, with wine bottles showing particular strength due to Croatia’s expanding viticulture industry and growing reputation for quality wines in international markets.

Food packaging applications demonstrate steady growth driven by increasing consumer preference for glass containers in premium food products, preserves, and specialty items. Pharmaceutical containers show the highest growth rates, reflecting expansion of Croatia’s pharmaceutical manufacturing sector and increasing export of medical products.

Cosmetic packaging presents opportunities for high-margin products, with local and international beauty brands seeking distinctive glass containers that convey premium positioning. Industrial applications remain stable but limited in volume, serving specialized needs in chemical and laboratory markets.

Premium segments across all categories outperform standard products, indicating market evolution toward higher-value applications. Custom manufacturing services generate additional revenue streams while strengthening customer relationships through specialized solutions and design capabilities.

Industry participants in Croatia’s container glass market enjoy numerous strategic advantages that support sustainable business growth and competitive positioning. Manufacturers benefit from stable demand patterns, established supply chains, and access to both domestic and export markets that provide revenue diversification and growth opportunities.

Operational benefits include:

Market stakeholders including suppliers, customers, and investors gain from:

Economic benefits extend to local communities through employment generation, tax revenues, and supporting industries that create multiplier effects throughout the regional economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping Croatia’s container glass market reflect broader industry evolution toward sustainability, customization, and technological advancement. Lightweighting initiatives continue gaining momentum as manufacturers develop thinner, stronger glass containers that reduce material usage and transportation costs while maintaining structural integrity and product protection.

Sustainable manufacturing practices increasingly influence production decisions, with companies investing in renewable energy sources, waste heat recovery systems, and closed-loop recycling processes. Digital integration transforms operations through smart manufacturing systems, predictive maintenance, and real-time quality monitoring that improve efficiency and reduce waste.

Customization demand grows across market segments as brands seek unique packaging solutions that differentiate products and enhance consumer appeal. Premium positioning trends drive development of specialty glass formulations, unique shapes, and decorative features that command higher margins and strengthen brand identity.

Circular economy principles influence business models, with manufacturers developing take-back programs and partnerships with recycling companies. Smart packaging integration explores opportunities for incorporating sensors and tracking technologies into glass containers for enhanced functionality and consumer engagement.

Recent industry developments demonstrate the dynamic nature of Croatia’s container glass market and ongoing evolution toward enhanced capabilities and market positioning. Capacity expansion projects by major manufacturers reflect confidence in long-term market growth and commitment to serving increasing demand from both domestic and export customers.

Technology investments include installation of advanced furnace systems, automated handling equipment, and quality control technologies that improve production efficiency and product consistency. Sustainability initiatives encompass renewable energy projects, waste reduction programs, and development of higher recycled content formulations.

Strategic partnerships between Croatian manufacturers and international companies facilitate technology transfer, market access, and capability development. Product innovation focuses on developing specialized containers for emerging applications in pharmaceuticals, cosmetics, and premium food products.

Market consolidation activities include acquisitions and joint ventures that strengthen competitive positions and expand operational capabilities. Export development programs supported by government initiatives promote Croatian glass products in international markets and facilitate trade relationship development.

Strategic recommendations for Croatia’s container glass market participants emphasize leveraging competitive advantages while addressing key challenges and capitalizing on emerging opportunities. MarkWide Research analysis suggests that companies should prioritize operational excellence and customer service differentiation to maintain competitive positioning in increasingly competitive markets.

Investment priorities should focus on energy efficiency improvements, automation technologies, and sustainability initiatives that reduce operational costs while enhancing environmental performance. Market development strategies should emphasize export expansion, particularly in Southeast European markets where Croatian producers enjoy competitive advantages.

Product development recommendations include:

Partnership strategies should explore collaborations with technology providers, research institutions, and international customers to accelerate innovation and market development. Risk management approaches should address energy cost volatility through diversification and efficiency improvements.

Future prospects for Croatia’s container glass market remain positive, supported by favorable demand trends, competitive positioning, and ongoing industry development initiatives. Growth projections indicate continued expansion at approximately 4.5% annual rate over the next five years, driven by export growth, premium segment development, and sustainable packaging demand.

Market evolution will likely emphasize higher-value applications, technological advancement, and sustainability leadership as key differentiating factors. Export opportunities are expected to expand significantly, with Croatian manufacturers gaining market share in European and regional markets through competitive pricing and quality advantages.

Technology adoption will accelerate, with Industry 4.0 implementations, artificial intelligence applications, and advanced materials development transforming production capabilities and market positioning. Sustainability initiatives will become increasingly important competitive factors, with companies investing in circular economy solutions and carbon footprint reduction.

Market consolidation may continue as companies seek scale advantages and operational efficiencies. Innovation focus will shift toward smart packaging solutions, specialized applications, and customer-specific product development that creates sustainable competitive advantages and supports premium pricing strategies.

Croatia’s container glass market demonstrates strong fundamentals and positive growth trajectory supported by favorable market conditions, competitive advantages, and strategic positioning within European markets. The industry benefits from established manufacturing capabilities, skilled workforce, and strategic geographic location that facilitate both domestic market service and export expansion opportunities.

Market dynamics reflect healthy balance between supply and demand, with manufacturers achieving strong capacity utilization while maintaining quality standards and competitive pricing. Sustainability trends create additional growth drivers as consumers and businesses increasingly prefer glass packaging for environmental and quality reasons.

Future success will depend on continued investment in technology, sustainability, and market development initiatives that strengthen competitive positioning and expand market opportunities. The Croatia container glass market is well-positioned to capitalize on emerging trends and maintain growth momentum through strategic focus on operational excellence, innovation, and customer service differentiation.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Croatia Container Glass Market?

Key players in the Croatia Container Glass Market include Vetropack, O-I Glass, and Ardagh Group, which are known for their production of high-quality glass containers for various industries, including food and beverage, among others.

What are the growth factors driving the Croatia Container Glass Market?

The growth of the Croatia Container Glass Market is driven by increasing consumer demand for sustainable packaging solutions, the rise in the beverage industry, and the growing trend of eco-friendly products that favor glass over plastic.

What challenges does the Croatia Container Glass Market face?

The Croatia Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials like plastic, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Croatia Container Glass Market?

Opportunities in the Croatia Container Glass Market include the expansion of the e-commerce sector, which increases demand for packaging, and the potential for growth in the export of glass products to neighboring countries.

What trends are shaping the Croatia Container Glass Market?

Trends shaping the Croatia Container Glass Market include the increasing focus on sustainability, innovations in glass manufacturing technologies, and the rising popularity of premium glass packaging in the food and beverage sectors.

Croatia Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Packaging Type | Recyclable, Non-Recyclable, Biodegradable, Multi-layer |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Specialty Grade |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Croatia Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at