444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The cough cold and allergy hay fever remedies market in Mexico represents a dynamic and rapidly evolving healthcare segment that addresses the widespread prevalence of respiratory ailments across the nation. Mexico’s unique geographical position, combined with diverse climatic conditions ranging from tropical coastal regions to high-altitude central areas, creates varied environmental factors that contribute to seasonal allergies and respiratory conditions. The market encompasses a comprehensive range of therapeutic solutions including over-the-counter medications, prescription drugs, natural remedies, and innovative treatment approaches.

Market dynamics in Mexico reflect the country’s growing healthcare awareness and increasing consumer spending on wellness products. The sector experiences consistent growth driven by urbanization, air pollution concerns, and changing lifestyle patterns that contribute to higher incidences of respiratory conditions. Recent analysis indicates the market is expanding at a compound annual growth rate of 6.2%, demonstrating robust demand for effective treatment solutions.

Consumer preferences in Mexico show a distinctive blend of traditional remedies and modern pharmaceutical solutions. The market caters to diverse demographic segments, from urban professionals seeking quick relief solutions to rural populations preferring natural and herbal treatments. Seasonal variations significantly impact demand patterns, with peak consumption periods coinciding with pollen seasons and weather transitions that trigger allergic reactions and cold symptoms.

The cough cold and allergy hay fever remedies market in Mexico refers to the comprehensive ecosystem of therapeutic products, treatments, and healthcare solutions specifically designed to address respiratory ailments, seasonal allergies, and related symptoms affecting the Mexican population. This market encompasses both pharmaceutical and non-pharmaceutical interventions that provide relief from common conditions including seasonal allergic rhinitis, chronic cough, common cold symptoms, and hay fever manifestations.

Market scope includes various product categories such as antihistamines, decongestants, cough suppressants, expectorants, nasal sprays, throat lozenges, and combination therapies. The definition extends beyond traditional medications to include natural remedies, homeopathic treatments, and preventive care products that Mexican consumers increasingly incorporate into their healthcare routines.

Healthcare infrastructure supporting this market includes pharmacies, hospitals, clinics, and specialized allergy treatment centers distributed across Mexico’s diverse geographical regions. The market also encompasses digital health platforms and telemedicine services that provide consultation and treatment recommendations for respiratory conditions.

Mexico’s cough cold and allergy hay fever remedies market demonstrates remarkable resilience and growth potential, driven by increasing health consciousness and environmental factors contributing to respiratory ailments. The market benefits from Mexico’s strategic position as a bridge between North and South American pharmaceutical markets, facilitating access to diverse treatment options and innovative therapeutic solutions.

Key market characteristics include strong demand for combination therapies that address multiple symptoms simultaneously, growing preference for natural and herbal remedies, and increasing adoption of preventive care approaches. The market shows particular strength in urban centers where air quality concerns drive higher consumption of respiratory health products.

Demographic trends reveal that approximately 35% of Mexican adults experience seasonal allergy symptoms annually, creating substantial market demand. The pediatric segment represents a significant growth opportunity, with parents increasingly seeking safe and effective treatments for children’s respiratory conditions. Regional variations in climate and environmental conditions create distinct market segments with specific product preferences and consumption patterns.

Innovation drivers include development of targeted therapies, improved delivery mechanisms, and integration of traditional Mexican herbal medicine with modern pharmaceutical approaches. The market increasingly emphasizes personalized treatment solutions that consider individual patient profiles and regional environmental factors.

Consumer behavior analysis reveals distinct purchasing patterns influenced by seasonal cycles, with peak demand occurring during spring pollen seasons and winter months when cold viruses circulate more frequently. Mexican consumers demonstrate strong brand loyalty while remaining open to trying new products that promise enhanced efficacy or natural ingredients.

Environmental factors serve as primary market drivers, with Mexico’s diverse climate zones creating varied allergen exposures that necessitate different treatment approaches. Urban air pollution, particularly in major metropolitan areas like Mexico City, Guadalajara, and Monterrey, contributes significantly to respiratory health challenges and drives demand for effective remedies.

Demographic shifts including urbanization and lifestyle changes create new market opportunities. As more Mexicans move to cities, exposure to air pollutants and allergens increases, while sedentary lifestyles may compromise immune system function. The growing middle class demonstrates increased willingness to invest in health and wellness products, expanding the addressable market for premium remedy solutions.

Healthcare awareness campaigns conducted by government agencies and healthcare organizations educate consumers about respiratory health management, leading to earlier intervention and preventive care adoption. These initiatives particularly focus on allergy management and the importance of treating symptoms before they become severe.

Technological advancements in drug delivery systems, such as improved nasal sprays and sustained-release formulations, enhance treatment effectiveness and patient compliance. Innovation in natural product extraction and standardization also drives market growth by providing scientifically validated herbal remedies that appeal to health-conscious consumers.

Seasonal climate patterns and climate change effects intensify allergy seasons and extend their duration, creating longer periods of high demand for remedies. Changing precipitation patterns and temperature fluctuations contribute to more severe and unpredictable allergy seasons across different regions of Mexico.

Economic constraints significantly impact market growth, particularly among lower-income populations who may delay or avoid purchasing remedies due to cost considerations. Economic volatility and currency fluctuations affect imported product pricing, making some treatments less accessible to price-sensitive consumers.

Regulatory challenges include complex approval processes for new products and stringent quality control requirements that may delay market entry for innovative treatments. Import regulations and tariff structures can increase costs for international pharmaceutical companies seeking to enter the Mexican market.

Self-medication risks pose concerns as consumers may inappropriately use over-the-counter products or delay seeking professional medical care for serious conditions. Lack of proper diagnosis can lead to ineffective treatment choices and potential complications from underlying respiratory conditions.

Competition from traditional remedies and home treatments may limit adoption of commercial products, particularly in rural areas where traditional healing practices remain prevalent. Some consumers prefer familiar herbal teas and folk remedies over modern pharmaceutical solutions.

Seasonal market fluctuations create challenges for manufacturers and retailers in inventory management and demand forecasting. The cyclical nature of respiratory ailments leads to periods of oversupply and stockouts that affect market efficiency and profitability.

Digital health integration presents significant opportunities for market expansion through telemedicine platforms, mobile health applications, and AI-powered symptom tracking systems. These technologies can provide personalized treatment recommendations and improve patient adherence to therapy regimens.

Natural product development offers substantial growth potential by combining traditional Mexican herbal medicine with modern pharmaceutical standards. Indigenous plant species native to Mexico provide unique opportunities for developing novel therapeutic compounds that appeal to both domestic and international markets.

Preventive care market expansion represents an underexplored opportunity, with potential for developing products that strengthen immune systems and reduce susceptibility to respiratory ailments. Air purification products and environmental control solutions complement traditional remedies by addressing root causes of respiratory problems.

Pediatric market specialization offers growth opportunities through development of child-friendly formulations, flavors, and delivery methods. Parents increasingly seek safe and effective treatments specifically designed for children’s unique physiological needs and preferences.

Cross-border market potential exists for Mexican companies to export successful products to other Latin American countries with similar climate conditions and health challenges. Mexico’s pharmaceutical manufacturing capabilities position the country as a potential regional hub for respiratory health products.

Supply chain dynamics in Mexico’s cough cold and allergy remedies market reflect the country’s position as both a consumer and producer of pharmaceutical products. Domestic manufacturing capabilities have strengthened significantly, with local companies producing generic versions of popular remedies while international brands maintain production facilities to serve the Mexican market efficiently.

Competitive dynamics show intense rivalry between established multinational pharmaceutical companies and emerging local manufacturers. Price competition remains fierce, particularly in the generic segment, while premium brands focus on differentiation through superior efficacy, natural ingredients, or innovative delivery systems.

Regulatory dynamics continue evolving as Mexican health authorities balance market access with safety requirements. Recent policy changes have streamlined approval processes for certain over-the-counter products while maintaining strict standards for prescription medications and new therapeutic compounds.

Consumer dynamics reflect changing preferences toward holistic health approaches that combine conventional treatments with lifestyle modifications and preventive measures. Social media influence and peer recommendations increasingly impact product selection, particularly among younger demographics who research treatments online before making purchases.

Distribution dynamics show evolution from traditional pharmacy-centric models toward multi-channel approaches including online platforms, supermarket chains, and direct-to-consumer services. This diversification improves product accessibility while creating new competitive pressures on traditional retailers.

Market research approach for analyzing Mexico’s cough cold and allergy hay fever remedies market employs comprehensive primary and secondary research methodologies designed to capture accurate market dynamics and consumer behavior patterns. Primary research includes structured interviews with healthcare professionals, pharmacy operators, and consumers across diverse demographic segments and geographical regions.

Data collection methods incorporate both quantitative surveys and qualitative focus groups to understand consumer preferences, purchasing behaviors, and treatment effectiveness perceptions. Healthcare provider interviews provide professional insights into prescribing patterns, patient compliance issues, and emerging treatment trends that influence market development.

Secondary research utilizes government health statistics, pharmaceutical industry reports, and academic studies to establish market baselines and validate primary research findings. Regulatory database analysis tracks product approvals, safety alerts, and policy changes that impact market dynamics and competitive positioning.

Market sizing methodology employs bottom-up analysis combining consumption patterns, demographic data, and epidemiological studies to estimate market scope and growth potential. Regional analysis considers climate variations, urbanization levels, and healthcare infrastructure differences across Mexican states to provide granular market insights.

Validation processes include cross-referencing multiple data sources, expert panel reviews, and statistical analysis to ensure research accuracy and reliability. MarkWide Research employs rigorous quality control measures to maintain high standards in market analysis and forecasting accuracy.

Northern Mexico demonstrates the highest per-capita consumption of allergy remedies, driven by desert climate conditions that create high pollen concentrations and dust exposure. Border states including Baja California, Sonora, and Nuevo León show strong market performance with 25% above-average consumption rates compared to national levels.

Central Mexico represents the largest market segment by volume, encompassing major metropolitan areas including Mexico City, Guadalajara, and Puebla. Urban pollution in these regions drives consistent demand for respiratory health products throughout the year, with particular emphasis on products addressing air quality-related symptoms.

Southern regions including Chiapas, Oaxaca, and Yucatan show distinct consumption patterns influenced by tropical climate conditions and higher humidity levels. Seasonal variations in these areas correlate with rainy seasons and mold exposure, creating different product demand profiles compared to northern regions.

Coastal areas along both Pacific and Gulf coasts experience unique market dynamics related to marine allergens and humidity-related respiratory challenges. Tourist destinations show elevated demand during peak travel seasons as visitors encounter new environmental allergens.

Rural markets demonstrate growing potential as healthcare access improves and disposable income increases. Traditional remedy integration remains strong in these areas, creating opportunities for products that combine modern efficacy with familiar natural ingredients.

Market leadership in Mexico’s cough cold and allergy remedies sector is distributed among several key categories of competitors, each serving distinct market segments and consumer preferences. Multinational pharmaceutical companies maintain strong positions through established brand recognition and extensive distribution networks.

Competitive strategies focus on product differentiation through improved formulations, natural ingredient integration, and enhanced delivery mechanisms. Brand positioning emphasizes efficacy, safety, and value propositions tailored to specific consumer segments and regional preferences.

Market consolidation trends show increasing collaboration between international companies and local manufacturers to leverage distribution networks and regulatory expertise. Innovation partnerships drive development of products specifically adapted to Mexican climate conditions and consumer preferences.

Product type segmentation reveals distinct market categories each serving specific therapeutic needs and consumer preferences within Mexico’s diverse healthcare landscape. Antihistamines represent the largest segment, addressing seasonal and perennial allergic reactions that affect significant portions of the Mexican population throughout the year.

By Product Category:

By Distribution Channel:

By Age Group:

Antihistamine category dominates market share due to widespread prevalence of allergic conditions across Mexico’s diverse climate zones. Second-generation antihistamines show particular strength as consumers prefer non-sedating formulations that don’t interfere with daily activities and work performance.

Combination therapy segment experiences robust growth as consumers seek comprehensive solutions addressing multiple symptoms simultaneously. Cold and flu combinations perform exceptionally well during winter months, while allergy combinations peak during spring pollen seasons.

Natural remedy category shows consistent expansion driven by increasing health consciousness and preference for traditional healing approaches. Mexican herbal traditions influence product development, with companies incorporating indigenous plants and traditional preparation methods into modern formulations.

Pediatric formulations represent a high-growth segment as parents become more proactive about children’s respiratory health. Safety considerations drive demand for age-appropriate dosing, pleasant flavors, and gentle formulations that minimize side effects in young patients.

Prescription segment maintains steady growth through healthcare provider recommendations and treatment of severe or chronic respiratory conditions. Specialized therapies for conditions like chronic allergic rhinitis and severe asthma-related cough show particular promise for market expansion.

Pharmaceutical manufacturers benefit from Mexico’s large population base and growing healthcare awareness, creating substantial market opportunities for both generic and branded products. Regulatory advantages include streamlined approval processes for certain product categories and government support for domestic pharmaceutical manufacturing.

Healthcare providers gain access to diverse treatment options that enable personalized therapy approaches for patients with varying symptom profiles and preferences. Professional education programs supported by pharmaceutical companies enhance clinical knowledge and improve patient outcomes through optimal product selection.

Retail pharmacies experience consistent revenue streams from respiratory health products while building customer loyalty through professional consultation services. Seasonal demand patterns provide predictable sales cycles that facilitate inventory planning and promotional strategies.

Consumers benefit from increased product availability, competitive pricing, and improved treatment options that address specific needs and preferences. Educational initiatives help consumers make informed decisions about symptom management and preventive care approaches.

Healthcare system advantages include reduced burden on medical facilities through effective self-care options and preventive treatments that minimize complications from untreated respiratory conditions. Cost-effective solutions help manage healthcare expenditures while maintaining quality patient care.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient integration represents a dominant trend as Mexican consumers increasingly seek products that combine traditional herbal medicine with modern pharmaceutical efficacy. Indigenous plant research drives innovation in developing unique formulations that leverage Mexico’s rich botanical heritage while meeting contemporary safety and efficacy standards.

Personalized medicine approaches gain traction through digital health platforms that provide customized treatment recommendations based on individual symptom profiles, environmental factors, and medical history. AI-powered solutions help consumers select optimal products and dosing regimens for their specific conditions.

Preventive care emphasis shifts market focus from reactive treatment toward proactive health management through immune system support, environmental control, and lifestyle modification products. Wellness integration connects respiratory health with broader health and wellness trends popular among Mexican consumers.

Sustainable packaging becomes increasingly important as environmentally conscious consumers prefer products with reduced environmental impact. Eco-friendly formulations and manufacturing processes appeal to sustainability-minded demographics while supporting corporate social responsibility initiatives.

Multi-channel distribution expansion provides consumers with convenient access options including online ordering, home delivery, and mobile pharmacy services. Digital prescription platforms streamline the process of obtaining professional recommendations and product access.

Regulatory modernization initiatives by Mexican health authorities streamline approval processes for certain over-the-counter products while maintaining rigorous safety standards. Digital submission systems reduce administrative burden and accelerate time-to-market for new therapeutic solutions.

Manufacturing capacity expansion by both domestic and international companies strengthens Mexico’s position as a regional pharmaceutical production hub. Technology investments in production facilities enhance quality control and enable development of more sophisticated formulations.

Research collaboration between Mexican universities, pharmaceutical companies, and international research institutions advances understanding of respiratory health challenges specific to Mexican populations. Clinical studies validate effectiveness of traditional remedies and support development of evidence-based natural products.

Distribution network evolution includes expansion of pharmacy chains, development of online platforms, and integration of telemedicine services that improve product accessibility across diverse geographical regions. MarkWide Research analysis indicates these developments significantly enhance market reach and consumer convenience.

Public health initiatives by government agencies promote respiratory health awareness and provide education about proper treatment selection and usage. Healthcare professional training programs improve clinical knowledge and enhance patient counseling capabilities in pharmacy settings.

Market entry strategies for new participants should focus on understanding regional variations in climate, consumer preferences, and distribution channels. Local partnerships with established Mexican companies provide valuable market knowledge and regulatory expertise that accelerate successful market penetration.

Product development priorities should emphasize combination therapies that address multiple symptoms while incorporating natural ingredients that resonate with Mexican cultural preferences. Pediatric formulations represent particularly attractive opportunities given growing parental awareness of children’s respiratory health needs.

Distribution strategy optimization requires multi-channel approaches that balance traditional pharmacy relationships with emerging online and retail opportunities. Rural market penetration strategies should consider mobile pharmacy services and community health programs that improve product accessibility.

Brand positioning should emphasize efficacy, safety, and cultural relevance while building trust through healthcare professional endorsements and consumer education initiatives. Digital marketing strategies must account for Mexico’s growing internet penetration and social media usage patterns.

Innovation investment should focus on developing products specifically adapted to Mexican climate conditions and consumer needs. Sustainability initiatives in packaging and manufacturing processes will become increasingly important for competitive differentiation and consumer appeal.

Market growth trajectory remains positive with projected expansion driven by demographic trends, increasing healthcare awareness, and environmental factors that sustain demand for respiratory health solutions. Urbanization continues to create new consumer segments with distinct product needs and purchasing behaviors.

Technology integration will reshape market dynamics through digital health platforms, personalized medicine approaches, and enhanced distribution mechanisms. Artificial intelligence applications in symptom assessment and treatment recommendation will improve patient outcomes while creating new business opportunities.

Natural product segment shows exceptional growth potential as scientific validation of traditional remedies combines with consumer preference for holistic health approaches. Research investments in Mexican botanical resources may yield breakthrough therapeutic compounds with global market potential.

Regulatory environment evolution will likely favor innovation while maintaining safety standards, potentially accelerating approval processes for certain product categories. International harmonization efforts may facilitate cross-border trade and technology transfer.

Climate change impacts may intensify allergy seasons and create new environmental health challenges that drive demand for advanced therapeutic solutions. MWR projections suggest the market will continue expanding at a steady growth rate of 6-8% annually over the next five years, supported by demographic trends and increasing health consciousness among Mexican consumers.

Mexico’s cough cold and allergy hay fever remedies market represents a dynamic and expanding healthcare segment with substantial growth opportunities driven by diverse environmental factors, increasing health awareness, and evolving consumer preferences. The market’s resilience stems from consistent demand patterns influenced by Mexico’s unique geographical and climatic conditions that create year-round needs for respiratory health solutions.

Strategic market positioning requires understanding of regional variations, consumer preferences for natural ingredients, and the importance of multi-channel distribution approaches. Companies that successfully integrate traditional Mexican healing wisdom with modern pharmaceutical standards will likely achieve sustainable competitive advantages in this evolving marketplace.

Future success factors include innovation in product development, strategic partnerships with local stakeholders, and adaptation to changing consumer behaviors influenced by digital health trends and sustainability concerns. The market’s continued expansion provides opportunities for both established players and new entrants willing to invest in understanding Mexico’s unique healthcare landscape and consumer needs.

What is Cough Cold And Allergy Hay Fever Remedies?

Cough Cold And Allergy Hay Fever Remedies refer to various treatments and products designed to alleviate symptoms associated with respiratory conditions and allergies, including over-the-counter medications, herbal remedies, and homeopathic solutions.

What are the key players in the Cough Cold And Allergy Hay Fever Remedies In Mexico Market?

Key players in the Cough Cold And Allergy Hay Fever Remedies In Mexico Market include companies like Genomma Lab, Bayer, and Procter & Gamble, which offer a range of products targeting these health issues, among others.

What are the growth factors driving the Cough Cold And Allergy Hay Fever Remedies In Mexico Market?

The growth of the Cough Cold And Allergy Hay Fever Remedies In Mexico Market is driven by increasing pollution levels, rising awareness of allergy-related health issues, and a growing preference for self-medication among consumers.

What challenges does the Cough Cold And Allergy Hay Fever Remedies In Mexico Market face?

Challenges in the Cough Cold And Allergy Hay Fever Remedies In Mexico Market include regulatory hurdles, competition from alternative therapies, and fluctuating consumer trust in pharmaceutical products.

What opportunities exist in the Cough Cold And Allergy Hay Fever Remedies In Mexico Market?

Opportunities in the Cough Cold And Allergy Hay Fever Remedies In Mexico Market include the development of innovative formulations, the expansion of e-commerce platforms for better accessibility, and increasing investment in research and development.

What trends are shaping the Cough Cold And Allergy Hay Fever Remedies In Mexico Market?

Trends in the Cough Cold And Allergy Hay Fever Remedies In Mexico Market include a shift towards natural and organic remedies, the rise of personalized medicine, and the growing use of digital health solutions for symptom management.

Cough Cold And Allergy Hay Fever Remedies In Mexico Market

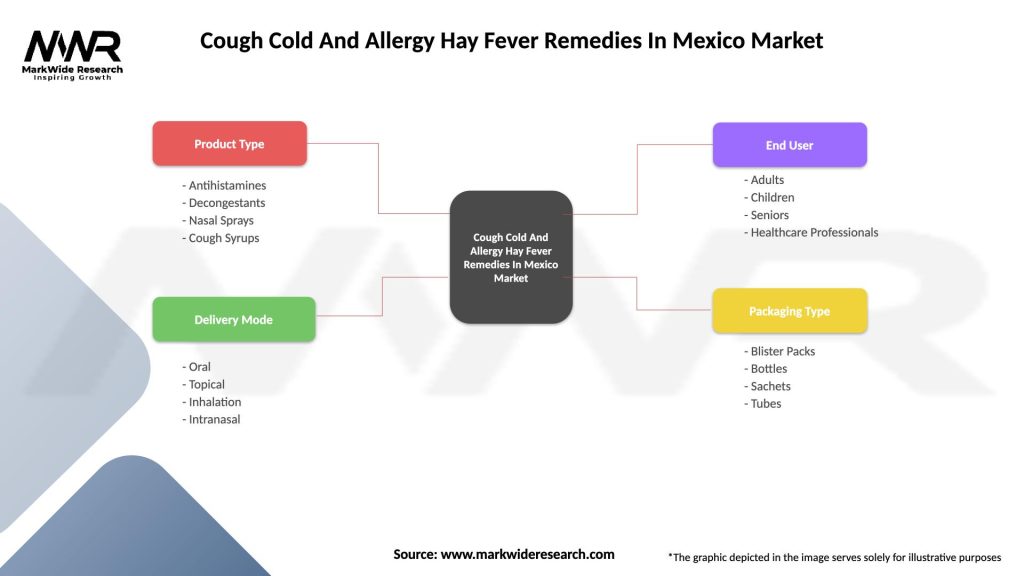

| Segmentation Details | Description |

|---|---|

| Product Type | Antihistamines, Decongestants, Nasal Sprays, Cough Syrups |

| Delivery Mode | Oral, Topical, Inhalation, Intranasal |

| End User | Adults, Children, Seniors, Healthcare Professionals |

| Packaging Type | Blister Packs, Bottles, Sachets, Tubes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cough Cold And Allergy Hay Fever Remedies In Mexico Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at