444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Core Investment Market is a vital component of the global financial landscape, encompassing various investment opportunities and instruments. It serves as a platform for individuals and institutions to allocate capital and generate returns over the long term. This market involves a diverse range of investment options, including stocks, bonds, real estate, commodities, and alternative investments. Understanding the dynamics and trends of the Core Investment Market is crucial for investors, businesses, and industry participants to make informed decisions and optimize their investment strategies.

Meaning

The Core Investment Market refers to the segment of the financial market that deals with long-term investments aimed at generating capital appreciation and income. It involves the allocation of funds in assets that are expected to appreciate in value over an extended period, typically more than one year. The primary objective of core investments is to preserve and grow capital over the long run, rather than seeking short-term gains.

Executive Summary

The Core Investment Market plays a pivotal role in facilitating economic growth by channeling funds from investors to businesses and projects that require capital for expansion, research, and development. It provides individuals and institutions with a platform to invest in a diversified range of assets, allowing them to participate in the growth potential of various industries and sectors. This market operates on the principles of risk and reward, where investors assume certain risks in exchange for potential returns.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Core Investment Market operates within a complex ecosystem influenced by various factors, including economic conditions, market trends, regulatory changes, and investor sentiment. It is a dynamic marketplace where participants constantly evaluate and adjust their investment strategies based on the prevailing market dynamics. Understanding the interplay of these dynamics is crucial for investors and industry participants to navigate the market successfully and capitalize on opportunities.

Regional Analysis

The Core Investment Market exhibits regional variations based on economic development, market maturity, regulatory frameworks, and investor preferences. Different regions may have distinct investment landscapes, with varying levels of market depth, liquidity, and investment opportunities. It is essential to conduct a comprehensive regional analysis to identify regional trends, assess market potential, and tailor investment strategies accordingly.

Competitive Landscape

Leading Companies in the Core Investment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

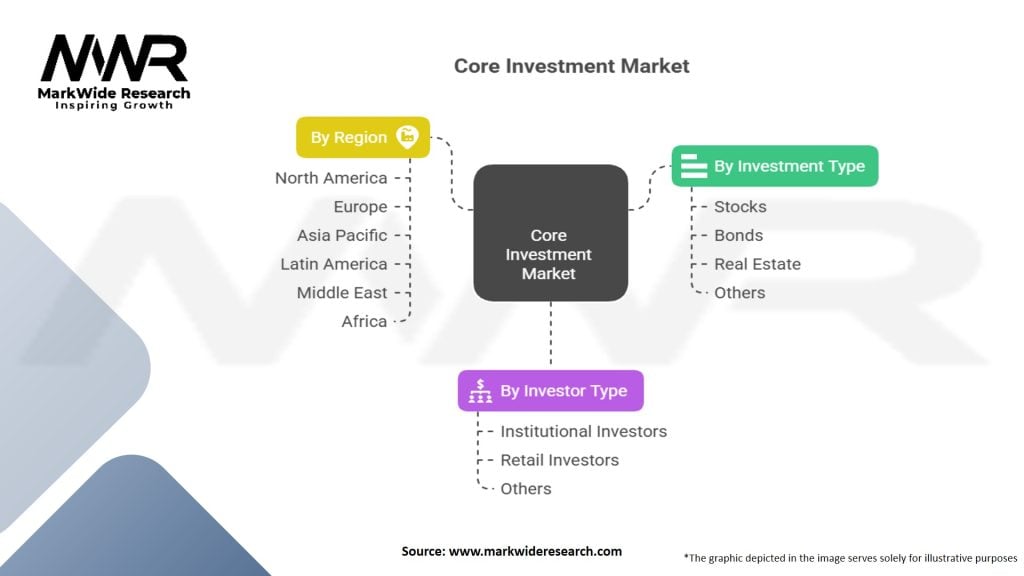

Segmentation

The Core Investment Market can be segmented based on various factors, including asset class, investment strategy, risk profile, and investor type. Common segments include equity investments, fixed income investments, real estate investments, alternative investments, and investment styles such as value investing, growth investing, and income investing. Segmenting the market allows investors and industry participants to focus on specific areas of interest and tailor their investment strategies accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Core Investment Market, causing volatility, uncertainty, and disruptions across various asset classes. The initial phase of the pandemic saw sharp declines in global stock markets, increased risk aversion among investors, and a flight to safe-haven assets. However, government stimulus measures, accommodative monetary policies, and the development of vaccines contributed to market recoveries and improved investor sentiment. The pandemic also accelerated digital transformation trends in the Core Investment Market, with increased adoption of remote trading, virtual meetings, and digital advisory services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Core Investment Market appears promising, driven by factors such as global economic growth, technological advancements, and increasing investor demand for sustainable and responsible investments. However, challenges remain, including market volatility, regulatory complexities, and the need to address systemic risks. The continued integration of technology, emphasis on sustainable practices, and evolving investor preferences are likely to shape the future landscape of the Core Investment Market.

Conclusion

The Core Investment Market serves as a vital platform for investors, businesses, and industry participants to allocate capital, generate returns, and foster economic growth. It offers a diverse range of investment options, allowing individuals and institutions to participate in the growth potential of various sectors and industries. Understanding the market dynamics, trends, and opportunities is crucial for investors to make informed decisions and optimize their investment strategies. The future of the Core Investment Market holds immense potential, driven by technological advancements, sustainable investing trends, and the pursuit of long-term wealth creation.

What is Core Investment?

Core Investment refers to a strategy focused on long-term investments in stable and reliable assets, typically including equities, bonds, and real estate. This approach aims to build a solid financial foundation while minimizing risk exposure.

What are the key players in the Core Investment Market?

Key players in the Core Investment Market include major financial institutions such as BlackRock, Vanguard, and Fidelity Investments, which offer a range of investment products and services. These companies are known for their extensive research and management capabilities, among others.

What are the main drivers of growth in the Core Investment Market?

The main drivers of growth in the Core Investment Market include increasing investor awareness of the benefits of long-term investing, the rise of passive investment strategies, and the growing demand for diversified portfolios. Additionally, favorable economic conditions can enhance investor confidence.

What challenges does the Core Investment Market face?

The Core Investment Market faces challenges such as market volatility, changing regulatory environments, and the impact of economic downturns on investor sentiment. These factors can lead to fluctuations in investment flows and affect overall market stability.

What opportunities exist in the Core Investment Market for future growth?

Opportunities in the Core Investment Market include the expansion of sustainable investment options, the integration of technology in investment management, and the increasing interest in alternative assets. These trends can attract new investors and enhance portfolio diversification.

What trends are shaping the Core Investment Market today?

Current trends in the Core Investment Market include the rise of ESG (Environmental, Social, and Governance) investing, the adoption of robo-advisors, and a shift towards more personalized investment strategies. These trends reflect changing investor preferences and technological advancements.

Core Investment Market

| Segmentation Details | Description |

|---|---|

| By Investment Type | Stocks, Bonds, Real Estate, and Others |

| By Investor Type | Institutional Investors, Retail Investors, and Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Core Investment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at