444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Cosmetology Insurance Market is experiencing significant growth and evolution, driven by the expanding beauty and wellness industry and the increasing demand for specialized insurance coverage tailored to cosmetology professionals. Cosmetology insurance provides coverage for a wide range of beauty-related services, including hair styling, skincare, nail care, and cosmetic treatments, offering financial protection against risks such as liability claims, property damage, professional errors, and accidents. With the rise of independent beauty professionals, mobile salons, and spa services, the cosmetology insurance market is poised for substantial expansion in the coming years.

Meaning

Cosmetology insurance, also known as beauty and wellness insurance, is a specialized type of insurance designed to protect cosmetology professionals and businesses from potential risks and liabilities associated with beauty-related services. This includes coverage for bodily injury, property damage, professional negligence, product liability, and other risks that may arise in the course of providing beauty treatments and services. Cosmetology insurance policies are tailored to meet the unique needs of beauty professionals, salon owners, spa operators, and independent practitioners, offering peace of mind and financial security in an industry where client satisfaction and reputation are paramount.

Executive Summary

The Cosmetology Insurance Market is witnessing robust growth as beauty professionals and businesses recognize the importance of mitigating risks and protecting their livelihoods. Cosmetology insurance provides essential coverage against a wide range of liabilities and contingencies, including accidents, injuries, property damage, and professional errors, enabling cosmetology professionals to focus on delivering quality services and building their businesses with confidence. However, challenges such as market fragmentation, regulatory compliance, and evolving industry standards underscore the need for comprehensive insurance solutions and proactive risk management strategies.

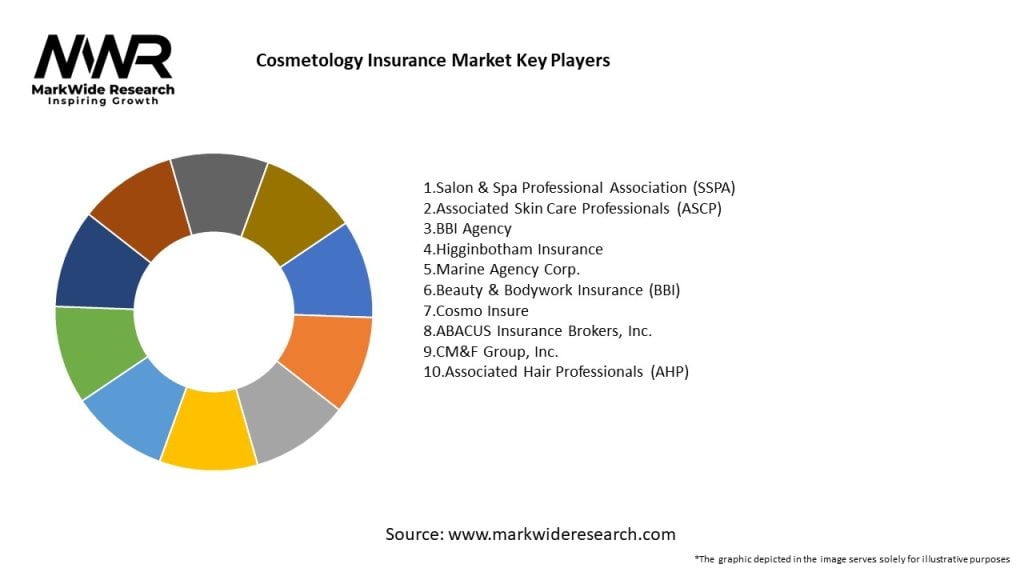

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Cosmetology Insurance Market operates within a dynamic ecosystem influenced by factors such as technological advancements, regulatory changes, market trends, consumer behavior, and industry dynamics. Understanding these dynamics is essential for insurance providers, beauty professionals, and businesses to navigate challenges, capitalize on opportunities, and drive sustainable growth in the cosmetology insurance landscape.

Regional Analysis

Regional variations in beauty trends, consumer preferences, regulatory environments, economic conditions, and cultural factors impact the dynamics of the cosmetology insurance market. Key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East present unique opportunities and challenges for insurance providers and beauty professionals seeking insurance coverage and protection.

Competitive Landscape

Leading Companies in the Cosmetology Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Cosmetology Insurance Market can be segmented based on various factors such as:

Segmentation enables insurance providers to tailor their offerings to specific customer needs, industry segments, and geographic regions effectively.

Category-wise Insights

Insights into categories such as professional liability, property coverage, product liability, and general liability provide a comprehensive understanding of the cosmetology insurance market landscape and opportunities for innovation and growth.

Key Benefits for Industry Participants and Stakeholders

Cosmetology insurance offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the Cosmetology Insurance Market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the Cosmetology Insurance Market include:

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Cosmetology Insurance Market, affecting industry dynamics, consumer behavior, and insurance needs in several ways:

Key Industry Developments

Key industry developments in the Cosmetology Insurance Market include:

Analyst Suggestions

Key suggestions for stakeholders in the Cosmetology Insurance Market include:

Future Outlook

The Cosmetology Insurance Market is poised for continued growth and evolution, driven by factors such as:

Conclusion

The Cosmetology Insurance Market represents a dynamic and evolving segment of the insurance industry, driven by the growth of the beauty and wellness industry and the increasing demand for specialized insurance coverage tailored to cosmetology professionals and businesses. With the rise of independent beauty practitioners, changing consumer preferences, and evolving regulatory requirements, the cosmetology insurance market offers significant opportunities for insurance providers, industry associations, and cosmetology professionals to collaborate, innovate, and drive sustainable growth in the beauty service industry. By embracing digital transformation, education, and advocacy, stakeholders in the cosmetology insurance market can navigate challenges, capitalize on opportunities, and build a resilient and vibrant ecosystem that promotes professionalism, safety, and trust in the beauty and wellness industry.

What is Cosmetology Insurance?

Cosmetology Insurance is a specialized type of insurance designed to protect beauty professionals, such as hairstylists, estheticians, and nail technicians, from various risks associated with their work. This insurance typically covers liability claims, property damage, and other related incidents that may occur in a salon or spa environment.

What are the key players in the Cosmetology Insurance Market?

Key players in the Cosmetology Insurance Market include companies like The Hartford, Hiscox, and Progressive, which offer tailored insurance solutions for beauty professionals. These companies provide various coverage options to meet the unique needs of cosmetologists and salon owners, among others.

What are the growth factors driving the Cosmetology Insurance Market?

The growth of the Cosmetology Insurance Market is driven by increasing awareness of liability risks among beauty professionals and the rising number of salons and beauty service providers. Additionally, the expansion of beauty services and the demand for comprehensive coverage options contribute to market growth.

What challenges does the Cosmetology Insurance Market face?

The Cosmetology Insurance Market faces challenges such as the complexity of insurance policies and the varying regulations across different regions. Additionally, many beauty professionals may underestimate their risk exposure, leading to lower insurance uptake.

What opportunities exist in the Cosmetology Insurance Market?

Opportunities in the Cosmetology Insurance Market include the potential for product innovation, such as customizable insurance packages tailored to specific beauty services. Furthermore, the increasing trend of freelance beauty professionals presents a growing customer base for insurers.

What trends are shaping the Cosmetology Insurance Market?

Trends shaping the Cosmetology Insurance Market include the rise of digital platforms for insurance purchasing and management, as well as an increased focus on holistic coverage that includes wellness and mental health services for beauty professionals. Additionally, the integration of technology in salon operations is influencing insurance needs.

Cosmetology Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | General Liability, Professional Liability, Property Insurance, Workers’ Compensation |

| Client Type | Salons, Spas, Freelancers, Mobile Beauticians |

| Policy Duration | Annual, Monthly, Short-Term, Long-Term |

| Service Type | Hair Care, Skin Care, Nail Services, Aesthetic Treatments |

Leading Companies in the Cosmetology Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at