444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Corneal topography systems are devices used to measure the curvature of the cornea, the clear, front surface of the eye. These systems are widely used in ophthalmology to diagnose and manage various eye conditions, such as keratoconus, astigmatism, and corneal dystrophies. The global corneal topography systems market is expected to grow at a significant rate in the coming years, driven by factors such as the increasing prevalence of eye diseases and the rising demand for advanced ophthalmic diagnostic tools.

Corneal topography systems use various technologies to map the shape of the cornea, including Placido disc technology, Scheimpflug imaging, and optical coherence tomography (OCT). These devices provide detailed information about the corneal shape, size, thickness, and curvature, which can be used to diagnose and monitor eye conditions, as well as plan and evaluate surgical interventions.

Corneal Topography Systems Market: Executive Summary

The global corneal topography systems market is expected to grow at a CAGR of XX% during the forecast period (2021-2028), driven by factors such as the increasing prevalence of eye diseases, the rising demand for advanced ophthalmic diagnostic tools, and the growing adoption of minimally invasive surgical procedures.

Based on product type, the corneal topography systems market can be segmented into Placido disc-based topographers, Scheimpflug-based topographers, and OCT-based topographers. The Placido disc-based topographers segment is expected to hold the largest share of the market in 2021, owing to their wide availability and lower cost compared to other types of corneal topography systems.

Based on application, the corneal topography systems market can be segmented into diagnosis, refractive surgery, and others. The diagnosis segment is expected to hold the largest share of the market in 2021, owing to the increasing prevalence of eye diseases and the rising demand for accurate and efficient diagnostic tools.

Based on end-user, the corneal topography systems market can be segmented into hospitals, clinics, and others. The clinics segment is expected to hold the largest share of the market in 2021, owing to the increasing number of ophthalmic clinics and the growing preference for outpatient care.

North America is expected to hold the largest share of the corneal topography systems market in 2021, followed by Europe and Asia Pacific. The growth of the North American market can be attributed to factors such as the high prevalence of eye diseases, the presence of well-established healthcare infrastructure, and the growing adoption of advanced ophthalmic diagnostic tools.

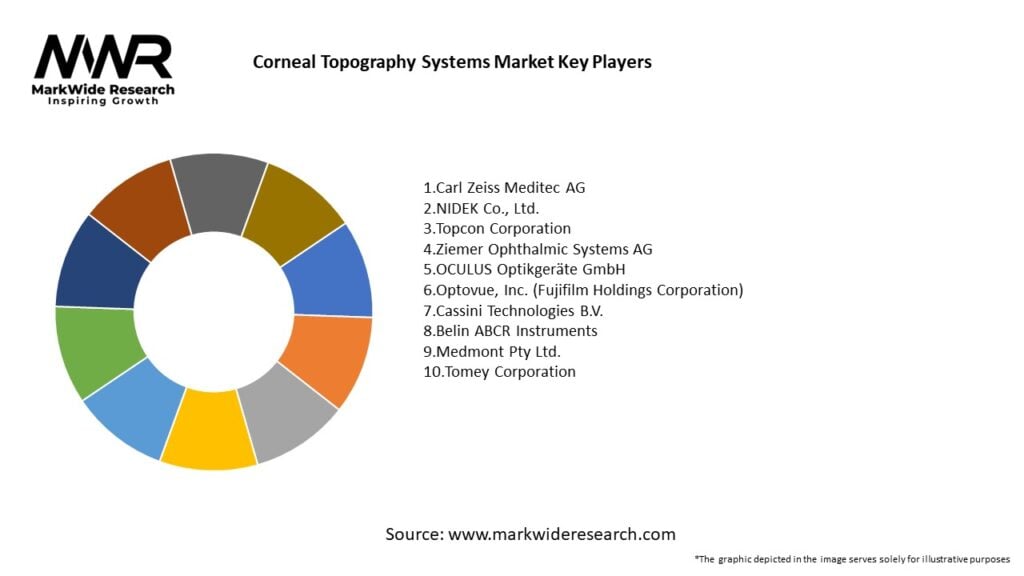

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The corneal topography systems market is highly competitive, with several established and emerging players operating in the market. The market is characterized by intense competition, rapid technological advancements, and increasing demand for efficient and accurate diagnostic tools.

The key players operating in the corneal topography systems market include Carl Zeiss Meditec AG, Topcon Corporation, Nidek Co., Ltd., Oculus Optikgeräte GmbH, and Ziemer Ophthalmic Systems AG, among others. These players are focusing on developing innovative products, expanding their geographical presence, and collaborating with other players to strengthen their market position.

Regional Analysis

North America is expected to hold the largest share of the corneal topography systems market in 2021, owing to the high prevalence of eye diseases, the presence of well-established healthcare infrastructure, and the growing adoption of advanced ophthalmic diagnostic tools. Europe is expected to be the second-largest market, followed by Asia Pacific, which is expected to grow at a significant rate in the coming years, driven by factors such as the increasing healthcare spending, the rising prevalence of eye diseases, and the growing demand for advanced ophthalmic diagnostic tools.

Competitive Landscape

Leading Companies in the Corneal Topography Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

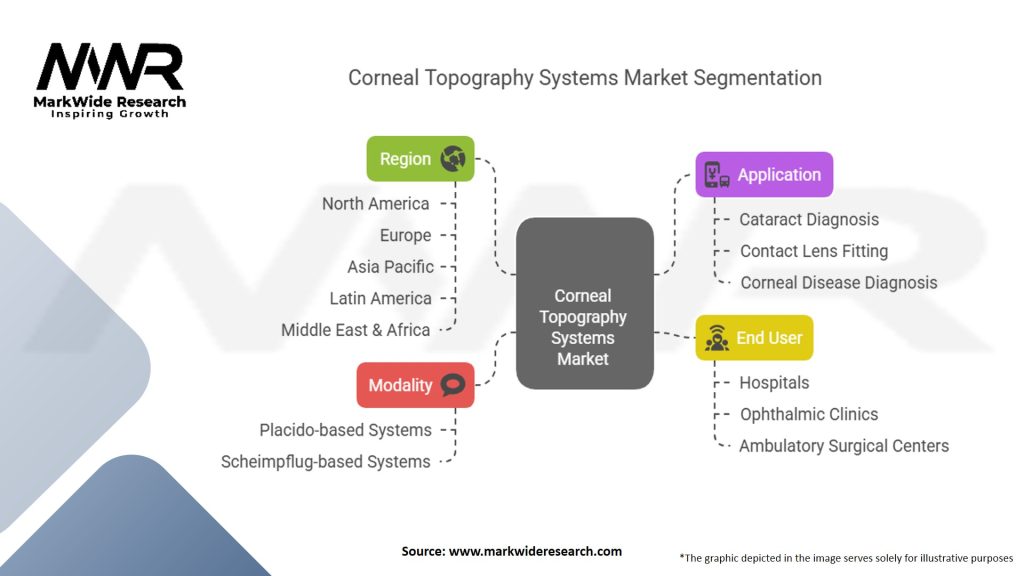

Segmentation

The corneal topography systems market can be segmented based on product type, application, end-user, and region.

Based on product type, the corneal topography systems market can be segmented into Placido disc-based topographers, Scheimpflug-based topographers, and OCT-based topographers.

Based on application, the corneal topography systems market can be segmented into diagnosis, refractive surgery, and others.

Based on end-user, the corneal topography systems market can be segmented into hospitals, clinics, and others.

Based on region, the corneal topography systems market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Category-wise Insights

Placido Disc-based Topographers Segment

The Placido disc-based topographers segment is expected to hold the largest share of the corneal topography systems market in 2021, owing to their wide availability and lower cost compared to other types of corneal topography systems. These devices use a series of concentric rings projected onto the cornea to map its shape and curvature.

Scheimpflug-based Topographers Segment

The Scheimpflug-based topographers segment is expected to grow at a significant rate in the coming years, driven by factors such as their ability to provide high-resolution images and accurate measurements of the cornea. These devices use a rotating camera to capture multiple images of the cornea and create a 3D reconstruction of its shape.

OCT-based Topographers Segment

The OCT-based topographers segment is expected to grow at a significant rate in the coming years, driven by factors such as their ability to provide high-resolution images and accurate measurements of the cornea, as well as their compatibility with other OCT imaging systems used in ophthalmology.

Diagnosis Application Segment

The diagnosis application segment is expected to hold the largest share of the corneal topography systems market in 2021, owing to the increasing prevalence of eye diseases and the rising demand for accurate and efficient diagnostic tools. Corneal topography systems can provide valuable information about the shape, size, and curvature of the cornea, which can help in the diagnosis and management of various eye conditions.

Refractive Surgery Application Segment

The refractive surgery application segment is expected to grow at a significant rate in the coming years, driven by factors such as the increasing demand for minimally invasive surgical procedures and the growing adoption of corneal topography systems in refractive surgery. These devices can provide valuable information about the corneal shape and thickness, which can help in planning and evaluating refractive surgical interventions.

Clinics End-user Segment

The clinics end-user segment is expected to hold the largest share of the corneal topography systems market in 2021, owing to the increasing number of ophthalmic clinics and the growing preference for outpatient care. Corneal topography systems are widely used in clinics for the diagnosis and management of various eye conditions, as well as for planning and evaluating surgical interventions.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the corneal topography systems market. The outbreak of the pandemic has led to the postponement of elective surgeries and routine eye exams, which has affected the demand for corneal topography systems. However, the increasing adoption of telemedicine services and the growing preference for outpatient care have helped mitigate the impact of the pandemic on the market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The corneal topography systems market is expected to grow at a significant rate in the coming years, driven by factors such as the increasing prevalence of eye diseases, the rising demand for advanced ophthalmic diagnostic tools, and the growing adoption of minimally invasive surgical procedures. The market is expected to witness significant technological advancements, such as the increasing adoption of OCT-based topographers, and growing focus on precision medicine. The emerging markets present significant opportunities for the market, and the players are expected to focus on expanding their geographical presence in these regions. However, the high cost of corneal topography systems and the shortage of skilled professionals are expected to remain the key challenges for the market.

Conclusion

The corneal topography systems market is a highly competitive and rapidly evolving market, driven by the increasing prevalence of eye diseases, the rising demand for advanced ophthalmic diagnostic tools, and the growing adoption of minimally invasive surgical procedures. The market is characterized by intense competition, rapid technological advancements, and increasing demand for efficient and accurate diagnostic tools.

The Placido disc-based topographers segment is expected to hold the largest share of the corneal topography systems market in 2021, owing to their wide availability and lower cost compared to other types of corneal topography systems. The diagnosis application segment is expected to hold the largest share of the corneal topography systems market in 2021, owing to the increasing prevalence of eye diseases and the rising demand for accurate and efficient diagnostic tools.

What are corneal topography systems?

Corneal topography systems are diagnostic tools used to map the surface curvature of the cornea. They are essential in assessing conditions like keratoconus and in planning refractive surgeries such as LASIK.

What are the key players in the corneal topography systems market?

Key players in the corneal topography systems market include Alcon, Zeiss, and Oculus, among others. These companies are known for their innovative technologies and contributions to ophthalmic diagnostics.

What are the growth factors driving the corneal topography systems market?

The growth of the corneal topography systems market is driven by the increasing prevalence of eye disorders, advancements in diagnostic technologies, and the rising demand for refractive surgeries.

What challenges does the corneal topography systems market face?

Challenges in the corneal topography systems market include high costs of advanced systems, the need for skilled professionals to operate them, and competition from alternative diagnostic methods.

What opportunities exist in the corneal topography systems market?

Opportunities in the corneal topography systems market include the development of portable devices, integration with telemedicine, and expanding applications in personalized medicine and research.

What trends are shaping the corneal topography systems market?

Trends in the corneal topography systems market include the adoption of artificial intelligence for enhanced data analysis, the shift towards minimally invasive procedures, and the growing emphasis on patient-centered care.

Corneal Topography Systems Market

| Segmentation Details | Details |

|---|---|

| Modality | Placido-based Systems, Scheimpflug-based Systems |

| Application | Cataract Diagnosis, Contact Lens Fitting, Corneal Disease Diagnosis, Others |

| End User | Hospitals, Ophthalmic Clinics, Ambulatory Surgical Centers, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Corneal Topography Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at