444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The cosmetic and fragrance retail chain market represents a dynamic and rapidly evolving sector within the global beauty industry, characterized by specialized retail outlets dedicated to selling cosmetics, skincare products, fragrances, and personal care items. This market encompasses established beauty retailers, department store beauty sections, specialty fragrance boutiques, and emerging direct-to-consumer beauty chains that have transformed how consumers discover and purchase beauty products.

Market dynamics indicate robust growth driven by increasing consumer awareness of personal grooming, rising disposable incomes, and the proliferation of social media influencing beauty trends. The sector has experienced significant transformation with the integration of digital technologies, personalized shopping experiences, and omnichannel retail strategies that bridge online and offline customer touchpoints.

Growth projections suggest the market is expanding at a compound annual growth rate (CAGR) of 6.2%, fueled by emerging markets adoption, premium product demand, and innovative retail concepts. The market demonstrates resilience through economic fluctuations, with beauty products often considered essential purchases by consumers across various demographic segments.

Regional variations show North America and Europe maintaining dominant positions, while Asia-Pacific emerges as the fastest-growing region with market share increasing by 8.5% annually. The sector benefits from continuous product innovation, celebrity endorsements, and the growing influence of beauty influencers and social media marketing strategies.

The cosmetic and fragrance retail chain market refers to the organized retail segment specializing in the distribution and sale of beauty products, cosmetics, fragrances, skincare items, and personal care accessories through dedicated retail outlets, chain stores, and specialized beauty destinations. This market encompasses both traditional brick-and-mortar stores and modern omnichannel retail concepts that integrate physical and digital shopping experiences.

Core components include specialty beauty retailers, department store beauty sections, fragrance boutiques, pharmacy beauty aisles, and emerging concept stores that focus exclusively on beauty and personal care products. These retail chains serve as crucial intermediaries between beauty brands and consumers, providing product discovery, expert consultation, and experiential shopping environments.

Market participants range from global beauty retail giants to regional specialty chains, each offering curated product selections, professional beauty services, and personalized customer experiences. The sector has evolved to include subscription-based beauty boxes, pop-up beauty experiences, and digitally-native brands that have expanded into physical retail spaces.

Strategic analysis reveals the cosmetic and fragrance retail chain market as a resilient and innovation-driven sector experiencing sustained growth across multiple regions and consumer segments. The market benefits from fundamental shifts in consumer behavior, including increased focus on self-care, premiumization trends, and the growing importance of experiential retail in beauty purchasing decisions.

Key growth drivers include the expansion of beauty consciousness among male consumers, representing 15% of total market growth, rising demand for clean and sustainable beauty products, and the integration of technology-enhanced shopping experiences. The sector demonstrates adaptability through successful omnichannel strategies that combine physical retail presence with robust digital platforms.

Market consolidation trends show established players acquiring emerging brands and retail concepts, while new entrants focus on niche segments and innovative retail formats. The competitive landscape emphasizes customer experience, product curation, and brand partnerships as key differentiation factors in an increasingly crowded marketplace.

Future prospects indicate continued expansion driven by emerging market penetration, demographic shifts, and evolving consumer preferences toward personalized beauty solutions. The market shows resilience against economic downturns, with beauty products maintaining essential status in consumer spending priorities across various income levels.

Consumer behavior analysis reveals significant shifts in beauty shopping patterns, with customers increasingly seeking personalized experiences, expert advice, and product trial opportunities that physical retail chains uniquely provide. The market benefits from the experiential nature of beauty shopping, where sensory engagement and professional consultation drive purchase decisions.

Consumer lifestyle changes represent the primary driver of cosmetic and fragrance retail chain market expansion, with increasing emphasis on personal grooming, self-expression, and wellness contributing to sustained demand growth. The market benefits from fundamental demographic shifts, including urbanization, rising female workforce participation, and evolving beauty standards across diverse consumer segments.

Social media influence has transformed beauty consumption patterns, with platforms like Instagram, TikTok, and YouTube driving product discovery and purchase decisions. Beauty retail chains capitalize on this trend through influencer partnerships, social media marketing campaigns, and user-generated content strategies that enhance brand visibility and customer engagement.

Economic prosperity in emerging markets creates new customer bases with increasing disposable income allocated to beauty and personal care products. This driver particularly benefits international retail chains expanding into Asia-Pacific, Latin America, and Middle Eastern markets where beauty consciousness is rapidly growing among middle-class consumers.

Product innovation within the beauty industry continuously creates new categories and premium offerings that drive retail chain growth. Advanced formulations, clean beauty trends, and personalized products generate consumer excitement and repeat purchases, supporting retail chain expansion and margin improvement initiatives.

Experiential retail demand favors physical beauty retail chains over pure e-commerce alternatives, as consumers value the ability to test products, receive professional advice, and enjoy immersive shopping experiences. This driver supports continued investment in flagship stores, concept shops, and service-enhanced retail formats.

Intense competition from e-commerce platforms and direct-to-consumer brands creates pressure on traditional retail chains, requiring significant investment in digital transformation and omnichannel capabilities. The market faces challenges from online retailers offering competitive pricing, extensive product selection, and convenient delivery options that appeal to price-sensitive consumers.

High operational costs associated with prime retail locations, skilled staff training, and inventory management impact profitability margins for cosmetic and fragrance retail chains. Rising commercial real estate costs in key metropolitan areas strain expansion plans and force retailers to optimize store formats and operational efficiency.

Economic sensitivity affects consumer spending on discretionary beauty products during economic downturns, although the impact varies by product category and consumer segment. Premium beauty products and fragrance purchases often decline first during economic uncertainty, impacting retail chain revenues and growth projections.

Regulatory compliance requirements across different markets create operational complexity for international retail chains, particularly regarding product safety standards, labeling requirements, and import regulations. These constraints increase operational costs and slow expansion into new geographic markets.

Supply chain disruptions can significantly impact product availability and inventory management for retail chains dependent on global beauty brand partnerships. Disruptions affect customer satisfaction and sales performance, particularly for chains specializing in imported or limited-edition beauty products.

Emerging market expansion presents substantial growth opportunities for established cosmetic and fragrance retail chains, particularly in Asia-Pacific, Latin America, and Africa where beauty market penetration remains below developed market levels. These regions offer significant potential for retail chain expansion with market growth rates exceeding 12% annually in key urban centers.

Male grooming segment represents an underexplored opportunity with growing acceptance of male beauty and personal care products creating new customer acquisition possibilities. Retail chains can capitalize on this trend through dedicated men’s beauty sections, targeted marketing campaigns, and specialized product curation strategies.

Technology integration opportunities include augmented reality try-on experiences, AI-powered product recommendations, and personalized beauty consultations that enhance customer experience and drive sales conversion. Advanced retail chains investing in technology infrastructure gain competitive advantages and improved customer loyalty.

Sustainable beauty focus creates opportunities for retail chains to differentiate through eco-friendly product curation, sustainable packaging initiatives, and partnerships with clean beauty brands. This positioning appeals to environmentally conscious consumers and supports premium pricing strategies.

Service expansion beyond traditional retail includes beauty education workshops, professional makeup services, and skincare consultations that increase customer engagement and create additional revenue streams. These services enhance customer lifetime value and build stronger brand relationships.

Competitive intensity within the cosmetic and fragrance retail chain market drives continuous innovation in customer experience, product curation, and service offerings. Market leaders maintain advantages through scale economies, brand partnerships, and prime retail locations, while emerging players focus on niche segments and innovative retail concepts.

Consumer preferences increasingly favor retailers offering comprehensive beauty ecosystems that combine product sales, professional services, and educational content. This dynamic supports retail chains that invest in staff training, service capabilities, and experiential store formats that differentiate from traditional retail approaches.

Brand relationships play crucial roles in retail chain success, with exclusive product launches, limited editions, and brand partnerships driving customer traffic and sales performance. Retail chains with strong brand relationships gain access to premium products and marketing support that enhance competitive positioning.

Digital transformation requirements force traditional retail chains to develop omnichannel capabilities, mobile applications, and social media presence to remain competitive. Successful chains integrate digital and physical touchpoints to create seamless customer experiences that drive loyalty and repeat purchases.

Market consolidation trends show larger retail chains acquiring smaller competitors and emerging brands to expand market share and geographic presence. This dynamic creates opportunities for well-capitalized players while challenging independent retailers to find sustainable competitive advantages.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the cosmetic and fragrance retail chain market. The research approach combines quantitative data analysis with qualitative industry expertise to provide holistic market understanding and strategic recommendations.

Primary research includes extensive interviews with industry executives, retail chain managers, beauty brand representatives, and consumer focus groups across key geographic markets. This approach provides firsthand insights into market trends, competitive dynamics, and consumer behavior patterns that drive industry evolution.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and market databases to validate primary findings and establish comprehensive market baselines. Data sources include industry associations, government statistics, and proprietary databases covering retail performance metrics.

Market modeling utilizes advanced analytical techniques to project market trends, segment growth patterns, and competitive landscape evolution. The methodology incorporates macroeconomic factors, demographic trends, and industry-specific drivers to generate reliable market forecasts and strategic insights.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review panels, and statistical verification methods. The research maintains objectivity through standardized analytical frameworks and transparent methodology documentation.

North America maintains market leadership in the cosmetic and fragrance retail chain sector, with the United States representing the largest single market driven by high consumer spending power, established beauty culture, and extensive retail infrastructure. The region demonstrates market share of approximately 35% globally, supported by major retail chains and strong brand presence.

European markets show steady growth with emphasis on premium beauty products, sustainable packaging, and luxury fragrance segments. Key markets including France, Germany, and the United Kingdom benefit from established beauty traditions and high consumer sophistication, contributing 28% of global market share.

Asia-Pacific region emerges as the fastest-growing market with annual growth rates exceeding 9.5%, driven by rising disposable incomes, urbanization, and increasing beauty consciousness among younger demographics. China, Japan, and South Korea lead regional growth through domestic retail chain expansion and international brand adoption.

Latin America presents significant growth opportunities with Brazil and Mexico leading regional market development. The region benefits from growing middle-class populations and increasing female workforce participation, supporting retail chain expansion and premium product adoption.

Middle East and Africa show emerging market potential with urban centers driving beauty retail development. The region demonstrates growing consumer sophistication and increasing acceptance of international beauty brands through specialized retail chain expansion.

Market leadership is characterized by a mix of global beauty retail giants, regional specialty chains, and emerging direct-to-consumer brands that have expanded into physical retail. The competitive environment emphasizes customer experience, product curation, and omnichannel capabilities as key differentiation factors.

Competitive strategies focus on exclusive brand partnerships, personalized customer experiences, and technology integration to drive customer loyalty and market share growth. Leading retailers invest heavily in staff training, store design, and digital capabilities to maintain competitive advantages.

Product category segmentation reveals diverse revenue streams within cosmetic and fragrance retail chains, with each category demonstrating distinct growth patterns and consumer behavior characteristics. Understanding these segments enables retailers to optimize product mix and inventory management strategies.

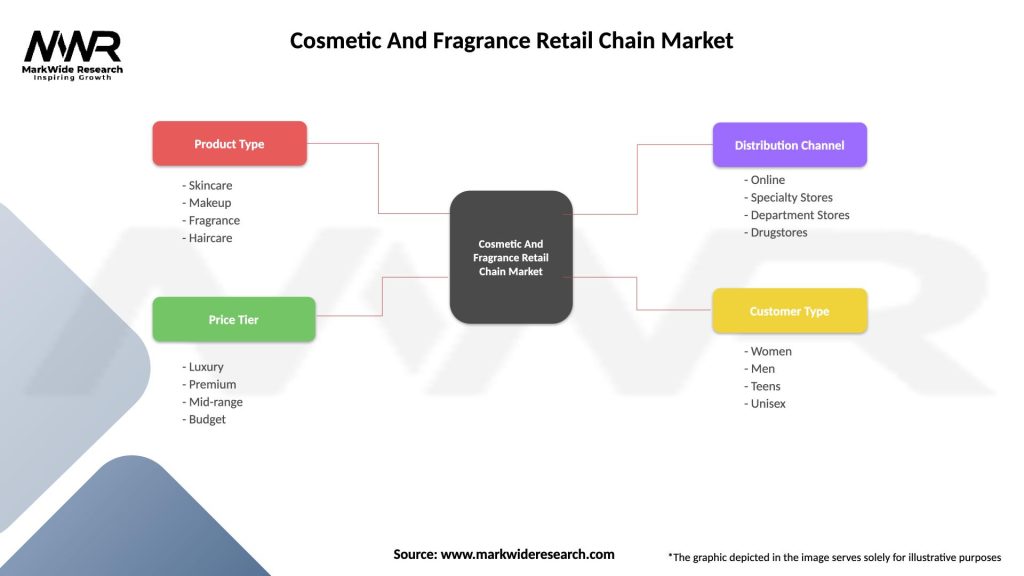

By Product Type:

By Price Segment:

By Distribution Channel:

Skincare category demonstrates the strongest growth momentum within cosmetic retail chains, driven by increasing consumer awareness of skin health, anti-aging concerns, and preventive care approaches. This category benefits from scientific innovation, dermatologist endorsements, and the growing influence of K-beauty and clean beauty trends that emphasize ingredient transparency.

Color cosmetics show seasonal volatility with strong performance during holiday periods and special occasions, while facing challenges from social media beauty trends that rapidly shift consumer preferences. Retail chains succeed in this category through trend forecasting, limited edition collections, and influencer partnerships that drive product discovery and trial.

Fragrance segment maintains premium positioning with high gross margins and strong customer loyalty, particularly in luxury and niche fragrance categories. This segment benefits from emotional purchasing decisions, gift-giving occasions, and the experiential nature of fragrance selection that favors physical retail environments.

Men’s grooming represents the fastest-growing category with annual growth rates of 11.3%, driven by changing male attitudes toward personal care and grooming. Retail chains capitalize on this trend through dedicated men’s sections, targeted marketing, and product education that addresses male-specific beauty concerns.

Clean beauty emerges as a significant category driver with consumers increasingly seeking natural, organic, and sustainably-produced beauty products. Retail chains differentiate through clean beauty curation, ingredient education, and partnerships with emerging sustainable beauty brands.

Beauty brands benefit from retail chain partnerships through expanded market reach, professional product presentation, and access to customer data that informs product development and marketing strategies. Retail chains provide brands with valuable consumer insights, market feedback, and promotional opportunities that drive brand growth and market penetration.

Consumers gain access to comprehensive product selection, expert advice, and trial opportunities that enhance purchase confidence and satisfaction. Retail chains offer convenience through multiple shopping channels, loyalty programs, and personalized recommendations that improve the overall beauty shopping experience.

Investors find attractive opportunities in the cosmetic and fragrance retail chain market through stable cash flows, defensive characteristics during economic downturns, and growth potential in emerging markets. The sector offers diversification benefits and exposure to consumer discretionary spending trends.

Suppliers including packaging companies, logistics providers, and technology vendors benefit from retail chain expansion and modernization initiatives. The market creates opportunities for innovation in retail technology, sustainable packaging, and supply chain optimization.

Employment creation occurs through retail chain expansion, requiring skilled beauty consultants, store managers, and support staff. The industry provides career development opportunities and specialized training in beauty expertise and customer service excellence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Omnichannel integration emerges as the dominant trend with successful retail chains seamlessly blending online and offline customer experiences. This trend includes buy-online-pickup-in-store services, virtual consultations, and mobile app integration that enhances customer convenience and engagement across multiple touchpoints.

Personalization technology transforms beauty retail through AI-powered product recommendations, virtual try-on capabilities, and customized beauty profiles that match products to individual skin tones, preferences, and concerns. MarkWide Research indicates that personalization initiatives increase customer satisfaction by 42% and drive repeat purchase rates.

Sustainability emphasis influences retail chain operations through eco-friendly packaging, refillable product options, and partnerships with clean beauty brands. Consumers increasingly prioritize environmental responsibility, driving retail chains to adopt sustainable practices and transparent supply chain management.

Social commerce integration connects retail chains with social media platforms, enabling direct purchasing through Instagram, TikTok, and other channels where beauty content drives product discovery. This trend particularly appeals to younger demographics who discover beauty products through social media influence.

Subscription services complement traditional retail through curated beauty boxes, replenishment programs, and exclusive member benefits that create recurring revenue streams and enhanced customer lifetime value for retail chains.

Inclusive beauty drives product range expansion to serve diverse skin tones, gender identities, and beauty needs. Retail chains invest in inclusive product curation, diverse marketing representation, and staff training to serve broader customer demographics effectively.

Strategic acquisitions reshape the competitive landscape as major retail chains acquire emerging beauty brands, technology companies, and regional competitors to expand market presence and capabilities. These transactions enable rapid market entry, technology integration, and product portfolio diversification.

Technology partnerships between retail chains and beauty tech companies create innovative customer experiences through augmented reality mirrors, AI-powered skin analysis, and virtual makeup applications. These collaborations enhance in-store experiences and differentiate retailers from online-only competitors.

International expansion accelerates as successful retail chains enter emerging markets through joint ventures, franchising agreements, and direct investment. This development particularly focuses on Asia-Pacific markets where beauty consumption growth outpaces global averages.

Service innovation includes the introduction of beauty schools, professional makeup services, and skincare clinics within retail environments. These developments transform retail chains from product sellers to comprehensive beauty service providers, increasing customer engagement and revenue per visit.

Sustainable initiatives gain momentum through packaging reduction programs, product recycling services, and carbon-neutral shipping options. Leading retail chains implement comprehensive sustainability strategies that appeal to environmentally conscious consumers and support corporate responsibility objectives.

Private label development enables retail chains to offer exclusive products with higher margins and unique positioning. This development includes collaborations with influencers, celebrity partnerships, and proprietary formulations that differentiate retail chains from competitors.

Investment priorities should focus on technology infrastructure development, particularly in augmented reality capabilities, mobile applications, and customer data analytics platforms that enable personalized shopping experiences. MWR analysis suggests that technology-forward retailers achieve 25% higher customer retention rates compared to traditional retail approaches.

Geographic expansion strategies should prioritize emerging markets with growing middle-class populations and increasing beauty consciousness, particularly in Southeast Asia, Latin America, and urban centers in Africa. Market entry should consider local beauty preferences, regulatory requirements, and partnership opportunities with established local players.

Product curation must balance established brand relationships with emerging clean beauty, inclusive beauty, and male grooming categories that drive future growth. Retail chains should develop expertise in trend forecasting and consumer behavior analysis to optimize product mix and inventory management.

Service integration represents a critical differentiation strategy, with successful retailers expanding beyond product sales to include beauty education, professional services, and personalized consultations. This approach increases customer lifetime value and creates competitive barriers against pure e-commerce competitors.

Sustainability initiatives should become integral to retail chain operations, including sustainable packaging, ethical sourcing, and environmental responsibility programs that appeal to conscious consumers and support long-term brand positioning.

Partnership strategies with beauty brands, technology providers, and influencers create competitive advantages through exclusive products, innovative experiences, and enhanced marketing reach. Strategic partnerships enable rapid capability development and market differentiation.

Market evolution indicates continued growth driven by emerging market expansion, demographic shifts, and evolving consumer preferences toward experiential retail and personalized beauty solutions. The sector demonstrates resilience and adaptability through economic cycles, supported by the essential nature of beauty and personal care products in consumer spending priorities.

Technology integration will accelerate with artificial intelligence, augmented reality, and data analytics becoming standard capabilities for competitive retail chains. Future success depends on seamlessly blending digital innovation with physical retail advantages to create superior customer experiences that drive loyalty and growth.

Geographic expansion opportunities remain substantial in emerging markets where beauty market penetration lags developed economies. Successful retail chains will adapt global concepts to local preferences while maintaining operational efficiency and brand consistency across diverse markets.

Category evolution will continue with clean beauty, male grooming, and personalized products driving growth while traditional categories mature. Retail chains must maintain agility in product curation and category management to capitalize on emerging trends and consumer preferences.

Competitive dynamics will intensify as digital-native brands expand into physical retail while traditional retailers enhance digital capabilities. Success will depend on creating unique value propositions that combine product access, expert guidance, and experiential elements that differentiate from pure e-commerce alternatives.

Sustainability requirements will become increasingly important as consumers and regulators demand environmental responsibility throughout the beauty supply chain. Retail chains that proactively address sustainability concerns will gain competitive advantages and appeal to conscious consumer segments.

The cosmetic and fragrance retail chain market represents a dynamic and resilient sector within the global beauty industry, characterized by continuous innovation, evolving consumer preferences, and substantial growth opportunities across diverse geographic markets. The sector successfully balances traditional retail advantages with digital transformation requirements, creating comprehensive beauty ecosystems that serve increasingly sophisticated consumer needs.

Market fundamentals remain strong with consistent demand growth driven by rising beauty consciousness, demographic shifts, and the essential nature of personal care products in consumer spending. The sector demonstrates adaptability through economic cycles and technological disruption, with successful retailers embracing omnichannel strategies and experiential retail concepts that differentiate from pure e-commerce competitors.

Future success in the cosmetic and fragrance retail chain market depends on strategic investment in technology integration, geographic expansion, and service innovation that creates superior customer experiences and sustainable competitive advantages. Retailers that effectively combine physical retail strengths with digital capabilities while maintaining focus on customer service excellence and product curation will capture the greatest opportunities in this evolving market landscape.

What is Cosmetic And Fragrance Retail Chain?

Cosmetic And Fragrance Retail Chain refers to businesses that specialize in selling beauty products, including cosmetics, skincare, and fragrances, through physical stores and online platforms. These chains cater to a diverse consumer base, offering a wide range of products from various brands.

What are the key players in the Cosmetic And Fragrance Retail Chain Market?

Key players in the Cosmetic And Fragrance Retail Chain Market include Sephora, Ulta Beauty, and Macy’s, among others. These companies are known for their extensive product offerings and strong brand partnerships, which help them attract a wide range of customers.

What are the growth factors driving the Cosmetic And Fragrance Retail Chain Market?

The growth of the Cosmetic And Fragrance Retail Chain Market is driven by increasing consumer demand for beauty products, the rise of e-commerce, and the growing influence of social media on beauty trends. Additionally, the expansion of product lines and the introduction of innovative formulations contribute to market growth.

What challenges does the Cosmetic And Fragrance Retail Chain Market face?

The Cosmetic And Fragrance Retail Chain Market faces challenges such as intense competition, changing consumer preferences, and regulatory pressures regarding product safety and labeling. These factors can impact profitability and market share for retailers.

What opportunities exist in the Cosmetic And Fragrance Retail Chain Market?

Opportunities in the Cosmetic And Fragrance Retail Chain Market include the expansion into emerging markets, the growth of sustainable and clean beauty products, and the increasing popularity of personalized beauty solutions. Retailers can leverage these trends to enhance customer engagement and drive sales.

What trends are shaping the Cosmetic And Fragrance Retail Chain Market?

Trends shaping the Cosmetic And Fragrance Retail Chain Market include the rise of online shopping, the demand for cruelty-free and vegan products, and the integration of augmented reality in shopping experiences. These trends reflect changing consumer values and technological advancements in retail.

Cosmetic And Fragrance Retail Chain Market

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Makeup, Fragrance, Haircare |

| Price Tier | Luxury, Premium, Mid-range, Budget |

| Distribution Channel | Online, Specialty Stores, Department Stores, Drugstores |

| Customer Type | Women, Men, Teens, Unisex |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cosmetic And Fragrance Retail Chain Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at