444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market is a thriving segment of the industrial protective coatings industry. CUI and SOI coatings play a crucial role in preventing corrosion and ensuring the longevity of equipment, pipelines, and infrastructure. Corrosion under insulation is a prevalent issue in industries such as oil and gas, petrochemicals, chemical processing, power generation, and marine sectors. It occurs when moisture infiltrates the insulation layer, leading to the development of corrosion beneath it. Spray-on insulation coatings, on the other hand, provide thermal insulation and act as a barrier against environmental elements, preventing CUI and other forms of corrosion.

Meaning

Corrosion Under Insulation (CUI) refers to the corrosion that occurs on metal surfaces hidden beneath insulation materials. It is a common and critical problem faced by industries dealing with high-temperature equipment and pipelines. When insulation is not properly sealed or becomes damaged, moisture can seep in and create a corrosive environment, eventually leading to equipment failure, safety hazards, and substantial maintenance costs. Spray-on Insulation (SOI) coatings are designed to protect surfaces from corrosion, provide thermal insulation, and offer resistance against extreme temperatures and harsh environmental conditions. These coatings serve as an effective solution to prevent CUI and extend the lifespan of assets and infrastructure.

Executive Summary

The Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market has experienced significant growth in recent years due to the increasing awareness about the importance of corrosion prevention in industrial settings. Key market players have been investing in research and development to introduce innovative and more effective coatings. The market has witnessed a surge in demand from various industries, including oil and gas, petrochemicals, power generation, and chemical processing, as they seek to enhance asset longevity and reduce maintenance costs. The COVID-19 pandemic has also influenced the market, presenting both challenges and opportunities.

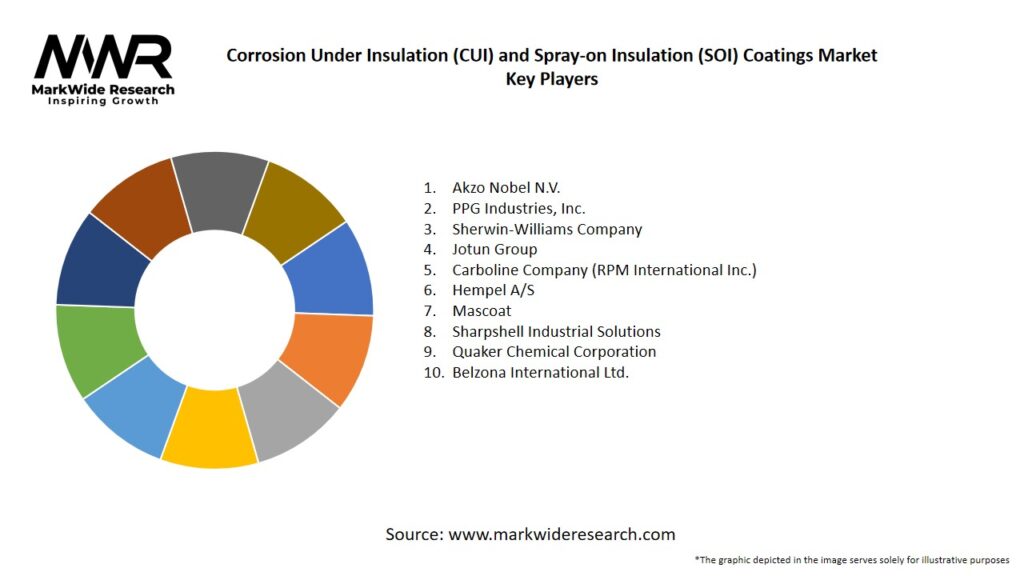

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The CUI and SOI Coatings market have seen substantial growth due to the rising focus on asset protection and safety. The key insights into the market include:

Market Drivers

Several factors contribute to the growth of the CUI and SOI Coatings market:

Market Restraints

Despite its growth prospects, the CUI and SOI Coatings market face certain challenges:

Market Opportunities

The CUI and SOI Coatings market present several opportunities for growth:

Market Dynamics

The CUI and SOI Coatings market are influenced by several dynamic factors:

Regional Analysis

The CUI and SOI Coatings market show variations across different regions:

Competitive Landscape

Leading Companies in the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The CUI and SOI Coatings market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had both positive and negative impacts on the CUI and SOI Coatings market. While the initial lockdowns and restrictions disrupted industrial activities, the subsequent recovery and resumption of operations led to an increased focus on asset protection. The pandemic highlighted the importance of safeguarding critical infrastructure, which resulted in heightened demand for CUI and SOI coatings to prevent corrosion and ensure uninterrupted operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the CUI and SOI Coatings market appears promising, driven by the need for asset protection, safety, and sustainability. Technological advancements will lead to the development of more advanced and efficient coatings with higher resistance to corrosion and extreme environments. As industries continue to expand, especially in developing regions, the demand for CUI and SOI coatings will likely witness steady growth.

Conclusion

The Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market play a vital role in safeguarding industrial assets and infrastructure from corrosion-related damage. With growing awareness about the significance of asset protection, the demand for these coatings is on the rise. Technological advancements, regulatory compliance, and safety concerns are significant drivers propelling market growth. While challenges such as high initial costs and complex application processes persist, the industry offers numerous opportunities for innovation and expansion. By focusing on sustainability, customized solutions, and the development of eco-friendly coatings, the market can capitalize on the increasing demand and achieve long-term success. As the world moves toward a more sustainable future, the CUI and SOI Coatings market will continue to evolve and contribute to the protection and longevity of industrial assets.

What is Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings?

Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings refer to protective materials applied to surfaces to prevent corrosion and enhance thermal insulation. These coatings are essential in industries such as oil and gas, chemical processing, and power generation.

What are the key players in the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market?

Key players in the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market include companies like Sherwin-Williams, PPG Industries, and AkzoNobel, among others. These companies are known for their innovative coating solutions and extensive product portfolios.

What are the growth factors driving the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market?

The growth of the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market is driven by increasing demand for energy efficiency, rising maintenance costs in industrial sectors, and the need for enhanced safety measures in corrosive environments.

What challenges does the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market face?

The Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market faces challenges such as the high cost of advanced coating materials and the complexity of application processes. Additionally, regulatory compliance and environmental concerns can hinder market growth.

What opportunities exist in the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market?

Opportunities in the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market include the development of eco-friendly coatings and the expansion of applications in emerging industries such as renewable energy and infrastructure.

What trends are shaping the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market?

Trends in the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market include the increasing adoption of nanotechnology in coatings, advancements in application techniques, and a growing focus on sustainability and environmental impact.

Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyurethane, Epoxy, Acrylic, Silicone |

| End User | Oil & Gas, Power Generation, Marine, Chemical Processing |

| Application | Industrial Equipment, Pipelines, Storage Tanks, Offshore Platforms |

| Technology | Spray Application, Brush Application, Roll Application, Injection |

Leading Companies in the Corrosion Under Insulation (CUI) and Spray-on Insulation (SOI) Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at