444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Credit Default Swap (CDS) market is a financial derivative market that plays a crucial role in managing credit risk. It provides investors with a means to hedge against the risk of default on debt instruments such as bonds, loans, and other forms of credit. The CDS market enables market participants to transfer credit risk to other parties and thereby mitigate potential losses. It is an important component of the global financial system and is widely used by banks, institutional investors, and corporations.

Meaning

A Credit Default Swap is a contract between two parties, commonly referred to as the protection buyer and the protection seller. The protection buyer pays a periodic fee, known as the premium, to the protection seller in exchange for protection against the default of a specific reference entity or debt instrument. In the event of a default, the protection seller compensates the protection buyer for the losses incurred.

Executive Summary

The Credit Default Swap market has experienced significant growth and development since its inception. It has emerged as a key tool for managing credit risk, providing market participants with flexibility, liquidity, and risk mitigation capabilities. The market has evolved to include various types of CDS contracts, including single-name CDS, index CDS, and bespoke CDS. The market is driven by several factors, including market participants’ risk management needs, regulatory developments, and overall market conditions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Credit Default Swap market is influenced by various dynamics that shape its performance and growth:

Regional Analysis

The Credit Default Swap market is a global market that transcends geographic boundaries. It is primarily concentrated in major financial centers such as New York, London, and Hong Kong. However, the market is accessible to participants worldwide, and trading activity can occur across different regions.

Competitive Landscape

Leading Companies in the Credit Default Swap Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

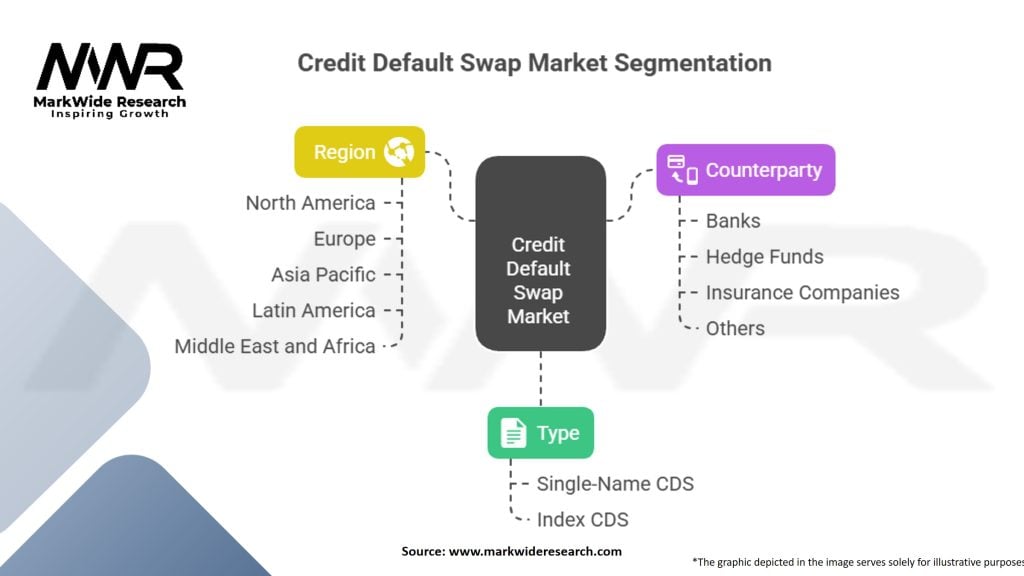

Segmentation

The Credit Default Swap market can be segmented based on several factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the global financial markets, including the Credit Default Swap market. The outbreak of the pandemic led to increased credit risk and market volatility, resulting in higher demand for credit protection. Central banks and regulatory bodies implemented measures to stabilize financial markets and support economic recovery, which had implications for the CDS market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Credit Default Swap market is expected to continue evolving in the coming years. The market will likely experience increased regulatory scrutiny and further advancements in technology. The integration of ESG considerations into credit risk analysis is expected to gain prominence. The market will continue to play a critical role in managing credit risk and providing market participants with valuable risk management tools.

Conclusion

The Credit Default Swap market is a vital component of the global financial system, offering market participants a means to manage credit risk effectively. It provides liquidity, risk mitigation, and trading opportunities, enabling participants to hedge their exposure to credit events. While the market has faced challenges and undergone regulatory reforms, it continues to evolve and adapt to changing market dynamics. The future outlook for the CDS market is positive, with continued growth expected as market participants seek innovative solutions to manage credit risk in an increasingly complex financial landscape.

What is Credit Default Swap?

A Credit Default Swap (CDS) is a financial derivative that allows an investor to ‘swap’ or transfer the credit risk of a borrower to another party. It is commonly used to hedge against the risk of default on debt instruments such as bonds and loans.

What are the key players in the Credit Default Swap Market?

Key players in the Credit Default Swap Market include major financial institutions such as JPMorgan Chase, Goldman Sachs, and Deutsche Bank, which facilitate trading and provide liquidity. These companies play a crucial role in the pricing and risk management of CDS contracts, among others.

What are the main drivers of growth in the Credit Default Swap Market?

The main drivers of growth in the Credit Default Swap Market include increasing demand for risk management tools, the rise of structured finance products, and the need for investors to hedge against credit risk in volatile economic conditions. Additionally, regulatory changes have also influenced market dynamics.

What challenges does the Credit Default Swap Market face?

The Credit Default Swap Market faces challenges such as regulatory scrutiny, counterparty risk, and market volatility. These factors can impact liquidity and the overall stability of the market, making it essential for participants to navigate these risks effectively.

What opportunities exist in the Credit Default Swap Market?

Opportunities in the Credit Default Swap Market include the development of new products tailored to specific credit risks and the expansion of CDS trading in emerging markets. Additionally, advancements in technology can enhance trading efficiency and risk assessment capabilities.

What trends are shaping the Credit Default Swap Market?

Trends shaping the Credit Default Swap Market include the increasing use of electronic trading platforms, the integration of artificial intelligence for risk analysis, and a growing focus on transparency and regulatory compliance. These trends are influencing how market participants engage with CDS products.

Credit Default Swap Market

| Segmentation | Details |

|---|---|

| Type | Single-Name CDS, Index CDS |

| Counterparty | Banks, Hedge Funds, Insurance Companies, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Credit Default Swap Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at